Gulf International Bank (GIB) Successfully Closes its Maiden USD500mn Syndicated Murabaha Facility as Market Demand Shows no Sign of Abating

Manama – Big ticket Commodity Murabaha Syndications continue to flourish in the Islamic finance market as if not to be outdone by the proliferation of Sukuk originations thus far in 2025. The latest debutante to the Murabaha syndication market is Gulf International Bank (GIB) Bahrain, which successfully closed its inaugural US$500mn syndicated Murabaha financing facility on 18 May 2025, marking the Bank’s first Islamic syndicated transaction in the international market.

The successful completion of the facility, stressed GIB, underscores the Bank’s sound financial position in the market. The strong interest garnered by the facility has enabled GIB to further diversify its funding base and facilitate the Bank’s continued business growth across its core markets and key business lines. The strong uptake of the facility also highlighted GIB’s sound credit profile while further strengthening the Bank’s financial position and diversifying its funding sources, it added.

Sara Abdulhadi, Chief Executive Officer of GIB B.S.C., commented: “We are proud to have successfully closed GIB’s inaugural syndicated Murabaha facility, marking a key milestone in the ongoing diversification of our funding strategy. The strong response and oversubscription from such a diverse group of regional and international banks reflects tremendous market confidence in GIB’s position as a leading pan-GCC universal bank”.

SMBC Group acted as the Initial Mandated Lead Arranger, Bookrunner and Coordinator for the facility. Emirates NBD Capital Limited and First Abu Dhabi Bank were the Mandated Lead Arrangers and Bookrunners.

Gulf International Bank B.S.C. is a pan GCC universal bank established in 1975 and regulated by the Central Bank of Bahrain. GIB’s services are delivered across the GCC and international markets through its subsidiaries: GIB Saudi Arabia, GIB Capital, GIB (UK) Ltd. Additionally, the bank has branches in London (UK), New York (USA), Abu Dhabi (UAE) and Muscat (Oman), in addition to a representative office in Dubai (UAE).

GIB is owned by the governments of the Gulf Cooperation Council countries, with Saudi Arabia’s Public Investment Fund (PIF) being the primary shareholder.

Amid a challenging market environment marked by heightened volatility and declining trading income due to trade tariffs, Gulf International Bank reported net profit attributable to shareholders of USD48.0mn for the first quarter of 2025, up 1% increase from USD47.5mn in the same period last year. The growth was fuelled by strong revenue from foreign exchange and other income, along with stable net interest income. Additionally, the bank maintained operational efficiency with a controlled 6% rise in operating expenses, driven by targeted investments in strategic initiatives aimed at fostering future revenue growth and enhancing the Bank’s competitive edge.

GIB’s major shareholder, PIF, the Saudi sovereign wealth fund, successfully closed a massive debut USD7bn Commodity Murabaha financing facility in January 2025.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the facility for GIB, which was facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.

Dubai Islamic Bank Widens its Digital Investment Footprint in Türkiye with USD150mn Murabaha Facility for Turkcell

Istanbul – DIB, the world’s first commercial Islamic bank and the largest in the UAE, signed a USD150mn Murabaha financing agreement with Turkcell, Türkiye’s leading telecommunications and technology services provider. The facility will support Turkcell’s ongoing investments in digital infrastructure.

The agreement was formalised at a high-level signing ceremony in Istanbul on 27 May 2025, attended by senior leadership from both organisations, led by Dr. Adnan Chilwan and Dr. Ali Taha Koç. The agreement said DIB reflects the Bank’s strategic approach to financing the sectors and institutions shaping the next phase of economic growth. With a clear focus on long-term value, the Bank continues to enable real-world impact by backing businesses that are building the digital, sustainable, and resilient foundations of tomorrow’s economies.

According to DIB, the transaction further reinforces DIB’s commitment to enabling growth in high-potential markets. As one of the most prominent Islamic financial institutions in the GCC, the Bank continues to foster cross-border partnerships that drive sustainable, innovation-led development.

Structured as a five-year bullet-term facility, the Shariah-compliant financing will enable Turkcell to advance critical infrastructure in areas such as data centres, cloud technologies, and renewable energy-further solidifying Turkcell’s role as a leading force in Türkiye’s evolving digital economy. The partnership with Turkcell also aligns with DIB’s mission to advance sustainable impact through Shariah-compliant finance.

Dr. Adnan Chilwan, Group Chief Executive Officer of DIB, commented: “At DIB, we have long believed that banking goes beyond funding, we drive transformation. This partnership with Turkcell is not merely about leveraging our balance sheet; it is about enabling the organisation to unleash its true potential. Türkiye represents a market with vision, scale, and ambition, an economy investing heavily in the infrastructure of tomorrow, and a natural partner in our cross-border strategy.

