IsDB President Dr Muhammed Al Jasser Calls for Bold Action in Fostering Global Economic Recovery and a Catalytic Role for Islamic Finance in Crowding in Private Sector Participation in Frontier Markets at World Bank 2025 Spring Meetings in Washington DC

Washington DC – Dr Muhammad Al Jasser, President of the Islamic Development Bank (IsDB), in addressing the 111th Meeting of the prestigious Development Committee of the World Bank during the Spring Meetings of the World Bank/International Monetary Fund on 24 April in Washington DC, warned that at a moment of heightened uncertainty and subdued global economic prospects the path to recovery remains uneven.

He called for bold structural transformation anchored in global cooperation and not just stabilisation. “Blended finance, credit enhancements, and Islamic finance instruments can further catalyze private sector participation in frontier markets,” he urged.

The aftershocks of recent global disruptions – from the COVID-19 pandemic and regional conflicts to rising global interest rates, he maintained, “continue to constrain growth and test the resilience of economies, particularly in the developing world. These shocks have not only derailed progress toward development goals but have also exposed the fragility of social systems, fiscal buffers, and economic resilience. Many developing countries, especially those with fragile economies, face constrained investment, eroding social spending, and heightened vulnerability. Gains in education, health, and livelihoods are at risk of reversal — especially in low-income and conflict-affected settings.

“Furthermore, downside risks continue to dominate the global outlook. Geopolitical tensions, trade disruptions, growing debt distress, and a weakening multilateral consensus threaten to fracture the global economy. The resurgence of protectionist industrial policies and fragmentation of trade pose real risks, particularly for emerging economies striving to diversify and ascend global value chains.”

According to the IsDB, private sector development is at the heart of inclusive growth and poverty reduction. Across developing economies, the private sector provides nearly 90% of employment. Yet its potential remains underleveraged due to institutional bottlenecks, infrastructure deficits, and limited access to finance.

“Unlocking this dynamism demands systemic reforms to reduce transaction costs, remove market distortions, and build investor confidence. Governments must establish enabling ecosystems through strong legal frameworks, transparent policies, and investment in reliable infrastructure. Public-private partnerships (PPPs) can be powerful tools in mobilizing private capital, especially in fiscally constrained environments. Blended finance, credit enhancements, and Islamic finance instruments can further catalyze private sector participation in frontier markets. But enabling the private sector means more than financial mobilization – it means shaping systems that direct capital to innovation, resilience, and inclusive opportunity,” he urged.

The job creation imperative is urgent. In the Global South alone, 1.2 billion young people will enter the workforce over the next decade, but only 420 million jobs are expected to be created. The risks of exclusion, instability, and generational disillusionment are profound.

To address this, Dr Al Jasser recommended a threefold strategy:

- Investing in Human Capital: Education, health, and job-relevant skills are the foundation of future-ready economies. Learning poverty must be tackled head-on.

- Empowering Cities: Urban areas must be enabled as hubs of innovation, enterprise, and job creation through infrastructure and digital connectivity.

- Scaling Support for MSMEs: These enterprises are the employment backbone in most economies. We must expand their access to finance, technology, and market linkages.

The IsDB Group, he assured, has prioritized these efforts through programmes such as the Education for Employment Initiative, the SME Funds, the Youth Employment Support Programme, and partnerships like the Youth Digitalization for Employability and the Women Techsters Initiative.

The world faces a critical inflection point, he concluded. Persistent macroeconomic shocks, debt distress, climate volatility, and geopolitical tensions continue to test the limits of development progress. Unlocking the full potential of the private sector is central to addressing these challenges. This requires not only mobilizing capital but also reinforcing the legal, institutional, and infrastructure foundations for sustainable growth.

“The challenges,” he added, “are immense — but so too are the opportunities. Through collective action, bold investments, and a shared commitment to equity and inclusion, we can convert disruption into direction and secure a resilient, prosperous future for all.”

IsDB Signs USD140mn Financing Agreement with Kyrgyz Republic to Fund Agricultural Productivity, Energy Access, and Inclusive Education Projects

Washington DC – The Islamic Development Bank (IsDB) and the Kyrgyz Republic signed financing agreements totalling USD129.11mn on the sidelines of the 2025 Spring Meetings of the World Bank and International Monetary Fund in Washington DC.

