Dubai-based Sobha Realty Taps International Market with a Benchmark Senior Unsecured USD500mn Wakala/Murabaha Sukuk as Real Estate Developers Cash in on Market Conditions

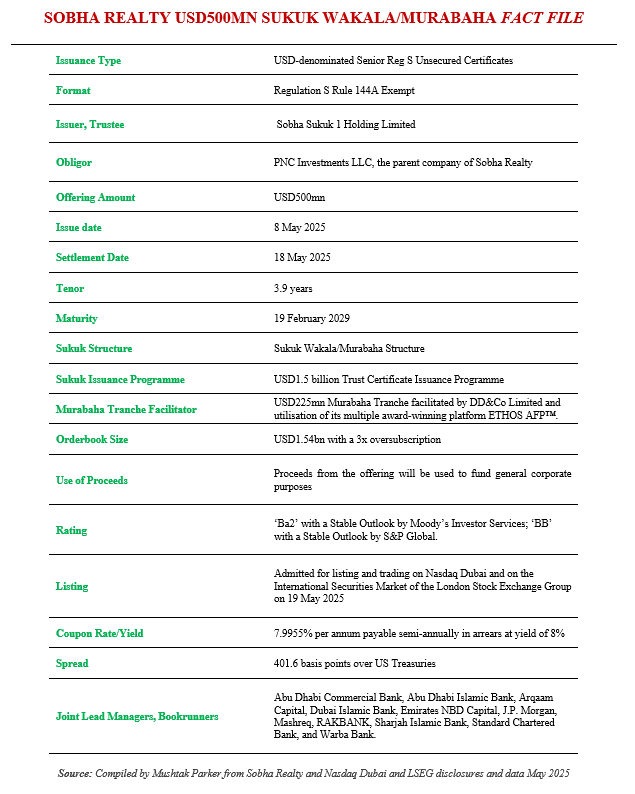

Dubai-based Sobha Realty, a leading global luxury real estate developer, successfully closed its latest Sukuk issuance – a benchmark USD500mn Senior Unsecured RegS Sukuk offering. The Sukuk certificates were issued by Sobha Sukuk 1 Holding Limited on behalf of the Obligor, PNC Investments LLC, the parent company of Sobha Realty, under its recently established USD1.5bn Trust Certificate Issuance Programme.

Sobha Realty had earlier mandated Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank, Arqaam Capital, Dubai Islamic Bank, Emirates NBD Capital, J.P. Morgan, Mashreq, RAKBANK, Sharjah Islamic Bank, Standard Chartered Bank, and Warba Bank to act as joint lead managers and book runners to the transaction, and to arrange a series of investor calls and meetings in London, Europe, the Middle East, Asia and with Offshore US Accounts.

The Initial Price Thoughts (IPTs) were set at 8.375%. The demand from a variety of investors was robust and the order book according to Sobha Realty was oversubscribed three times to reach USD1.54bn.

Not surprisingly, strong interest from regional and international investors led to a notable price tightening of 37.5 basis points, bringing the effective yield to 8% p.a. Of the total issuance, 61% has been allocated to local and 39% to international investors, respectively, reaffirming investors’ confidence in Sobha Realty’s growth and Dubai’s real estate sector outlook.

In recent months, the UAE property rally has seen a string of luxury end developers accessing the market with Sukuk issuances, including Dubai-based luxury developer Omniyat being the latest with a USD500mn Green Sukuk in April, preceded by Aldar Investment Properties (AIP), a subsidiary of Abu Dhabi’s Aldar Properties, also with a USD500mn 10-year green Sukuk in March, and Dubai’s Damac Real Estate Development’s 3.5 Year USD750mn Sukuk in February 2025.

Prior to this latest transaction, PNC Investments, the parent of Sobha Realty, issued a USD300mn Sukuk Wakala/Murabaha in July 2023 and followed by a USD230mn tap issuance in September 2023, thus bringing the total to a benchmark sized USD500mn.

Mr. Ravi Menon, Chairman of Sobha Group, commented: “The successful completion of Sobha Realty’s USD500 million Sukuk issuance underscores the continued confidence of the investor community in our financial stability and strategic direction. Our strategy, underpinned by our Backward Integration model, continues to yield strong financial results, including a substantially healthy revenue backlog, increased topline, and EBITDA generation. This reinforces our long-term commitment to growth and value creation.”

“Maturing in 2029, the new Sukuk issuance follows the recent upgrade of PNC Investments LLC (PNCI), the parent company of Sobha Realty, by Moody’s Investor Services. In April 2025, Moody’s upgraded PNCI’s rating to Ba2/Stable from Ba3/Stable.

In line with the improved existing rating, the newly issued Sukuk are expected to achieve Ba2/stable rating by Moody’s and BB/stable rating by S&P. The proceeds of this Sukuk will be used to settle existing financings and for PNC Investments’ general corporate purposes.

The Sukuk certificates were admitted for listing and trading on Nasdaq Dubai and on the International Securities Market of the London Stock Exchange Group on 19 May 2025

According to Nasdaq Dubai, the five-year Sukuk, due in 2029, were issued under Sobha Realty’s recently established USD 1.5 billion Trust Certificate Issuance Programme. The issuance attracted strong investor demand, reflecting robust market confidence in Sobha Realty’s strategic growth initiatives, particularly its expanding residential and commercial real estate portfolio across prime locations in Dubai.

This latest Sukuk issuance follows Sobha Realty’s successful prior listings on Nasdaq Dubai, including a USD300mn standalone Sukuk in July 2023 and a USD230m tap issuance subsequently consolidated under the same series.

With Sobha Realty’s listing, the total value of Sukuk on Nasdaq Dubai now exceeds USD96.7b, reinforcing its position as a leading international exchange for Islamic finance. The total value of debt securities currently listed on Nasdaq Dubai exceeds USD138bn across 159 issuances.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by Sobha Realty, with the US$225m Murabaha tranche being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.