“As the UAE’s largest Islamic bank, our role increasingly lies in establishing and shaping meaningful connections between geographies, sectors, and the players within. We see Islamic finance as a bridge, one that supports real economies while remaining true to the principles of ethical finance. With this facility, we are supporting a business that understands the future: digital, decentralised, and inclusive essentially, a future that DIB fully believes in.”

The deal also strengthens financial and commercial connectivity between the UAE and Türkiye, while offering Turkcell increased access to alternative Islamic financial engineering and structures—particularly as it accelerates investment into strategic and sustainability-linked technologies.

According to Dr. Ali Taha Koç, Chief Executive Officer of Turkcell, “as Türkiye advances towards a more digital and data-driven economy, our focus remains on building the infrastructure that supports this evolution. Partnering with a trusted institution like DIB, with its strong regional presence and deep-rooted values, brings both credibility and strategic alignment. This facility is not just timely – it lays a strong foundation for our growth journey in the years ahead.”

DIB in late 2023 acquired a significant minority stake in T.O.M. Group (established by the Aydin Group), which includes T.O.M. Katılım Bankası A.Ş. (Türkiye’s First Licensed Digital Retail Bank), T.O.M. Pay Elektronik Para ve Ödeme Hizmetleri A.Ş. (Licensed e-money company with a fast-growing customer base in Türkiye), and T.O.M. Finansman A.Ş. (Licensed financing company specialized in developing innovative digital products) and their subsidiaries. The aim is to increase DIB’s digital investment footprint in Türkiye as a gateway to other regions such as Central Asia and the wider MENA region.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the facility for Turkcell, which was facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.

ICIEC Extends €232 million Insurance Policy to Standard Chartered-led Consortium to Support Murabaha Financing for Côte D’Ivoire’s Landmark Flagship “Tour F” Development Project

Algiers – The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), the Shariah-based multilateral insurer and member of the Islamic Development Bank (IsDB) Group, signed an endorsement to the Non‑Honouring of Sovereign Financial Obligation (NHSFO) insurance policy it underwrote for Standard Chartered (Hong Kong) Limited and others on 21 May 2025 on the sidelines of the 2025 Annual Meetings of the IsDB Group in Algiers.

The endorsement supports an additional EUR130mn Murabaha facility to the Ministry of Finance and Budget of the Republic of Côte d’Ivoire, building on the initial €102mn previously insured by ICIEC. With this uplift, the total value of the insured Murabaha facility now stands at €232mn.

The endorsement policy was signed by Dr. Khalid Khalafalla, Chief Executive Officer of ICIEC, and Mr. Sujithav Sarangi, Executive Director, Development & Agency Finance at Standard Chartered. Under the arrangement, ICIEC’s NHSFO policy covers the participating financial institutions with robust credit enhancement. The proceeds will fund the construction of “Tour F”- a flagship government office tower within Abidjan’s new Administrative City, designed to modernize public‑sector infrastructure and improve public service delivery across Côte d’Ivoire.

Dr. Khalid Khalafalla, CEO of ICIEC, commented: “This policy exemplifies how ICIEC’s risk‑mitigation solutions unlock affordable, Shariah‑compliant capital for transformational public projects. Through this, ICIEC is supporting Côte d’Ivoire to realise a state‑of‑the‑art administrative hub that will boost efficiency, stimulate the local construction sector, and advance the country’s development agenda in line with the UN SDGs.”

According to Sujithav Sarangi, Executive Director, Development & Agency Finance, Standard Chartered, “this collaboration with ICIEC is testament to our shared commitments to impact and advancement. We are thrilled to combine our expertise, and continue our long-standing partnership, with ICIEC to support this significant development in Côte d’Ivoire.”

In a second transaction on 21 May 2025, ICIEC signed a Non‑Honouring of Financial Obligations for Multilateral Development Banks (NHFO‑MDB) policy to secure a €250mn financing package arranged by Standard Chartered, which is aimed at unlocking €250mn for infrastructure and trade growth in Six African Member States.

ICIEC’s NHFO‑MDB policy insures the financing provided by Standard Chartered (Hong Kong), Standard Chartered (Kenya) and DZ Bank to the Eastern and Southern African Trade and Development Bank (TDB). The funds will support an eligible portfolio of infrastructure, energy and trade‑finance initiatives in six common member states of ICIEC and TDB – Mozambique, Uganda, Comoros, Djibouti, Egypt and Senegal – by providing credit enhancement to the lenders and thereby unlocking critical capital for high‑impact projects.

