IsDB Board Approves US$478 mn of New Development Financing in Four Member States to Fund Sustainable Development Projects in Key Sectors such as Energy, Education, Transport, and the SMEs

Riyadh – The Islamic Development Bank (IsDB), the multilateral development bank of the 57 OIC member states, celebrating its Golden Jubilee 50th Anniversary Annual Meetings in Riyadh on 1 May 2024, signed an impressive 85 financing agreements between IsDB Group institutions and 38-member countries and 22 international financial institutions, with a total amount exceeding US$8 bn. The agreements revealed IsDB President Dr Mohammad Al Jasser include financing development operations and projects in multiple economic and social sectors.

A few days prior, Dr Al Jasser chaired the 355th meeting of the IsDB’s Board of Executive Directors, which approved US$478 mn of financing for five new projects in support of socio-economic development and promoting sustainability in key sectors such as energy, education, and transport as follows:

i) US$150 mn to Tajikistan for the construction of the Rogun Hydropower Plant Project’s Lot-4 (Left Bank Structures), to provide clean, affordable, and reliable renewable electricity to meet the country’s growing domestic demand, enhance energy security, and commercialize it through the central Asian Regional Power Market

ii) EUR60.57 mn (US$65.99 mn) to Benin for the Root and Tuber/Regional Cassava Value Chains Development Project, which aims to improve food security, economic growth, and household income through better production, processing, marketing, and private sector involvement in the cassava, sweet potato, and yam value chains.

iii) EUR70.46 mn (US$76.76 mn) to Côte d’Ivoire to finance its Root and Tuber/Regional Cassava Value Chains Development Project, similarly seeking to boost food security, economic growth, and household incomes through improved cassava production, processing, marketing, and private sector participation. It also aims to create employment opportunities, particularly for women and youth, and develop national and regional trade.

iv) EUR120 mn (US$130.73 mn) to Türkiye towards financing the Türkiye Nakkas-Basaksehir Motorway Project, a subsection of the larger North Marmara Motorway Government Initiative. The main project aims to provide an alternative Bosphorus crossing, significantly reducing traffic congestion, travel times, and greenhouse gas emissions.

v) A US$60 mn financing facility for Tunisia, of which US$50 mn will be used to fund operations of small and medium-sized enterprises (SMEs), while the remaining US$10 mn will be provided as a grant in collaboration with the United Nations Development Program (UNDP) for the same purpose.

Regular Issuer Rawabi Holdings Successfully Completes its Largest Ever Local Currency Sukuk of SAR1.2 bn (US$320 mn) in April 2024 as Demand for Such Debt Certificates Increases in Saudi Market

Al Khobar – Rawabi Holding Company returned to the Sukuk market successfully concluding its largest ever Saudi Riyal-denominated Sukuk issuance of SAR1.2 bn (US$320 mn) on 25 April 2024.

This latest issuance surpasses the Company’s 2023 issuance of SAR875 mn (US$233.33 mn), both of which were issued under the company’s SAR5 bn Trust Certificates Issuance Programme, established in 2020. To date Rawabi Holding has issued Sukuk totalling SAR6.5 bn (US$1,733.31 mn) across 18 tranches and redeemed seven tranches totalling approximately SAR2.9 bn (US$773.32 mn).

Rawabi Holdings had mandated Albilad Capital, Alinma Investment Company, Al Rajhi Capital, and Riyad Capital, to act as joint lead managers and bookrunners for the transaction.

The strong credit worthiness, growing operations and key contribution of the Group’s operations to the Saudi economy, stressed Ahmad Al-Shubbar, Chief Financial Officer at Rawabi Holding Company, attracted wide support of the investment community, which resulted in the upsizing of the transaction after the coverage exceeded 2.8x the initial issuance size.

The investor universe for this latest Sukuk transaction comprised 41% Asset Managers and Funds; 10% Bank Treasuries; 39% Wealth Management Entities; 7% Corporates and Agencies; and 3% Insurance (Takaful), Awqaf and Endowment Institutions.

According to Rawabi Holdings, the Company’s ability to diversify its funding sources, building strong long-term relationship with DCM investors, and solid ties within the banking system, successfully mitigates the risk of cyclical liquidity in the market. This is in line with the Company’s risk management policies and aligns with capital structure management best practice. “The Company’s strong credentials and positive track record of Saudi Riyal-denominated Sukuk issuances, including refinancing maturing Sukuk, distinctly highlights Rawabi Holding as the most active regular issuer in the growing Local Currency Debt Capital Markets (DCM),” it added.

