Abu Dhabi’s Mubadala Investment Company is the Latest Sovereign Wealth Fund to Access International Financial Markets with Inaugural US$1bn Sukuk Wakala in April 2024

These are both changing and exciting times for the global Sukuk market. No sooner had the second largest sovereign wealth fund (SWF) in the OIC countries, The Public Investment Fund (PIF), issued its second Sukuk Tawarruq in March 2024 raising US$2 bn in the process, the Abu Dhabi SWF, Mubadala Investment Company, the 10th largest in the OIC, issued its maiden Senior Unsecured RegS Sukuk Wakala – a 10-year US$1 bn offering, in April 2024.

The PIF issuance follows on from its maiden US$3.5 bn Sukuk in October 2023, which brings its aggregate funds raised through two Sukuk transactions in four months to US$5.5 bn.

The entry of heavy-weight quasi-sovereign issuers such as PIF and Mubadala has the potential to be a seismic game changer in the global Sukuk market if their Sukuk strategy encompasses a programme of regular issuances as opposed to the odd foray into the market, underpinned by a genuine diversification of sources of funding strategy.

Reports that NEOM Company, which is spearheading the Kingdom’s multi-trillion-dollar giga projects initiative, is also planning to issue a debut Sukuk imminently, suggests the ascendancy and much-needed traction Sukuk as an infrastructure and fund-raising instrument is gaining.

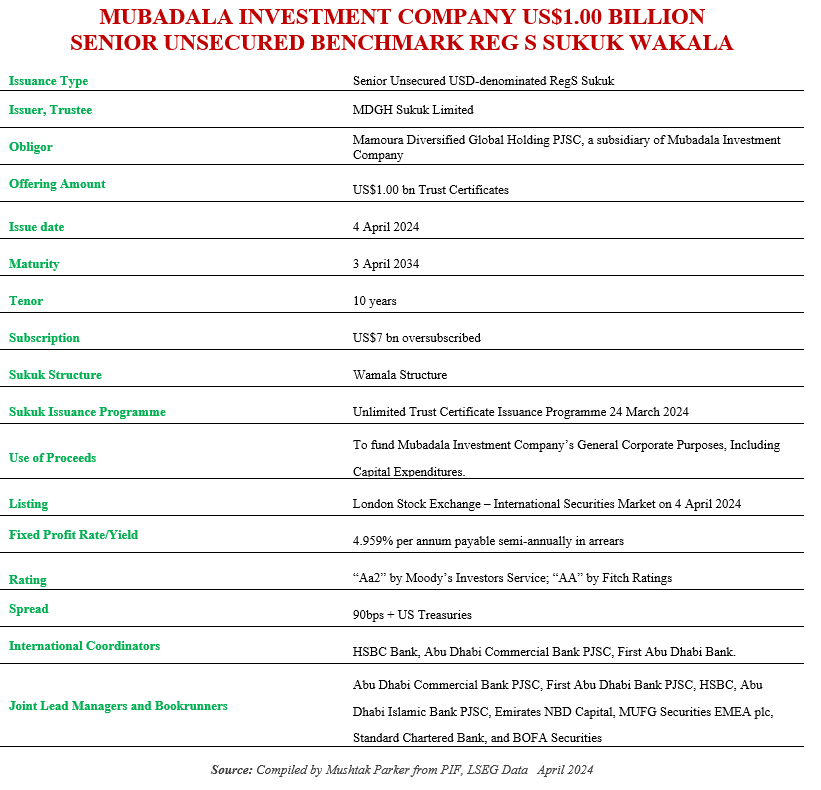

Mubadala through its subsidiary, Mamoura Diversified Global Holding, incorporated in the Abu Dhabi Global Market on 20 February 2024, had mandated Abu Dhabi Commercial Bank (ADCB), First Abu Dhabi Bank and HSBC as joint global coordinators, and together with Abu Dhabi Islamic Bank (ADIB), BOFA Securities, Citi, Emirates NBD Capital, MUFG and Standard Chartered Bank as joint lead managers and bookrunners, to arrange a series of investor meetings starting on 25 March 2024 in London, Europe, the Gulf Cooperation Council (GCC) region, the MENAT region, Asia and with Offshore US accounts for the issuance of 10-year senior unsecured RegS benchmark-sized papers.

The Sukuk certificates were issued through MDGH Sukuk Limited, a subsidiary of Mamoura Diversified Global Holding, the Obligor, under its newly established unlimited Trust Certificate Issuance Programme, established on 25 March 2024 and arranged by ADCB, Emirates NBD Capital, ADIB, First Abdu Dhabi Bank and Standard Chartered Bank, who together with HSBC also acted as dealers. MDGH Sukuk Limited acted as both issuer of the Sukuk certificates and as Trustee for and on behalf of them.

The transaction was well received by the market with robust demand for the certificates and the order book reaching US$7 bn, which means it was seven times over-subscribed. Mubadala had set the initial price guidance for the transaction at around 100 basis points (bps) over US Treasuries.

