Publication of Saudi Arabia’s Ambitious Green Finance Framework Raises Prospects of Significant Increase in Islamic Green and ESG Sukuk and Murabaha Syndications

Riyadh – The Saudi Ministry of Finance published the Kingdom’s Green Financing Framework (GFF) at end March 2024 under one of the Financial Sector Development Programme initiatives “to support the Kingdom’s ambitions towards sustainability, reach net zero emissions through the Circular Carbon Economy approach, and to further display the Kingdom’s efforts towards sustainability to investors and market participants.”

The framework is a major step to achieve the Saudi Vision 2030 goals, which focuses on a more sustainable future, starting from policies and investment development to planning and building infrastructures. The GFF is established in line with the Kingdom’s announcement in October 2021 to achieve net zero emissions by 2060 through the Circular Carbon Economy approach, and to fulfil the pledge to reduce its Greenhouse gas (GHG) emissions by 278 mn tons per year by 2030 in line with the Paris Agreement, in accordance with the Green Bonds Principles (GBP) of the International Capital Market Association (ICMA).

The GFF is a comprehensive but catchall Roadmap of Saudi Arabia’s pathway to a Sustainable Future, encompassing inter alia Climate Mitigation Measures, Climate Adaptation Measures, the various components of the GFF including Use of Proceeds, Project Evaluation and Selection Process, Management of Proceeds, Reporting, External Review, and Independent Third-Party Opinions.

The document is explicit: “The Kingdom will require large amounts of investment, stemming from both the public and private sectors to finance climate commitments. The National Debt Management Centre (NDMC), in line with its mandate of securing financing for the government, is responsible for communicating on these investments to fixed income investors through this Green Financing Framework.”

The Framework could be a major step in demonstrating leadership in sustainable finance within the region, and with this, the Kingdom aims to encourage more public and private initiatives towards climate and environmental finance.

Given the scale of Saudi Arabia’s Sustainability ambitions and the Kingdom’s pre-eminence in issuing domestic sovereign Sukuk, a major involvement of Green and ESG financing including debt instruments such as Sukuk, bonds, Murabaha syndications, equity investments are almost certain. “The Kingdom of Saudi Arabia has established its Green Financing Framework in accordance with the Green Bond Principles (GBP) 2021 (with June 2022 Appendix 1), as published by ICMA. Under this Framework, the Kingdom will be able to issue Green Bonds/Sukuk,” says the GFF document.

The GFF has been welcomed by various sectors within the Saudi and GCC economies. According to Bashar Al Natoor, Global Head of Islamic Finance at Fitch Ratings, the publication of the Kingdom’s Green Financing Framework is an important step that could facilitate the country’s ongoing efforts in sustainable finance and could foster confidence among investors and stakeholders in the environmental integrity of green financing through this framework. This also follows other steps demonstrating Saudi Arabia’s efforts to advance transparency and governance in the environmental sector, such as the introduction of entities like the National Centre for Environmental Compliance and the National Centre for Waste Management. These steps are critical in bolstering the credibility of the Green Financing Framework.

“Within the context of Islamic finance,” stressed Bashar Al Natoor, “the integration of Sukuk within its Green Financing Framework is particularly noteworthy. The use of Sukuk to fund eligible green projects add an important dimension to sustainable finance, catering to investors seeking Sharia’a-compliant instruments that also support environmental objectives. The adherence to principles of Islamic finance coupled with a green mandate provides a compelling proposition for a diverse investor base. Sukuk, and Islamic finance in general, is expected to play a key role on the funding side, as the Kingdom will require large amounts of investment, stemming from both the public and private sectors, to finance climate commitments.’’

According to Fitch, outstanding ESG Sukuk grew significantly in 2023, reaching US$36.1 bn globally at year-end (all currencies). The rating agency expects the ESG Sukuk market to cross 7.5% of global outstanding sukuk in the coming years (end-2023: 4.3%), with growth likely to be supported by issuers’ funding diversification plans, to satisfy international ESG investors’ mandates, and by government sustainability initiatives.’