KIB Issues Third US$300mn Perpetual Additional Tier 1 Capital Sukuk Mudaraba to Further Boost its Capital Structure Under the Basel III Capital Adequacy Regime

Kuwait City – Regular Sukuk issuer Kuwait International Bank (KIB) successfully completed its latest offering on 1 May 2024 – a US$300 mn Perpetual Additional Tier 1 (AT1) Capital Sukuk issuance. KIB had received approval from the Central Bank of Kuwait and the Capital Markets Authority on 8 April 2024 for the issuance of an US$300 mn Perpetual AT1 Capital Sukuk Mudaraba.

In a disclosure to Boursa Kuwait, KIB confirmed that the Sukuk certificates were issued by KIB Tier 1 Sukuk 2 Limited on behalf of the Obligor, Kuwait International Bank, which is rated ‘A’ with a Stable Outlook by Fitch Ratings. The Mudaraba Sukuk has a perpetual tenor and is non-callable for 5.5 years.

KIB had mandated Citigroup Global Markets Limited and Standard Chartered Bank to act as global coordinators to the transaction. They, together with Abu Dhabi Islamic Bank, Al Dawli Investment Company (KIB Invest – the investment banking arm of KIB), Bank of Sharjah, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, Kamco Investment Company, Mashreq Bank, and SMBC Nikko Capital Markets, acted as joint lead managers and bookrunners and were mandated to arrange a series of investor calls with accounts in the UK, EU, the MENA region, Asia and Offshore US Accounts.

According to Raed Jawad Bukhamseen, Vice Chairman and CEO of KIB, “this Sukuk transaction is clear evidence that Kuwait possesses the components required to attract international investors to enter the Kuwaiti market. We are very pleased with the outcome of this Sukuk transaction. This AT1 Sukuk has been issued as capital instrument under Basel III Capital Adequacy compliance and in line with the rules and regulations of the Central Bank of Kuwait and the Capital Markets Authority, to be made available for trading in the Secondary Market.”

The Sukuk was priced at a profit rate of 6.625% payable semi-annually in arrears. The transaction represented the first US dollar Additional Tier 1 (AT1) issuance from Kuwait since 2021 and marked KIB’s third issuance into the US dollar capital markets. Prior to this latest offering, KIB issued its maiden AT1 Sukuk in 2019 and a Tier 2 Sukuk in 2020 – both with an issuance size of US$300 mn.

Demand for the KIB Sukuk certificates was robust. The order book was oversubscribed 2.2 times, with interest from both international and regional investors, reflecting the bank’s solid market position. The strong market response enabled KIB to price the issuance at a coupon rate of 6.625% p.a., representing a significant tightening of 37.5 basis points (bps) from the Initial Price Thoughts (IPTs) of 7.00%.

The issuance, according to Mohamed Khadiri, CEO of Bank of Sharjah, one of the joint lead managers, concluded with an exceptional spread of 195bps above US Treasuries, setting a new benchmark for the tightest spread achieved for an AT1 issuance in the Central, Eastern Europe, Middle East, and Africa (CEEMEA) region, and it stands as one of the most competitive globally for AT1 issuances.

The Sukuk certificates are listed on the International Securities Market of the London Stock Exchange.