The financing is for three projects is aimed at strengthening priority sectors in the Kyrgyz Republic. The first facility is a Line of Financing for promoting Agricultural Mechanization to improve productivity and rural livelihoods, the 2nd facility will finance the Construction of Electricity Transmission Line and Substations in Tamga and Karakol in Issyk-Kul Region, while the third one is towards the financing of the Smart-Education Project for Improving Access to and Quality of Inclusive Learning Opportunities for all Children in the Kyrgyz Republic.

The agreements were signed between Dr. Muhammad Al Jasser, President of the Islamic Development Bank, and Mr. Baketaev Almaz Kushbekovich, Minister of Finance of the Kyrgyz Republic and Alternate Governor of the IsDB. The signing was witnessed by H.E. Kasymaliev Adylbek Aleshovich, Chairman of the Cabinet of Ministers and Head of the Administration of the President of the Kyrgyz Republic. In his remarks following the signing, Dr. Al Jasser emphasized that these projects represent strategic investments in agricultural productivity, energy access, and inclusive education – all key enablers of sustainable growth in the Kyrgyz Republic.

To date, the IsDB Group has approved US$631mn for 89 operations in the Kyrgyz Republic, supporting infrastructure development, private sector growth, and international trade. Its insurance arm, the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), has provided US$48.1mn in credit and investment insurance and US$0.7 million in new insurance commitments.

IsDB President Dr Al Jasser also met the Kyrgyz delegation separately to explore prospects for future cooperation in energy production, water and sanitation. The delegation included Minister of Finance Mr Kushbekovich, Minister of Finance, and Mr Ibrayev Taalaibek Omukeevich, Minister of Energy, alongside other senior officials.

Aqaseem Factory for Chemicals and Plastics Company Latest Saudi issuer to Raise Funds Through Small Ticket SAR50mn (USD13.33mn) Sukuk Issue

Jeddah – Ultra-retail and small ticket corporate/SME Sukuk issuances continue in Saudi Arabia with Aqaseem Factory for Chemicals and Plastics Co the latest company to raise funds through a riyal-denominated Sukuk offering starting on 27 April 2025.

The public offering was for a SAR50mn (USD13.33mn) transaction offered to qualified Saudi nationals and other legal persons entitled to subscribe to local Sukuk offerings. The minimum subscription is SAR5,000 (USD1,333.03), The Sukuk certificates were issued under Aqaseem’s undisclosed Saudi riyal-denominated Sukuk Issuance Programme.

In a disclosure to Tadawul (the Saudi Exchange), Aqaseem said that it had appointed Al Khair Capital Saudi Arabia to act as the lead arranger and initial dealer for the Sukuk offering. The primary dealers for the Sukuk issuance include AlAhli Capital, Al Rajhi Capital, Saudi Fransi Capital, Riyad Capital, Albilad Investment Company, Aljazira Capital, Alistithmar Securities and Brokerage Company, Derayah Financial Company, Al Arabi Financial Company, Alinma Investment Company, Al Awal Investment Company, Yaqeen Financial Company, Al-Khabeer Financial Company, and Sukuk Financial Company.

The Sukuk has a tenor of 5 years maturing in April 2030 and is priced at a profit rate of 10% per annum payable semi-annually in arrears. The Sukuk certificates have been assigned a “BBB” with a Stable Outlook by the local Financial Analysis Company.

On the maturity date, the Sukuk will be redeemed at a rate of 100% of the total par value of the series. The Sukuk certificates are listed and traded on the Saudi Stock Exchange (Tadawul).

Bahrain-based Takaful Operator Solidarity Group Secures BHD58mn (USD153mn) Murabaha Facility to Acquire Bahrain National Holding

Bahrain – Solidarity Group Holding, the Manama-based Takaful operator, secured a BHD58mn (USD153mn) Murabaha financing facility from the Bank of Bahrain and Kuwait Bank (BBK) on 3 April 2025.

The proceeds from the facility will be used towards funding Solidarity’s acquisition of Bahrain National Insurance (BNI), a subsidiary of Bahrain National Holding. Early this year, the company’s unit, Solidarity Bahrain signed definitive sale and purchase agreements with Bahrain National Holding (BNH) for the acquisition of 100% of the issued share capital of BNI and Bahrain National Life Assurance, which are wholly owned by BNH. The total purchase price was pegged at BHD 75 million.

“This acquisition will reinforce our leadership position, strengthen our operational platform and enhance our ability to deliver differentiated insurance solutions to a wider customer base,” said Ashraf Bseisu, Group CEO of Solidarity Group Holding.

