Saudi Arabia’s Public Investment Fund (PIF) Issues Second Sukuk to Date Through a US$2bn Offering in the US Dollar Market in February 2024 Consolidating Primary Sukuk Issuance as a Key Fund-Raising Tool

The Public Investment Fund (PIF), Saudi Arabia’s sovereign wealth fund (SWF), is emerging potentially as the most important quasi-sovereign Sukuk issuer in the international market. Following on from its maiden US$3.5 billion Sukuk in October 2023, PIF was at it again in March 2024 raising US$2 billion through a US dollar denominated international Sukuk offering. This brings the aggregate funds raised through two Sukuk transactions in four months to US$5.5 billion.

In addition, PIF successfully completed the pricing of a US$5 billion Reg S international conventional bond offering at end January 2024 under its Euro Medium-Term Note Programme, which brings the total volume of funds raised by PIF in the international debt market in Q1 2024 to US$7.0 billion. All the above transactions are in line with PIF’s stated strategy to continually diversify its funding sources.

Whilst the three major rating agencies may speculate about the vagaries of Sukuk market traction in 2024 and beyond, the entry of mega primary and repeat issuers such as PIF could have a profound impact in mainstreaming Sukuk as a public debt instrument as part of an evolving fund-raising strategy.

“This latest Sukuk offering,” explained PIF, “signifies PIF’s continued commitment to its diversified sources of funding, which include loans and debt instruments, earnings from investments, capital injections from government and government assets transferred to PIF.”

The involvement of PIF in the Sukuk market has important wider implications, especially in a market in which a growing number of international investors, including new ones from non-traditional markets, are increasingly keen to invest in pursuit of A-rated debt papers.

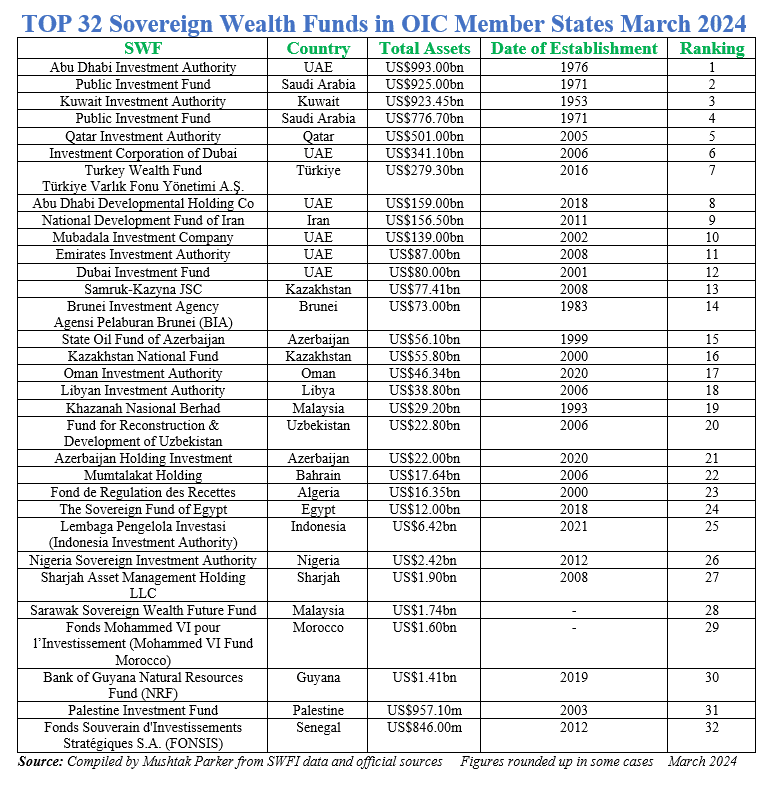

PIF involvement could also spur Sukuk issuance by other SWFs from member countries of the Organisation of Islamic Conference (OIC) as part of their sources of fund-raising diversification strategies. Of the top 100 SWFs in the world, 32 are from OIC member countries, with combined assets under management exceeding US$4.2 trillion.

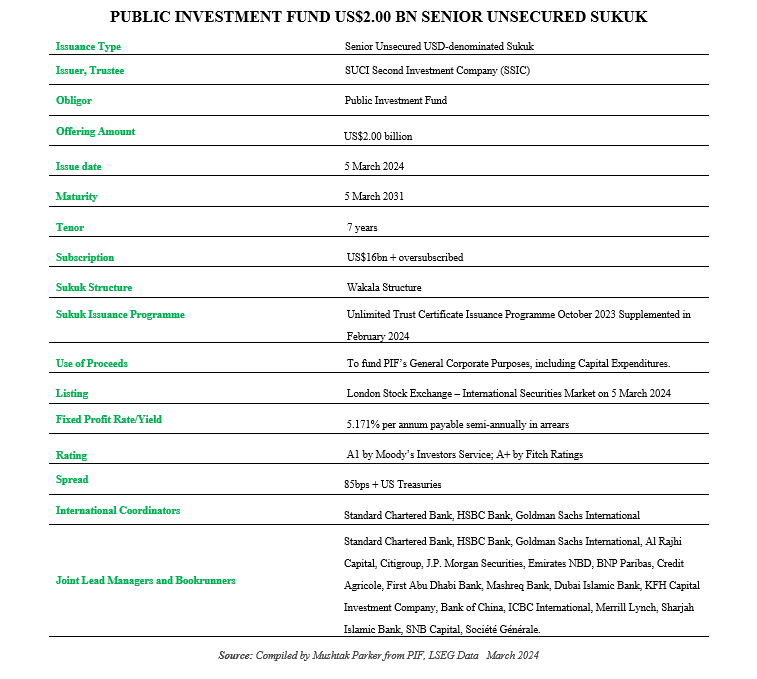

This latest Sukuk transaction based on a Wakala structure was launched on 27 February 2024. The Sukuk certificates were issued by PIF’s wholly owned Cayman Islands-incorporated special purpose vehicle, SUCI Second Investment Company (SSIC), on behalf of the Obligor PIF, as part of its medium-term capital raising strategy. SSIC is also the Trustee on behalf of the Sukuk certificate holders.