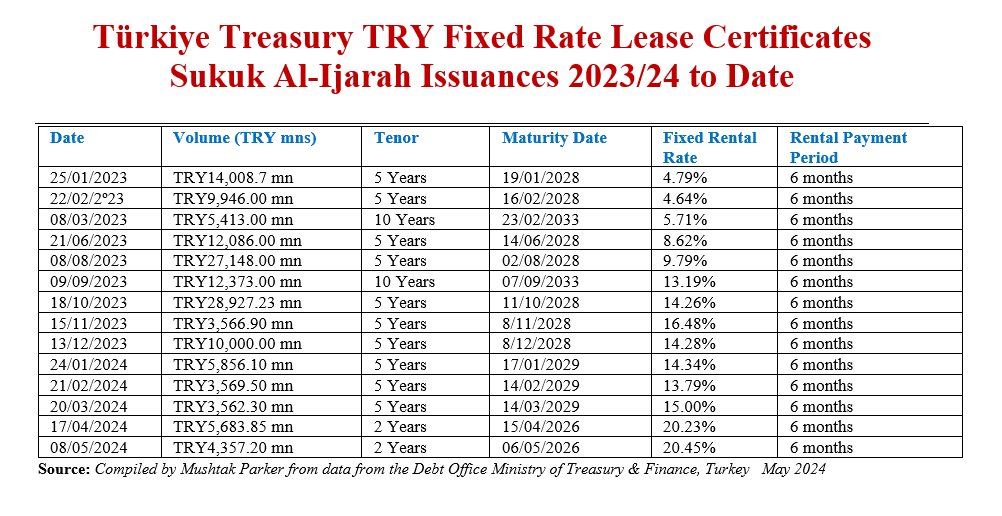

Türkiye Treasury Continues Fixed Rate Domestic Sukuk Al-Ijarah Issuance Momentum in May Raising an Aggregate TRY23,028.95mn (US$714.22mn) in the First Five Months in 2024

Ankara – Türkiye’s sovereign Sukuk issuance continued its momentum with its fifth consecutive auction of Fixed Rate Lease Certificates (Sukuk al Ijarah) on 8 May 2024 raising TRY4,357.20 mn (US$135.13 mn) conducted by the Central Bank of Turkey.

Issuance of Lease Certificates is now an established component of the Türkiye Treasury’s diversified sources of public fund-raising mix which includes regular issuance of Sukuk Al-Ijarah in the domestic market, FX-linked leasing certificates and Gold-backed leasing certificates. The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificate (Sukuk Al-Ijarah) market.

In the Fixed Rate Lease Certificates (Sukuk al Ijarah) market, the Türkiye Treasury raised TRY4,357.20 mn (US$135.13 mn) in an auction on 8 May 2024 through the issuance of 2-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 6 May 2026 priced at a fixed profit rate of 20.45% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

Thus far for the first five months of 2024, the Türkiye Treasury has raised TRY23,028.95 mn (US$714.22 mn) through five auctions of Fixed Rate Lease Certificates.

According to the Ministry, the lease certificates were issued “in order to increase domestic savings, broaden the investor base and diversify the Treasury’s borrowing instruments.” The latest Lease Certificate transaction was done through a direct sale auction in May 2024.

All the auctions were conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions is “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor.

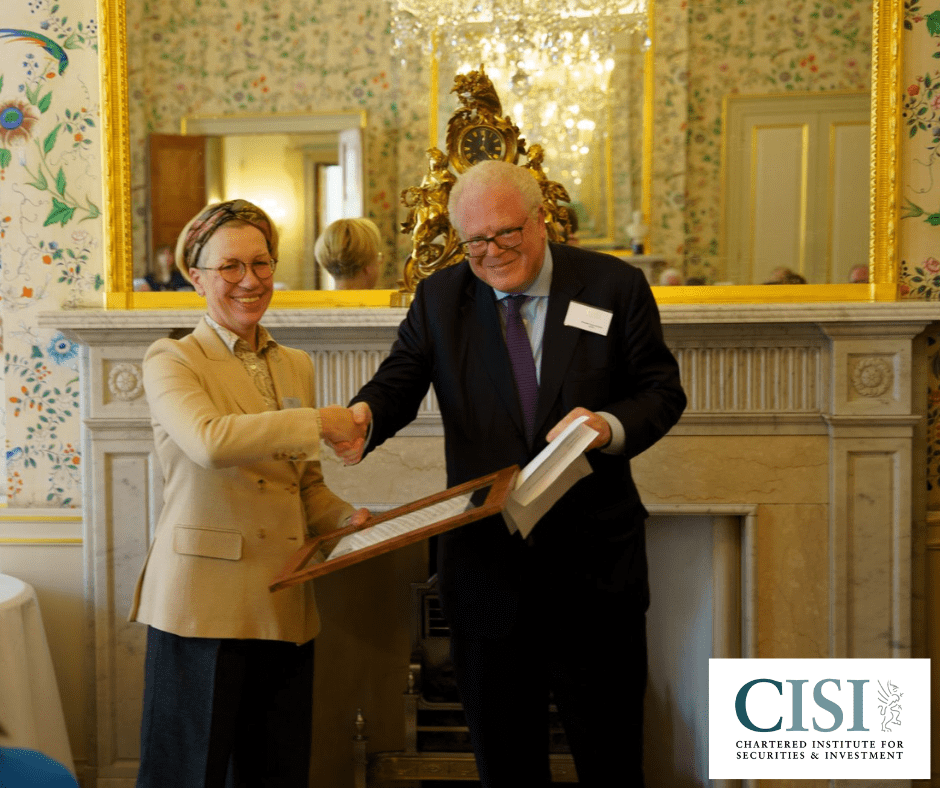

Chartered Institute for Securities and Investment (CISI) Honours DDCAP’s Stella Cox, CBE, and Norton Rose Fullbright’s Farmida Bi, CBE, with Honorary Fellowships for their Outstanding Positive Contribution to Financial Services including Islamic Finance

