The Turkish Ministry of Treasury & Finance continues to raise funds from the international markets through Sukuk issuances as part of its active but diversified public funding and debt strategy.

The Turkish economy has shown a remarkable resilience recently, notwithstanding a number of challenging considerations – including the volatility and sharp depreciation of the Turkish lira against the US dollar of more than 40%, the high national debt in US dollars and changes in the stewardship of the economy at the Ministry of Treasury and Finance and the Central Bank of Turkey. In the participation banking sector, for instance, banks have evolved from hedging against currency volatility to developing retail banking products which protect customers against currency volatility. Kuveyt Türk Participation Bank, for instance has introduced ‘Currency Protected’ and ‘Conversion Supported’ TL Participation Accounts.

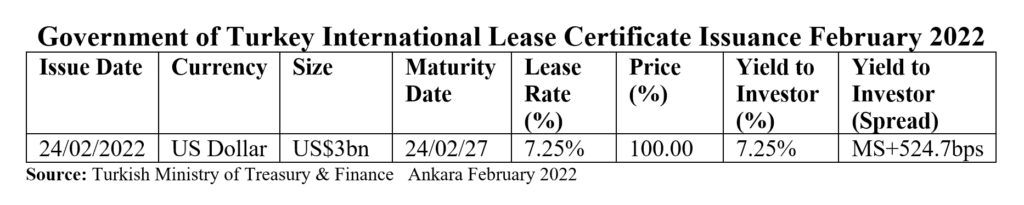

On 16 February 2022, the Ministry of Treasury and Finance issued lease certificates

(Sukuk Al Ijarah) in the international markets with a size of US$3.0 billion. The benchmark Sukuk Al Ijarah, which has a tenor of 5 years and matures on 24 February 2027, was priced at a leasing rate and yield to investors of 7.250% per annum and a spread of MS (Mid Swaps) + 524.7 basis points. The proceeds from the issue were transferred to Treasury accounts on 24 February and will be used for budget purposes.

The Treasury and Finance Ministry two days earlier had mandated Citi, Dubai Islamic Bank, HSBC and Kuwait Finance House (KFH) Capital to arrange the issuance of US dollar denominated Sukuk Al Ijarah certificates with a maturity of 5 years and to arrange a series of investor calls and meetings with accounts in London, Europe, the GCC, Asia and Offshore US. The four institutions also acted as joint bookrunners to the transaction.

In a statement, the Treasury and Finance Ministry said that the offering attracted a substantial demand from over 200 regional and international investors, with the issuance over-subscribed three times and the order book reaching in excess of US$10.75 billion. Some 66% of the certificates were taken up by investors in the Middle East, 12% by US Offshore Accounts, 12% in the UK, 5% in other European countries, 4% in Turkey, and 1% in Asia.

According to Abdulaziz Nasser Al Marzooq, CEO of KFH Capital, “the initial indicative yield hit the level of 7.5%-7.625% per annum, where the over-demand for the issuance contributed to pricing the Sukuk at a final yield of 7.25% per annum. The Sukuk, rated B+ by Fitch and B2 by Moody’s Investor Service, are listed on the Dublin Euronext stock exchange.

“For the Turkish government, the Sukuk issuance is seen as a step forward in its efforts to provide adequate funding from multiple sources for its projects and the country’s economic development. The issuance gained a large coverage in a record time, attracting investors from the region and the world, which confirms the significance of Sukuk as a product that provides subordinate financing for the growth and expansion operations of governments, companies and mega development projects,” explained Al Marzooq.

The Turkish Treasury is a proactive issuer of lease certificates (Sukuk Al-Ijarah) primarily in the domestic Turkish Lira market but also regularly from the international market through US dollar and Euro denominated Sukuk issuances. This is part of a wider universe of government fund-raising instruments which include international and domestic bonds and Sukuk – leasing certificates/bonds, FX denominated issuances and gold-backed certificates/bonds. The Treasury also raises funds in the US dollar and Euro markets on an ad hoc basis through transactions conducted by the Central Bank of Turkey via its Auction System under the Central Bank Payment Systems.

The Turkish Ministry of Treasury and Finance, prior to this offering, issued a 5-year US$2.5 billion Sukuk Al-Ijarah in the international capital markets in June 2021.

It was this better-than-expected economic recovery then too that influenced the pricing of the offering to close at a lease rate and yield to investor of 5.125%, with a spread of Mid Swaps + 426.7 bps.

President Recep Tayyip Erdogan is keen to see a greater involvement of the participation banking system in the Turkish economy and in structural government finances. Last year the Central Bank of Turkey (CBRT) established a dedicated Participation Banking Division under the Banking and Financial Institutions Department “to increase efficiency in the CBRT’s relations and work with participation banks, to contribute to the sector’s development and financial stability, and to carry out relations with international institutions that work in this field in a more effective way.”

Another proactive move on the part of the CBRT is to allow Turkish banks (both participation and conventional) to increase their holdings of government securities for reasons other than reserve and liquidity management purposes, as the requirement for them to maintain an asset ratio of at least 100% from 1 May 2020 set in.

According to Fitch Ratings, the move introduced by the Banking Regulation & Supervision Authority to stimulate lending to support the economy amid the COVID-19 pandemic has forced some banks to increase lending at a time when the operating environment has weakened, with heightened risks to borrowers’ repayment capacity and therefore to banks’ credit profiles. Banks failing to meet the target are faced with a fine based on their ratio shortfall.

The encouraging sign is that demand for Turkish government papers, despite the potential volatility of the Turkish lira, the economic and health impact of the COVID pandemic and other internal economic vulnerabilities, international investors especially from the GCC, UK and Europe, continue to be comfortable with Turkish sovereign and credit risk.

The lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a locally-incorporated special purpose vehicle on behalf of the Ministry of Treasury and

Finance, the obligor.