IsDB President Dr Muhammad Al Jasser Puts the Case for Islamic Green and Sustainable Finance, including Sukuk, to the World Bank’s Influential Development Committee at the World Bank/IMF Spring Annual Meetings in Washington DC

Washington DC – IsDB President Dr Mohammad Al Jasser, addressed the prestigious Development Committee Meeting of the World Bank Group (WBG) at the WBG/IMF Spring Annual Meetings in Washington DC on 19 April 2024. It is a sign of the growing stature and maturity of the IsDB in the mainstream global development finance community and the increasing engagement with the global Islamic finance industry.

“At IsDB Group,” he informed the influential Committee, “we continue to implement our Realigned Strategy adopted in June 2022, which is built around two key pillars supported by Islamic finance modalities: the first one on green, resilient, and sustainable infrastructure, and the other on inclusive human capital development.

“Alongside the rolling-out of the realigned strategy, the IsDB introduced a General Capital Increase of US$5.5 bn which was fully subscribed to by our Member States. This capital increase is part of our efforts to enhance our financing capacity while preserving the financial sustainability of the institution. We aim to reinforce our resource mobilization initiatives to scale up our financing, encompassing both concessional and non-concessional channels. In this regard, strengthening our partnerships with other MDBs and catalyzing private finance will provide critical leverage.”

Dr Al Jasser outlined the challenges faced by developing countries stressing that in the aftermath of the pandemic crisis, the escalation of geopolitical tensions and conflicts has exacerbated supply chain disruptions and volatility in commodity markets.

For economies highly dependent on trade in primary products, which is the case of most of the IsDB member countries, this increased volatility has had serious implications for their macroeconomic stability.

High inflation, especially high food prices, disproportionately affects the poor and has become a major driver of social unrest in many instances. The abrupt shift towards monetary tightening as a means for taming inflation, especially in Advanced Economies, has triggered capital outflows, currency depreciation, and increased the cost of servicing external debt for many emerging markets and developing economies. For lower-income countries, the fiscal space has further tightened inhibiting governments’ capacity to allocate subsidies and increase social transfers.

For the 15 low-income IsDB member countries, he reminded, the average public debt soared from 47 percent of GDP in 2014 to 93% in 2020, mainly due to the impact of the pandemic. It is expected to remain around 80% in the near term, which corresponds to a crisis level for most of these countries already in debt distress or at a high risk thereof.

Dr Al Jasser also stressed the importance of addressing climate change. “At the IsDB,” he explained, “we emphasize the critical importance of forging a just transition path, recognizing the specific conditions and priorities of countries at different stages of economic and social development.

“It is in this principle that IsDB’s Just Transition Conceptual Framework and Action Plan 2023-2025 underscores our resolve to rally further support for global climate action. This blueprint is tailored to the unique contexts of our member countries, whether they are grappling with fragility, conflict, economic hurdles, or climate vulnerabilities.”

However, these ambitions can best be achieved through collaboration and partnerships. In this respect a Group of Ten Multilateral Development Banks (MDBs) including the IsDB and the World Bank, launched The Global Collaborative Co-Financing Platform on 19 April 2024 in Washington DC during the Spring Meetings comprising the Digital Co-Financing Portal hosted by the World Bank, which will create a secure platform for registered co-financiers to share project pipelines and information; and the Co-Financing Forum which will provide a space for participants to discuss co-financing opportunities, best practices, and common issues, and will support ongoing efforts to coordinate policies to reduce the burden on partner countries.

IsDB is unique in that it is the only MDB operating under Sharia’a financing, investment, and intermediation principles, and that it has common Member States with all the remaining MDB cohorts participating in the Platform.

ICISA and AMAN UNION Sign Landmark Joint Strategic Collaboration in April 2024 to Enhance Credit and Investment Insurance Cooperation in Member States Common to Both

Schipol – Export Credit and political risk insurance (PRI) in the Member States of the Organization of Islamic Cooperation (OIC) stand to receive a major boost following the signing of a potentially game-changing Joint Strategic Collaboration in April 2024 between the International Credit Insurance & Surety Association (ICISA) and the AMAN UNION, the forum comprising Commercial and Non-commercial Risks Insurers and Reinsurers in OIC states and of the Arab Investment and Export Credit Guarantee Corporation (DHAMAN), aimed at enhancing the culture and business of trade and investment insurance in Member States common to both of them.

