Saudi NDMC Domestic Sovereign Sukuk Momentum Continues with Closure of SAR6.1bn (US$668.5m) of Sukuk Issuances in September and October 2023, as Aggregate Issuance Tops an Impressive US$24.21bn in the January-October 2023 Period

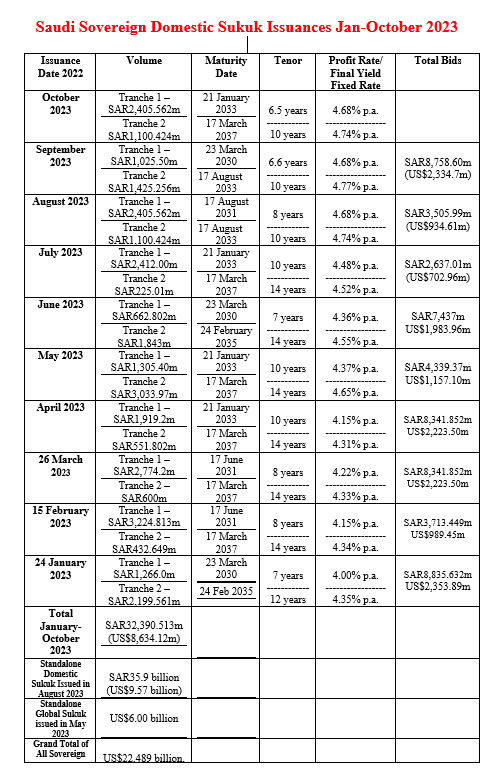

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) successfully closed its ninth and tenth consecutive monthly domestic sovereign Sukuk issuance on 27th September and 21st October 2023 respectively raising an aggregate SAR6,434.12 million (US$1,715.10 million) in the process.

This follows a similar issuance on 27th July and 24th August 2023 when the NDMC raised an aggregate SAR6,142.996 million (US$1,637.58 million) through a two-tranche auction conducted by the Saudi Central Bank (SAMA).

The NDMC kicked off with its first issuance of the year in January 2023 followed by consecutive monthly auctions till October 2023 to date. The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The two tranches auctioned on 27th September 2023 which raised an aggregate SAR2,450.75 million (US$653.28.28 million) comprised:

- A first tranche of SAR1,025.50 million (US$273.36 million) with a 6.6-year tenor maturing on 23rd March 2030 and priced at a yield of 4.68% per annum and a price of SAR88.94857. Bids received totalled SAR5,278.35 (US$1,407.01 million), the allocated amount.

- A second tranche of SAR1,425.256 million (US$379.92 million) with a 10-year tenor maturing on 17th August 2033 and priced at a yield of 4.77% per annum and a price of SAR98.66619. Bids received totalled SAR3,480.256 million (US$927.71 million), the allocated amount.

Similarly, the two tranches auctioned on 21st October 2023 which raised an aggregate SAR3,983.37 million (US$1,061.82 million) comprised:

- A first tranche of SAR2,212.57 (US$589.79 million) with a 6.6-year tenor maturing on 23rd March 2030 and priced at a yield of 5.19% per annum and a price of SAR86.51930. Bids received totalled SAR2,212.57 (US$589.79 million), the allocated amount.

- A second tranche of SAR1,770.80 million (US472.03 million) with a 10-year tenor maturing on 17th August 2033 and priced at a yield of 5.30% per annum and a price of SAR94.69209. Bids received totalled SAR1,770.80 million (US$472.03 million), the allocated amount.

In 2022 the Saudi Ministry of Finance issued an aggregate SAR86,491.29 million (US$23,042.00 million) of Saudi-riyal denominated Sukuk for the January-December period through consecutive monthly issuances. In the same period in 2021, according to data compiled by Mushtak Parker from official MoF reports, the NDMC issued an aggregate SAR65,741.315 million (US$17,491.51 million).

Thus far in 2023, the NDMC has raised a total of SAR32,390.513 million (US$8,634.12 million) in the January-October period.

In a statement, the NDMC stressed that “this issuance confirms the NDMC’s statement on the mid of February 2022, that it will continue, in accordance with the approved Annual Borrowing Plan, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while taking into account market movements and the government debt portfolio risk management.”

This latest transaction also follows the one-off Saudi sovereign Sukuk issuance in the international Sukuk market in mid-May 2023 through a dual tranche Sukuk totalling US$6 billion in response to “receiving investors’ requests for the issuance of international trust certificates (Sukuk).”

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2023 Calendar of Local Sukuk Issuances, released in January, confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

In addition to the above issuance activity, the NDMC also issued a standalone Sukuk tranche under the Local Saudi Sukuk Issuance Program in Saudi Riyal with a total value around SAR35.9 billion (US$9.57 billion) in August 2023. This means that the total funds raised by the NDMC through domestic and international Sukuk issuances thus far in 2023, is a staggering SAR68.30 billion (US$18.21 billion) through domestic Saudi riyal denominated Sukuk in the January to October period and the standalone US$6 billion issuance in the international market in May. In US dollar terms, the grand total raised through Sukuk thus far for the first ten months of 2023 amounts to an impressive US$24.21 billion.

“This initiative is a continuation of the NDMC’s efforts to strengthen the domestic market and to keep up with market developments which have been reflected positively on the growing trading volume in the secondary market. Further, this initiative enables the NDMC to exercise its role in managing the government debt obligations and its future maturities. This will also align the NDMC’s efforts with other initiatives to enhance the public finance in the medium and long term,” stressed the NDMC.

At the World Bank/IMF Autumn Annual Meetings in Marrakech in October 2023, Saudi Minister of Finance Mohammed Aljadaan maintained that “in Saudi Arabia, Vision 2030 is on a fast track to achieve its targets and ultimate objectives. Despite the challenging global environment, non-oil GDP is growing stronger, unemployment is at a record low, inflation is contained, fiscal and external buffers are robust, and the banking system remains strong, liquid, and well-capitalized underpinned by sound supervisory and regulatory frameworks. Saudi Arabia maintains a close engagement and collaboration with the IMF to support members’ economic reform programmes and catalyze further international support to help the membership navigate these challenging times, which should have positive spill overs for the region.”

The Kingdom also received a major boost from the IMF’s Article IV Consultation on Saudi Arabia which was published in September 2023. “Saudi Arabia was the fastest growing G20 economy in 2022. Overall growth reached 8.7%, reflecting both strong oil production and a 4.8% non-oil GDP growth driven by robust private consumption and non-oil private investment, including giga projects. Wholesale, retail trade, construction, and transport were the main drivers of non-oil growth. The output gap is estimated to have closed during 2022, with the non-oil growth momentum continuing in 2023,” observed the IMF.

The Saudi unemployment rate says the IMF is at a historical low. Amid an increase in labour force participation, total unemployment dropped to 4.8% by end-2022 – from 9% during Covid. Despite a booming economic activity, inflation remains low and appears to be easing. Despite an uptick in early 2023 to 3.4% y-o-y, headline inflation is back at 2.8% y-o-y in May 2023.

The NDMC is currently also working on attracting new capital, and more international financial institutions in addition to selected local banks to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC. Already, BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank have signed up as new primary dealers in the government’s local debt instruments. They join five local institutions, namely Saudi National Bank, Saudi British Bank (SABB), Al Jazira Bank, Alinma Bank, and Al Rajhi Bank, already in the NDMC’s Primary Dealers Programme.