Kingdom of Bahrain Returns to the International Debt Market with a USD1.75bn Sukuk Ijara/Murabaha and a USD750mn Conventional Bond in May 2025 to Support its General Budgetary Requirements

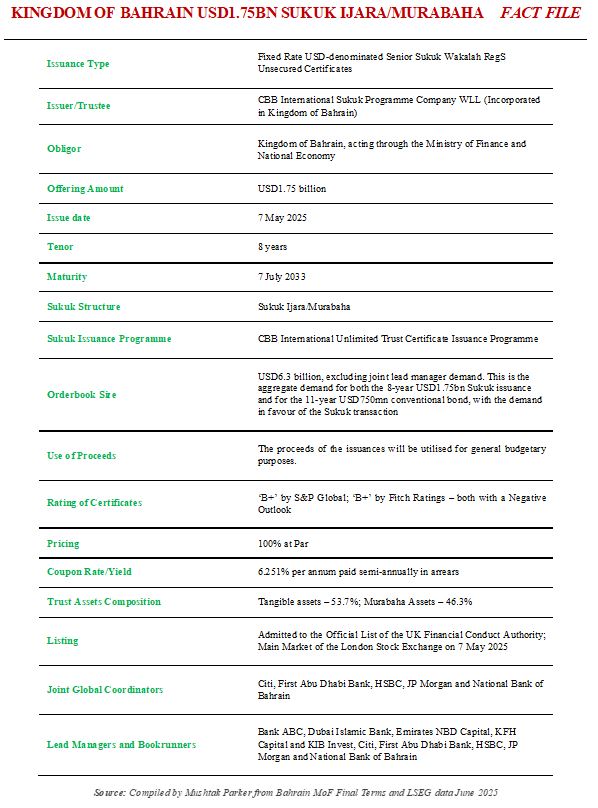

The Kingdom of Bahrain, acting through the Ministry of Finance and National Economy, returned to the international debt market in May 2025 with a dual tranche offering comprising a USD1.75bn fixed rate senior unsecured Sukuk Ijara/Murabaha and a USD750mn fixed rate senior unsecured conventional bond on 7 May 2025. Both tranches were issued under the US 144/A Reg S rules.

This latest transaction echoes the previous such one in February 2024 when the Ministry of Finance similarly raised USD2bn through a two-tranche offering comprising a USD1bn fixed rate senior unsecured conventional bond and an USD1bn fixed rate senior unsecured Sukuk Ijara/Murabaha. Both tranches were similarly issued under the US 144/A REG S rules.

In this latest transaction in June 2025, the USD1.75bn Sukuk Ijara/Murabaha certificates were issued through CBB International Sukuk Programme Company WLL, the trustee incorporated in Bahrain on behalf of the Obligor, the Kingdom of Bahrain, with a tenor of 8 years maturing on 7 July 2033 and issued under its unlimited Trust Certificate Issuance Programme established in April 2025. The USD750mn conventional bond has a tenor of 11 years maturing on 7 July 2036 and was issued under the Kingdom’s Global Medium Term Note Programme. Both tranches were closed on 7 May 2025.

The Ministry of Finance (MoF) had announced its intention to tap the international markets for a two-trance transaction at end April 2025. For the Sukuk Tranche it mandated Citi, First Abu Dhabi Bank, HSBC, JP Morgan and National Bank of Bahrain to act as joint global coordinators and together with Bank ABC, Dubai Islamic Bank, Emirates NBD Capital, KFH Capital and KIB Invest as joint lead managers and bookrunners for the transaction, and to arrange a series of investor calls and roadshows with accounts in the UK, Europe, the MENA region, Asia and Offshore US.

Ther aim was to issue a US dollar-denominated Regulation S/144A benchmark Sukuk Ijara/Murabaha as part of dual-tranche hybrid Sukuk/conventional bond transaction. The Initial Price Thoughts (IPTs) was set around a profit rate of 6.625% for an 8-year Sukuk and 7.75% for a 11-year USD750mn conventional bond. The aggregate demand for the two tranches reached USD6.3bn in the order book, excluding joint lead manager subscription, with the higher demand in favour of the Sukuk transaction.

This allowed some price tightening with the final pricing for the Sukuk tranche settled at a profit rate of 6.251% per annum and for the conventional tranche at 7.5% per annum both payable semi-annually in arrears.

This compared with the pricing of the February 2024 transaction where the conventional notes offering was priced at a fixed interest rate of 7.5% per annum while the Trust Certificates were priced at a fixed profit rate of 6% per annum payable semi-annually in arrears.

The Sukuk trust asset pool for the June 2025 transaction comprises a 53.7% of tangible assets and 46.3 % of Murabaha assets. The proceeds of the issuance will be utilised for general budgetary purposes.

Some of the proceeds of the Sukuk will be used to re-finance existing conventional debt, which is burdening the Kingdon with costly interest servicing. S&P Global in fact in April 2025 downgraded its outlook for the Kingdom to ‘negative’ from ‘stable’, which was echoed by Fitch Ratings.

The Sukuk certificates have been rated as ‘B+’ by both rating agencies. The certificates have been admitted to the Official List of the UK Financial Conduct Authority and Main Market of the London Stock Exchange on 7 May 2025.

Bahrain is a pioneer of the contemporary Islamic finance movement. It was one of the first countries to issue regular domestic Sukuk Al Ijara (Leasing Sukuk) and Sukuk Al-Salam at the Central Bank of Bahrain with short-to-medium-term tenors to manage liquidity requirements of locally authorised Islamic banks and where such institutions can park their reserve requirements on a Shariah-compliant basis.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by the Kingdom of Bahrain, with the US$810.25m Murabaha tranche being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.