NDMC Sustains Saudi Riyal Sovereign Sukuk Issuance in July 2025 with a 4-Tranche Offering Totalling SAR5,019.7mn (USD1,337.8mn) and Bringing the Total Issuance for the First 7 Months in 2025 to SAR24.6bn (USD6.6bn)

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) continued its monthly Sukuk issuance momentum in July 2025 amid growing volatility in the global crude oil prices, with a four-tranche aggregate issuance of Saudi-riyal-denominated SAR5,019.681mn (USD1,337.84mn) Sukuk certificates on 31 July 2025.

The Kingdom is ahead in tapping the domestic sovereign Sukuk market for manifold reasons including the presence of an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The uncertainties and unpredictability relating to the tariff announcements by the Trump administration and the potential global trade disruption has subsided to a certain extent given that the unpredictability remains due to the geopolitical tensions in the region, which in turn has contributed to the continued volatility in oil and gas prices with its knock-on effects of national budgets, impacting on the global economy, on national budgets and the cost of living in all economies, which is inevitably leading to higher borrowing and debt accumulation.

In this context, the IMF’s report card for its 2025 Article IV Consultation with the Kingdom is generally positive.

“Saudi Arabia’s economy,” observed the IMF Executive Board, “has demonstrated strong resilience to shocks, with non-oil economic activities expanding, inflation contained, and unemployment reaching record-low levels. Despite heightened uncertainty and declining commodity prices, the outlook remains strong with risks to the downside. External and fiscal buffers remain ample, even as current account and fiscal deficits persist over the medium term.” As its economic diversification advances, Saudi Arabia, added the IMF, has shown strong resilience to external shocks. In 2024, non-oil real GDP grew by 4.5%, driven by retail, hospitality, and construction, while OPEC+ production cuts held oil output at 9 mbpd, causing a 4.4% decline in oil GDP and moderating overall growth to 2.0%. Inflation remained contained, with housing rent increases continuing to decelerate. Unemployment among Saudi nationals hit a record low, with youth and female unemployment rates halved over four years.

The Kingdom’s near-term outlook, however stressed the Fund, faces downside risks, including weaker oil demand due to global trade tensions, lower government spending, and regional security risks that could dampen investor sentiment. On the upside, higher oil production or additional investments linked to Vision 2030 initiatives would support growth, and oil prices could rise if the global recovery strengthens or in the case of disruptions to the global supply of oil.

In June 2025 Fitch Ratings projected the Saudi Debt Capital Market (DCM) to exceed USD500bn outstanding in 2025. By end of Q1 2025, the DCM had already reached USD465.8bn outstanding, up 16% y-o-y, with a Sukuk majority of 60.4%, split mostly between US dollars (52.4%) and Saudi riyal issues (45.3%).

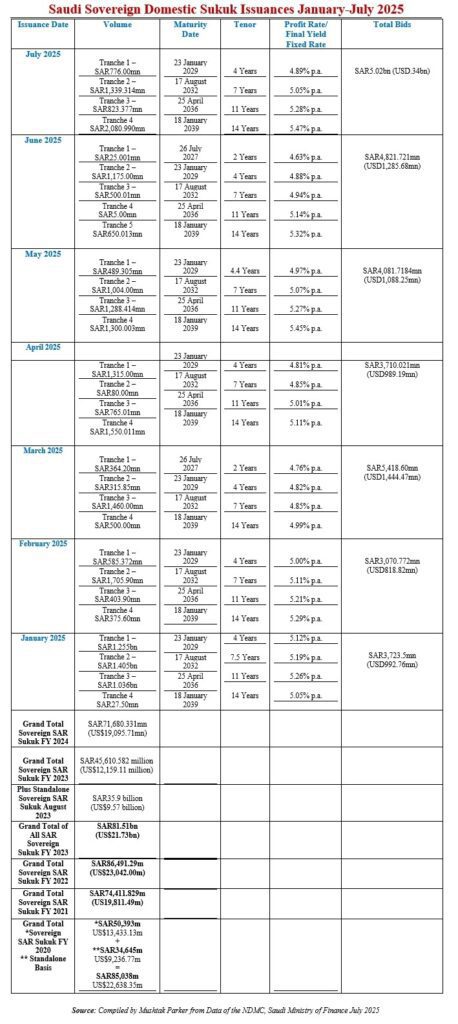

Sukuk issuance has emerged as a major public debt raising instrument alongside conventional banks. Sukuk however dominates Saudi sovereign domestic debt issuance. On 15 July 2025 the NDMC raised an aggregate SAR5,019.681mn (USD1,337.84mn) in an auction which comprised:

i) A 4 -Year Tranche of SAR776.00mn (USD206.82mn) priced at a yield of 4.89% p.a. maturing on 23 January 2029.