London – The Board of Trustees of the Chartered Institute for Securities & Investment (CISI) based in the City of London awarded Honorary Fellowships to two seasoned and experienced finance and legal professionals, Stella Cox, CBE, FCSI (Hon) and Farmida Bi, CBE, FCSI (Hon) for their “outstanding positive contribution, both to the financial services profession and to the CISI.”

The CISI Board in fact honoured a cohort of six outstanding individuals to receive the Institute’s highest accolade in 2024. Apart from Stella Cox and Farmida Bi, the other recipients honoured included Karina Robinson, the CEO of Redcliffe Advisory, which advises CEOs and Chairs; Alderman Alastair King DL, who subject to election is likely to become the 696th Lord Mayor of London in November 2024; Professor Sir John Kay CBE, one of Britain’s leading economists; and Prof Russell Napier, who has been an advisor to investment institutions on asset allocation for almost thirty years.

Both Stella Cox, Managing Director of DDCAP Group™ since 1998, and Farmida Bi, Chair (Europe, Middle East, and Asia) of global law firm Norton Rose Fulbright, have almost four decades of experience and outstanding contribution serving the global Islamic finance industry.

DDCAP Group™ under the leadership of Stella Cox has become a leading provider of capital market intermediary services and technology solutions to Islamic financial market institutions for more than 25 years. Stella was a member of the Islamic Finance Task Force convened by UK Treasury and the Bank of England and acted as practitioner lead for the regulatory work stream leading to the inaugural UK sovereign Sukuk issuance in 2014. Since then, she has been Chair of the Islamic Finance Market Advisory Group for TheCityUK. In June 2016, Stella was appointed a Commander of the Order of the British Empire (CBE) in honour of her services to the Economy and, specifically, as a Champion for the Development of Islamic Finance in the UK. In 2019, Ms Cox was appointed Patron-in-Chief of WOMANi, when she also became a Freeman of the City of London.

Stella received her Honorary Fellowship from CISI Chair, Michael Cole-Fontayn MCSI, at a ceremony at the Merchant Taylors’ Company on 29th April 2024. “The CISI Board and I are delighted to announce the six outstanding individuals who have received our highest accolade this year. We commend each of them for their contribution to the financial services sector and to CISI. All have shown a commitment to professionalism, life-long learning and the CISI community. We look forward to their continued guidance, inspiration, and leadership,” he emphasised.

Similarly, Farmida Bi, who was made a Commander of the Order of the British Empire (CBE) in the Queen’s Birthday Honours 2020 for her services to the law and charity, continues transactional work advising on multi-billion-dollar transactions (debt capital markets, securitisation, and corporate trust) in conventional/Islamic finance for sovereigns and corporates.

Ms Bi is also the Chair of the International Regulatory Strategy Group (IRSG) Council, Chair of the Barbican Centre Trust, Chair of the Patchwork Foundation and Vice Chair of the Disasters Emergency Committee, and is an Honorary Fellow of Downing College, Cambridge.

Both Stella Cox and Farmida BI are outstanding examples of the involvement and leadership of women in the Islamic finance and wider financial services, policy, and regulatory space, starting their careers well before the issue of gender empowerment and parity gained greater prominence in the financial services industry and wider corporate sector.

ICIEC Provides NHFSO Cover for Société Générale’s EUR259mn (US$281.45mn) Murabaha Facility for the Construction of and Expansion of Key Road Transport Networks in Senegal

Riyadh –The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), the multilateral credit and investment insurer of the Islamic Development Bank (IsDB) Group, issued a Non-Honouring of a Sovereign Financial Obligation (NHFSO) insurance policy to Société Générale to finance the construction of key highways in Senegal.

The NHSFO policy provides coverage for the EUR259 mn (US$281.45 mn) Murabaha financing facility extended by Société Générale for the construction of the Dakar-Tivaouane Highway and the expansion of the Cyrnos-Seven Up Road Project. These initiatives are set to dramatically enhance transportation networks within the country, promoting economic growth and regional connectivity.

