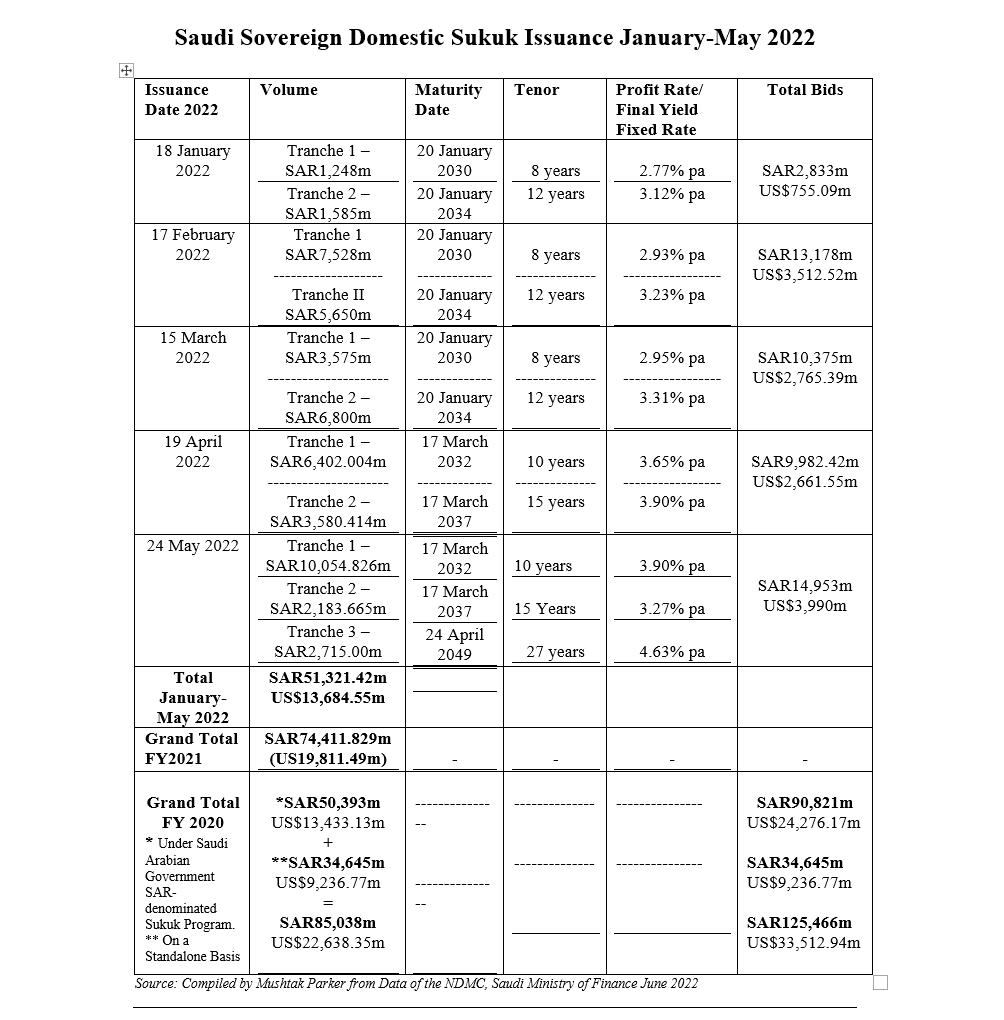

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) Saudi Arabia continued its consecutive monthly Sukuk issuance under its Saudi Riyal-denominated Sukuk Issuance Programme with two auctions – one in April and the second in May 2022, raising an aggregate SAR24.935 billion (US$6.65 billion).

The 24 May 2022 Sukuk auction comprised three tranches with an aggregate SAR14,953 million (US$3.99bn), with bids in each case again matching the allocated volume:

• A first tranche of SAR10,054.826 million (US$2,680 million) with a 10-year tenor maturing on 17 March 2032 and priced at a profit rate of 3.90% per annum.

• A second tranche of SAR2,183.665 million (US$580 million) with a 15-year tenor maturing on 17 March 2037 and priced at a profit rate of 3.27% per annum.

• A third tranche of SAR2,715.00 million (US$720 million) with a 27-year tenor maturing on 24 April 2049 and priced at a profit rate of 4.63% per annum.

The 19 April 2022 Sukuk auction comprised two tranches with an aggregate SAR9,982.42 million (US$2,661.55 million), with bids in each case again matching the allocated volume:

• A first tranche of SAR6,402.004 million (US$1,706.93 million) with a 10-year tenor maturing on 17 March 2032 and priced at a profit rate of 3.65% per annum.

• A second tranche of SAR3,580.414 million (US$954.62 million) with a 15-year tenor maturing on 17 March 2037 and priced at a profit rate of 3.90% per annum.