ii) A 7 -Year Tranche of SAR1,339.314mn (USD356.95mn) priced at a yield of 5.05% p.a. maturing on 17 August 2032.

iii) A 11-Year Tranche of SAR823.377mn (USD219.45mn) priced at a yield of 5.28% p.a. maturing on 25 April 2036.

iv) A 14-Year Tranche of SAR2,080.990mn (USD554.62mn) priced at a yield of 5.47% p.a. maturing on 18 January 2039.

The auction attracted total bids of SAR5.02bn (USD.34bn) which matched the allocated amounts raised.

This compared with the SAR2,355.024mn (USD627.95mn) raised in a 5-tranche auction on 24 June 2025 which attracted bids amounting to SAR4,821.721mn (USD1,285.68mn), and the total bids of SAR4,081.7184mn (USD1,088.25mn) for the May 2025 auction, suggesting sustained demand for the certificates from both qualified domestic and foreign institutional investors.

The NDMC started the year 2025 with a four-tranche auction on 23 January 2025 which raised an aggregated SAR3,723.5mn (USD992.76mn). It continued its proactive sovereign Sukuk issuance momentum in the Saudi riyal-denominated domestic market in February 2025 with a 4-tranche transaction aggregating SAR3,070.772mn (USD818.82mn), in March 2025 with an auction which raised SAR2,640.05mn (USD703.78mn), in April 2025 with a similar 4-tranche transaction which raised an aggregate SAR3,710.021mn (USD989.19mn), an aggregate SAR4,081.7184mn (USD1,088.25mn) offering in May 2025, followed by an auction in June 2025 which raised SAR2,355.024mn (USD627.95mn).

The Kingdom has raised an aggregate SAR24,600.7664mn (USD6,556.58mn) for the first seven months of 2025 through Saudi riyal-denominated sovereign Sukuk issuances under its dedicated SAR Sukuk Issuance Programme Calendar.

The NDMC finished the year 2024 with a flourish of activities resulting in an auction on 24 December 2024 amounting to SAR11,598.081mn (USD3,087.44mn) – its 12th consecutive monthly auctions of the year under its published issuance calendar and the NDMC’s SAR Sukuk Issuance Programme.

The Programme raised a staggering SAR71,680.33mn (USD19,095.71mn) in 2024; SAR45,610.582mn (USD12,159.11mn) in 2023 supplemented by an additional SAR35.9bn (USD9.57bn) through a standalone local currency Sukuk, bringing the total SAR-denominated Sukuk to SAR81.51bn in 2023; SAR86,491.29m (USD23,042.00mn) in 2022; SAR74,411.829mn (USD19,811.49mn) in 2021; and SAR50,393m (USD13,433.13m) in 2020 supplemented by an additional SAR34,645mn (USD9,236.77mn) through a standalone local currency Sukuk, bringing the total to SAR-denominated Sukuk to SAR85,038mn (US$22,638.35mn) in 2020.

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.” These issuances, confirmed the NDMC, will continue in accordance with the approved 2025 Annual Borrowing Plan, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while considering market movements and the government debt portfolio risk management.

The NDMC says it is committed to ensuring the Kingdom’s sustainable access to various debt markets to issue sovereign debt instruments at fair prices while maintaining prudent risk levels. To achieve this objective, it will continue to diversify financing channels throughout 2025. This diversification will include expanding financing through export credit agencies (ECAs), financing infrastructure projects, and exploring tapping into new markets in new currencies. These initiatives aim to expand the investor base and enhance the Kingdom’s access to global capital markets.

In January 2025, the Saudi Ministry of Investment’s updated investment rules also came into effect, which according to the NDMC will make it easier for foreign investors to invest in the Kingdom to attract more international investment by streamlining the process and creating a more investor-friendly environment. The ministry highlighted that the updated regulations would eliminate the need for many licenses and prior approvals, as well as significantly reduce paperwork and bureaucratic hurdles.

In this respect, the NDMC continues to work on attracting new capital, and more international financial institutions in addition to selected local banks to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC. Already, BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank have signed up as new primary dealers in the government’s local debt instruments. They join five local institutions, namely Saudi National Bank, Saudi British Bank (SABB), Al Jazira Bank, Alinma Bank, and Al Rajhi Bank, already in the NDMC’s Primary Dealers Programme.