Sharjah Real Estate Developer, Arada Development Returns to International Market in July 2025 with Third Fixed Rate RegS Public Sukuk Offering – a 5-year USD450mn Sukuk Ijarah/Murabaha Issuance

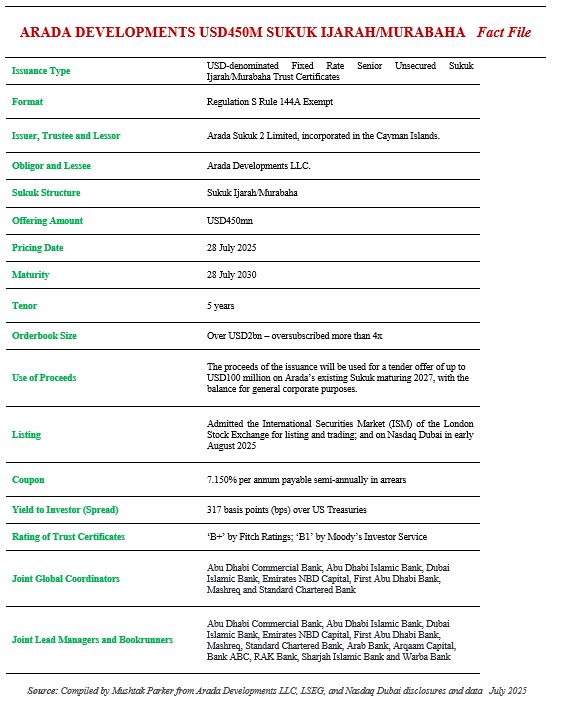

Arada Developments LLC, the largest real estate developer in Sharjah and one of the region’s fastest-growing and most progressive realty companies, successfully closed its latest public Sukuk offering – a 5-year senior unsecured RegS USD450mn Sukuk Ijarah/Murabaha on 28 July 2025.

The Sukuk Certificates were issued by Arada Sukuk 2 Limited, incorporated in the Cayman Islands, as the Issuer, Trustee and Lessor, on behalf of the Obligor and Lessee, Arada Developments LLC. This is the third issuance under Arada Sukuk 2 Limited’s newly established US$1bn Trust Certificate Issuance Programme, which was arranged by Emirates NBD Capital and Standard Chartered Bank.

Arada had mandated Abu Dhabi Commercial Bank, , Abu Dhabi Islamic Bank, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, Mashreq, and Standard Chartered Bank to act as Joint Global Coordinators for the transaction, and were joined by Arab Bank, Arab Bank, Arqaam Capital, Bank ABC, RAK Bank, Sharjah Islamic Bank and Warba Bank as Joint Lead Managers and Bookrunners. They were mandated to arrange a series of investor calls and roadshows with accounts in the UK, Europe, the MENA region, Asia and Offshore US.

Arada, rated ‘B1’ by Moody’s Investors Service and ‘B+’ by Fitch Ratings, priced the transaction at par with a coupon of 7.150% per annum payable semi-annually in arrears, inside the initial guidance area of 8.625% for a spread of 355 basis points (bps) over US Treasuries.

The 5-year fixed rate RegS Sukuk issuance, rated BB- by Fitch and B1 by Moody’s, was priced with a coupon of 7.150%, tightening 47.5-60 basis points (bps) from the initial price guidance of 7.625%-7.750% for a spread of 317 bps over US Treasuries, for the tightest reoffer yield ever achieved by Arada.

The proceeds of the issuance will be used for a tender offer of up to $100 million on Arada’s existing Sukuk maturing 2027, with the balance for general corporate purposes.

According to Arada, the Sukuk issuance saw strong demand from both regional and international investors with a subscription order book peaking above USD2bn (excluding Joint Lead Managers interest), equivalent to over four times the offer size. Investor interest for the Sukuk was diversified geographically, coming from Europe, the Middle East and Asia. The investors for this issuance included banks, private banks, asset and fund managers and hedge funds.

Prince Khaled bin Alwaleed bin Talal, Executive Vice Chairman of Arada, commented: “Our latest successful return to the global markets reflects once again the trust being placed by regional and international investors in Arada’s track record, robust financial position and growth prospects. This issuance serves as a platform of our next phase of growth as we continue target growth opportunities both at home in the UAE and abroad.”

Prior to this latest Sukuk issuance, Arada issued a 5-year fixed rate USD400mn RegS Sukuk Ijarah/Murabaha in June 2024, which was priced at par with a coupon of 8.000% per annum payable semi-annually in arrear, inside the initial guidance area of 8.625% for a spread of 355 bps over US Treasuries. This was followed by a second transaction in October 2024 – a USD150mn Tap Sukuk which forms part of the 5-year fixed rate USD400mn RegS Sukuk Ijarah/Murabaha issued by the company in June 2024. The Sukuk tap was priced at an issue price of USD102.54, a coupon rate of 8% per annum payable semi-annually in arrears on each Periodic Distribution Date, and a yield of 7.35% per annum, narrowing by 15 basis points from the initial pricing guidance, reflecting strong investor demand.

The asset pool composition for the latest Sukuk issuance, according to the final terms document, comprises 57.9% Ijara assets, and 42.1% Murabaha assets. The proceeds of the Sukuk will be be used for a tender offer of up to USD100mn on Arada’s existing Sukuk maturing 2027, with the balance allocated for general corporate purposes. Since its launch in 2017, Arada has launched nine successful projects in both Sharjah and Dubai and has a pipeline of existing and future projects in the UAE and Australia valued at over AED90bn.

In total, Arada has sold over 17,000 units since inception, valued at over AED29bn, with over 10,000 units completed.

The certificates were admitted to the International Securities Market (ISM) of the London Stock Exchange for listing and trading, and on the Official List of the DFSA and admitted to trading on Nasdaq Dubai in early August 2025.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by Arada Developments, with the US$200.6m Murabaha tranche being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.