Leading Saudi Residential Property Developer Dar Al Arkan (DAAR) Taps International Sukuk Investor Market with Latest Benchmark SAR2.812bn (US$750m) Sukuk Ijara/Murabaha Issue in June 2025 Amid Robust Demand

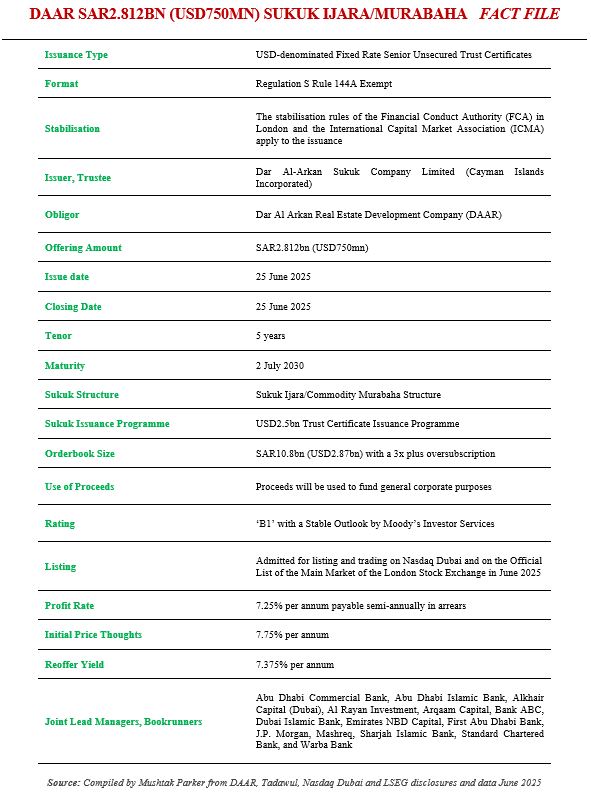

Saudi Arabia’s leading and largest publicly listed residential property developer and mortgage financier, Dar Al Arkan Real Estate Development Company (DAAR), returned to the Sukuk market in June 2025 by successfully closing its latest offering – a SAR2.812bn (US$750 million) fixed rate RegS Senior Unsecured hybrid Ijara/Commodity Murabaha (Tawarruq) Sukuk on 25 June 2025.

Dar Al-Arkan in fact is a dedicated Shariah-compliant real estate development and financing company involved in all major aspects of real estate development, including sourcing and purchasing land, overseeing design and construction of developments and marketing and sales, and providing housing finance solutions.

DAAR is a regular issuer of Sukuk both in the Saudi domestic and international markets and is one the most active mortgage finance and housing development and delivery companies in the Kingdom aimed at meeting the ambitious targets set in the Housing Pillar of the Saudi Vision 2030. This latest issuance is DAAR’s 14th Sukuk overall and the tenth tranche issued under its US$2.5 billion Trust Certificate Issuance Programme established on 11 June 2025 and arranged by Alkhair Capital (Dubai) Limited, Standard Chartered Bank, JP Morgan and Emirates NBD Capital.

This latest SAR2.812bn (US$750 million) Sukuk was issued through Cayman Island-incorporated Trustee, Dar Al-Arkan Sukuk Company Limited, on behalf of its obligor, DAAR. Prior to this transaction, DAAR issued a US$600mn Sukuk Ijara/Commodity Murabaha on 19 July 2023. The Company mandated Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank, Alkhair Capital (Dubai), Al Rayan Investment, Arqaam Capital, Bank ABC, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, J.P. Morgan, Mashreq, Sharjah Islamic Bank, Standard Chartered Bank, and Warba Bank to manage this tenth tranche issuance, and to arrange a series of fixed income investor calls starting on 24 June 2025 with accounts in the UK, Europe, the MENA region, Asia and Offshore US.

This follows a decision by DAAR’s Board of Directors on 29 May 2025 to approve the company accessing the international market through a benchmark fixed rate RegS senior unsecured riyal-denominated Sukuk issuance subject to the right market conditions.

The intention was for a benchmark Saudi Riyal-denominated Fixed Rate RegS Senior Unsecured Trust Certificates, an Ijara /Commodity Murabaha Sukuk offering with a 5-year tenor. The order book for the Sukuk was opened on Wednesday 25th of June 2025 and closed on the same day. DAAR had set the initial price thoughts (IPTs) for the transaction at a profit rate of around 7.75% per annum payable semi-annually in arrears.

