Türkiye Consolidates its Position as a Regular Issuer of Sukuk with Third US Dollar Transaction in Seven Months Through a USD2.5bn 5-Year Sukuk-Al-Ijara Offering in the International Financial Market in June 2025

Sovereign Türkiye returned to the international financial market after an absence of just seven months with a USD2.5bn Sukuk Al-Ijara offering on 24 June 2025, following on from its previous issuance on 26th November 2024 with a similar USD2.5bn Sukuk Al Ijara offering.

On the back of the successful closing of Ankara’s latest Eurobond issuance in May 2025 and the affirmation of a “stable outlook” and ‘BB-’ rating of sovereign Türkiye by ratings agency S&P Global, despite earlier political and economic uncertainty, Türkiye has seen a steady inflow of investment and capital from the from the GCC states especially the UAE, Qatar, Kuwait and Saudi Arabia, whose Islamic banks are very familiar with local market conditions through their subsidiaries, including Türkiye’s country credit risk dynamics.

Sukuk origination is now firmly in the public fund-raising playbook of the Government of Türkiye. All the signs are that Sukuk issuance – both in the domestic and international markets – are now becoming established features of the Türkiye Treasury’s public debt raising strategy, on the back of rapidly improving economic fundamentals and upgrading of Türkiye’s international credit ratings. In 2024, it issued three US dollar Sukuk transactions alone raising an aggregate USD3.458bn. Türkiye Varlık Fonu Yönetimi A.Ş. (Türkiye Wealth Fund (TWF), the state-owned sovereign wealth fund, also issued its maiden benchmark USD750mn Sukuk Al-Ijara on 18 October 2024.

This latest transaction is the Ministry of Treasury and Finance’s second foray into the international Sukuk market in 2025. The Treasury issued FX-linked leasing certificates on 15 April 2025 when it raised USD213.125mn through a Fixed Rent Rate Lease Certificate (Sukuk Al Ijara) issuance with a tenor of 364 days priced at a fixed rental rate of 2.60% over 6 months and maturing on 15 April 2026. Demand for both issuances was robust. All this is helping Türkiye build up a yield curve albeit only for Sukuk Al Ijara issuance, partly due to local market familiarity with and scepticism over the more outwardly debt-backed Sukuk structures as opposed to asset-backed ones.

Sukuk origination is an established part of the Türkiye Treasury’s active but diversified public funding and debt strategy which includes Sukuk and bond issuances in the domestic and international market; and in the Islamic finance space the issuance of fixed and CPI-linked lease certificates, FX-linked lease certificates, and gold-backed lease certificates.

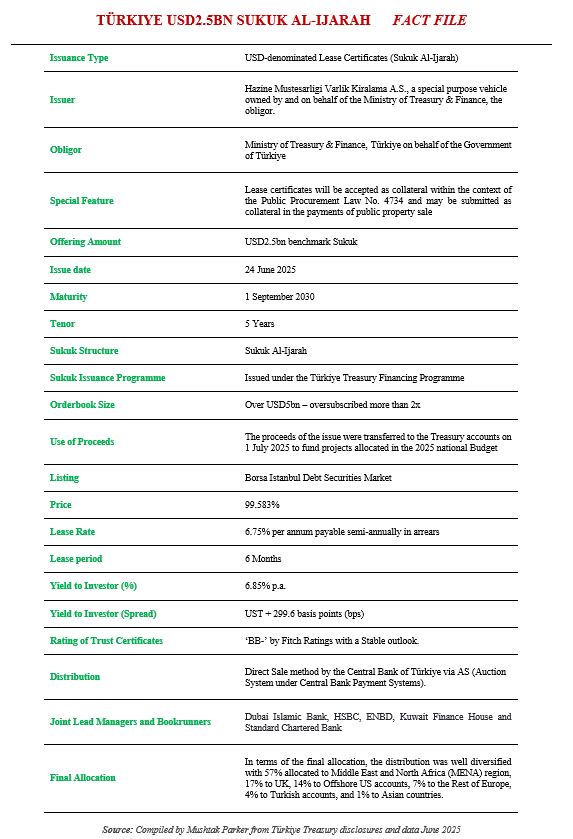

As part of the 2025 external borrowing programme, the Ministry of Treasury and Finance mandated Dubai Islamic Bank, ENBD, HSBC, Kuwait Finance House and Standard Chartered on 21 June 2025 to act as joint lead managers and bookrunners, and to arrange a series of investor calls and meetings with accounts in the UK, Europe, the MENA Region, Offshore US and Asia for the issuance of a US dollar denominated lease certificate (Sukuk Al Ijara) due September 2030 in the international capital markets.

According to the Ministry, the Sukuk Ijarah certificates, rated ‘BB-’ by Fitch Ratings with a Stable outlook, were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury and Finance, the obligor on behalf of the Government of Türkiye, under the Türkiye Treasury’s Public Debt Financing Programme. The result was that on 24 June 2025, the Ministry of Treasury and Finance issued Sukuk (lease certificates) in the international capital markets with a size of USD2.5bn and a tenor of 5 years maturing on 1 September 2030.

The transaction was priced at a lease rental rate of 6.75% per annum payable semi-annually in arrears on a lease period of 6 months and a yield to the investor of 6.85% which translates into a spread of UST + 299.6 basis points (bps). The proceeds of the issue were transferred to the Treasury accounts on 1 July 2025 to fund projects allocated in the 2025 National Budget.

This compared with the pricing for the November 2024 transaction which was priced at a lease rental rate of 6.50% per annum payable semi-annually in arrears on a lease period of 6 months and a yield of 6.55% which translated into a spread of UST + 230 basis points.

The offering attracted an orderbook of more than twice the actual issue size from 119 accounts. 57% of the certificates have been sold to investors in the Middle East, 17% in the UK, 14% in the US, 7% in other European countries, 4% in Türkiye, and 1% in other countries.

With this transaction, the amount of funds that have been raised from the international capital markets in 2025 has reached a total of USD7bn comprising USD5bn through international bond issuances and USD2.5bn through Sukuk Al Ijara. It is interesting that the two bond issuances of USD2.5bn each – both with a seven-year tenor – were priced at a coupon rate of 7.125% per annum and a spread of UST + 287.9 bps for the February 2025 issuance and a coupon rate of 7.25% per annum and a spread of UST + 308.4 bps for the May 2025 issuance.

The Sukuk certificates were admitted for listing and trading on the Borsa Istanbul Debt Securities Market in late June 2025.