This follows a two-tranche SAR13,178 million (US$3,512.52 million) issuance in February and a similar two-tranche Sukuk totalling SAR10,375 million (US$2,765.39 million) in March 2022.

This means that in the first five months of 2022 the Saudi Ministry of Finance issued an aggregate SAR51,321.42m (US$13,684.55m) of Sukuk. In the same period in 2021, according to data compiled by Mushtak Parker from official MoF reports, the NDMC issued an aggregate SAR29,516.8 million (US$7,868.72m).

As such, the NDMC Sukuk issuances in the first five months of 2022 increased year-on-year for the same period by SAR21,804.62 million (US$5,811.39 million) or 42.49% respectively. This buoyancy in Saudi domestic sovereign issuance backed by the up-to-date data is contrary to rating agency and media reports of a dampening of Saudi sovereign domestic Sukuk issuances.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2022 Calendar of Local Sukuk Issuances, released in January, confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its Fiscal Balance Programme and Financial Sector Development Programme, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The true figure of the Kingdom’s domestic sovereign Sukuk issuance activity assumes even greater importance if we include “the standalone Sukuk issued by the NDMC in March 2022 under the Sukuk Issuance Programme in Saudi Riyal with a total value around SAR26.2 billion (US$6.98 billion).”

This transaction, says the NDMC, is one of its initiatives “to unify the Kingdom’s domestic issuances under the Sukuk Issuance Programme in Saudi Riyal, that represents the third phase of this initiative which was started in 2020 and it will continue until unifying all domestic debt outstanding.

“This initiative is a continuation of NDMC’s efforts to strengthen the domestic market and to carry on with the market developments which have been positively reflected on growing the trading volume in the secondary market. Further, this initiative enables NDMC to exercise its role in managing the government debt obligations and future maturities. This will also align NDMC’s effort with other initiatives to enhance and optimize the public fiscal in the medium and long term.”

This means that the actual aggregate volume of sovereign domestic Sukuk issued by the NDMC in the First Five Months of 2022 reached SAR77,521.42 million (US$20,664.55 million).

In fact, in May 2022, the NDMC announced the completion of arranging local Sukuk issuances under the Saudi Arabian Government SAR-denominated Sukuk Programme for the debt principal repayments as per the financing needs for the year 2022, with a funding amount of about SAR43 billion (US$11.46 billion).

It further confirmed that it may, in accordance with the Annual Borrowing Plan, “continue to consider additional funding activities subject to market conditions and through available funding channels locally or internationally through debt markets and government alternative financing. This is to ensure Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years, in addition to, facilitating the financing of capital expenditures and infrastructure projects which will contribute to promote economic growth while taking into account market movements and the debt portfolio risk management.”

The Kingdom’s issuances for 2022 were in the local market as it is relatively stable in comparison to international markets. These issuances included early repurchase of some of the Kingdom’s debt instruments and pre-funding transactions for maturities due in 2023, 2024 and 2026. According to Hani Al Medaini, NDMC CEO, the immediate future strategy is on expanding the investors base, strengthening communication channels, reaching new geographic areas, and utilizing the arising opportunities in local and international markets in accordance with risk management and debt strategy.

He also added that the NDMC is working on attracting new capital, and international financial institutions to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC.

The Kingdom received a further boost in the last two months first when when Fitch Ratings affirmed Saudi Arabia’s “A” credit rating and revised the outlook from stable to positive, followed by Moody’s in May affirming its “A1″ rating for the Kingdom albeit with a stable outlook.

Both rating agencies are upbeat about the Kingdom’s economic and fiscal reform programmes evidenced by policy responses to both periods of low and high oil prices, which demonstrate a commitment to fiscal consolidation and longer-term fiscal sustainability.

Moody’s expected the continuation of positive growth in real GDP by 5.0% on average in the period 2021-2023, supported by further post pandemic recovery, progress on economic diversification, capital and development projects, and a further unwinding of oil production cuts.

According to Fitch, “the revision reflects the improvements in the Kingdom’s balance sheet given higher oil revenue driven by increase in oil prices, commitment to fiscal consolidation and implementation of various plans to diversify the economy.” Fitch also forecasts government debt to GDP to remain below 30% until 2025, and GDP growth to be positive with budget surpluses for the years 2022 and 2023 for the first time since 2013.

Fitch’s outlook revision makes Saudi Arabia one of the few countries globally, and the only G20 country, to have received two consecutive upward outlook revisions from the beginning of 2022. This highlights the positive impact of the structural measures and reforms taken by the Kingdom during the past five years. These reforms are in accordance with the Kingdom’s Vision 2030 objectives and illustrate the fiscal policy effectiveness and increased government efficiency.