ACWA Power Secures SAR750mn (USD200mn) Murabaha Facility from Alinma Bank to Finance its New Sustainable Green Headquarters in Riyadh

Riyadh – ACWA Power, the world’s largest private water desalination company, leader in energy transition and first mover into green hydrogen, has secured a SAR750mn (USD199.95mn) Shariah-compliant Murabaha term loan facility from Alinma Bank, to fund the development of its new corporate headquarters in Riyadh, Sudi Arabia.

The facility has a tenor of seven years, and according to Acwa Power, which is a subsidiary of the Saudi sovereign wealth fund, the Public Investment Funfs (PIF), the sizeable financing underscores Alinma Bank’s confidence in ACWA Power’s robust financial standing and its strategic role in Saudi Arabia’s Vision 2030 and energy transition goals.

Abdulhameed Al Muhaidib, Chief Financial Officer of ACWA Power, and Jameel Alhamdan, Chief Corporate Banking Officer of Alinma Bank, signed the loan agreement in April 2025.

According to Jameel Alhamdan, Chief Corporate Banking Officer, Alinma Bank, “Alinma is proud to announce its role as the sole financier for the development of ACWA Power’s new state-of-the-art, environmentally sustainable head office. This landmark project aligns with both organizations’ commitment to driving sustainability and innovation in the corporate sector and with the Kingdom’s net zero strategy.”

Similarly, Abdulhameed Al Muhaidib, Chief Financial Officer of ACWA Power stressed that “this financing from Alinma Bank highlights our strong financial position and the confidence the market has in our vision. Our new headquarters will be more than just a building; it will be a symbol of our commitment to innovation, sustainability, and the Kingdom’s ambitious goals for a cleaner, more prosperous future.

“ACWA Power’s new headquarter in Riyadh marks our commitment as the local champion for energy transition, through a state-of-the-art facility specifically designed to unify the company’s operations and enhance collaboration and innovation among teams. It will also provide an environmentally friendly workplace that enables the employees to perform their duties within a framework that promotes sustainability, creating an attractive environment for attracting and retaining top talent.”

IsDB Upscales Climate Finance and Adaptation Commitments with New Initiatives and Calls for Transformation in How Climate Finance is Structured, Accessed, and Deployed, in Cooperation with V20 Partners

Washington DC – The Islamic Development Bank (IsDB) is stepping up its climate finance playbook by calling for a transformation in how climate finance is structured, accessed, and deployed.

Dr. Issa Faye, Director General of Global Practice and Partnership at the IsDB, speaking on behalf of Dr Muhammed Al Jasser, President of the IsDB, at the high-level V20 Ministerial Dialogue XIV held on the sidelines of the 2025 Spring Meetings of the World Bank Group and the IMF in Washington on 25 April themed “Enabling Climate Prosperity: A Global Agenda for Jobs, Security, Resilience”, stressed that the green transition presents an opportunity to unlock a new era of inclusive growth.

The Bank he emphasized is committed to advancing a global framework where climate prosperity is not a distant ambition, but a practical roadmap centred on jobs, security, and resilience. Dr Al Jasser called for climate finance that is affordable, timely, and scalable. In 2024 alone, he revealed that IsDB climate financing reached US$2bn, comprising nearly 50% of the Bank’s total approvals, with a strong focus on climate adaptation.

Additionally, the IsDB pledged US$1 billion at COP28 in support of fragile states, bringing its total cumulative climate finance since COP27 to over US$5.5bn, of which 47% has been allocated to adaptation. To further scale its impact, the IsDB, he revealed, is expanding the use of innovative financing instruments, including a dedicated concessional window, and is deepening its partnerships with thematic funds such as the Green Climate Fund and the Lives and Livelihoods Fund.

In addition, the IsDB Group has also launched Food Security Response Programme that – with US$6bn in approvals – is helping address hunger and rural poverty in member countries. The IsDB is also in the process of launching a new Response and Resilience Facility expected to benefit over 10 million people affected by disaster, fragility, and conflict.

The CVF-V20 is an intergovernmental group headquartered in Accra, Ghana, representing 70 members from small island developing states (SIDS), least developed countries (LDCs), low-and-middle-income-countries (LMICs), landlocked developing countries (LLDCs) and fragile and conflict-affected states (FCS), which form the majority of the 57 member countries of the IsDB.