The MoU, which symbolizes a pivotal step towards industry synergy and international cooperation, was signed by Mr. Richard Wulff, Executive Director of ICISA, and Mr. Oussama Kaissi, the Secretary-General of AMAN UNION and CEO of ICIEC, the multilateral insurer of the IsDB Group, at ICISA headquarters in Schipol, The Netherlands on 14 April. It also heralds a new era of collaborative endeavours aimed at fortifying trade and investment insurance frameworks globally.

ICISA, as a leading trade association representing trade credit insurance and surety companies internationally, serves as a platform for collaboration and the development of best practices. The AMAN UNION is dedicated to promoting and developing the commercial and non-commercial risks insurance industry in OIC-Member States, as well as strengthening mutual relationships among its members.

The collaboration between ICISA and AMAN UNION underscores a shared commitment to advancing the trade and investment insurance landscape, particularly within OIC Member States. By sharing their respective expertise and networks, the parties aim to facilitate enhanced knowledge exchanges and initiatives that contribute to the sustainable development of OIC Member States.

Key highlights of the Joint Strategic Collaboration include:

- Facilitating knowledge exchanges on trade and investment insurance initiatives

- Enhancing collaboration and development of best practices in the industry

- Strengthening mutual relationships among members of both associations

According to Mr. Richard Wulff, Executive Director of ICISA, “through this strategic alliance, we are assured to unlock unprecedented opportunities and drive innovation within our respective spheres. The signing of this MoU signifies a transformative leap towards harmonizing our efforts and maximizing the potential for sustainable growth and prosperity on a global scale.”

Similarly, Mr. Oussama Kaissi, the Secretary-General of Aman Union and CEO of ICIEC, sees the partnership as signifying “our collective dedication to enhancing the capabilities and opportunities within the trade and investment insurance sector. By pooling our resources and expertise, we can drive positive change and sustainable growth for our member countries.”

Both ICISA and AMAN UNION recognize the significant potential for cooperation to drive positive outcomes in the trade and investment insurance sector. Through this collaboration, the parties reaffirm their dedication to fostering innovation, resilience, and sustainable development within OIC Member States and beyond.

The fact that the General Secretariat of the AMAN UNION is based at ICIEC headquarters in Jeddah, Saudi Arabia, underscores the commitment of ICIEC and Mr Kaissi over the last few years in enhancing and realizing that potential. The export credit and investment insurance industry have a sizable impact on the real economy.

The industry has demonstrated great resilience and adaptability throughout the Covid-19 pandemic. In the post-pandemic recovery, the industry must continue to innovate, to support exporters and investors in Member States in an evolving environment for risk and uncertainties.

ICIEC, which marks its 30th Anniversary this year, has cumulatively insured business to date surpassing US$108.3 bn since it started operations in 1995, comprising US$86.2 bn in export credit insurance and US$22.1 bn in investment insurance. ICIEC has also underwritten policies since inception totalling US$51 bn in support of intra-OIC trade and business at end FY2023, and cumulative business insured by SDG Impact since inception of US$77.8 bn.

Türkiye Treasury Continues Fixed Rate Domestic, FX-denominated and Gold-linked Sukuk Al-Ijarah Issuance Momentum Through Several Auctions in March/April 2024 Raising an Aggregate TYR9.246bn (US$284.37m)

Ankara – Türkiye’s sovereign Sukuk issuance continued its momentum in March and April 2024 with several auctions as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic, international, and Gold-linked markets on the back of improving macro-economic fundamentals, with inflation on a downward trajectory from the 65% recorded in January 2024.

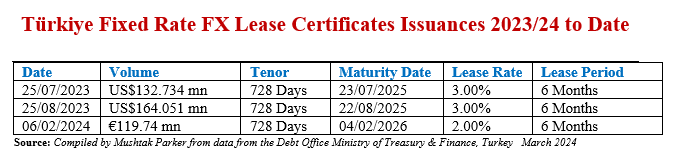

Not surprisingly, for manifold reasons, public debt issuance including domestic Sukuk Al Ijarah, FX-linked leasing certificates and Gold-linked leasing certificates have settled down into a regular pattern as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond markets. The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificate (Sukuk Al-Ijarah) market.

On 18 March 2024 the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 728 days maturing on 18 March 2026 priced at a Lease Rate of 1.00% payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 9,677,370 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 9,677,370 gold lease certificates (at a nominal value). The amount of Gold Lease Certificates issued, according to the Treasury, is taken as 1,000 for 1 gram collected gold from the issuances to individual investors and 1 for 1 gram collected gold from the issuances to institutional investors.

