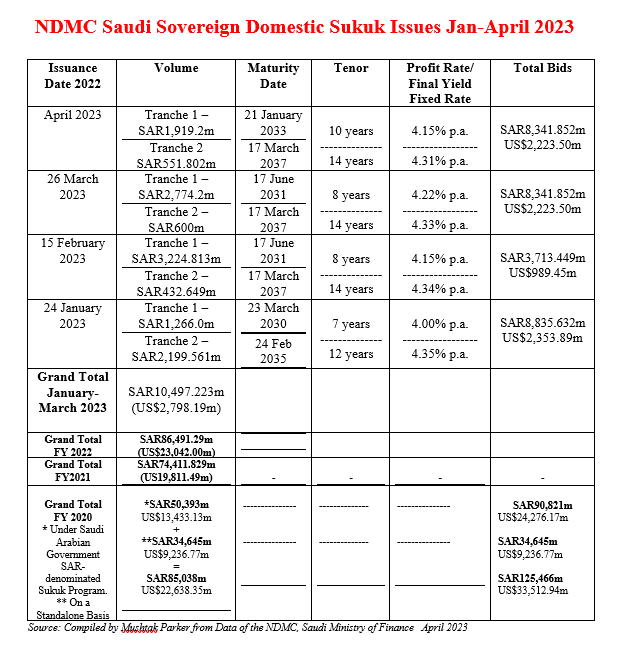

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) successfully closed its fourth consecutive monthly domestic sovereign Sukuk issuance on 11th April 2023 raising an aggregate SAR2,471.002 million (US$658.93 million) in the process through a two-tranche auction conducted by the Saudi Central Bank (SAMA). The total amount of bids received was SAR2,471.002 million (US$658.93 million).

This follows a similar issuance in March 2023 which raised an aggregate SAR3,374.2 million (US$899.39 million). The NDMC kicked off with its first issuance of the year with a two-tranche auction completed on 24 January 2023 for an aggregate SAR3,465.561 million (US$923.25 million), followed by a second two-tranche issuance on 15 February 2023 for an SAR3,657.462 million (US$974.53 million).

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The two tranches auctioned in April 2023 comprised:

- A first tranche of SAR1,919.2 (US$511.79 million) with a 10-year tenor maturing on 21 January 2033 and priced at a yield of 4.15% per annum and a price of SAR87.25012. Bids received totalled SAR1,919.2 million (US$511.79 million).

- A second tranche of SAR 551.802 million (US$147.15 million) with a 14-year tenor maturing on 17 March 2037 and priced at a yield of 4.31% per annum and a price of SAR90.02279. Bids received totalled SAR551.802 million (US$147.15 million).

In 2022 the Saudi Ministry of Finance issued an aggregate SAR86,491.29 million (US$23,042.00 million) of Saudi-riyal denominated Sukuk for the January-December period through consecutive monthly issuances. In the same period in 2021, according to data compiled by Mushtak Parker from official MoF reports, the NDMC issued an aggregate SAR65,741.315 million (US$17,491.51 million).

Thus far in 2023, the NDMC has raised a total of SAR12,968.225 million (US$3,458.18 million) in the January-April period.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2023 Calendar of Local Sukuk Issuances, released in January, confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The NDMC is currently working on attracting new capital, and more international financial institutions in addition to selected local banks to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC. Already, BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank have signed up as new primary dealers in the government’s local debt instruments. They join five local institutions, namely Saudi National Bank, Saudi British Bank (SABB), Al Jazira Bank, Alinma Bank, and Al Rajhi Bank, already in the NDMC’s Primary Dealers Programme.

Dr Mohammed Aljadaan, Saudi Minister of Finance, in his statement to The International Monetary and Financial Committee at the Spring Meetings of the World Bank/IMF in April 2023, revealed that the Saudi economy’s performance has exceeded expectations, growing at 8.7 percent in 2022, making it the fastest growing economy among the G20 countries and bringing the official overall unemployment rate down from 6.9% in Q4 2021 to 4.8% in Q4 2022, and among Saudi nationals from 11% to 8%, respectively.

Among Saudi females, the unemployment rate decreased by 7.1% from 22.5% in Q4 2021 to 15.4% in Q4 2022. This is despite the massive increase in women’s participation in the labour force from 17% in 2017, the baseline under vision 2030, to 36% in 2022, overshooting the official target of 31.4% in 2025 by 4.6%.

The Saudi banking system, he maintained, remains strong, liquid, and well-regulated. “We are closely monitoring the developments in the global financial system and have the tools and the resolve to safeguard the stability of our financial system. A great deal of progress is underway in the Giga projects and the announced initiatives under the Vision 2030 programmes. We remain committed to achieving our net-zero target by 2060 by deploying all available technologies within the Circular Carbon Economy framework as well as the Saudi Green Initiative to increase vegetation cover and planting 10 billion trees, combating pollution and preserving marine life. Furthermore, Saudi Arabia is playing a leading role in coordinating regional efforts to combat climate change through the Middle East Green Initiative.”

The Kingdom is in the process of amending its existing Banking Control Law. The Saudi Central Bank (SAMA) published a Draft Amended Banking Law in January 2023 for consultation.

The objectives of the amended Law, according to SAMA is to:

- Ensure stability and growth of the banking sector, encouraging investment in

the banking sector and contributing to financial stability.

- Set forth the legal framework for practicing banking business.

- Promote the protection of deposits, funds, rights and interests of depositors and

clients and their information.

The Draft Law does not differentiate between conventional banks and Islamic banks, albeit there is reference to Islamic financial instruments such as “Sukuk and other Financial Products” and “Other banking business.”

The economic outlook for the Kingdom in April received a boost when Fitch Ratings upgraded Saudi Arabia’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘A+’ from ‘A’. The Outlook is Stable.

The rationale driving the upgrade includes:

a) The Kingdom’s strong fiscal and external balance sheets.

b) The strong government debt/GDP ratio and sovereign net foreign assets (SNFA)

projected to remain above 55% of GDP in 2023-2024, and significant fiscal buffers in the form of deposits and other public sector assets.

c) Ongoing commitment to gradual progress with fiscal, economic and governance reforms.

d) Formidable External Finances. Foreign reserves excluding gold remained broadly stable in 2022, at US$459 billion.

e) Low government debt. Gross government debt/GDP declined to 23.8% in 2022 and projected to increase to 24.7% in 2023 and rise but remain below 30% in 2024-2025.

f) A budget close to balance.

g) The non-oil economy gaining traction with a forecast of 5% growth in 2023 compared with 5.4% in 2022.

Moody’s Investors Service similarly changed its outlook on Saudi Arabia in March 2023 to positive from stable and affirmed its long-term issuer and senior unsecured ratings at ‘A1.’ The rationale is that government reforms and investment in non-oil sectors will, over time, lead to the diversification of the economy and, therefore, reliance on hydrocarbons.

The affirmation is a recognition of the progress made in the Kingdom’s reform program, the moderate debt burden of SAR985 billion, most of which had already been pre-funded in 2022, or 30.7% of GDP in Q3/2022, solid fiscal buffers, and Saudi Arabia’s highly competitive and pre-eminent position in the global oil market.