Saudi NDMC Issues Ninth and Tenth Consecutive Monthly Domestic Sukuk in September and October as Total for January-October 2021 Touches SAR75bn (US$20bn) Mark

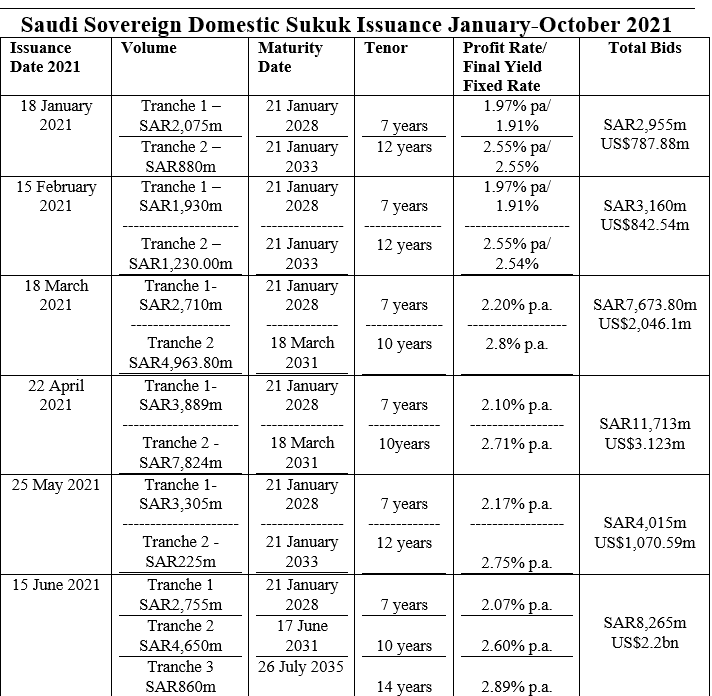

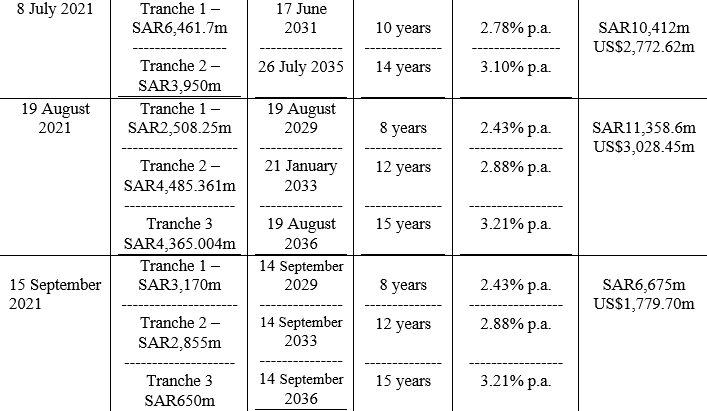

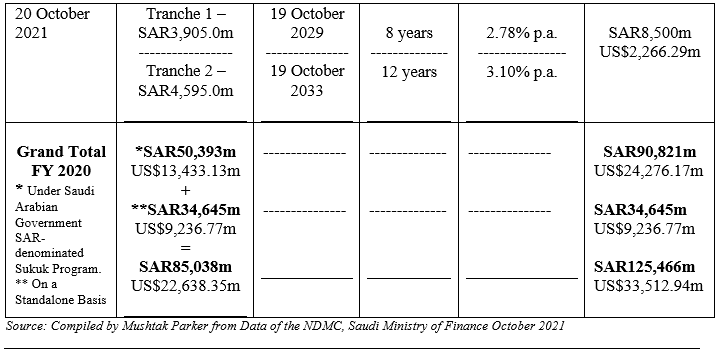

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) issued its ninth and tenth consecutive monthly issuance of Riyal-denominated sovereign Sukuk with a three-tranche SAR6,675m (US$1,779.70m) offering on 15 September 2021, and a two tranche SAR8,500m (US$2,266.29m) offering on 20 October 2021 respectively.

This follows the closing of a similar three-tranche SAR11,358.6m (US$3,028.45 million) offering in August 2021 – all under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme. This means that in the first ten months of 2021, the NDMC has raised the equivalent of SAR74,727.414 million (US$19,923.96 million) through ten domestic sovereign Sukuk issuances.

The SAR6,675m (US$1,779.70m) offering comprised three tranches offered through three auctions held on 14 September 2021:

1) A first tranche of SAR3,170m (US$845.19m) with an 8-year tenor maturing on 14 September 2029 and priced at a final fixed profit rate/yield of 2.43% per annum, with total bids amounting to SAR3,170m (US$845.19m).

2) A second tranche of SAR2,855m (US$761.2m) with a 12-year tenor maturing on 14 September 2033 and priced at a final fixed profit rate/yield of 2.88% per annum, with total bids amounting to SAR2,855m (US$761.2m).

3) A third tranche of SAR650m (US$173.3m) with a 15-year tenor maturing on 14 September 2036 and priced at a final fixed profit rate/yield of 3.21% per annum, with total bids amounting to SAR650m (US$173.3m).