The V20 Ministerial Dialogue is a primary forum for the Finance Ministers of the Climate Vulnerable Forum (V20), co-hosted by the World Bank during the 2025 Spring Meetings of the World Bank/IMF in Washington. The dialogue, which was chaired by the Prime Minister of Barbados, nd which brought together V20 members and key international partners, including G7, G20, and G24, addressed challenges like fiscal space limits, high debt, and unprepared health systems, as well as opportunities like green growth and job creation.

In their communique the participants underlined the need to move beyond crisis management toward bold opportunity creation—embedding climate resilience, adaptation, and growth guided investments at the core of member countries’ macroeconomic frameworks, budgets, policies, infrastructure, financing, and peace-building efforts.

First Mills Company Signs Long-term Murabaha Financing Facility with Saudi Awwal Bank Amounting to SAR630mn (USD167.96mn)

Jeddah – First Mills Company signed a long-term Shariah-compliant Murabaha financing facility agreement with Saudi Awwal Bank (SAB) amounting to SAR630mn (USD167.96mn) on 21 April 2025 to support the Company’s commercial and operation activities contributing to its future expansion and growth.

The facility which has a 10-year tenor, is guaranteed by promissory notes provided by the company to the value of the facility amount.

In a disclosure to Tadawul (the Saudi Exchange), the company said that the proceeds from the facility will be used “to support the Company’s growth and expansion while aligning with its strategy to optimize financing costs, enhance profitability, and drive sustainable long-term returns for shareholders, as these facilities include financing debt repayments, financing working capital requirements, bank guarantee facilities, and letters of credit (when needed).”

Islamic Development Bank Institute’s Pioneering Smart Voucher System Receives Patent from US Patent and Trademark Office

Jeddah – The United States Patent and Trademark Office (USPTO) has granted a patent for the Islamic Development Bank Institute (IsDBI’s) groundbreaking solution, the Smart Voucher System. The Patent number 12282916 was granted on 22 April 2025.

The Smart Voucher System is a blockchain-based solution designed to allow regulatory authorities to authorize selected service providers (e.g., privatized enterprises, schools, and hospitals) to provide goods or services to eligible beneficiaries. The voucher system is funded through sales tax proceeds to provide such goods and services to disadvantaged individuals, which makes the system serve as a tax-credit receipt and, subsequently, to support social impact financial instruments.

The System integrates three critical functions:

I). Financial inclusion: Enhancing access to financial tools for underserved people.

II). Tax incentives: Facilitating tax obligations and promoting compliance through the use of vouchers.

III). Resource mobilization: Securely allocating token-backed vouchers to support financial accessibility.

The innovative integration of these key functions is unique to the Smart Voucher System. The System was originally designed and developed in 2018, based on which it was granted patent number 10201908262Y by the Intellectual Property Office of Singapore (IPOS) in 2021. Both IPOS and USPTO are consistently ranked among the world’s foremost intellectual property offices.

Dr. Sami Al-Suwailem, Acting Director General of IsDBI, commented: “The issuance of this patent by the United States Patent and Trademark Office underscores the commitment of the Institute to creating pioneering fintech applications that drive inclusive social and economic development. We are working closely with our partners to capitalize on this and other patents to offer comprehensive development solutions to our Member Countries.”

Cagamas Successfully Raised a Total of RM10.74bn (USD2.5bn) in Debt Funding in Q1 2025 to Support Home Ownership and to Facilitate the Growth of Malaysia’s Proactive Secondary Mortgage Market

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, has successfully raised a total of RM10.74bn (USD2.5 bn) in funding for the first quarter of 2025, reinforcing its commitment to supporting home ownership and to facilitate the growth of Malaysia’s secondary mortgage market. This marks a significant increase compared to the RM3.1bn (USD720mn) raised in the corresponding period in 2024. The Q1 2025 issuances, according to the mortgage securitiser, were supported by robust demands from both local and international investors, showcasing continued confidence in Cagamas’ credit profile and its high-quality bonds and Sukuk.

Notably, Cagamas was the top Sukuk issuer in Q1 2025 Malaysian Sukuk market, raising RM7.73bn (USD1.8bn) in Sukuk issuance, further highlighting the company’s leadership in the Islamic finance space. The funds raised comprised a diversified mix of instruments, including Islamic and conventional debt securities, of which RM7.85bn (USD1.83bn) was derived from local currency issuances, RM1.50bn (USD350mn) equivalent from foreign currency issuances, and the remaining RM1.39 billion from other funding sources.

