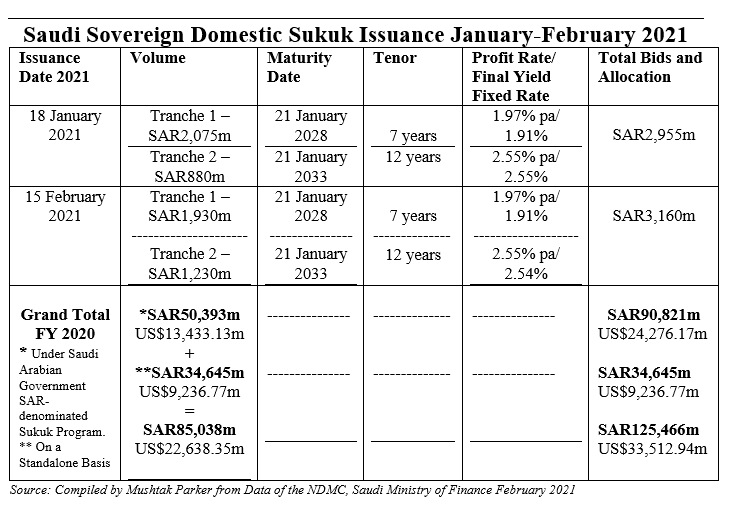

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) continued its consecutive monthly issuances of Riyal-denominated sovereign Sukuk with a two-tranche SAR3,160 million (US$842.47 million) offering in February 2021. This follows the closing of a similar two-tranche SAR2,955 million (US$788.85 million) fixed rate Sukuk in January 2021 under the Saudi Arabian Government SAR-denominated Sukuk Programme.

The SAR3,160 million (US$842.47 million) Sukuk issued in February comprised two tranches:

i) A first tranche of SAR1,930 million (US$514.55 million) with a 7-year tenor maturing in January 2028 and priced at a final fixed profit rate of 1.97% per annum and final yield of 1.91% per annum, with total bids amounting to SAR4,005 million (US$1,067.75 million).; and

ii) A second tranche of SAR1,230 million (US$327.92 million) with a 12-year tenor maturing in January 2033 and priced at a final fixed profit rate of 2.55% per annum and final yield of 2.54% per annum, with total bids amounting to SAR2,110 million (US$562.53 million).

The NDMC’s Domestic Sukuk Issuance Calendar for 2021 commits to a consecutive monthly Sukuk issuance strategy from January to December 2021. No other jurisdiction has committed to such a dedicated domestic Sukuk issuance regime in 2021. Moody’s Investors Services in October assigned (P)A1/Aaa.sa rating to the Government’s Saudi-riyal denominated Sukuk Programme for 2021.

Last year, according to data compiled by Mushtak Parker for this newsletter from MoF statistics, the NDMC issued under its Sukuk Issuance Programme domestic Sukuk totalling SAR50,393 million (US$13,433.13 million) with total bids amounting to SAR79,100 million (US$21,085.17 million). In addition, the NDMC also raised SAR34,645 million (US$9,236.77 million) from a four-tranche standalone auction last July, bringing the total Saudi-riyal denominated Sukuk issued by the government in 2020 to SAR85,038 million (US$22,638.35 million), which is almost a 50% increase on the previous year.

Thus far the NDMC has issued an aggregate SAR6,115 million (US$1,631.32 million) sukuk in January-February 2021. This is well down on the aggregate volume of SAR11,216 million (US$2,990.23 million) for January-February 2020. This does not suggest that Sukuk issuance will moderate in 2021.

It is probably tempered by the US$5 billion (SAR18.751 billion) two-tranche conventional bond offering of the NDMC in January 2021 – the eighth under the Kingdom of Saudi Arabia’s Global Medium-Term Note Programme. After the robust issuance in the first two months in 2020, the volumes for the Sukuk issuances in the subsequent months started to equalise to slightly lower levels. But demand from local institutional investors remained strong. The fact that foreign investors can also invest in local currency Sukuk through Tadawul (the Saudi Stock Exchange) may increase demand and volumes even further.

NDMC has confirmed that it has merged all the Saudi Government domestic Sukuk issuance under the Sukuk Programme, and there would be no Saudi Riyal-denominated offerings other than under the Programme henceforth. The Kingdom will separately continue to tap the market with foreign currency-denominated Sukuk issuances and conventional bond offerings in the international market. This year’s plan will similarly be “through diversified funding sources which include domestic and international Sukuk and bond issuances as well as new financing channels, including Government Alternative Financing, [and] Supply Chain Financing, in addition to unifying the domestic Sukuk issuance programmes.”

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer. All the Kingdom’s sovereign domestic Sukuk issuances come under the unlimited Saudi Arabian Government Saudi Riyal denominated Sukuk Issuance Programme established on 20 July 2017 by the Ministry and updated on 20 July 2020 “to issue and offer, at its discretion, Sukuk in multiple issuances to investors, pursuant to the Royal Decree approving the National Budget.” The Programme, structured and lead arranged by Alinma Bank, according to the MoF, also comes as part of the NDMC’s role in securing Saudi Arabia’s debt financing needs with the best financing costs and would contribute to the development of the Saudi Sukuk and Islamic Capital Markets.

The Saudi sovereign domestic Sukuk issuance is also driven by the high volume of trading of Sukuk certificates in the secondary market on the Tadawul (the Saudi Stock Exchange) and allowing these certificates holders to benefit from the Zakat redemption applied within the framework of the local currency Sukuk issuance programme. The continued traction and upward growth trajectory of Saudi domestic Sukuk issuance is driven by robust investor demand and the emergence of tenors of up to 40 years, which is underlined by the high investor oversubscription.

Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market, because it has an established issuance infrastructure complete with a government policy framework under its Fiscal Balance Programme and Financial Sector Development Programme, whose objectives inter alia is to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

At the annual Future Investment Initiative (FII) forum organised by the Public Investment Fund (PIF) and held in Riyadh at the end of January to discuss trends in the world and Saudi economy and the investment outlook for the Kingdom, Saudi Minister of Finance Mohammed Al-Jadaan explained that “the year 2020 was an exceptionally testing year for the world and Saudi Arabia. The pandemic has “tried and tested” the Saudi Vision 2030. Investments proved its flexibility by swiftly shifting from physical to a virtual environment. It also allowed the diversification of the economy to create more revenues, which can be invested in better services for the people. This is all powered by the private sector and we win if they win as they provide jobs for the Saudi people.”

Al-Jadaan confirmed that Saudi Arabia has significant investment opportunities in new and conventional sectors such as renewable energy, “where we are not only installing but also investing in. The government will also accelerate the privatisation programme by 100% in 2021, providing many opportunities for investors in such areas as water, healthcare, education and wastewater treatment.”

In addition, he added that reforms of the capital markets both on the equity and the debt side led to strong growth in 2020 and is expected to grow even further in 2021.