Dr Khalafalla commented: “By providing ICIEC’s NHFO-MDB insurance cover to this landmark facility, we are doing more than mitigating risk – we are fast‑tracking development. Such facility empowers TDB to accelerate infrastructure, energy and trade projects that will light homes, connect markets and create dignified jobs across six of our common member states. It is a clear demonstration of how Islamic finance can mobilize private resources for inclusive, sustainable growth. The transaction underscores ICIEC’s commitment to deploy innovative risk‑mitigation solutions that advance the IsDB Group’s objective of fostering inclusive, resilient and sustainable development across its member countries.”

Similarly, Sujithav Sarangi, Executive Director, Development & Agency Finance, Standard Chartered added that “the success of this project is rooted in the significant, and tangible, benefits this development will bring. Our enduring partnership with ICIEC exemplifies our shared mission to drive meaningful impact in the communities and markets we support.”

IsDB and Asian Development Bank Sign USD2bn Co-financing Agreement to Finance Joint Operations in Their 14 Common Member Countries

Milan – The Islamic Development Bank (IsDB) and the Asian Development Bank (ADB) renewed their development commitment by pledging to dedicate USD1bn each in cofinancing of joint operations in Member Countries common to both institutions through 2030. The new investments aim to enhance the effectiveness, impact, efficiency, and sustainability of their development operations. The Memorandum of Understanding (MoU) was signed by Ibrahim Ali Shoukry, Director of Partnerships, Global Advocacy and Resource Mobilization Department at IsDB, and Xinning Jia, ADB’s Director General for Strategy, Policy, and Partnerships.

The signing ceremony took place in Milan, Italy in May 2025 on the sidelines of ADB’s 58th Annual Meeting of the Board of Governors. IsDB and ADB Common Member Countries include Afghanistan, Azerbaijan, Bangladesh, Brunei Darussalam, Indonesia, Kazakhstan, Kyrgyz Republic, Malaysia, Maldives, Pakistan, Tajikistan, Türkiye, Turkmenistan, and Uzbekistan.

Under the MoU, IsDB and ADB will work closely through programmatic cofinancing to share ideas, values, and resources to help finance the development of their countries of common membership.

Speaking during the ceremony, Ibrahim Ali Shoukry stated, “This MoU is a critical step in our partnership with ADB. By combining our resources and expertise, we can drive impactful development projects that will benefit our member countries and foster sustainable economic growth. Our commitment to cofinancing joint operations demonstrates our dedication to achieving shared prosperity and resilience in the face of global challenges.”

“This partnership MOU marks a significant milestone in our collaboration with IsDB,” said Xinning Jia, Director General of ADB’s Strategy and Policy Department. “By leveraging our collective expertise and resources, we are committed to addressing critical development challenges, driving innovative financing solutions, and fostering economic growth across Asia. Our shared vision is to create lasting, meaningful impacts that will improve the lives of millions in our common-member countries.”

The MoU is expected to facilitate collaboration between the Parties to promote programmes and activities that foster cooperation between them, with a focus on optimizing and strengthening sustainable infrastructure, reducing the digital infrastructure gap, empowering youth and women, enabling regional integration and cross-border trade and cooperation, and joint efforts in scaling-up partnerships, global advocacy, and resource mobilization.

Türkiye Treasury Continues Domestic Sovereign Sukuk Al-Ijarah Issuance in April/May 2025 Through Three Auctions of Fixed Rate Leasing Certificates including US Dollar and Gold-backed Transactions

Ankara – Türkiye’s sovereign domestic Sukuk issuance continued its momentum in April and May 2025 with auctions of fixed rate lease certificates (Sukuk Al-Ijarah), FX denominated (US Dollar) fixed rate lease certificates (Sukuk Al-Ijarah), and Gold-backed lease certificates (Sukuk Al-Ijarah) as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic markets on the back of mixed macro-economic fundamentals including rising inflation and cost of living.

However, on the back of the successful closing of Ankara’s latest Eurobond issuance in May 2025 and the affirmation of a “stable outlook” and ‘BB-’ rating of sovereign Türkiye by ratings agency, S&P Global, despite earlier political and economic uncertainty, Türkiye has seen a steady inflow of investment and capital from the GCC states especially the UAE, Qatar, Kuwait and Saudi Arabia.

The Treasury’s public debt issuance domain includes domestic fixed rate and CP Indexed lease certificates (Sukuk Al Ijarah), FX-linked lease certificates and Gold-linked lease certificates as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond markets. The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificates (Sukuk Al-Ijarah) market.