Kameel Abdul Halim, President/Chief Executive Officer of Cagamas, commented: “We are extremely pleased with the strong demand for our issuances in 1Q 2025. This achievement demonstrates both the resilience of Cagamas and the sustained investor confidence in our funding activities. It also underscores our ongoing role in providing liquidity to Malaysia’s mortgage market. While global market volatility has intensified following the recent U.S. tariff announcement, Cagamas remains committed to a prudent and agile funding approach, which allows us to navigate volatile conditions effectively. We will continue to monitor global developments closely while maintaining market resilience in supporting the Malaysian housing finance system.”

Cagamas is a major player in the mortgage securitisation market and issues bonds and Sukuk regularly to buy housing finance bundles from the market, thus increasing liquidity in the housing finance sector and reaffirming the Corporation’s role as a secondary mortgage corporation in providing liquidity to primary lenders of home financing and housing loans. Cagamas plays an important role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia. Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysia’s sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM413.76 billion (US$88.16 billion) worth of corporate bonds and Sukuk.

IILM Continues Short Term Sukuk Issuance Momentum with Two Auctions in April 2025 with an Aggregate Reissuance of USD1.92bn and for the First Four Months of 2025 of USD6.97bn Amid Robust Investor Demand

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Shariah-compliant liquidity management instruments, continued its short-term Sukuk issuance momentum with two auctions in April 2025 – the first one was a reissuance of USD1.02bn of short-term Sukuk on 8 April and the second one a reissuance of USD900mn of short term Sukuk on 22 April.

These transactions follow the Corporation’s first auction for 2025 in January with a reissuance of an aggregate USD1.27bn short-term Sukuk across three different tenors of one, three, and six-month respectively; and an aggregate USD1.76bn Sukuk issued in February with the same tenors. With the March reissuance of an aggregate USD1.21 billion short-term Sukuk across three different tenors of one, three, and six-months, the total volume of Sukuk issued in the first quarter of 2025 amounted to USD5.05bn.

The first April auction on 8 April 2025 saw the successful completion of the reissuance of an aggregate USD1.02bn short-term Sukuk across three different tenors of one, three, and six-months were priced competitively at:

I). 60% for USD350mn for 1-month tenor.

II). 50% for USD450mn for 3-month tenor.

III). 40% for USD220mn for 6-month tenor.

The short-term Sukuk transaction on 8 April marked the IILM’s sixth auction year-to-date, with cumulative issuances totalling USD6.07bn across 17 Sukuk series of varying tenors. The auction saw a competitive tender amongst the Primary Dealers and Investors globally, with a strong orderbook of USD2.2bn, representing an impressive average bid-to-cover ratio 216%.

Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented: “Today’s successful reissuance comes against the backdrop of a global market rout, marked by a sharp sell-off that were triggered by the latest wave of US tariff hikes and growing protectionist measures that have shaken investor confidence worldwide. The strong demand from a diverse base of global investors underscores continued confidence in the IILM’s short-term Sukuk as a safe haven, Shariah-compliant instrument for effective liquidity management during one of the most challenging periods in recent years. The IILM remain committed to supporting our investor community — particularly Islamic financial institutions — through the regular supply of high-quality securities that meet the evolving needs of the Islamic financial markets globally.

“Notably, the significant demand for IILM’s 3-month and 6-month Sukuk reflects market expectations of potential monetary easing ahead. This suggests that investors are positioning for a more accommodative global monetary policy environment, driven by central banks’ efforts to stabilise growth amid persistent uncertainty.”

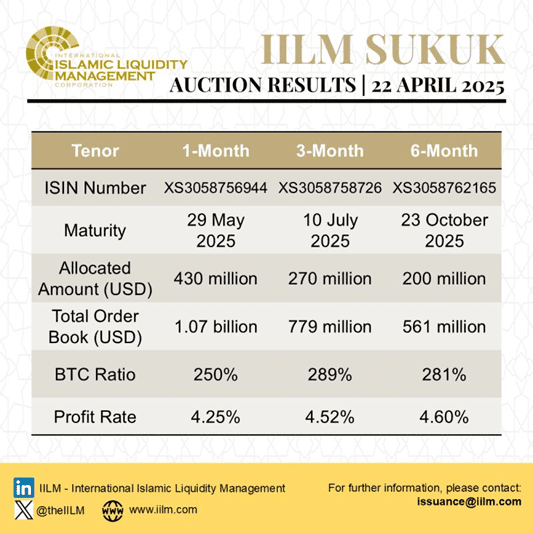

In the second transaction on 22 April 2025, the IILM also successfully completed the reissuance and issuance of an aggregate USD900mn short-term Sukuk across three different tenors of one, three, and six-month respectively.

