ICD Returns to International Sukuk Market with a US$500m Hybrid Wakala/Commodity Murabaha Issuance in February 2024 After an Absence of 4 Years

After an absence of almost four years, the Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the Islamic Development Bank (IsDB) Group, returned to the international Sukuk market with a benchmark 5-year RegS US$500m million senior unsubordinated hybrid Wakala/Commodity Murabaha Sukuk issuance on 14 February 2024. The Sukuk certificates, rated ‘A2’ by Moody’s Investors Service and ‘A+’ by Fitch Ratings and due on 14 February 2029, were issued through Cayman Islands incorporated ICDPS Sukuk Limited, the trustee on behalf of the Obligor and Service Agent, ICD.

The Sukuk issuance, which attracted robust demands from 46 accounts in the UK, Europe, the GCC, Offshore US and Asia, had an orderbook of over U$D 2.2 billion and was oversubscribed by 4.2 times. This demand dynamic, says ICD, demonstrates the confidence of investors in the ICD’s vision and prospects.

Eng. Hani Salem Sonbol, the Acting Chief Executive Officer of ICD, commented: “We are thrilled with the overwhelming response to our Sukuk issuance, which reflects the trust and confidence investors have in ICD’s business strategy and financial stewardship. This successful issuance not only strengthens our balance sheet but also provides us with the resources needed to pursue our strategic objectives and drive sustainable growth. The Sukuk issuance was well-received by a diverse group of investors and is a testament to the growing belief on the financial and operational improvements of ICD and appreciation of ICD’s development impact across our 56 Member Countries.”

The proceeds from the Sukuk issuance will be invested in development assets, facilitating ICD’s mission to foster economic growth and development initiatives across its member countries.

“With its return to the fixed income market and being a multilateral development financial institution, ICD has established itself as a unique credit quality. The Corporation is rated ‘A2’ by Moody’s, ‘A+’ by Fitch, and ‘A-’ by S&P. Further, 82% of voting power is held by shareholders that are rated A+ or above,” added Eng. Sonbol.

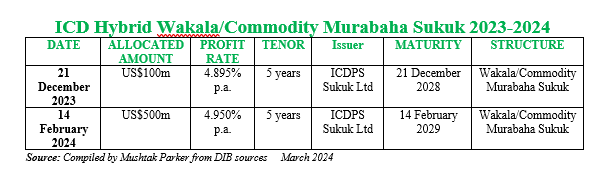

This issuance in fact precedes a similar RegS US$100 million senior unsubordinated hybrid Wakala/Commodity Murabaha Sukuk issuance by ICDPS Sukuk Limited on 21 December 2023, with each issued under ICDPS Sukuk Limited’s Trust Certificate Issuance Programme. The consortium of dealers for the Programme included Bank ABC, CIMB, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, Gulf International Bank, Goldman Sachs International, HSBC, Maybank, Mizuho, SMBC Nikko, Standard Chartered Bank and Warba Bank.

These issuances mark ICD’s return to the capital markets since its last issuance in October 2020. ICD aims to support economic development and foster the private sector in its member countries by providing Sharia’a-compliant financing facilities and investments. Additionally, ICD offers advisory services to governments and private entities to facilitate the establishment, expansion, and modernization of private enterprises.

The December 2023 US$100 million Sukuk was arranged by Standard Chartered Bank and priced at a fixed profit rate of 4.895% payable semi-annually in arrears. The February 2024 US$500 million Sukuk was jointly arranged by Standard Chartered Bank, Al Rayan Investment, Bank ABC, Boubyan Bank, Emirates NBD Bank, First Abu Dhabi Bank, HSBC, KFH Capital Investment, Mashreqbank, and MUFG Securities EMEA, and was priced at a fixed profit rate of 4.950% payable semi-annually in arrears.

The US$100 million trust certificates due in 2028 were unrated and are listed on the regulated market of Euronext Dublin. The US$500 million Sukuk certificates due in 2029 were admitted for listing and trading on the regulated market of Euronext Dublin and Nasdaq Dubai on 14 February 2024.

The ICD has played an important role in promoting sovereign domestic currency Sukuk issuance especially in investment grade or below investment grade rated member states. It has arranged and co-managed such CFA Franc Sukuk issuances in BCEAO (La Banque Centrale des Etats de l’Afrique de l’Ouest) member states including Senegal, Mali, Cote D’Ivoire and Togo over the last few years.

Conversely, the Corporation also tapped the Kazakhstan Tenge market in June 2023 with a debut foray into the Kazakhstani Tenge market with a KZT 2 billion 5-year amortized Sukuk issuance, which was rated ‘A+’ by Fitch Ratings. The Tenge-denominated Sukuk ticked off a list of firsts. It is the first-ever KZT Sukuk in the World, the first Sukuk in the national currency of one of the Commonwealth of Independent States (CIS) and the first KZT Sukuk from an international development institution.

The Sukuk proceeds were for ICD’s onward financing to the Kazakh JSC Leasing Group, whose securities are officially listed on Kazakhstan Stock Exchange. Leasing Group offers leasing products and caters primarily to small and medium-sized enterprises (SMEs) operating across various industries. ICD and Leasing Group signed an agreement in relation to a Kazakhstan Tenge (KZT) denominated line of finance facility (LoF) to support private sector businesses, especially SMEs, in the country.

The issuance of the tenge-denominated Sukuk is in line with ICD’s strategy to source medium-term funding and create access to local currency finance for private sector expansion, helping to boost economic growth and create jobs and by introducing a new asset class to the Kazakh fixed income market.

This strategy is underpinned by Sukuk technical cooperation and workshops with regulators and industry bodies in member states. In early March 2024, ICD organized a Sukuk technical workshop in collaboration with the Egyptian Financial Supervisory Authority (FSA), the Islamic Development Bank Institute (IsDBI) and the Egyptian Ministry of Planning and Economic Development.

The workshop held at the Financial Regulatory Authority’s headquarters in Cairo attracted over 170 participants and covered both the theoretical and practical aspects of issuing sukuk. The workshop also explored the experience of the ICD and the IsDB Group, specifically focusing on how to manage excess liquidity within Islamic banks through Sukuk issuance.

Dr Mohamed Farid, Chairman of the Financial Supervisory Authority, reiterated the Authority’s commitment to diversifying financial and fixed income debt products, including Sukuk. “These solutions aim to meet the evolving needs of the financial and business communities, encompassing individuals and companies. By doing so, the Authority seeks to facilitate access to financing necessary for growth, expansion, and achieving overall goals, he added.

Egypt is a late comer to the Sukuk market. The Egyptian Ministry of Finance issued the country’s debut sovereign Sukuk – a 3-year US$1.5 billion offering priced at an annual profit rate of 10.875%, in February last year. The Ministry of Finance has established a US$5 billion three-year Trust Certificates Issuance Programme, and a further sovereign issuance is expected during 2024. A number of Egyptian corporates have tapped the Sukuk market, but the market depth and critical mass of issuances are currently lacking.