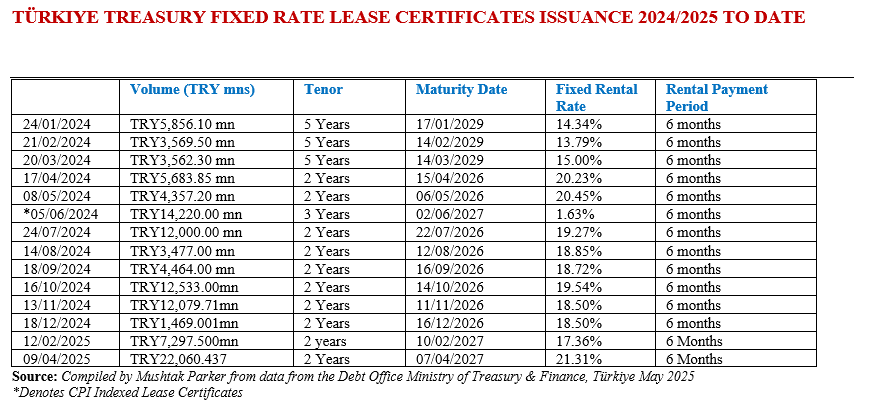

The Fixed Rate Lease Certificate market however is the mainstay of the Treasury’s fund-raising in the Sukuk market. The Türkiye Treasury raised in an auction on 9 April 2025 through the issuance of 2-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 7 April 2027 priced at a fixed profit rate of 21.31% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

The Türkiye Treasury issued consecutive monthly Sukuk Al Ijarah during 2024, aggregating TRY83,272.161mn (US$2,321.83mn), suggesting that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy.

In the second auction, the Treasury issued FX-linked leasing certificates market on 15 April 2025 when it raised USD213.125mn through a Fixed Rent Rate Lease Certificate (Sukuk Al Ijarah) issuance with a tenor of 364 days priced at a fixed rental rate of 2.60% over 6 months and maturing on 15 April 2026. Demand for the certificates was robust.

In the third auction, the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) on 20 May 2025 with a tenor of 364 days maturing on 20 May 2026 and priced at a Lease Rate of 0.60% payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 15,173,750grams of gold (995/1000 purity) from institutional investors for issuance of an aggregate 15,173,750 gold lease certificates (at a nominal value).

The amount of Gold Lease Certificates issued, according to the Treasury, is taken as 1,000 for 1 gram collected gold from the issuances to individual investors and 1 for 1 gram collected gold from the issuances to institutional investors. The direct sale auction of its latest Gold-backed Lease Certificates (Sukuk Ijarah) offering was conducted by the Central Bank of Türkiye via AS (Auction System under Central Bank Payment Systems).

According to Turkish Treasury “citizens are provided with a safe investment tool for gold savings. With the gold bond and gold-denominated lease certificate issuance through five banks, our citizens will win themselves and contribute to the economy.” Investors will be paid TL-denominated returns on a semi-annual basis indexed to the gold price. On maturity, according to the Treasury, investors may request the principal payment as 1 kilogram of gold bar (produced by refineries) or Republic Gold Quarter Coins printed by the Turkish State Mint.

The Treasury also issues these gold-backed lease certificates “to diversify borrowing instruments, broaden the investor base and bring the idle gold into the economy.”

The Türkiye Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds.

The usual mantra of the Turkish Treasury when announcing these auctions are “to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor. The auction was conducted by the Central Bank of Turkey via its AS (Auction System under Central Bank Payment Systems).

Pakistan Launches Inaugural Rs31.98bn (USD113.5mn) Sovereign Green Sukuk Al-Ijarah to Support Sustainable Shariah-compliant Public Finance

Karachi – The Government of Pakistan, with strategic support from Meezan Bank and the Pakistan Stock Exchange, launched its inaugural sovereign Green Sukuk on 30 May 2025, marking a significant advancement in sustainable and Shariah-compliant public financing.

Meezan Bank played a central role in this landmark issuance, serving as Joint Financial and Shariah Advisor. In addition to its advisory responsibilities, the Bank was instrumental in developing the Sustainable Investment (SI) Sukuk Framework, which was approved by the federal cabinet in April 2025. The framework aligns with international best practices and integrates both the United Nations Sustainable Development Goals (SDGs) and the Maqasid-e-Shariah.

To support market readiness and investor participation, Meezan Bank conducted a series of information sessions and webinars, engaging Non-Resident Pakistanis, financial institutions, asset management companies, and ESG-focused investors. The Bank also collaborated with Dubai Islamic Bank Pakistan, Bank Islami, and Bank Alfalah Islamic to ensure full compliance with Shariah principles and uphold the structural integrity of the transaction.

The Rs30 billion issuance, according to Meezan Bank, received an overwhelming response, with bids exceeding Rs.161bn – an oversubscription of 5.4 times within two hours. In view of the strong demand, the issue size was raised to Rs.31.98bn (USD113.5mn). The auction was conducted via the Pakistan Stock Exchange and executed by the Pakistan Domestic Sukuk Company Limited (PDSCL), a wholly owned entity of the Ministry of Finance.