The SAR8,500m (US$2,266.29m) offering on 20 October 2021 comprised two tranches offered through two auctions held on 19 October 2021:

i) A first tranche of SAR3,170m (US$845.19m) with an 8-year tenor maturing on 14 September 2029 and priced at a final fixed profit rate/yield of 2.43% per annum, with total bids amounting to SAR3,170m (US$845.19m).

ii) A second tranche of SAR2,855m (US$761.2m) with a 12-year tenor maturing on 14 September 2033 and priced at a final fixed profit rate/yield of 2.88% per annum, with total bids amounting to SAR2,855m (US$761.2m)

The NDMC’s Domestic Sukuk Issuance Calendar for 2021 commits to a consecutive monthly Sukuk issuance strategy from January to December 2021. No other jurisdiction has committed to such a dedicated domestic Sukuk issuance regime in 2021. Moody’s Investors Services in October assigned (P)A1/Aaa.sa rating to the Government’s Saudi-riyal denominated Sukuk Programme for 2021.

In 2020, according to data compiled by Mushtak Parker for this newsletter from MoF statistics, the NDMC issued under its Sukuk Issuance Programme domestic Sukuk totalling SAR50,393 million (US$13,433.13 million) with total bids amounting to SAR79,100 million (US$21,085.17 million). This means that the January-October 2021 total of SAR59,552.414 million (US$15,876.53 million) has already surpassed the entire total for 2020.

The NDMC also raised SAR34,645 million (US$9,236.77 million) from a four-tranche standalone auction in July 2020, bringing the total Saudi-riyal denominated Sukuk issued by the government in 2020 to SAR85,038 million (US$22,638.35 million), which is almost a 50% increase on the previous year.

The momentum of Saudi domestic sovereign and corporate Sukuk issuance is concomitant with the Ministry of Finance and the Saudi Central Bank (SAMA’s) efforts in upscaling market education on Islamic finance in order for institutions, corporates, investors and retail customers to understand and therefore benefit from the opportunities the industry has to offer.

SAMA, for instance organised a workshop in September 2021 as part of a series of quarterly ones focused on Islamic finance, where Dr Fahad A Aldossari, Deputy Governor for Research and International Affairs at the Saudi Central Bank, indeed stressed “the important role of educational programmes in the Islamic finance industry as a strategic pillar in supporting the qualitative growth of the industry through the development of educational and technical programmes that suit the sector’s requirements.”

Similarly, Fahad Abdullah Almubarak, Governor of SAMA, speaking at an Islamic Finance innovation webinar in September, reminded about the increasing and important role of the sector in contributing to Saudi GDP and the growth of the domestic private sector.

He re-affirmed that Saudi Arabia is the largest Islamic Finance market in the world and that local Islamic banking assets reached more than US$565 billion in Q1 2021. SAMA, he revealed is working to enhance the digital infrastructure of the financial sector to bring forward innovative growth and that “the Islamic FinTech space in particular offers exciting new growth opportunities for the industry.”

Saudi Sukuk issuance is expected to sustain its buoyancy in the second half of 2021 thanks to the demands of Saudi Vision 2030 and the government’s economic reform agenda. Sukuk issuance, which is particularly suited to financing infrastructure and urban regeneration, is also relevant in the context of the efforts of the G20 to boost investment in these sectors, and through privatisation.

Trading of Sukuk certificates in the sector got a major boost in early October when the FTSE Russell index group announced the inclusion of local currency Saudi Arabian government Sukuk in the FTSE Emerging Markets Government Bond Index (EMGBI), effective from April 2022.

According to FTSE Russell, the Group expects 42 Sukuk with around US$81.6 billion in par amount outstanding to be included in the EMGBI which would comprise 2.75% of the index on a market value-weighted basis. In addition, to ensure comprehensive index coverage for global government bond markets, FTSE Russell will continue to track both Saudi Sukuk and bonds as part of its standalone FTSE Saudi Arabian Government Bond Index.

Both the Saudi Ministry of Finance (MoF) and its National Debt Management Centre (NDMC) consider this development “as an achievement for Saudi Arabia and clear evidence of the efforts made by the Government to develop, deepen, and enhance the efficiency of the local debt market, the diversification of its investor base, and the alignment with best global market practices and standards. This is in line with the strategy of the Financial Sector Development Program to achieve the goals of “Saudi Vision 2030” which will contribute to increasing the attractiveness of the market and enhancing its competitiveness regionally and internationally.”

According to the NDMC, this inclusion of Saudi Government Sukuk in the EMGBI, “will have a significant impact on the local debt market by increasing the market liquidity as a result from the new international investors who use this index to track and evaluate their assets.”

Domestic Sukuk issuances are also driven by the objectives of the Kingdom’s Fiscal Balance Programme and Financial Sector Development Programme, the robust demand from local institutional investors, and the fact that foreign investors can also invest in local currency Sukuk through Tadawul (the Saudi Stock Exchange), which also has an active secondary trading in government Sukuk.

The NDMC confirmed that it’s Sukuk issuance strategy centres around the Saudi Government SAR Sukuk Programme and foreign currency Sukuk issuances, as well as conventional bond offerings in the international market. This year’s plan will continue to be “through diversified funding sources which include domestic and international Sukuk and bond issuances as well as new financing channels, including Government Alternative Financing, [and] Supply Chain Financing, in addition to unifying the domestic Sukuk issuance programmes.”

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer. NDMC’s role is to secure Saudi Arabia’s debt financing needs with the best financing costs.

Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market, because it has an established issuance infrastructure complete with a government policy framework under its Fiscal Balance Programme and Financial Sector Development Programme, whose objectives is to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

In August the MoF appointed Al Rajhi Bank as a primary dealer in government local debt securities (Sukuk) to join Alinma Bank, Bank Al-Jazira, Saudi National Bank, and Saudi British Bank. They play an important role as market makers for government domestic Sukuk issuances especially for trading in the secondary market in accordance with the regulations of the Saudi Capital Market Authority (CMA).