This transaction was followed by a similar one on 15 April 2024 when the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 728 days maturing on 15 April 2026 priced at a Lease Rate of 0.85% payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 10,740,030 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 10,740,030 gold lease certificates (at a nominal value).

The amount of Gold Lease Certificates issued, according to the Treasury, is taken as 1,000 for 1 gram collected gold from the issuances to individual investors and 1 for 1 gram collected gold from the issuances to institutional investors.

These two transactions follow the one on 21 February 2024 when the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 728 days maturing on 18 February 2026 priced at a Lease Rate of 1.00% payable over the 6 Month lease period.

The amount of gold collected, according to the Treasury, amounted to 24,316,805 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 24,316,805 gold lease certificates (at a nominal value). The amount of Gold Lease Certificates issued, according to the Treasury, is taken as 1,000 for 1 gram collected gold from the issuances to individual investors and 1 for 1 gram collected gold from the issuances to institutional investors.

The direct sale auction of its latest Gold-backed Lease Certificates (Sukuk Ijarah) offering was conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

The Treasury also had a transaction in the FX-linked issuance market on 7 February 2024 when the Treasury raised €119.74 mn through a Fixed Rent Rate Lease Certificate (Sukuk Al Ijarah) issuance with a tenor of 728 days priced at a fixed rental rate of 2.00%over 6 months and maturing on 4 February 2026. Demand for the certificates was robust.

The issuance was part of a hybrid fixed rate Eurobond and Euro-denominated Sukuk Al Ijarah transaction. The Euro Denominated Fixed Coupon Rate Government Bond tranche raised €779.443 mn for the Treasury. The total demand for these issuances matched the aggregate allocated amount of €899.183 mn.

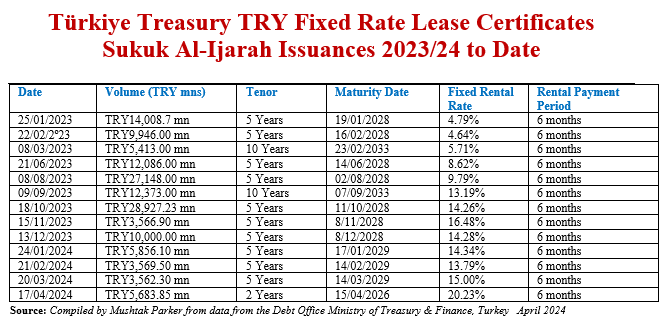

In the Fixed Rate Lease Certificates (Sukuk al Ijarah) market, the Türkiye Treasury raised of TRY3,562.30 mn (US$109.56 mn) in an auction on 20 March 2024 through the issuance of 5-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 14 March 2029 priced at a fixed profit rate of 15.00% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

This was followed by another transaction of TRY5,683.85 mn (US$174.81 mn) in an auction on 17 April 2024 through the issuance of 2-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 15 April 2029 priced at a fixed profit rate of 20.23% over a 6-month rental period. The total bids for this issuance matched the allocated amount. The Türkiye Treasury in fact raised TRY120,994.22 mn (US$4,174.22 mn) from the domestic market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah) in nine auctions in FY2023. This issuance calendar for 2024, and the first two issuances in January and February 2024, suggest that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy.

According to the Ministry, the lease certificates were issued “in order to increase domestic savings, broaden the investor base and diversify the Treasury’s borrowing instruments.” The latest Lease Certificate transactions were done through a direct sale auction in March and April 2024 respectively. All the auctions were conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions is “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor. The Ministry of Treasury & Finance issues these gold-backed lease certificates “to diversify borrowing instruments, broaden the investor base and bring the idle gold into the economy.”

According to Turkish Treasury “citizens are provided with a safe investment tool for gold savings. With the gold bond and gold-denominated lease certificate issuance through five banks, our citizens will win themselves and contribute to the economy.” Investors will be paid TL-denominated returns on a semi-annual basis indexed to the gold price. On maturity, according to the Treasury, investors may request the principal payment as 1 kilogram of gold bar (produced by refineries) or Republic Gold Quarter Coins printed by the Turkish State Mint.