The Green Sukuk is a three-year Ijarah-based instrument, offering semi-annual rental returns. It is fully tradable on the Pakistan Stock Exchange and qualifies for Statutory Liquidity Requirement (SLR). With a minimum investment of PKR 5,000, the issuance was designed to encourage broad participation, including retail investors, institutions, and Roshan Digital Account (RDA) holders.

Proceeds will finance selected green infrastructure projects, including the Garuk Storage Dam in Kharan, Naigaj Dam in Dadu (Sindh), and the 26MW Shagarthang Hydropower Project in Skardu. These initiatives aim to improve water resource management, expand renewable energy capacity, and strengthen climate resilience in underserved areas.

ITFC Ups its Murabaha Trade Finance Allocations with Pan-African Development Banks with Two Agreements in May Aggregating USD400mn

Algiers – The International Islamic Trade Finance Corporation (ITFC), the trade fund of the Islamic Development Bank (IsDB) Group, is not only forging longstanding relations with state agencies, commercial banks and corporates, but also with regional multilateral developments banks especially through the extending of Murabaha trade finance facilities.

In May on the side lines of the 2025 IsDB Annual Meetings in Algiers, ITFC signed a record USD2.6bn of agreements with various counterparties. Two of the largest agreements were with regional development banks including the renewal of a USD300mn Murabaha financing facility with Cairo-based pan-African Afreximbank, the export import and trade finance bank launched by the African Development Bank, aimed at securing food and energy supplies and enhancing intra-African trade flows.

In the second such transaction, ITFC also signed a Terms Letter for a USD100mn Murabaha Financing Agreement with the ECOWAS Bank for Investment and Development (EBID). This facility, according to ITFC, will support the import of critical commodities for member countries, helping to strengthen regional trade and economic stability, and furthering ITFC and EBID’s commitment to promoting sustainable development and facilitating economic growth across West Africa.

“At ITFC, we view access to markets as a gateway to economic prosperity. That’s why we combine trade finance, technical assistance, and strategic partnerships to help our member countries—especially SMEs – connect with regional and international markets. From trade-related capacity building to convening platforms like the Intra-African Trade Fair IATF, our mission is clear: enable trade, empower businesses, and improve lives,” explained Nazeem Noordali, COO, ITFC, during a panel discussion on ‘Trade Facilitation & Regional Integration.’

ITFC Pens Murabaha Trade Finance Deals Totalling USD2.6bn With a a Wide Variety of Counterparties in Africa and Asia during the 2025 IsDB Annual Meetings as Murabaha Trade Finance Comes of Age

Algiers – The International Islamic Trade Finance Corporation (ITFC), the trade fund of the Islamic Development Bank (IsDB) Group, signed a record USD2.6bn of agreements with various counterparties during the 2025 IsDB Group Annual Meetings in Algiers at end May 2025.

“With a total of US$2.6 billion of agreements signed, the Corporation reaffirmed its strong commitment to supporting the socio-economic and development priorities of its member countries. These included sovereign and private sector-focused facilities, new partnerships, and strategic engagements designed to enhance trade resilience, food and energy security, and SME growth,” said the ITFC.

In one of the Panel Discussions titled “Unlocking Trade Potential in Africa,”, Nazeem Noordali, Chief Operating Officer of ITFC, stressed that “Islamic trade finance is shifting from niche to strategic across Arab and African regions, shaping the financial and trade ecosystem of the two regions. Its Shariah principles offer inclusive solutions for underbanked SMEs and align with national development goals of the economies in Africa. With flagship initiatives supporting trade like AfCFTA, Arab Africa Trade Bridges (AATB) Programme, and AfTIAS, Islamic finance is driving regional trade and integration. Growing regulatory support and GCC interest in Africa reinforce its rising role as a key enabler of cross-border investment and socioeconomic sustainable growth.”

During the meetings, ITFC signed a landmark five-year framework agreement with the Republic of Senegal with total envelope amount of €2bn to support key sectors such as energy, agriculture, healthcare, and the development of small and medium-sized enterprises. Another key sovereign financing was announced with the Republic of Guinea, to provide a Murabaha trade finance facility through the Central Bank of Guinea to support the import of petroleum products and essential commodities. ITFC also signed a USD100mn Murabaha facility with EBID to facilitate imports of essential commodities for private sector clients across Member Countries.

A strong focus was placed on supporting the private sector and expanding Islamic trade finance tools. ITFC signed a USD10 million in Mudaraba financing with Uzbekistan’s Smartbank and signed another agreement with Agrobank to increase the total financing amount to USD25mn aimed at providing Shariah-compliant financing to the country’s growing private sector. Furthermore, a €20mn Murabaha facility was signed with Albaraka Türk to boost access to finance for SMEs and private sector clients in Türkiye.

