Indonesia Returns to the International Market with an Aggregate USD2.2bn Two-tranche Sukuk Wakala Issuance Including a 10-year Green Sukuk – its Eighth Consecutive Annual Such Issuance Aggregating USD7.7bn

The Republic of Indonesia, one of the most proactive sovereign Sukuk issuers in both the international and domestic capital markets, returned to the global market and successfully priced a two-tranche aggregate USD2.2bn Sukuk Wakala on 23 July 2025 – a mere eight months’ absence from the market.

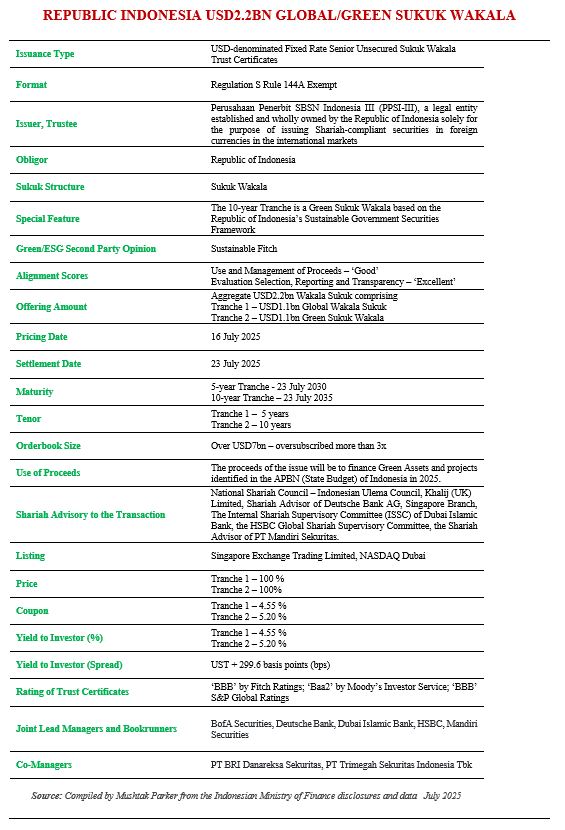

The transaction comprised: i) an USD1.1bn tranche with a 5-year tenor maturing on 23 July 2030, and ii) an USD1.1bn tranche with a tenor of 10 years maturing on 23 July 2035. The structure of the first tranche is a 5-year Global Sukuk Wakala and the second tranche a 5-year Green Sukuk Wakala, with the latter issued under Indonesia’s Sustainable Government Securities Framework. Sustainable Fitch provided the Second Party Opinion to the Green Sukuk tranche and assigned Alignment Scores relating to the Use and Management of Proceeds as ‘Good’, and those relating to Evaluation Selection, Reporting and Transparency relating to the transaction as ‘Excellent.’

The trust certificates were issued through Perusahaan Penerbit SBSN Indonesia III (PPSI-III), a legal entity established and wholly owned by the Republic of Indonesia solely for the purpose of issuing Shariah-compliant securities in foreign currencies in the international markets.

This latest USD2.2bn offering comprised senior unsecured Reg S/144A Trust Certificates priced at par. This is Indonesia’s first foray into the global Sukuk market in 2025. Prior to this transaction the Ministry of Finance on behalf of the Government raised USD2.75bn through a Global Sukuk Wakala in November 2024, and USD2.35bn through a similar Global Sukuk Wakala in the international market in June 2024.

There is no doubt that Indonesia is the leading and most consistent issuer of Green Sukuk in the world, which adds credence to the Government’s ambition of promoting green sustainable finance as part of its public fund-raising and climate action finance mix. This latest USD1.1bn Green Sukuk is its eighth consecutive such annual issuance since its inaugural Green Sukuk in 2018 raising an aggregate USD7.7bn to finance green assets and projects under Jakarta’s Sustainable Government Securities Framework as per the various provisions of the country’s national budget (APBN). To date Indonesia has issued Green Sukuk as follows – USD1.25bn (2018), USD750mn (2019), USD750mn (2020), USD750mn (2021), USD1.5bn (2022), USD1bn (2023), USD600mn (2024), and USD1.1bn (2025).

According to the Directorate of Islamic Financing, a unit in the Directorate General of Budget Financing and Risk Management of the Indonesian Ministry of Finance, “this transaction is in line with the Government’s strategy to finance the APBN (State Budget) in 2025. The success of this transaction also reflects strong demand from a diverse range of global investors and their faith in Indonesia’s economic fundamentals and credibility, as well as the performance of the State Budget managed by the Government.

“As evidence of the Republic of Indonesia’s dedication and long-term commitment to green and sustainable financing, and as part of its effort in mitigating and adapting to climate change, the 10-year tranche is a green series, backed by the Republic’s pool of green assets. This issuance of Green Sukuk is based on Sustainable Government Securities Framework that refers to internationally recognized guidelines, in accordance with Second Party Opinion by Sustainable Fitch. Th trust certificates are rated Baa2 by Moody’s Investor Service, BBB by S&P Global Ratings Services and BBB by Fitch Ratings.

The Shariah advisory process especially the structure and composition of the asset pool of the transaction was exhaustive involving the National Sharia Council of the Indonesian Ulema Council, Khalij (UK) Limited, and the Shariah Supervisory Committees of Deutsche Bank AG, Singapore Branch, Dubai Islamic Bank, HSBC, and of the local PT Mandiri Sekuritas.

The Directorate General of Budget Financing and Risk Management had mandated BofA Securities, Deutsche Bank, Dubai Islamic Bank, HSBC, and Mandiri Securities to act as Joint Lead Managers and Joint Bookrunners to the transaction, and to arrange a series of investor calls and an investor roadshow with accounts in London, the EU, the Middle East and Asia in on 15 July 2025. PT BRI Danareksa Sekuritas and PT PT Trimegah Sekuritas Indonesia Tbk acted as Co-Managers for this transaction.

Taking advantage of a constructive market backdrop as well as capitalizing on future market uncertainties, the Directorate General of Budget Financing and Risk Management announced an initial price guidance of 4.85% for the 5-year USD1.1bn Global Sukuk Wakala tranche and 5.5% for the USD1.1bn 10-year Green Sukuk Wakala tranche during the Asia morning session on 16 July 2025. The offering, according to the Directorate General drew strong investor interest from the outset, with combined orderbooks reaching peak demand of US$ 7 billion – more than 3 times oversubscribed.

Due to the robust demand for the certificates, the price tightened considerably with the Global Sukuk subsequently priced at par and with a coupon rate during final pricing of 4.55% per annum on the 5-year Global Sukuk Wakala tranche, and 5.20% per annum on the 10-year Green Sukuk Wakala tranche – all payable semi-annually in arrears.

This compared with the pricing of the USD2.75bn November 2024 Global Sukuk at par and with a profit rate of 5.00% per annum on the USD1.1bn 5.5-year tranche, 5.25% per annum on the USD900mn 10-year tranche and 5.85% per annum on the USD750mn 30-year tranche – all payable semi-annually in arrears. This also compared with the pricing of the USD2.35bn June 2024 transaction in which the Global Sukuk were priced at par and with a profit rate of 5.10% per annum on the USD750mn 5-year tranche, 5.20% per annum on the 10-year USD1bn tranche, and 5.50% per annum of the USD600mn 30-year Green Sukuk tranche.

Settlement of the Global Sukuk was on 23 July 2025 and the certificates have been admitted for listing on both the Singapore Exchange Securities Trading Limited and NASDAQ Dubai.