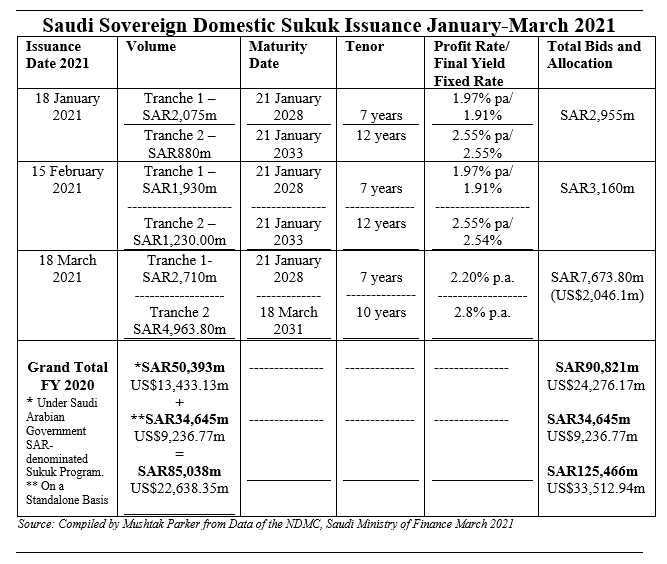

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) issued its third consecutive monthly issuances of Riyal-denominated sovereign Sukuk with a two-tranche SAR7,673.80 million (US$2,046.11 million) offering in March 2021.

This follows the closing of a similar two-tranche SAR3,160 million (US$842.47 million) fixed rate Sukuk in February 2021 under the Saudi Arabian Government SAR-denominated Sukuk Programme. This means that in the first quarter of 2021, the NDMC has raised the equivalent of SAR18,889.80 million (US$5,036.34 million) through three domestic Sukuk issuances.

The SAR7,673.80 million (US$2,046.11 million) offering comprised two tranches through two auctions held on 18 March 2021:

i) A first tranche of SAR2,710.00 million (US$722.58 million) with a 7-year tenor maturing on 21 January 2028 and priced at a final fixed profit rate/yield of 2.20% per annum, with total bids amounting to SAR2,710 million (US$722.58 million); and

ii) A second tranche of SAR4,963.80 million (US$1,323.53 million) with a 10-year tenor maturing on 18 March 2031 and priced at a final fixed profit rate/yield of 2.80% per annum, with total bids amounting to SAR4,967.50 million (US$1,324.51 million).

The NDMC’s Domestic Sukuk Issuance Calendar for 2021 commits to a consecutive monthly Sukuk issuance strategy from January to December 2021. No other jurisdiction has committed to such a dedicated domestic Sukuk issuance regime in 2021. Moody’s Investors Services in October assigned (P)A1/Aaa.sa rating to the Government’s Saudi-riyal denominated Sukuk Programme for 2021.

Last year, according to data compiled by Mushtak Parker for this newsletter from MoF statistics, the NDMC issued under its Sukuk Issuance Programme domestic Sukuk totalling SAR50,393 million (US$13,433.13 million) with total bids amounting to SAR79,100 million (US$21,085.17 million). In addition, the NDMC also raised SAR34,645 million (US$9,236.77 million) from a four-tranche standalone auction last July, bringing the total Saudi-riyal denominated Sukuk issued by the government in 2020 to SAR85,038 million (US$22,638.35 million), which is almost a 50% increase on the previous year.

However, Saudi sovereign domestic Sukuk issuances for First Quarter 2021 are well down on the aggregate figure for the same period in 2020. In Q1 2020 the NDMC raised SAR26,783 million (US$7,141.44 million), some SAR7,893.70 million (US$2,104.74 million) more than the aggregate figure for Q1 2021 of SAR18,889.80 million (US$5,036.34 million).

This does not suggest that Saudi domestic Sukuk issuance will moderate in 2021. Despite the oil price bounce to US$61/b for the benchmark Brent Crude Futures in late March 2021 partly due to the impact of the Suez Canal blockage by the Taiwanese-operated and Japanese-owned 400m-long 200,000 ton Ever Given container ship, oil price stability remains largely dependent on the success and pace of post-COVID-19 economic recovery in a current phase of third and fourth waves of the virus and its numerous variants.

Fitch Ratings earlier this year changes its outlook for Sovereign Saudi Arabia to Negative Outlook which resulted in a concomitant Negative Outlook on Saudi Islamic banks. “This,” explained Bashar Al Natoor, Global Head of Islamic Finance at Fitch, “reflects the continued weakening of the sovereign’s fiscal and external balance sheets, which has been accelerated by the coronavirus pandemic and lower oil prices despite the government’s strong commitment to fiscal consolidation.

However, Fitch remains confident that sovereigns in key Islamic finance jurisdictions including Saudi Arabia, many of whom are net oil exporters, are expected to increasingly issue Sukuk and bonds to fund rising fiscal deficits due to oil price falls and coronavirus-related economic disruptions. “Sukuk issuance is expected to rise in the short and medium term, as sovereigns, financial institutions and corporates diversify their funding and take advantage of low funding costs.

Investors are expected to continue seeking higher yields in Emerging Markets, where key Sukuk-issuing jurisdictions are domiciled. However, investors will remain focused on issuers with strong credit fundamentals,” added Al Natoor.

Also, the demands of the revised Saudi Vision 2030, together with the aim of closing the Kingdom’s budget deficit, means that public debt will continue to feature in the NDMC’s short-to-medium-term strategy. Domestic Sukuk issuances is also driven by the objectives of the Kingdom’s Fiscal Balance Programme and Financial Sector Development Programme, the robust demand from local institutional investors, and the fact that foreign investors can also invest in local currency Sukuk through Tadawul (the Saudi Stock Exchange).

NDMC has confirmed that it’s Sukuk issuance strategy going forward centres around the Saudi Government SAR Sukuk Programme and foreign currency-denominated Sukuk issuances and conventional bond offerings in the international market. This year’s plan will similarly be “through diversified funding sources which include domestic and international Sukuk and bond issuances as well as new financing channels, including Government Alternative Financing, [and] Supply Chain Financing, in addition to unifying the domestic Sukuk issuance programmes.”

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer. All the Kingdom’s sovereign domestic Sukuk issuances come under the unlimited Saudi Arabian Government Saudi Riyal denominated Sukuk Issuance Programme established on 20 July 2017 by the Ministry and updated on 20 July 2020 “to issue and offer, at its discretion, Sukuk in multiple issuances to investors, pursuant to the Royal Decree approving the National Budget.” The Programme, structured and lead arranged by Alinma Bank, according to the MoF, also comes as part of the NDMC’s role in securing Saudi Arabia’s debt financing needs with the best financing costs and would contribute to the development of the Saudi Sukuk and Islamic Capital Markets.

Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market, because it has an established issuance infrastructure complete with a government policy framework under its Fiscal Balance Programme and Financial Sector Development Programme, whose objectives inter alia is to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.