Government of Egypt Returns to International Financial Market After an Absence of 2.5 Years with a Privately Placed USD1bn Sukuk Issuance Entirely Underwritten by KFH Despite Difficult Global Market Conditions

It’s not the usual way to raise funds from the international financial market, but when the originator is the Government of Egypt, one of the largest economies in Africa, then it is of significance especially for the issuance of sovereign Sukuk. After an absence of almost two and a half years, Egypt returned to the international market in June 2025 with a benchmark USD1bn Sukuk offering.

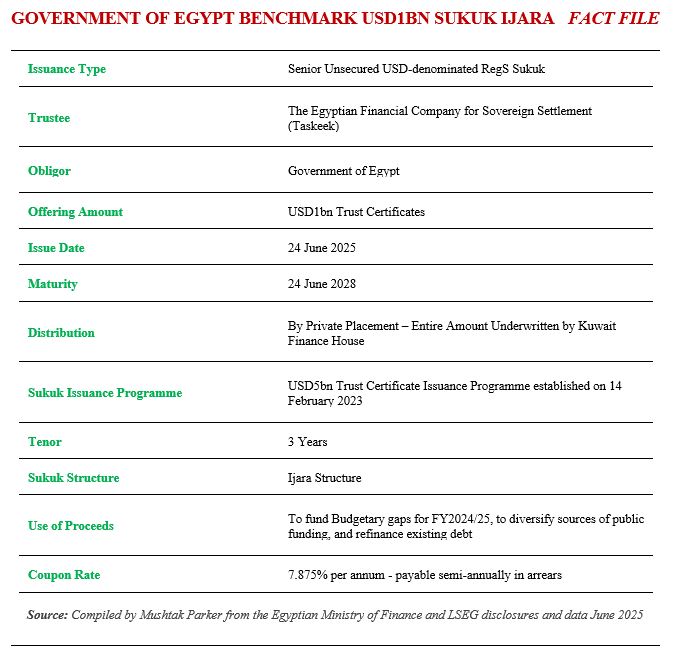

What is unique about this transaction is that it was privately placed and underwritten by one institution, Kuwait Finance House (KFH), the second oldest Islamic commercial bank after Dubai Islamic bank.

According to the Egyptian Ministry of Finance, the government “succeeded to get back on track of international markets to resume the plan of international issuance of sovereign Sukuk.” Prior to this, Egypt issued its maiden Sukuk in February 2023 – a US$1.5bn Reg S Rule 144A Sukuk Ijarah offering with a 3-year tenor maturing in February 2026.

According to The Public Debt Management Unit at the Ministry of Finance, the plan is to issue several further Sukuk tranches over the next three years to cover the remaining US$3.5 billion under the Programme, and if needed to extend the size of the Programme in the future.

Egyptian sovereign issuances like its conventional bond offerings will always be subject to the risks associated with the stewardship of the Egyptian economy, especially in controlling inflation, burgeoning public debt, rising food and energy prices, interest rates and unemployment, and political governance risks.

This latest Sukuk was also issued by The Egyptian Financial Company for Sovereign Settlement (Taskeek), an Egyptian joint stock company wholly owned by the Ministry of Finance and incorporated in the Arab Republic of Egypt, under its US$5bn Trust Certificate Issuance Programme registered on the London Stock Exchange (LSE) on 14 February 2023, and arranged by Citigroup, Abu Dhabi Islamic Bank, Crédit Agricole, Emirates NBD, First Abu Dhabi Bank and HSBC.

According to Egyptian Finance Minister Ahmed Kouckouk, despite the present economic challenges related to the current conflicts in the region, which negatively affected all markets and increased uncertainty and risks, the Sukuk issuance also comes at a time of a notable improvement of the Egyptian economic situation and most of the financial and economic indicators.

The proceeds from the issuance will be used to finance certain parts of the 2024/25 national budget and government funding requirements. -The Ministry of Finance affirmed its commitment to reduce the external debt for budget bodies, by around USD1bn to USD 2bn this year. The initial data suggests that the Ministry is on track to achieve this objective.

This latest USD1bn transaction, which has a tenor of 3 years, was priced a coupon rate of 7.875% per annum payable semi-annually in arrears. The transaction says the Ministry of Finance also meets its objectives diversification of source of funding, markets, instruments and investor base. In contrast, the profit rate for the debut 3-year USD1.5bn Sukuk Ijara was 10.875% per annum payable semi-annually in arrears.

“This affirms the ability of the Ministry of Finance to achieve the financial objectives despite the variant economic and political challenges, as well as the diversification of finance instruments and resources in terms of markets, currencies, investors, and the achievement of best terms and conditions. The issuance also comes as part of the Ministry of Finance plan to diversify markets of issuance, segments of investors, elongation of debt life, reduction of external debt, which will lead in turn to a reduction in the cost of finance,” added the Ministry.