The three series were priced competitively at:

i) 4.25% for USD430mn for 1-month tenor.

ii) 4.52% for USD270mn for 3-month tenor.

iii) 4.60% for USD200mn for 6-month tenor.

The second auction for the month of April, said the IILM, comes on the back of the IILM securing a new highly rated (Sukuk) asset worth USD510mn, bringing the total outstanding amount of IILM Sukuk in the market to an all-time high of USD5.2bn (end-December 2024: USD4.14bn; end-December 2023: USD3.51bn). This clearly reinforces IILM’s core mandate and firm status as one the most prolific and sought after issuers and providers of high-quality Islamic liquidity management solutions globally,

The successful completion of the short-term Sukuk transaction on 22 April marked the IILM’s seventh auction year-to-date, with cumulative issuances totalling USD6.97bn across 20 Sukuk series of varying tenors. The auction saw a competitive tender amongst the Primary Dealers and Investors globally, with a very healthy orderbook of USD2.41bn, representing a strong and sustained average bid-to-cover ratio of 268%.

Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented: “The IILM continues to break new grounds following yet another highly successful auction today, which included a fresh issuance of USD510bn to fund a highly rated obligor via a private placement Sukuk. As a result, our total outstanding asset has now crossed the USD5bn mark for the very first time in IILM’s history, with a total outstanding asset of USD5.2bn. The onboarding of the new high-quality, Shariah-compliant Sukuk asset into our pool marks a significant enhancement to the depth and diversification of our underlying asset portfolio. This strategic inclusion strengthens the structural integrity and credit profile of the IILM Sukuk, reinforcing its global appeal as a safe heaven, low-risk Islamic instrument.

“The strong interest and oversubscription seen in today’s issuance reflect continued investor confidence in the IILM’s short-term Sukuk programme as a reliable and trusted Islamic liquidity management tool. With USD1.92bn issued across two auctions in April alone, we are encouraged by the sustained demand for our papers across all tenors. As we continue to navigate a dynamic and uncertain global financial environment, the IILM remains committed to offering Shariah-compliant short-term instruments that meet the evolving needs of our growing investor base, while contributing to the development of robust Islamic money markets globally.

The IILM’s short-term Sukuk is distributed by a diversified and growing network of 14 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Affin Islamic Bank, Boubyan Bank, CIMB Islamic Bank Berhad, Dukhan Bank, First Abu Dhabi Bank, Golden Global Investment Bank, Kuwait Finance House, Kuwait International Bank, Maybank Islamic Berhad, Golden Global Investment Bank, Meethaq Islamic Banking from Bank Muscat, Qatar Islamic Bank, and Standard Chartered Bank.

The Corporation is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The Corporation says it will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The issuance forms part of the IILM’s “A-1” (S&P Ratings) and “F1” (Fitch Ratings) rated USD6bn short-term Sukuk issuance programme.

Looking ahead into 2025, the IILM plans to boost its asset origination activities through bespoke and attractive offerings to address the diverse needs of global sovereign and sovereign-linked Sukuk issuers, as well as rolling out alternative to Sukuk assets to allow further growth of supply and meet the growing market demand.

The IILM will also continue to expand its investor base and network of primary dealers as it looks to expand regional collaborations and enter new markets to further integrate Islamic liquidity solutions into the global financial system. The Corporation, says Mr Mohamad Safri, remains committed to developing the Islamic liquidity management infrastructure and enhancing the Sharia’a-compliant liquidity tools available to the market, working closely with scholars, regulators, and industry stakeholders to resolve inconsistencies that may hinder growth.

The IILM says it will also continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The IILM’s ongoing commitment to innovation and impact, according to the Corporation, continues to bolster the liquidity management capabilities of Islamic financial institutions. By providing highly rated tools that are increasingly traded in secondary markets, the IILM helps these institutions meet their Liquidity Coverage Ratio (LCR) requirements while offering sustainable returns.

The IILM consistently issues short-term Sukuk across 1-month, 3-month, 6-month, as well as 12-month tenors, tailored to the liquidity needs of Islamic financial institutions. Since its inaugural issuance in 2013, the IILM has successfully issued a cumulative of USD120.17bn worth of short-term Sukuk across 290 series.

The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Tȕrkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.