The Takaful cover agreement was signed on 29 April 2024 during the IsDB Group Annual Meetings 2024 in Riyadh, Saudi Arabia. According to ICIEC, the projects will boost transportation networks within Senegal, promote economic growth and West African regional connectivity and improve the quality of life for Senegalese citizens.

In addition, the Dakar-Tivaouane and Cyrnos-Seven Up roads will reduce travel times significantly and resultant carbon emissions, facilitate trade and movement of goods, and create jobs during construction and beyond.

ICIEC CEO, Mr. Oussama Kaissi, emphasized the importance of this partnership for sustainable development in Senegal. “By mitigating risks,” he maintained, “this collaboration ensures these critical projects progress smoothly. This collaboration with Société Générale underlines our commitment to facilitating sustainable economic development through strategic partnerships. The Dakar-Tivaouane and Cyrnos-Seven Up projects are more than infrastructure development; they are vital arteries that will invigorate trade and improve the quality of life for the people of Senegal. The insurance support attests to ICIEC’s dedication to supporting member countries in their pursuit of infrastructure development that aligns with sustainable economic policies. By mitigating the risks associated with the underlying financial obligations, ICIEC and Société Générale are ensuring that these pivotal projects move forward without financial impediments.”

ICIEC remains committed to supporting its member countries through Sharia’a compliant risk mitigation tools and financial solutions through its role as a catalyst for economic resilience and transformation within the OIC countries, contributing to the prosperity and well-being of its member states through the provision of risk mitigation tools and credit enhancement financial solutions.

IFSB Council Appoints Prominent IMF Economist and Islamic Finance Policy Expert Dr Ghiath Shabsigh as the New Secretary General of the Islamic Financial Services Board (IFSB)

Kuala Lumpur – Seasoned IMF economist Dr. Ghiath Shabsigh has been appointed as the new Secretary General of the Islamic Financial Services Board (IFSB), the international standard setting organisation for the global Islamic financial services industry. Syrian-born Dr Shabsigh becomes the fourth Secretary-General of the IFSB effective 1 April 2024. He succeeds Dr. Bello Lawal Danbatta, whose tenure concluded on 28 January 2024.

Prior to this latest appointment as the Secretary General of the IFSB, Dr. Shabsigh served as Assistant Director at the International Monetary Fund (IMF)’s Monetary and Capital Markets Department where he played a pivotal role in driving IMF’s central banking and fintech initiatives.

His prominent career includes 25 years of experience in Islamic finance, where he has been instrumental in shaping international institutions, formulating policies and standards, conducting analytical work, and providing technical assistance in Islamic banking regulatory frameworks, central banking operations, and Sukuk markets for IMF member countries.

His appointment as the Secretary General of the IFSB was endorsed by the Council of the IFSB during its 43 meeting in Jeddah, Saudi Arabia last December 2023. Under the guidance of Dr. Shabsigh, said the IFSB Council, the IFSB will continue to solidify its role as a pivotal standard-setting body. It remains resolute in its dedication to strengthening the Islamic finance sector and advancing its initiatives, in line with the shifting needs and aspirations of its members.

The IFSB recently celebrated its 20-year anniversary and has a global membership base of 191 entities spanning 58 jurisdictions as December 2023. This includes the Islamic Development Bank, the Asian Development Bank, the Bank for International Settlements, the International Monetary Fund, the World Bank, and the West African Development Bank.

Uganda Consolidates Partnership with IsDB Group with US$445mn of Islamic Credit Financing Facilities to Fund Transport Projects

Riyadh – Uganda is consolidating its relationship with the IsDB Group and its Islamic finance proposition in its pursuit of a sustainable economic growth path amidst challenging global conditions and uncertainties.

At the Islamic Development Bank Group’s (IsDB) Annual Meetings, in Riyadh at end April/early May 2024, Ugandan Minister of Finance, Planning, and Economic Development, Matia Kasaija, who also serves as the IsDB Governor of Uganda, outlined the country’s strategies for prudent debt management and economic resilience.

“Our commitment to fiscal responsibility is unwavering in the current financial climate. We have instituted a multipronged strategy that includes bolstering vital infrastructure to enhance trade and connectivity – expanding our road network and advancing railway development. We are mindful of the pivotal role our natural resources, like our newly discovered oil, play in the economy. It is imperative that we leverage these assets responsibly,” he explained.

Minister Matia Kasaija, also stressed that the government is creating an ecosystem that supports industrial expansion and job creation, recognizing the urgency of integrating youth into the workforce.

