Oil and Gas Utility Giant ADNOC Murban Issues USD1.5bn Debut Sukuk Wakala, the Largest AA-rated Corporate Sukuk Ever Issued Globally and at One of the Lowest New Issue Premiums for Islamic Securities in MENA

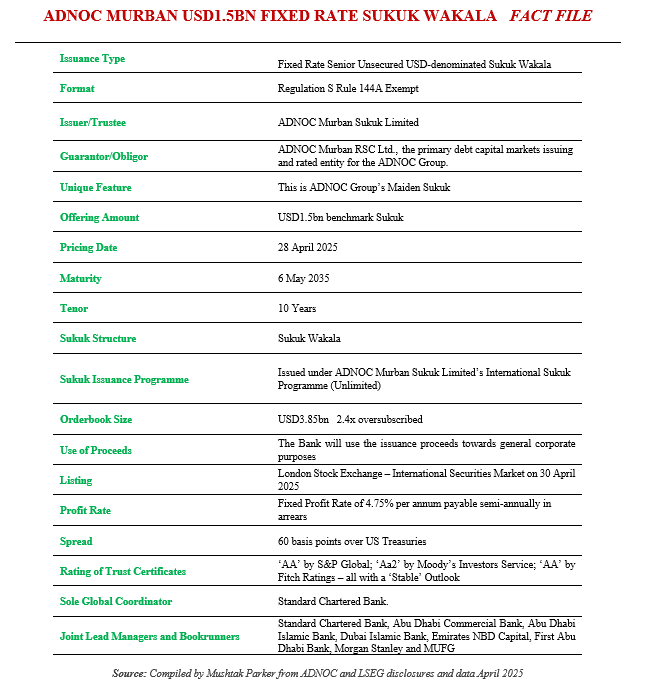

ADNOC Murban Sukuk Limited, a special purpose vehicle specifically set up to issue Sukuk Certificates, successfully priced its maiden USD1.5bn Sukuk Wakala issuance on 28 April 2025 under its newly established unlimited International Sukuk Programme, which the issuer says represents “the largest-AA rated Corporate Sukuk ever issued globally.”

The Sukuk was issued on behalf of the Obligor ADNOC Murban RSC Ltd., a wholly owned subsidiary of Abu Dhabi National Oil Company (ADNOC) and the primary debt capital markets issuing and rated entity for the ADNOC Group, a leading diversified energy and petrochemicals company wholly owned by the Government of Abu Dhabi. ADNOC says its objective is to maximize the value of the Emirate’s vast hydrocarbon reserves through responsible and sustainable exploration and production to support the UAE’s economic growth and diversification. ADNOC is Abu Dhabi’s national oil company and contributes around 75% of the Government of Abu Dhabi’s revenues and 50% to the Emirate’s GDP.

ADNOC Murban Sukuk Limited had mandated Standard Chartered Bank to act as the sole Global Coordinator and together with Abu Dhabi Islamic Bank, Dubai Islamic Bank, and First Abu Dhabi Bank, Emirates NBD Capital, Abu Dhabi Commercial Bank, MUFG, and Morgan Stanley as Joint Lead Managers and Active Bookrunners of the transaction. KFH Capital, Sharjah Islamic Bank, SMBC, and the Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the Islamic Development Bank (IsDB) Group acted as Passive Bookrunners on the Sukuk offering. The mandate was also to arrange a series of investor calls and roadshows with accounts in the UK, EU, the MENA region, Asia and Offshore US for a benchmark US dollar-denominated Sukuk Wakala offering.

The issuance was 2.4x oversubscribed with the orderbook exceeding USD3.85bn from a range of investors in the GCC, the MENA region, UK, Europe, Asia and Offshore US accounts. The transaction was closed at fixed profit rate of 4.75% per annum payable semi-annually in arrears

And a spread of 60 basis points over US Treasuries, following an accelerated intraday offering.

According to ADNOC Murban, “the Sukuk was successfully priced at one of the lowest-ever new issue premiums for Shariah-compliant securities in the region, and at the region’s tightest-ever corporate US dollar 10-year spread. This was driven by significant investor interest across key Islamic investor markets, reflecting the market’s belief in ADNOC’s exceptional credit quality and resilient strategy across commodity price cycles. The issuance, which captures a strategic opportunity to further diversify ADNOC’s funding sources and broaden its investor base, is part of a disciplined funding strategy building on ADNOC Murban’s inaugural Global Medium Term Note bond issuance in September 2024, and Green Financing Facility signed in June 2024.”

The Sukuk certificates were admitted for listing and trading on the International Securities Market of the London Stock Exchange in early May 2025.

ADNOC Murban is rated “Aa2” by Moody’s Investor Services, “AA” by Standard & Poor’s (S&P) and “AA” by Fitch Ratings (Fitch) – aligned with ratings assigned to ADNOC’s shareholder, the Government of Abu Dhabi. The Sukuk certificates have been assigned a rating of “Aa2” by Moody’s, and “AA” by Fitch.

According to Moody’s in its rating rationale, “the proceeds of the certificates will be used by ADNOC Murban Sukuk Limited (in its capacity as the Issuer) to acquire a Wakala portfolio (comprised of shares of companies listed on a stock exchange located in the UAE) from ADNOC (or any of its direct or indirect wholly owned subsidiaries). The portfolio will be managed by ADNOC Murban as the servicing agent on behalf of the Issuer.”

ADNOC’s entry into the US dollar Sukuk market is belated but not surprising. The oil and gas sector has had a long history of raising funds from the international market through Sukuk and Islamic credit facilities such as the syndicated Murabaha. In fact, it was Shell MSD (Malaysia) which issued the world’s first ever Sukuk 35 years ago in 1990. The Sukuk denominated in Malaysian ringgit was equivalent to USD125mn.

Over the last year there has been renewed interest from oil and gas majors mainly in the GCC countries in raising funds through Sukuk issuances. In January 2025, Bapco Energies BSC (formerly The Oil and Gas Holding Company (nogaholding)), the energy investment and development holding entity of the Government of Bahrain, successfully priced its latest Sukuk Murabaha/Ijara issuance – a 10-year benchmark USD1bn Senior Reg S Unsecured Certificates offering.

Arkad Engineering & Construction, a leading EPC contractor in Saudi Arabia’s oil and gas pipeline industry and which has an extensive track record of delivering high-profile projects, including for Saudi Aramco, also issued a USD800mn Perpetual Sukuk in November 2024.

In many respects Saudi Aramco, the world’s largest oil exporter and one of the world’s leading integrated energy and chemicals companies, is a trend setter not only in its core sector constituency of crude oil, natural gas and chemicals, but also in the international Sukuk market.

In June 2021 for instance, Aramco issued the world’s largest single US dollar corporate Sukuk – a three-tranche USD6bn transaction which marked the oil giant’s maiden offering and its entry into the global Sukuk market under a newly-established unlimited Trust Certificate Issuance Programme. The fact that the issuance was oversubscribed an incredible 20 times with the orderbook exceeding a staggering USD120bn speaks volumes and arguably paved the way for other major corporates and sovereign wealth funds in the GCC to enter the Sukuk market.

Fast forward to 2024. After an absence of just over 3 years, Aramco returned to the international Sukuk market in October 2024 with a two-tranche two-tenor aggregate USD3bn benchmark Sukuk Wakala senior unsecured RegS Rule 144A issuance under its unlimited Trust Certificate Issuance Programme.