Another milestone signing was in favour of Algeria, where ITFC signed a USD100mn syndicated LC confirmation facility with Crédit Populaire d’Algérie (CPA) Bank to support trade transactions of both public and private sector clients, with a special emphasis on SME development. Additionally, ITFC inked a €10mn facility with Crédit Communautaire d’Afrique (CCA) Bank in Cameroon, €10mn facility with Commercial Bank Cameroon, and a USD15mn Murabaha agreement with The Alternative Bank in Nigeria to support agricultural pre-exports and essential equipment imports.

The meetings with officials and stakeholders also provided an opportunity to strengthen regional trade development platforms. A grant agreement under the AfTIAS 2.0 program was signed with the government of Algeria to enhance cross-border trade with Tunisia. These partnerships were complemented by ITFC’s hosting of high-level dialogues during the Private Sector Forum, including a panel on trade facilitation and regional integration and a knowledge-sharing event exploring complementarities in trade and economic diversification across the OIC region.

ICIEC and Al Baraka Bank (Egypt) Sign Two Credit Insurance Policies Worth an Aggregate USD100mn to Support Trade Finance and Exports

Algiers – The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), the Shariah-based multilateral insurer and member of the Islamic Development Bank Group, signed two credit insurance policies on 21 May 2025 with Al Baraka Bank (Egypt) each worth USD50mn. The policies were signed during the 2025 IsDB Group Annual Meetings held in Algiers at the end of May. The first agreement was for a Bank Master Policy (BMP) aimed at supporting Islamic trade finance transactions worth USD50mn. It represents a key step toward the development of Islamic finance and enhancing its role in supporting SMEs in member countries.

“We are delighted to partner with Al Baraka Bank – Egypt on this landmark Policy. This agreement underscores our shared commitment to facilitating reliable, Shariah-compliant trade finance solutions that foster sustainable economic growth and resilience across our member states,” said Dr. Khalid Khalafalla, CEO of ICIEC. “By mitigating transaction risks, we help our partners expand into new markets and promote development initiatives that benefit member countries.”

The second agreement was for a Documentary Credit Insurance Policy (DCIP) with Albaraka Bank (Egypt), to support export transactions backed by Letters of Credit worth USD50mn.

The insurance policy provides a comprehensive coverage for Al Baraka Bank’s documentary credit transactions by protecting the bank againt non-payment risk of overseas banks issuing letters of credit (LCs). This enables Albaraka Bank to enlarge its LC confirmation business to support Egyptian exports. Dr. Khalid Khalafalla, CEO of ICIEC, stated, “We are honored to partner with Al Baraka Bank – Egypt on this Documentary Credit Insurance Policy to de-risk Egyptian exports. This collaboration strengthens economic resilience and supports growth across our member states.”

Both agreements were signed on the sidelines of the IsDB Group Annual Meetings 2025 in Algiers by Dr. Khalid Khalafalla, CEO of ICIEC, together with Mr Ahmed Atteya, Head of Financial Institutions Department, Al Baraka Bank (Egypt).

IILM Continues Short Term Sukuk Issuance Momentum with Two Auctions in May 2025 with an Aggregate Reissuance of USD2.52bn and for the First Five Months of 2025 of USD9.49bn Amid Robust Investor Demand