During the Annual Meetings proceedings, the Ugandan Minister also signed a concessional Islamic credit financing facility totalling US$295 mn to fund the construction of a bridge crossing the River Nile in northwest Uganda and roads totalling 105 kilometres. The move underscores Uganda’s efforts to diversify its sources of external funding, as talks with the World Bank to resume lending have stalled because of Western opposition to the introduction of socio-cultural laws.

In fact, during the Annual Meetings, the Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the IsDB Group, approved an aggregate US$150 mn for two lines of finance facilities with Uganda Development Bank Limited (UDBL) and the African Export–Import Bank (Afreximbank), aimed at fostering economic growth and development in Uganda and across common member countries of ICD and Afreximbank.

The first line of financing is a US$40 mn Sharia’a compliant facility to UDBL for the purpose of onward financing and support to private sector enterprises, including Small and Medium Enterprises (SMEs), in Uganda. In the second line of financing, ICD has approved a US$100 mn facility for Afreximbank, which will be used under its second strategic pillar, (facilitation of Industrialization and Export Development), for onward financing of eligible private sector projects in the common member countries of ICD and Afreximbank.

On 3 April 2024, Ugandan President Yoweri Museveni officially launched the East African country’s first Islamic commercial bank, Salam Bank in the presence of Mahmoud Ali Youssouf, Minister of Foreign Affairs and International Cooperation of Djibouti, and Ibrahim Abdirahman the Chairman of the Board of Directors of Salaam Bank.

Salam Bank is the Ugandan subsidiary of Salaam African Bank of Djibouti, through Top Finance Bank which it acquired in August 2023. Salam Bank’s launch in Uganda followed the Group’s expansion in Asia, particularly in Malaysia as well as in Ethiopia and Kenya. The issuance of the Islamic Banking license in Uganda follows the signing of the Financial Institutions (Amendment) Act 2023 last month by President Yoweri Museveni, which paved the way for the introduction of Islamic banking in Uganda.

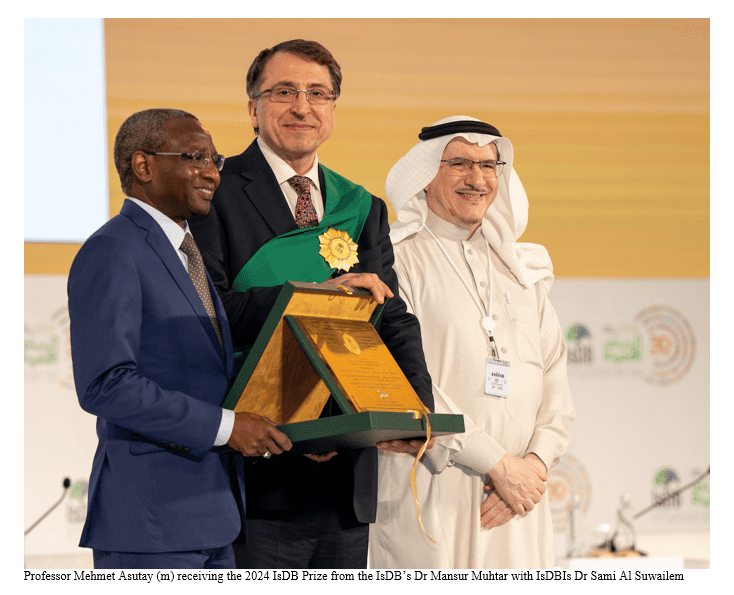

UK’s Durham University Professor Dr Mehmet Asutay Wins 2024 IsDB Prize for Impactful Achievement in Islamic Economics

Riyadh – The UK-based Dr Mehmet Asutay, Professor of Middle Eastern and Islamic Political Economy & Finance at Durham University, has won the 2024 Islamic Development Bank (IsDB) Prize for Impactful Achievement in Islamic Economics. for his significant and influential contributions to the field of Islamic economics and finance.

Professor Asutay received the honour from the IsDB Vice President (Operations), Dr. Mansur Muhtar, on behalf of IsDB Chairman, Dr. Muhammad Al Jasser, at an awards ceremony during the IsDB Golden Jubilee Annual Meetings held in Riyadh on 28 April 2024. In its citation, the Selection Committee stressed that Prof. Asutay was awarded the prize “in recognition of his significant work on the Islamic moral economy and the articulation of Islamic finance to be supportive of sustainable development and the welfare of human beings.”