The US$2.00 billion Sukuk were issued on 5 March 2024 under SSIC’s Unlimited Trust Certificate Issuance Programme which was established in October 2023 and updated in February 2024 and arranged by Al Rajhi Capital, Emirates NBD Capital, HSBC and Standard Chartered Bank, with Citigroup and JP Morgan joining as dealers.

PIF had mandated HSBC, Standard Chartered Bank, and Goldman Sachs International to act as international coordinators to the transaction and to arrange a series of investor meetings and calls in London, Europe, Offshore US Accounts, the GCC and MENA regions, and Asia. The Sukuk issuance, according to PIF, was more than eight times oversubscribed with strong interest from a diverse range of accounts in Europe, UK, the Middle East, Asia and Offshore US Accounts, reflecting investor confidence in the SWF’s corporate and investment strategy.

The initial price guidance was set at around 115 basis points (bps) over US Treasuries for the 7-year certificates. Due to very robust demand with the order book exceeding US$16 billion, the pricing saw substantial tightening to a final spread of US Treasuries + 85bps for the 7-year certificates, no doubt assisted by PIF’s credit strength as highlighted by Moody’s Investors Service upgrading its outlook for PIF to “positive” from “stable,” and Fitch Ratings its long-term foreign and local-currency issuer default ratings to A+ from A, with a “stable” outlook. This translates into a profit rate of 5.171% per annum payable semi-annually and maturing in March 2031.

According to Fahad Al Saif, Head of PIF’s Global Capital Finance Division and formerly the Head of the NDMC at the Ministry of Finance who oversaw the Centre’s domestic sovereign Sukuk issuance programme, this latest Sukuk issuance which saw strong investor demand, underlined the success of PIF’s capital raising strategy and recognizes its role as a key driver of Saudi Arabia’s economic transformation, and signified the SWF’s continued commitment to its diversified sources of funding. The success of this transaction also reflected PIF’s ongoing commitment to delivering on its mandate and Vision 2030 targets.

Against a background of tepid global oil prices and an extraordinarily fast pace of investment needs, especially in the NEOM gigaprojects infrastructure initiative, PIF Governor, Yasir Al Rumayyan, speaking at a conference in Miami in February 2024, suggested that the SWF may increase its annual capital deployment capacity to US$70 billion from the previous US$40-50 billion starting in 2026. This means more forays into the international bond and Sukuk markets over the next three years at least.

Proceeds from the issuance will be used by PIF for its general corporate and balance sheet purposes. The Sukuk certificates were admitted for listing and trading on the London Stock Exchange plc’s International Securities Market (ISM) on 5 March 2024 as part of PIF’s international sukuk issuance programme.

The involvement of SWFs in the Islamic finance space has been limited and disappointing since the advent of the contemporary Islamic finance movement in 1975. SWFs have lamented the lack of standardisation, especially of Shariah governance and rules relating to Sukuk issuance; the lack of quality asset pools for securitisation, the lack of engagement between stakeholders and market education; the lack of regular AAA-rated benchmark issuances, and perhaps most importantly the lack of a secondary trading market to unlock liquidity from both sovereign and corporate Sukuk transactions.

It is just over 13 years when Khazanah Nasional Berhad, the Malaysian SWF, issued the first Sukuk by a SWF in 2011 – a RM500m (US$107.58 million) offering. Since then, Khazanah has pioneered several Sukuk offerings including structures incorporating equity exchange options and others especially aimed at financing socially responsible, sustainable and social projects in the education, financial inclusion and other sectors. Very few other SWFs and pension funds have entered the Sukuk market. As such the US$3.5 billion Sukuk issued by PIF in October 2023 and this latest US$2 billion are by far the largest aggregate transactions issued by a single OIC SWF to date.

PIF, according to the SWF Institute, is the fifth largest sovereign wealth fund in the world with assets under management (AUM) totalling US$925 billion. Thanks to the Kingdom’s aggressive investment development strategy, especially projects related to the futuristic NEOM City, PIF and its subsidiaries and joint ventures have committed an estimated US$2.3 trillion of investment to a cornucopia of projects and initiatives over a whole spectrum of economic and social sectors. These include several in the Islamic finance space such as the Halal Products Development Company (HPDC); The Saudi Real Estate Refinance Company (SRC), the Sharia’a compliant mortgage finance and securitisation company; and other entities such as GIB KSA and The Helicopter Company, which are also accessing Islamic finance facilities or issuing Sukuk.

According to the SWF Institute, PIF accounted for more than 25% of the US$124 billion invested by SWFs worldwide in 2023.