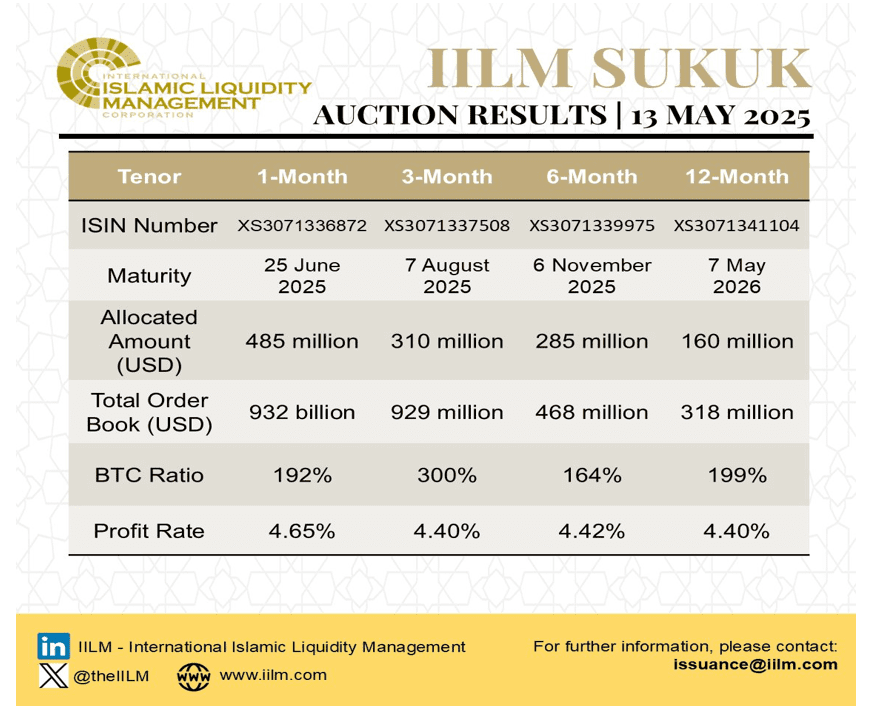

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Shariah-compliant liquidity management instruments, continued its short-term Sukuk issuance momentum with two auctions in May 2025 – the first one was a reissuance of an aggregate USD1.24bn short-term Sukuk across four different tenors of one, three, six, and twelve-month respectively on 13 May and the second one an issuance and reissuance of an aggregate USD1.28bn across three different tenors of one, three, and six-month on 27 May, including a new USD500mn asset. These transactions follow the Corporation’s first auction for 2025 in January with a reissuance of an aggregate USD1.27bn short-term Sukuk across three different tenors of one, three, and six-month respectively; and an aggregate USD1.76bn Sukuk issued in February with the same tenors. With the March reissuance of an aggregate USD1.21 billion short-term Sukuk across three different tenors of one, three, and six-months, the total volume of Sukuk issued in the first quarter of 2025 amounted to USD5.05bn.

The first auction on 13 May 2025 comprised four series which were priced competitively at:

i) 4.65% for USD485 million for the 1-month tenor

ii) 4.40% for USD310 million for the 3-month tenor

iii) 4.42% for USD285 million for the 6-month tenor

iv) 4.40% for USD160 million for the 12-month tenor.

The successful completion of the first May short-term Sukuk transaction marked the IILM’s eighth auction year-to-date, with cumulative issuances totalling USD8.21bn across 24 Sukuk series of varying tenors. The auction saw a competitive tender amongst the Primary Dealers and Investors globally, with a very healthy orderbook of USD2.65bn, representing a strong and sustained average bid-to-cover ratio of 214%.

Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, said: “Today’s transaction marks yet another pivotal and historic milestone for the IILM, as we successfully offered four different tenors – one, three, six, and twelve-month – for the first time in a single auction. This strategic move underscores the IILM’s firm commitment to providing greater flexibility and depth in high-quality Shariah-compliant short-term liquidity management space, in line with the growing and evolving needs of Islamic financial institutions globally.”

The auction saw impressive demand across all the four tenors, despite the ongoing volatility in global rate markets and rising short-term funding costs amid tightening liquidity conditions.

“Investor appetite remained resilient, bolstered by a renewed risk-on tone, following a joint US-China announcement on reciprocal tariff reductions. The positive market sentiment exceeded expectations and provided a constructive backdrop for the issuance. As market conditions continue to stabilise, the IILM remains a reliable and trusted provider of high-quality Islamic liquidity management tools for the global Islamic finance community,” added Mohamad Safri Shahul Hamid.