The winner was selected by an independent committee of experts from outside the IsDB Group, whose work is coordinated by the Islamic Development Bank Institute (IsDBI).

According to the IsDB, this year’s prize cycle aimed to recognise, reward, and encourage significant knowledge contributions in Islamic economics with the potential to solve major development challenges of IsDB member states.

In the full citation the prize selection committee stressed that:

- Professor Mehmet Asutay’s knowledge contributions emphasize reconstituting Islamic economics in the form of an Islamic moral economy by essentializing an extended stakeholder-based governance system to ensure the moral grounds of the economic system.

- An overall theme of the multidisciplinary research of Prof. Asutay relates to the articulation of Islamic finance to be supportive of sustainable development and the well-being of human beings. His empirical research resonates with and articulates the conceptual and theoretical reconstruction he attempts in his research.

- The original contributions of Prof. Asutay have tangible policy implications with practical applications in Member Countries and Muslim communities worldwide.

In his acceptance speech, Dr Asutay said: “I am grateful to the Selection Committee for this prestigious prize and the recognition of my work in Islamic Moral Political Economy and the impact it has so far created.”

IILM Successfully Closes its Fifth Auction of 2024 with a US$1.03bn Three Tranche Re/issuance of Short-Term A-1 Rated Sukuk in May

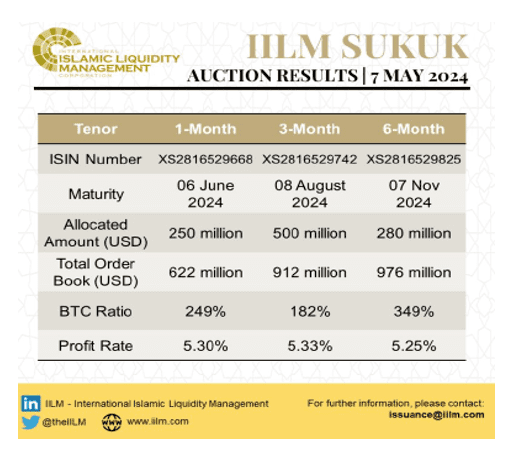

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Sharia’a-compliant financial instruments, successfully reissued its fifth transaction with a total of US$1.03 billion of short-term Ṣukuk across three different tenors of one, three, and six-months respectively on 7 May 2024, as follows:

The IILM’s US$1.03 bn Sukuk reissuance witnessed a competitive tender among Primary Dealers and investors from markets across the GCC region as well as Asia, with a combined orderbook more than US$2.51 bn.

Mr. Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented: “With global investors continuously searching for high quality Sharia’a-compliant liquidity solutions, we are pleased with today’s successful conclusion of the IILM’s fifth auction for the year. Despite the changing expectations surrounding the Federal Reserves’ decision on interest rates, we witnessed a healthy average bid-to-cover ratio of 244% across all three tenors, reflecting a booming demand for the IILM’s short-term Islamic papers.”

Further to today’s reissuance, the IILM has achieved year-to-date cumulative issuances totalling US$4.64 bn through 15 Sukuk series. The Sukuk offering was completed under the IILM’s “A-1” (S&P) and “F1” (Fitch Ratings) rated US$4 bn short-term Sukuk Issuance Programme.

The IILM is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The total amount of IILM Sukuk outstanding is now US$3.51 bn. The IILM, added Mr Moihammed Safri, will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

The IILM’s short-term Sukuk is distributed by a diversified network of 10 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, and Standard Chartered Bank.

The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Turkey, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.

IsDB Partners with the Bill & Melinda Gates Foundation, ADFD and KSrelief to Approve US$219m in Additional Donor Funding to the Lives and Livelihoods Fund 2.0 for Projects in 22 Member States

Riyadh – The Islamic Development Bank (IsDB) has joined three of its global development partners in approving US$219 million in additional donor funding support for 37 projects in 22 IsDB member states through the Lives and Livelihoods Fund 2.0 (LLF 2.0).

The Lives and Livelihoods Fund is a US$ 2.5 bn development initiative launched in 2016 and funded by an unprecedented global coalition including the ADFD, the BMGF, the IsDB, the Islamic Solidarity Fund for Development (ISFD), KSrelief, and the Qatar Fund for Development (QFFD). As the largest development initiative in the Middle East, its goal is to lift the poorest out of poverty across 33 IsDB member states by addressing nine Sustainable Development Goals (SDGs) through projects in health, agriculture, and basic infrastructure.