Due to the strong demand, the price tightened and eventually the transaction was closed at a spread of 70bps over US Treasuries. This compared with the yield of 85bps over US Treasuries for the 7-year US$2 bn PIF certificates last month.

The Sukuk certificates were admitted for listing and trading on the main market of the London Stock Exchange from 4 April 2024.

The involvement of SWFs, pension funds, social security funds and other such public and private funds in the Islamic finance and capital markets space has been limited since the advent of the contemporary Islamic finance movement in 1975.

SWFs have lamented the lack of standardisation, especially of Shariah governance and rules relating to Sukuk issuance; the lack of quality asset pools for securitisation, the lack of engagement between stakeholders and market education; the lack of regular AAA-rated benchmark issuances, and perhaps most importantly the lack of a secondary trading market to unlock liquidity from both sovereign and corporate Sukuk transactions.

It is just over 13 years when Khazanah Nasional Berhad, the Malaysian SWF, issued the first Sukuk by a SWF in 2011 – a RM500 mn (US$107.58 mn) offering. Since then, Khazanah has pioneered several Sukuk offerings including structures incorporating equity exchange options and others especially aimed at financing socially responsible, sustainable, and social projects in the education, SME, financial inclusion, and other sectors.

Very few other SWFs and pension funds have entered the Sukuk market. The US$3.5 billion Sukuk issued by PIF in October 2023 and this latest US$2 billion are by far the largest aggregate transactions issued by a single OIC SWF to date.

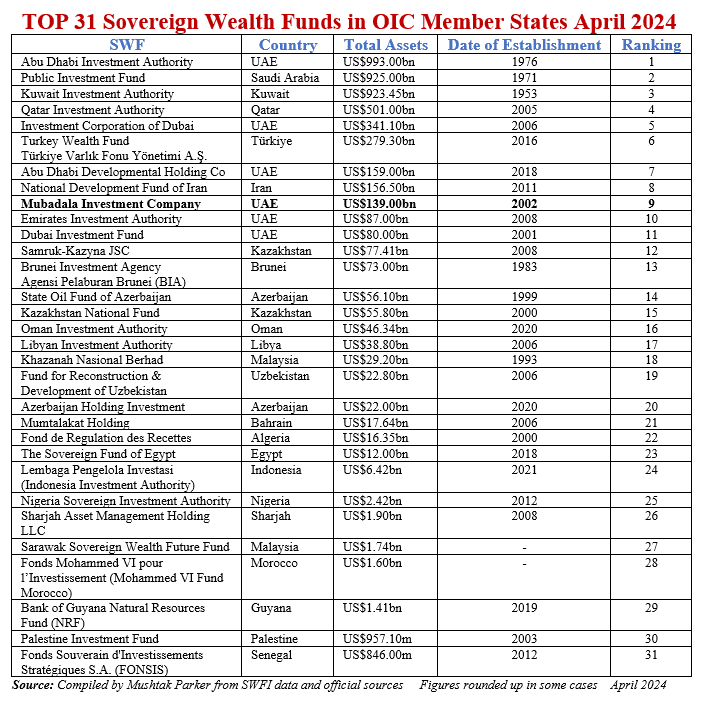

Mubadala Investment Company, according to the SWF Institute data, is the 9th largest sovereign wealth fund in the OIC with assets under management (AUM) totalling US$138.981 bn at April 2024.

There are some 31 SWFs in the OIC country universe with a combined AUM of about US$4.8 trillion.

Even the slightest change in fund-raising strategy to include Sukuk could contribute significantly to market depth and critical mass of issuances, whose lack is still the bane of the global Sukuk market dynamics.

The two major movers and shakers of the OIC SWFs are undoubtedly those from the UAE and Saudi Arabia. There are five SWFs from the UAE of which the Abu Dhabi Investment Authority (ADIA) is the single largest SWF in the OIC and the fourth in the world, with an AUM of US$993.00 bn at April 2024, followed by Saudi Arabia’s Public Investment Fund (PIF), the second largest SWF in the OIC and the fifth largest SWF in the world, with an AUM of US$925 bn.

Thanks to the Kingdom’s aggressive investment development strategy, especially projects related to the futuristic NEOM City, PIF and its subsidiaries and joint ventures have committed an estimated US$2.3 trillion of investment to a cornucopia of projects and initiatives over a whole spectrum of economic and social sectors.

These include several in the Islamic finance space such as the Halal Products Development Company (HPDC); The Saudi Real Estate Refinance Company (SRC), the Sharia’a compliant mortgage finance and securitisation company; and other entities such as GIB KSA and The Helicopter Company, which are also accessing Islamic finance facilities or issuing Sukuk.

According to the SWF Institute, PIF accounted for more than 25% of the US$124 bn invested by SWFs worldwide in 2023.