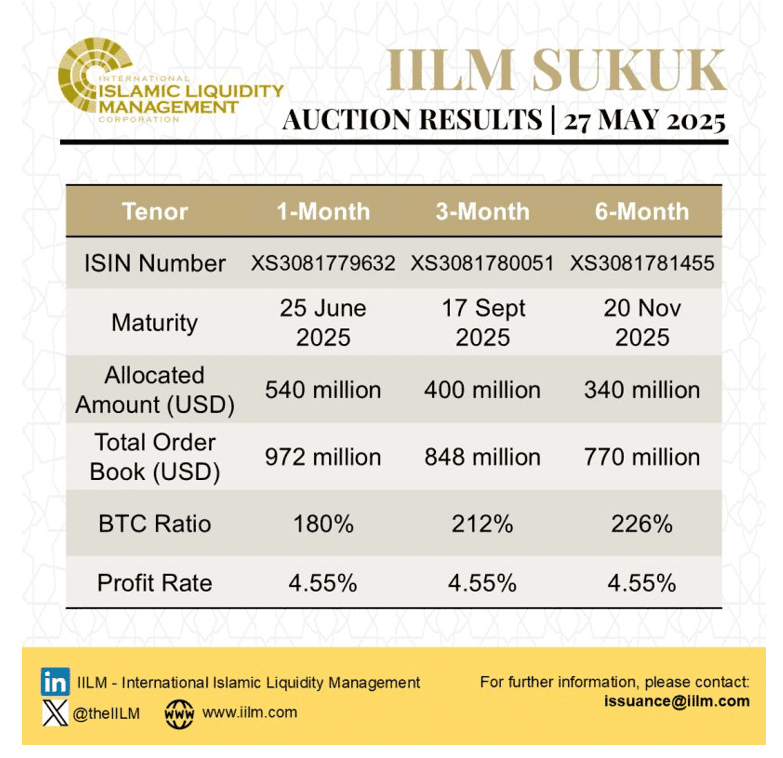

In the second transaction on 27 May 2025, the IILM also successfully completed the reissuance and issuance of an aggregate USD1.28bn short-term Sukuk across three different tenors of one, three, and six-months, which included a new asset in the portfolio.

The three series on 27 May 2025 were priced competitively at:

i) 4.55% for USD540 million for the 1-month tenor

ii) 4.55% for USD400 million for the 3-month tenor

iii) 4.55% for USD340 million for the 6-month tenor.

Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented: “Today’s auction marks another historic and significant milestone in the IILM’s growth trajectory with the inclusion of a new highly rated USD500 million Sukuk asset. This addition not only bolsters our issuance capacity but also enhances the diversification of our asset pool across the GCC region. It represents a huge strategic step forward in expanding our geographical footprint as well as strengthening the credit quality and resilience of the IILM Sukuk programme.

“Reaching an all-time high of USD5.7bn in outstanding short-term Sukuk is a testament to the robustness of our unique business model and continued the trust placed in the IILM by our investors and network of highly rated asset obligors. This milestone underscores the growing demand for reliable, Shariah-compliant liquidity instruments and highlights the IILM’s evolving role as a key player in the global Islamic finance ecosystem. We are pleased to collaborate with an expanding network of globally respected institutions as we continue to support the development of robust, Shariah-compliant liquidity management tools for the Islamic financial market. This latest development reaffirms the IILM’s commitment to delivering transparent, consistent, creditworthy, and liquidity solutions to Islamic financial institutions worldwide.”

This auction on 27 May marked the IILM’s ninth auction year-to-date and its second for the month. Year-to-date, cumulative issuances have reached USD9.49bn billion across 27 Sukuk series of varying tenors. The auction attracted strong demand from the IILM’s network of Primary Dealers and global investors, resulting in a healthy orderbook of USD2.58bn and a robust average bid-to-cover ratio of 202%, reflecting continued confidence in the IILM’s short-term Sukuk programme.

Both issuances form part of the IILM’s “A-1” (S&P) and “F1” (Fitch Ratings) rated USD6bn short-term Sukuk issuance programme.

The IILM’s short-term Sukuk is distributed by a diversified and growing network of 14 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Affin Islamic Bank, Boubyan Bank, CIMB Islamic Bank Berhad, Dukhan Bank, First Abu Dhabi Bank, Golden Global Investment Bank, Kuwait Finance House, Kuwait International Bank, Maybank Islamic Berhad, Golden Global Investment Bank, Meethaq Islamic Banking from Bank Muscat, Qatar Islamic Bank, and Standard Chartered Bank.

The Corporation is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The Corporation says it will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The issuance forms part of the IILM’s “A-1” (S&P Ratings) and “F1” (Fitch Ratings) rated USD6bn short-term Sukuk issuance programme.

Looking ahead into 2025, the IILM plans to boost its asset origination activities through bespoke and attractive offerings to address the diverse needs of global sovereign and sovereign-linked Sukuk issuers, as well as rolling out alternative to Sukuk assets to allow further growth of supply and meet the growing market demand.

The IILM will also continue to expand its investor base and network of primary dealers as it looks to expand regional collaborations and enter new markets to further integrate Islamic liquidity solutions into the global financial system. The Corporation, says Mr Mohamad Safri, remains committed to developing the Islamic liquidity management infrastructure and enhancing the Sharia’a-compliant liquidity tools available to the market, working closely with scholars, regulators, and industry stakeholders to resolve inconsistencies that may hinder growth.

The IILM says it will also continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The IILM’s ongoing commitment to innovation and impact, according to the Corporation, continues to bolster the liquidity management capabilities of Islamic financial institutions. By providing highly rated tools that are increasingly traded in secondary markets, the IILM helps these institutions meet their Liquidity Coverage Ratio (LCR) requirements while offering sustainable returns.

The IILM consistently issues short-term Sukuk across 1-month, 3-month, 6-month, as well as 12-month tenors, tailored to the liquidity needs of Islamic financial institutions. Since its inaugural issuance in 2013, the IILM has successfully issued a cumulative of USD122.69bn worth of short-term Sukuk across 297 series.

The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.