It seems that participation (Islamic) banking in Turkey is getting a second wind in terms of government policy and support which augurs well for the industry in the Middle East, North Africa and Turkey (MENAT) region.

The appointment of the respected Lütfi Elvan as the new Turkish Finance Minister in November 2020 and the stated strategy of President Recep Tayyip Erdogan for the greater use and involvement of the participation banking sector in the Turkish economy is contributing to this new-found proactiveness.

On 3 February 2021, the Central Bank of the Republic of Turkey (CBRT) established a dedicated Participation Banking Division under the Banking and Financial Institutions Department, “to increase efficiency in the CBRT’s relations and work with participation banks, to contribute to the sector’s development and financial stability, and to carry out relations with international institutions that work in this field in a more effective way.”

Hitherto, the government evaluated the developments in the local and global Islamic finance industry through ad hoc meetings of the Interest-Free Finance Coordination Board. Under the old prime ministerial system, it was usually held under the Chairmanship of the then Deputy Prime Minister. But since the adoption of the Presidential System cross department coordination on participation banking has been lost in transition, with occasional policy statements coming from the President’s Office or from the Minister of Treasury and Finance.

Not that Turkey is a latecomer to Islamic finance. Turkey introduced interest-free (Islamic) finance legislation at the same time as Malaysia in 1983, which since then has evolved into special finance houses and then to participation banking.

The sector has managed to sustain a market share of about 4% of the total banking assets for the last three decades led by Kuveyt Turk Participation Bank, a subsidiary of Kuwait Finance House, and Albaraka Turk Participation House, part of the Bahrain-incorporated but Saudi owned Albaraka Banking Group.

However, the entry of Turkiye Finance (an affiliate of National Commercial Bank of Saudi Arabia) and more recently of the participation banking subsidiaries of state-owned banking majors such as Ziraat Bankasi and Vakif Bankasi and others has given the sector a much-needed boost. The 2008 global financial crisis and the economic impact of COVID-19 affected Turkey like any other economy. But the weakness of the Turkish lira against the US dollar especially has given rise to extreme volatility of the currency which has played havoc with the general macro-economy. But the strength of the Turkish economy has always been the private sector and the SMEs, which form a strong component of participation banking customers.

But these are changing times. According to the latest data from the Banking Regulation and Supervision Agency (BDDK), the regulator, the market share of the participation banks’ assets crossed the 7% mark in 2020, albeit still well short of the Turkish Government’s stated target for the participation banking sector of 15% by 2025. The market share of the six participation banks in terms of assets increased from 6.33% (TRY284.459 billion) in 2019 to 7.1% (TRY437.092 billion) in 2021. Their profitability increased from TRY2.438 billion in 2019 to TRY3.716 billion in 2021.

With their emphasis on product innovation such as gold-backed instruments and accounts, and an aggressive engagement with digitisation, participation bankers stress that 15% target is achievable by 2025.

As such the establishment of the dedicated participation banking department at the CBRT is long overdue and is vital in raising awareness of the sector. The department also aims to boost cooperation amongst public and private sectors, universities and non-governmental organisations, with the objective of improving the performance and reach of the sector.

Turkey also has the ambition of developing Istanbul as an Islamic financial hub as part of its wider strategy of developing its financial capital into an international financial centre. Islamic finance is well established in the Turkish retail, SME, corporate, infrastructure and public finance mix. But it needs scaling up.

The Debt Office of the Turkish Treasury and Finance Ministry is a proactive issuer of lease certificates (Sukuk Al-Ijarah) as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates/bonds, FC denominated issuances and gold-backed certificates/bonds.

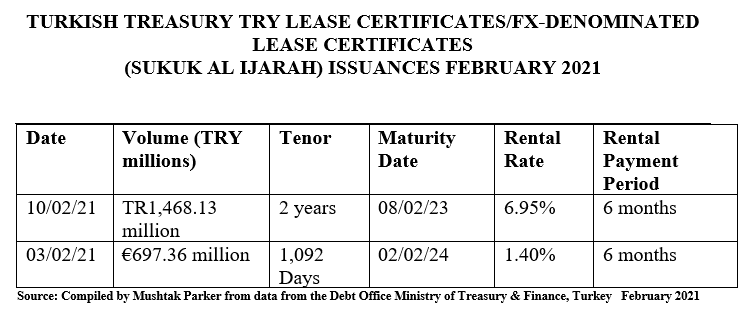

In fact, the Treasury held three auctions of lease certificates during February 2021. The first auction of FX-denominated fixed-rate lease certificates (Sukuk Al-Ijarah) denominated in Euros raised €697.36 million (US$830.45 million) through a direct sale auction on 3 February 2021. The auction was conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

The issuance has a tenor of 1,092 days maturing on 2 February 2024 and was priced at a fixed rental rate of 1.40% payable over a 6-month rental payment period.

The usual mantra of the Turkish Treasury when announcing these auctions is “In order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

Similarly, the Treasury raised TR1,468.13 million (US$192.32 million) in a second transaction through a direct sale auction on 10 February 2021 of its latest fixed rate CPI Indexed lease certificates (Sukuk Al-Ijarah) offerings. The auction was also conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems). The issuance has a tenor of 2 years maturing on 8 February 2023 and was priced at a fixed rental rate of 6.95% payable over a 6-month rental payment period.

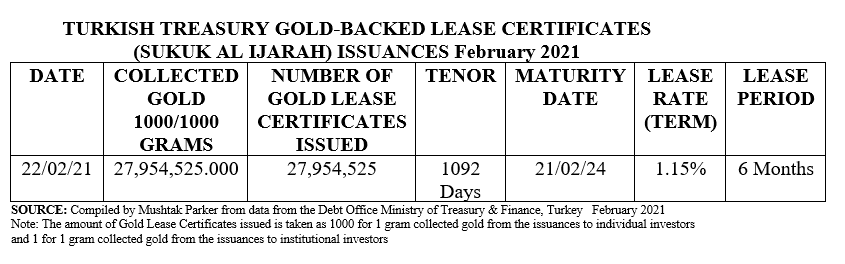

In the third transaction on 22 February 2021 the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 1,092 days maturing on 21 February 2024 priced at a Lease Rate of 1.15% payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 27,954,525.000 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 27,954,525 gold lease certificates (at a nominal value). The amount of Gold Lease Certificates issued, according to the Treasury, is taken as 1000 for 1 gram collected gold from the issuances to individual investors and 1 for 1 gram collected gold from the issuances to institutional investors.

The direct sale auction of its latest Gold-backed Lease Certificates (Sukuk Ijarah) offering was conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems). In 2020, the Treasury conducted six such gold-backed lease certificate auctions in January, March, April, May, July and October 2020 collecting a total 51,105,190.000 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 51,105,190 gold lease certificates (at a nominal value).

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a wholly-owned special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor. The Ministry of Treasury & Finance issues these gold-backed lease certificates “to diversify borrowing instruments, broaden the investor base and bring the idle gold into the economy.”

According to Turkish Finance Minister Lütfi Elvan “citizens are provided with a safe investment tool for gold savings. With the gold bond and gold-denominated lease certificate issuance through five banks, our citizens will win themselves and contribute to the economy.” Investors will be paid TL-denominated returns on a semi-annual basis indexed to the gold price. On maturity, according to the Treasury, investors may request the principal payment as 1 kilogram of gold bar (produced by refineries) or Republic Gold Quarter Coins printed by the Turkish State Mint.