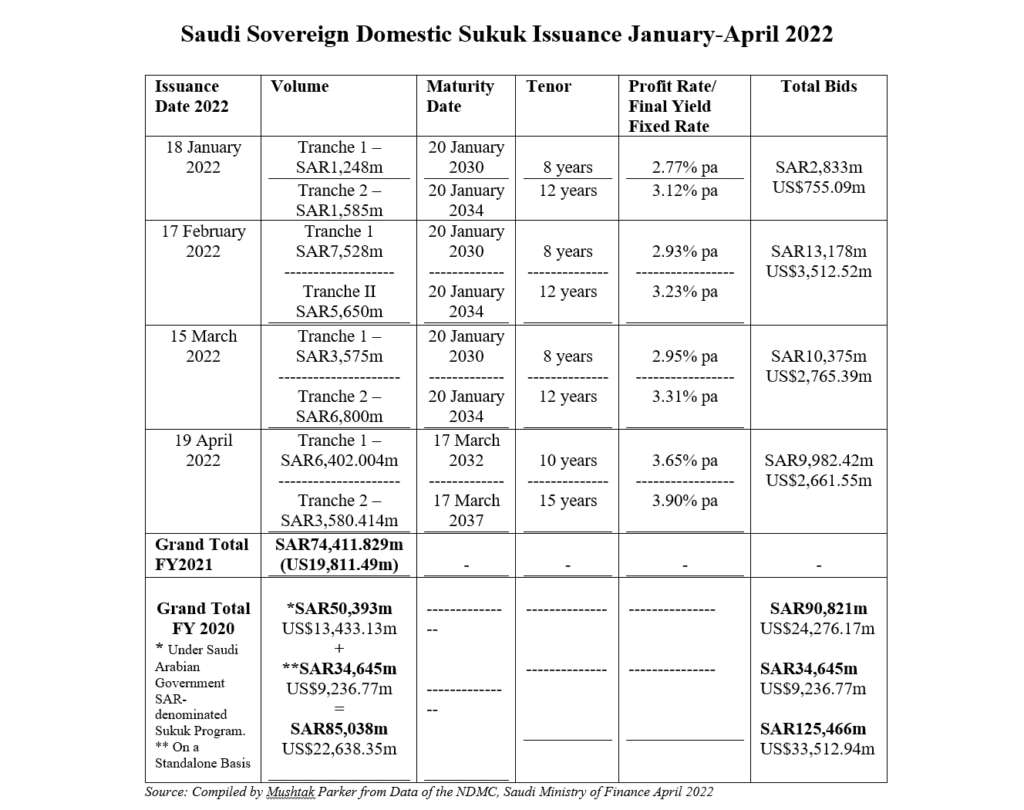

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) Saudi Arabia continued its consecutive monthly Sukuk issuance under its Saudi Riyal-denominated Sukuk Issuance Programme with a two-tranche offering totalling SAR9,982.42 million (US$2,661.55 million).

This follows a two-tranche SAR13,178 million (US$3,512.52 million) issuance in February and a similar two-tranche Sukuk totalling SAR10,375 million (US$2,765.39 million) in March 2022.

The 19 April 2022 Sukuk auction comprised two tranches, with bids in each case again matching the allocated volume:

- A first tranche of SAR6,402.004 million (US$1,706.93 million) with a 10-year tenor maturing on 17 March 2032 and priced at a profit rate of 3.65% per annum.

- A second tranche of SAR3,580.414 million (US$954.62 million) with a 15-year tenor maturing on 17 March 2037 and priced at a profit rate of 3.90% per annum.

This means that in the first quarter of 2022 the Saudi Ministry of Finance issued an aggregate SAR36,368.42 million (US$9,696.70 million) of Sukuk. In the same period in Q1 2021, according to data compiled by Mushtak Parker from official MoF reports, the NDMC issued an aggregate SAR25,501.8 million (US$,6799.39 million) of Sukuk in four consecutive monthly issuances. As such the Q1 2022 issuances have increased by SAR10,866.62 million (US$2,897.31 million). The data disproves rating agency and media reports of a dampening of Saudi sovereign domestic Sukuk issuances.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2022 Calendar of Local Sukuk Issuances, released in January, confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its Fiscal Balance Programme and Financial Sector Development Programme, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The true figure of the Kingdom’s domestic sovereign Sukuk issuance activity assumes even greater importance if we include “the standalone Sukuk issued by the NDMC in March 2022 under the Sukuk Issuance Programme in Saudi Riyal with a total value around SAR26.2 billion (US$6.98 billion).”

This transaction, says the NDMC, is one of its initiatives “to unify the Kingdom’s domestic issuances under the Sukuk Issuance Programme in Saudi Riyal, that represents the third phase of this initiative which was started in 2020 and it will continue until unifying all domestic debt outstanding.

“This initiative is a continuation of NDMC’s efforts to strengthen the domestic market and to carry on with the market developments which have been positively reflected on growing the trading volume in the secondary market. Further, this initiative enables NDMC to exercise its role in managing the government debt obligations and future maturities. This will also align NDMC’s effort with other initiatives to enhance/optimize the public fiscal in the medium & long term.”

This means that the actual aggregate volume of sovereign domestic Sukuk issued by the NDMC in Q1 2022 reached SAR62,368.62 million (US$16,628.98 million).

The Saudi Arabian Government Annual Borrowing Plan Report for 2022 shows that the Kingdom’s sovereign debt portfolio increased during 2021 by about SAR85 billion (US$22.66 billion) to reach SAR938 billion (US$250.01 billion), representing 29.2% of estimated GDP, against 32.5% in 2020. The debt-to-GDP ratio “is expected to decrease further in 2022 to 25.9% due to the forecasted stabilization of debt levels and the estimated GDP growth.”

As per the 2022 National Budget statement, public debt is estimated to remain at about SAR938 billion (US$250.01 billion) by 2022 year-end. Therefore, the funding requirement under NDMC’s 2022 Funding Plan will mainly focus on debt refinancing, which amounts to about SAR43 billion (US$11.46 billion).

The Kingdom received a further boost in April when Fitch Ratings affirmed Saudi Arabia’s “A” credit rating and revised the outlook from stable to positive. According to Fitch, “the revision reflects the improvements in the Kingdom’s balance sheet given higher oil revenue driven by increase in oil prices, commitment to fiscal consolidation and implementation of various plans to diversify the economy.”

Fitch also forecasts government debt to GDP to remain below 30% until 2025, and GDP growth to be positive with budget surpluses for the years 2022 and 2023 for the first time since 2013.

The NDMC is also keen to further enhance accessibility to the domestic debt markets by developing, expanding, and diversifying the investor base to ensure sustainable access to domestic debt markets. Indeed, the huge appetite for such debt papers from local and increasingly from international institutional investors follows the gradual opening of the Tadawul stock market over the last year or so to foreign investors who can now directly invest in local stocks and papers. This has been done by expanding the Primary Dealers Programme of the Government Local Debt Instruments to include top global financial institutions.