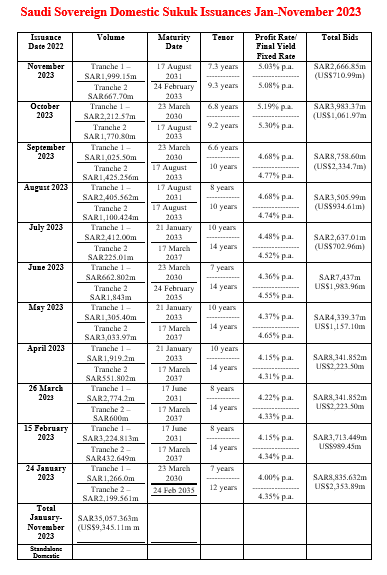

Saudi NDMC Domestic Sovereign Sukuk Momentum Continues with Closure of SAR2,67bn (US$710.99m) Sukuk Issuance in November, as Total Sukuk Issuance Tops an Impressive US$24.92bn in the January-November 2023 Period

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) successfully closed its eleventh consecutive monthly domestic sovereign Sukuk issuance on 23rd November 2023 raising a total SAR2,666.85 million (US$710.99 million), through a two-tranche auction conducted by the Saudi Central Bank (SAMA).

This follows similar issuances on 27th September and 21st October 2023 respectively raising an aggregate SAR6,434.12 million (US$1,715.10 million) in the process. The NDMC kicked off with its first issuance of the year in January 2023 followed by consecutive monthly auctions till November 2023 to date. The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The two tranches auctioned on 23rd November 2023 which raised an aggregate SAR2,666.85 million (US$710.99 million) comprised:

- A first tranche of SAR1,999.15 million (US$532.98 million) with a 6.6-year tenor maturing on 17th August 2031 and priced at a yield of 5.03 % per annum and a price of SAR96.63193. Bids received totalled SAR1,999.15 million (US$532.98 million), the allocated amount.

- A second tranche of SAR667.70 million (US$178.01 million) with a 10-year tenor maturing on 24th February 2033 and priced at a yield of 5.08% per annum and a price of SAR82.33345. Bids received totalled SAR667.70 million (US$178.01 million), the allocated amount.

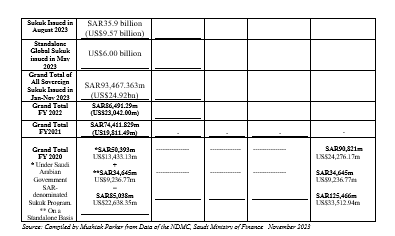

Thus far in 2023, the NDMC has raised a total of SAR35,057.363 million (US$9,345.11 million) in the January-November period, compared to SAR86,491.29 million (US$23,042.00 million) and SAR65,741.315 million (US$17,491.51 million) for the same periods in 2022 and 2021 respectively.

In a statement, the NDMC stressed that “this issuance confirms the NDMC’s statement on the mid of February 2022, that it will continue, in accordance with the approved Annual Borrowing Plan, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while taking into account market movements and the government debt portfolio risk management.”

This latest transaction also follows the one-off Saudi sovereign Sukuk issuance in the international Sukuk market in mid-May 2023 through a dual tranche Sukuk totalling US$6 billion in response to “receiving investors’ requests for the issuance of international trust certificates (Sukuk).”

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2023 Calendar of Local Sukuk Issuances, released in January, confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

In addition to the above issuance activity, the NDMC also issued a standalone Sukuk tranche under the Local Saudi Sukuk Issuance Program in Saudi Riyal with a total value around SAR35.9 billion (US$9.57 billion) in August 2023. This means that the total funds raised by the NDMC through domestic and international Sukuk issuances thus far in 2023, is a staggering SAR93,467.363 million (US$24.92 billion) through domestic Saudi riyal denominated Sukuk in the January to November period and the standalone US$6 billion (SAR22.51 billion) issuance in the international market in May. In US dollar terms, the grand total raised through Sukuk thus far for the first eleven months of 2023 amounts to an impressive US$24.92 billion.

“This initiative is a continuation of the NDMC’s efforts to strengthen the domestic market and to keep up with market developments which have been reflected positively on the growing trading volume in the secondary market. Further, this initiative enables the NDMC to exercise its role in managing the government debt obligations and its future maturities. This will also align the NDMC’s efforts with other initiatives to enhance the public finance in the medium and long term,” stressed the NDMC.

In a report in November 2023 titled “Saudi Debt Capital Markets Dashboard: 3Q23”, Fitch Ratings noted that the Kingdom’s outstanding debt capital market (DCM) will continue to grow, having reached US$358.8 billion for all currencies (up 18.4% y-o-y) in 3Q23 with Sukuk accounting for 62% and the rest in bonds. The DCM growth is expected to be supported by the diversification of funding and the development of capital markets in Saudi Arabia, with Sukuk playing a major role.

“With the Saudi Vision 2030,” maintained Bashar Al-Natoor, Global Head of Islamic Finance at Fitch Ratings, “we expect the Kingdom to continue developing its DCM, supported by funding diversification, ambitious giga projects and capital market development initiatives. We expect continued initiatives to diversify funding – not only by the sovereign, but also by banks, corporates and projects that are likely to seek alternative channels like the DCM”.

Other observations by Fitch include: i) The corporate funding culture in Saudi Arabia is still geared mostly towards bank financing, but this is gradually changing; ii) Saudi riyal issuance was almost solely dominated by Sukuk across all sectors over the past five years, and the government only issues local-currency debt in Sukuk format.

According to Bashar Al-Natoor, Saudi Arabia is a key Sukuk issuer, with a 25.1% share of the global US dollar Sukuk market in 3Q23. It has the largest DCM in the GCC and has 69.4% of the GCC Sukuk market (all currencies), as well as 23.4% of the US dollar global ESG Sukuk market.

Fitch’s dashboard shows that Sukuk issuances (all currencies) reached US$12.3 billion in 3Q23 (down 2.1% q-o-q), while bonds issuances were US%1.4 billion (up 16.8% q-o-q); 90% of issuances in 3Q23 were in Sukuk format. Fitch rates US$46.7 billion of Saudi outstanding Sukuk, 97.1% of which are investment-grade.

“Liquidity available to the banking sector has tightened, and we expect deposits to remain the main source of funding for Saudi banks in the longer term. However, all banks are expected to continue diversifying their funding bases through wholesale funding, including issuing Sukuk and bonds. We also expect corporate segment to reduce reliance on bank financing and issue more debt,” stressed Mr Al-Natoor.

The NDMC is currently also working on attracting new capital, and more international financial institutions in addition to selected local banks to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC. Already, BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank have signed up as new primary dealers in the government’s local debt instruments. They join five local institutions, namely Saudi National Bank, Saudi British Bank (SABB), Al Jazira Bank, Alinma Bank, and Al Rajhi Bank, already in the NDMC’s Primary Dealers Programme.