President Yoweri Museveni Inaugurates Salam Bank, Uganda’s First and Africa’s Latest Islamic Commercial Bank in April 2024

Kampala – Ugandan President Yoweri Museveni officially launched the East African country’s first Islamic commercial bank, Salam Bank on 3 April 2024 in the presence of Mahmoud Ali Youssouf, Minister of Foreign Affairs and International Cooperation of Djibouti, and Ibrahim Abdirahman the Chairman of the Board of Directors of Salaam Bank.

Salam Bank is the Ugandan subsidiary of Salaam African Bank of Djibouti, through Top Finance Bank which it acquired in August 2023. Salam Bank’s launch in Uganda followed the Group’s expansion in Asia, particularly in Malaysia as well as in Ethiopia and Kenya. The issuance of the Islamic Banking license in Uganda follows the signing of the Financial Institutions (Amendment) Act 2023 last month by President Yoweri Museveni, which paved the way for the introduction of Islamic banking in Uganda.

Salam Bank Uganda Ltd became the first commercial bank to acquire a license to offer Islamic banking services in Uganda when the Deputy Governor of the Bank of Uganda (the central bank), Mr. Michael Atingi-Ego issued the first Islamic banking licence to Salam Bank Limited in September 2023.

Salam Bank Limited applied in 2022 to acquire Top Finance Bank and to offer Islamic Banking Services. While the Bank’s acquisition of Top Finance Bank was granted, the commencement of Islamic banking services was stayed pending an amendment to the Islamic Banking Regulatory Framework in the Financial Institutions Act 2004 and related tax laws, which was completed in August 2023.

“The introduction of Islamic banking,” said Deputy Governor, Micheal Atingi-Ego, “marks a pivotal moment in Uganda’s financial landscape, unlocking fresh investment opportunities for Foreign Direct Investments (FDI) into this segment of the financial sector, and funding avenues for businesses and individuals through new products, thereby fostering financial sector development. We are committed to providing oversight and support to Salam Bank Limited as it embarks on this new journey. Islamic banking has the potential to make a significant contribution to the development of Uganda’s financial sector.”

The licenses in Uganda will now allow Ugandan nationals to enjoy 100 per cent Islamic financial products, allowing the introduction of quality products and services to the Ugandan banking market, said Salam Bank in a statement.

IsDB Board Approves US$225m of Financing for the Integrated Road Infrastructure Project in Abia State in Nigeria and the Pengerang Energy Complex Project in Malaysia under the Bank’s PPP Program

Jeddah – The Board of Executive Directors of the Islamic Development Bank (IsDB) approved US$225 mn of financing at its 354th meeting held in Jeddah in March 2024 to fund two new development projects – one in Nigeria and the other in Malaysia.

The Board, chaired by IsDB President and Group Chairman, Dr. Muhammad Al Jasser, approved a US$125 mn financing package to contribute to the Abia State Integrated Infrastructure Development Project. The project aims to reduce travel times and costs along key roads, while also improving access to markets and social services for local communities. Additionally, the project is also aimed at enhancing overall mobility by ensuring safe and accessible transportation for all residents, including vulnerable groups. The Board also approved a US$100 mn contribution to financing the Pengerang Energy Complex Project (PEC) in Malaysia under the Bank’s Public Private Partnership (PPP) programme. The project, says the IsDB, aims to develop a sustainable, energy-efficient, state-of-the-art aromatics complex in Pengerang, thereby adding value to Malaysia’s downstream oil and gas chain and promoting economic growth.

The project is located in the Pengerang Integrated Petrochemical Complex (PIPC), a petrochemical and refinery hub in Johor, Malaysia and will contribute directly to Johor’s economic growth by stimulating economic growth through development and employment opportunities. Johor is one of the three states that have a designated petrochemical zone.

Saudi Arabia’s Al Rajhi Bank and Alinma Bank Co-arrange Massive SAR6bn (US$1.6bn) Murabaha Syndication for Clock Towers Com-panies, the Largest Hotel and Hospitality Complex in the World Located in the Muslim Holy City of Makkah

Makkah – In one of the single largest big ticket Saudi Riyal-denominated Murabaha Syndications in the market to date, Al Rajhi Bank and Alinma Bank of Saudi Arabia – two of the largest Islamic banks in the world in terms of assets under management, led the completion of “a monumental” SAR6 bn (US$1.6 bn) Syndicated Murabaha Financing Agreement with the Clock Towers Companies.