The financing agreement for the donor funding support was signed during the IsDB Annual General Meetings in Riyadh which included Dr Muhammad Al Jasser, IsDB Chairman, Mohammed Saif Al Suwaidi, Director General of the Abu Dhabi Fund for Development (ADFD), Bill Gates, Co-Chair of the Bill & Melinda Gates Foundation (BMGF), and Dr Abdullah Al Rabeah, Supervisor General of the King Salman Humanitarian Aid & Relief Centre (KSrelief).

Addressing the signing ceremony, Dr Al Jasser emphasised: “We stand at a pivotal moment as we gather to pledge robust support for the Lives and Livelihoods Fund 2.0. Since its launch in May last year, our focus has been on securing the necessary resources for this next phase of the Fund. We are ready to commit a total of US$219 million in grant funds, complemented by up to US$325 million in concessional loans from the IsDB.”

The UAE through the ADFD has already committed US$50 mn to the additional LLF 2.0. According to Mr. Al Suwaidi the UAE’s commitment to LLF 2.0 “will be instrumental in addressing some of the most pressing issues faced by the developing world and ensuring that vulnerable communities are not left behind. By focusing on key sectors such as smallholder agriculture, food security, women’s empowerment, and essential services like water, sanitation, and healthcare, we can build a more resilient and sustainable future for all.”

Similarly, the IsDB-administered LLF 2.0 received a major boost in Riyadh when KSrelief approved a new funding of US$100 mn. This fresh replenishment by KSrelief, according to Dr Abdullah Al Rabeah, aims to build upon its initial contributions of US$100 mn to LLF as a demonstration of its commitment to improving lives in low-income countries.

Similarly, Bill Gates, co-chair of the BMGF, reminded: “Eight years ago, our foundation was proud to partner with the Islamic Development Bank and the countries who jointly built the Fund – Saudi Arabia, the United Arab Emirates, and Qatar. Our goal was to build a new multilateral financing mechanism—something that could fund efforts to improve everything from agriculture, to healthcare, to better sanitation across more than 30 member countries of the Bank. It’s great to see the Lives and Livelihoods Fund succeed in those efforts.”

Last year, the IsDB through the Islamic Solidarity Fund pledged US$50 mn and the Bill & Melinda Gates Foundation a 20% match of total funding up to US$150 mn to LLF. In the joint communique, all partners agreed that the dire impacts of climate, conflicts, and economic instability in some of the IsDB’s poorest member countries are mounting every day, having a regional and global spill over effect. This necessitates for a cohesive and coordinated donor response for the member countries and their people.

“With US$ 1.5 bn already invested in 22 member states,” stressed Dr Al Jasser, “the renewed pledges are a visible demonstration of the commitment to international cooperation that underpins the collective mission of the LLF 2.0 partners to provide financial assistance needed for inclusive human capital development in target countries. While a major tranche of LLF 2.0 grants will be directly disbursed to country projects, key investments in technical assistance and implementation support are envisioned to maximize countries’ value for money.”

The cumulative impact of the LLF 2.0 investments is already being observed as some the first generation of projects are either coming to an end or have been completed in critical development sectors. These include:

- The financing of 15 health projects that strengthen primary healthcare systems, combat infectious diseases, and support routine immunization. The Fund’s healthcare funding contribution has amounted to US$681 million. This has resulted in 43 million children in Pakistan getting vaccinated against the deadly Polio virus. Additionally, 38 million malaria cases are being treated through the provision of insecticide-treated bed-nets for 2 million people in Senegal.

- The financing of 17 agriculture projects across 13 countries, improving 719,000 hectares of arable land through on and off-farm infrastructure development. The LFF 2.0 also introduced climate-smart agricultural practices and methodologies and provision of improved seed varieties and essential farm inputs to 65,000 farmers in Morocco, Nigeria, Uganda, Cameroon, and Indonesia, etc.

- The collaborative efforts forged by the Fund aim to empower and ensure a safety net for vulnerable groups, especially women entrepreneurs, to overcome poverty through strategic social investments.

LLF 2.0 will employ a blended finance approach in recognition of the fact that grant funding alone isn’t sufficient to meet the US$2.4 trillion SDG financing gap. Hence, this approach, say the LLF partners, multiplies available concessional financing. The second phase of LLF will continue to promote equitable expansion of the fund investments and assist lower income and lower-middle income countries to optimize their existing financial, human, and other resources for high-impact sectors. This is expected to mobilize additional in-country resources along the way and create more co-financing opportunities.