In a disclosure to Tadawul, the Saudi Exchange, the issuance received significant interest from regional and international market participants with the order book reaching SAR10.8bn (USD2.87bn) – oversubscribed by more than 3x. A resultant benchmark offering of SAR2.812bn (US$750 million) Sukuk Ijara/Commodity Murabaha certificates followed which mature on 2 July 2030. The robust demand allowed DAAR to tighten the profit rate at a closing price of 7.25% per annum payable semi-annually in arrears, with a reoffer yield of 7.375%.

Applications have been made to admit the DAAR trust certificates for listing and trading on Nasdaq Dubai and on the Official List of the Main Market of the London Stock Exchange Group during June 2025. In 2023 Dar al Arkan’s independent international development subsidiary, Dar Global PLC, was admitted to the Standard Segment of the Official List of the FCA (UK’s Financial Conduct Authority) and to the Main Market of the London Stock Exchange with a valuation of SAR2.25bn (USD600mn). The official direct listing on the London Stock Exchange makes Dar Al Arkan one of the first Saudi homegrown brands to list on the Exchange.

During the three-month period ended 31 March 2025, DAAR reported revenue from Properties Development projects at SAR855.36mn (USD228.10mn), or 91.78% of Dar Al-Arkan’s total revenue, compared to SAR830.44mn (USD221.45mn), or 96.01% of total revenue, in the three-month period ended 31 March 2024. In Q1 2025 revenue from Properties Development projects was comprised of the Sale of Development Properties of SAR464.75mn (USD123.93mn) and Sale of Residential Properties of SAR390.62mn (USD104.16mn). Total assets at end Q1 2025 stood at SAR36.09bn (USD9.62bn) and the total value of long-term development properties at SAR20.41bn (USD5.44bn).

According to DAAR, although the Saudi population is increasing, average household sizes are declining. Together with the population increase, the Kingdom has undergone rapid urbanisation in recent decades and, as of 31 March 2025, over 85.30% of the total population of the Kingdom lives in cities, with approximately half the population being concentrated in the six largest cities of Riyadh, Jeddah, Makkah, Madinah, Ta’if and Dammam.

This shift is largely due to better job opportunities, modern infrastructure, and improved quality of life found in urban areas. The average annual housing demand is anticipated to grow to 153,000 units by 2030, averaging 124,000 units over the period. The housing market in the Kingdom is also currently witnessing an increase in public-private partnerships (PPPs) as part of the Government’s plan to attract more private sector investment in the housing sector.

The Kingdom currently faces a shortage of availability in the housing sector, particularly in the low to mid income levels. According to estimates by the MoMRAH and the Real Estate Development Fund (the REDF), the Kingdom will require an additional 1.2mn homes to reach a total housing stock of 4.96mn units by 2030. Following two increases in the financing-to-value ratio by SAMA (the Saudi Central Bank) in 2016 and 2018, the level of and demand for mortgage financing in the Kingdom has increased markedly which, in turn, has enhanced the Kingdom’s real estate sector.

The real estate sector in the Kingdom, including the housing market, which is a large part of the real estate sector, is driven by positive economic developments as well as favourable demographic fundamentals. Notwithstanding the continued volatility in global oil prices, Dar Al-Arkan expects that continued growth in other sectors of the Kingdom’s economy is likely to drive continued growth in real estate development.

The Kingdom’s housing market, says the Base Prospectus to the Sukuk issuance, has benefitted significantly from several Government initiatives in recent years aimed at developing the sector and increasing house building and home ownership as well as initiatives designed to increase access to mortgage finance for home buyers.

DAAR believes that the financing initiatives referred to above will continue to contribute to an increase in demand for housing in the Kingdom which, amongst other things, could raise the average selling price of residential units, including those sold under Dar Al-Arkan’s residential and commercial projects.

DAAR earlier this year also fully redeemed its USD600mn benchmark Sukuk Ijara/Murabaha issued in October 2020. HSBC Bank acted as the Paying Agent and Sukuk Holders’ Agent. The company used its internal resources to pay the Sukuk on due date and transferred the principal to the designated account in February 2025.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by Dar Al Arkan Real Estate Development Company, with the Murabaha tranche being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.