Saudi Arabia returned to the international Sukuk market in October 2022 with its first US dollar-denominated issuance of the year. The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance confirmed that the Sukuk issuance was part of a US$5 billion (SAR18.8 billion) transaction which comprised two tranches – a US$2.5 billion (SAR9.4 billion) Hybrid Sukuk Murabaha/Mudaraba issuance with a tenor of 6 years maturing in October 2028, and a 10-year US$2.5 billion conventional bond issue maturing in October 2032.

According to the NDMC, the transaction received robust investor demand from various international, local and regional accounts. The total amount of bids received exceeded US$27 billion, which meant that the transaction was oversubscribed by 5 times of the total issuance volume of US$5 billion. The Sukuk were issued under the Kingdom’s Global Trust Certificate Issuance Programme and the bonds under its Global Medium Term Note Issuance Programme.

Given the volatile global geopolitical conditions and oil market dynamics, and the on-going impacts of the pandemic, the conflict in Ukraine, and resultant global economic shocks including tightening of interest rates by the US Fed to reign in high inflationary pressures, fuel and food prices and subdued GDP growth, bond and Sukuk issuances by GCC sovereigns in 2022 have been equally subdued. The only exception is the issuance of Saudi sovereign riyal-denominated domestic issuances. The return of Saudi Arabia to the international Sukuk market may signal growing optimism of Riyadh in better headwinds ahead for the economy and financial sector.

The Sukuk certificates were issued by KSA Sukuk Limited, an exempted company incorporated in the Cayman Islands with limited liability, under the Trust Certificate Issuance Programme one behalf of the Obligor, the Kingdom of Saudi Arabia acting through the Ministry of Finance. The Programme was arranged by Bank of China (London Branch), Citigroup, HSBC, J.P. Morgan Securities, Mizuho and MUFG. They were joined by BNP Paribas, Crédit Agricole CIB, Deutsche Bank, Goldman Sachs International, ICBC, BofA Securities, Morgan Stanley, SMBC Nikko, Société Générale, and Standard Chartered Bank as dealers.

The Sukuk transaction was coordinated by BNP Paribas, Goldman Sachs and HSBC who also acted as joint bookrunners on the debt sale, while Aljazira Capital, Citi, JPMorgan and Standard Chartered acted as passive joint lead managers and bookrunners.

The transaction was launched at an initial price guidance of around 135 basis points (bps) over U.S. Treasuries (UST) for the 6-year Sukuk and around 180 bps over UST for the 10-year conventional bond. Given the robust demand for the certificates for both tranches, the price guidance tightened. The transaction was finally priced at 105bps over UST for the US$2.5 billion 6-year Sukuk tranche, and at 150 bps over UST for the US$2.5 billion 10-year conventional bond tranche payable bi-annually.

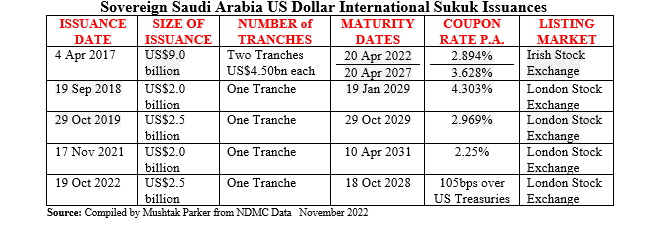

This latest transaction is the Kingdom’s fifth international Sukuk issuance to date. The Kingdom’s debut international Sukuk issuance in April 2017 totalled US$9 billion with two tranches – a 5-year US$4.5 billion tranche priced at a profit rate of 2.894% per annum; and a 10-year US$4.5 billion tranche carried a profit rate of 3.628% per annum.

This was followed by a US$2 billion Sukuk in September 2018 with a 10.5-year tenor maturing in January 2029 which was priced at a final spread of MS plus 127bps, which is equivalent to a yield of 4.303% per annum. Two further Sukuk transactions followed – a 10-year US$2.5 billion issuance in October 2019 maturing in 2029 and priced at a coupon of 2.969% and a US$2 billion 9.5-year Sukuk maturing in April 2031 priced at a coupon of 2.25% respectively.

The NDMC confirmed that it’s Sukuk issuance strategy centres around the Saudi Government SAR Sukuk Programme and foreign currency Sukuk issuances, as well as conventional bond offerings in the international market. This year’s plan will continue to be “through diversified funding sources which include domestic and international Sukuk and bond issuances as well as new financing channels, including Government Alternative Financing, [and] Supply Chain Financing, in addition to unifying the domestic Sukuk issuance programmes.”

The latest issuances, according to the Ministry of Finance, are part of NDMC’s on-going strategy to diversify the investor base and meet the Kingdom’s financing needs from international debt capital markets efficiently and effectively. The bid-to-cover ratio reflects the strong demand of the Kingdom’s issuances, confirming the investors’ confidence in the reliability and stability of the Kingdom’s economy,” it added.

The transaction is based on a Hybrid Murabaha (Tawarruq)/Mudaraba structure and according to the base prospectus the proceeds from each issuance of Trust Certificates will be used by the Trustee (KSA Sukuk Limited) to enter into Murabaha Transactions with the Kingdom and the Primary Mudaraba with the Onshore Investment Vehicle. “The Kingdom will sell the commodities purchased pursuant to the Murabaha Transactions to a third party broker and will use the proceeds from the sale for its general domestic budgetary purposes. The Kingdom will utilise the proportion of the proceeds provided as the Infrastructure Investment Amount to finance infrastructure projects in the Kingdom,”.

The Sukuk Certificates are admitted to the Official List and traded listed on the London Stock Exchange’s main market.

The Saudi Government plans to continue raising further indebtedness in the domestic and international markets through timely Sukuk and bond issuances, in addition to domestic sovereign issuances, mainly to refinance debt maturities. The Government is progressing several initiatives and reforms to achieve fiscal sustainability and build a framework that organises fiscal policy in the medium and long terms, as an extension of the Fiscal Sustainability Programme.

Pursuant to these initiatives, the Government projected the debt to GDP ratio to be equal to or less than 25.4% by financial year 2024. As at end of June 2022, according to the NDMC, Saudi Arabia’s total outstanding direct indebtedness amounted to SAR967.8 billion (US$258.1 billion), comprising SAR606.0 billion (US$161.6 billion) of domestic indebtedness and SAR361.8 billion (US$ 96.5 billion) of external indebtedness.

This must be seen in the context of an equally regular Sukuk and bond redemption strategy including earlier repurchase exercises. In September, the NDMC announced the completion of an early redemption of a portion of the Issuer’s outstanding bonds and Sukuk maturing in 2023, 2024 and 2026 with a total value exceeded SAR25 billion.

In October, the NDMC arranged the first international partial earlier repurchase offer exercise for conventional bonds denominated in US dollars maturing in 2023, 2025, and 2026. The Ministry of Finance invited holders of its US$3 billion bonds due in 2023, US$4.5 billion notes due in April 2025, US$2.5 billion bonds due in October 2025 and US$5.5 billion notes maturing in 2026 to tender them for cash.

“The tender offers are being made as part of the Kingdom’s effective debt management, which includes the pro-active management of its refinancing risk and debt maturities of the debt portfolio,” explained the NDMC.