Steps away from Islam’s most sacred site – the Masjid Al Haram in Makkah, the Clock Towers are the largest hotel complex in the world accommodating more than 4 mn guests per year. The towers consist of 7 skyscraper hotels with a room view of the Kaaba and provide high-end hospitality services to all visitors fulfilling their pilgrimage journey. “This significant financial partnership underscores the bank’s role as both the facilities and guarantee agent, marking a historic milestone in the financial landscape of Makkah’s hospitality and retail sectors for the first quarter of 2024,” said Al Rajhi Bank in a statement. The Bank acted in its capacity as the Investment and Security Agent for the Syndicated Facilities.

“This strategic financing initiative, amounting to SAR 6 bn, aims to refinance existing debts, boost working capital, and support expansive development projects. It reflects the robust operational success of the Clock Towers Companies and signals a deep-seated confidence in the future growth of Makkah’s hospitality and retail markets. This optimism is in harmony with the Kingdom of Saudi Arabia’s Vision 2030 goals, which include welcoming 6 mn pilgrims and 30 mn Umrah participants by 2030,” added Al Rajhi Bank.

The Clock Towers Companies, a consortium of elite hospitality and retail entities in Makkah, is poised to leverage this financing to enhance several key properties. Among these are the iconic Makkah Clock Royal Tower, Fairmont Hotel, Raffles Makkah Palace, Makkah Swissotel, Swissotel Al Maqam Shopping Mall, along with other operating assets.

“Al Rajhi Bank’s commitment to facilitating this substantial agreement not only showcases our dedication to supporting the Kingdom’s vision but also strengthens the financial foundations and prospects of the Clock Towers Companies. Together, we are setting new benchmarks for the hospitality and retail sectors in Makkah, fostering economic growth, and enhancing the spiritual journey of mns of visitors to the holy city,” stressed Al Rajhi Bank.

Al Rajhi Bank is one of the most active financial institutions in the Murabaha market in the Kingdom. In early February 2024, it extended a SAR500 mn (US$133.32 mn) Murabaha financing agreement to Saudi Tadawul Group Holding Co., which owns the Saudi Stock Exchange and its affiliate companies. The proceeds said the company in a disclosure to Tadawul, will be used to finance the Group’s planned mergers and acquisitions programme.

IsDB Co-finances Sindh Flood Emergency Housing Reconstruction Project in Pakistan with the World Bank through a €188.7m Sharia’a Compliant Facility

Islamabad – The UAE Islamabad – The Islamic Development Bank (IsDB) signed financing agreements with the Government of Pakistan totalling €188.7 mn for the Sindh Flood Emergency Housing Reconstruction Project in March 2024.

This €188.7 mn tranche of the project, which is also co-financed by the World Bank, says the IsDB, is a critical part of the recovery efforts following the devastating floods in 2022, aimed at rebuilding the affected communities in Sindh and providing much-needed climate-resilient housing facilities for families displaced by the floods.

The project’s goal is to construct 700,000 houses, benefiting an estimated 4.2 mn people in rural areas. Additionally, it will support the creation of 75,000 water, sanitation, and hygiene (WASH) facilities, significantly improving conditions for over 1.3 mn individuals.

The agreements were signed in Islamabad by Dr. Kazim Niaz, Secretary of the Economic Affairs Division on behalf of the Government of Pakistan, and Dr. Walid Abdelwahab, Director of the Regional Hub Türkiye on behalf of the IsDB, in the presence of Pakistan’s Minister of Economic Affairs, Ahad Khan Cheema.

The financing facility also comes under the IsDB Group Country Engagement Framework with Pakistan is focused on: (1) boosting recovery; (2) tackling poverty and building resilience; and (3) green economic growth which is in line with Government of Pakistan’s vision and development priorities.

The Government of Sindh, in collaboration with the Economic Affairs Division, will oversee the project’s implementation through the Sindh Peoples Housing for Flood Affectees (SPHF), ensuring that the efforts meet their objectives efficiently.

This partnership between the Government of Pakistan, IsDB, and the international community, says the IsDB, signifies a shared commitment to sustainable development and disaster resilience.

IILM Successfully Closes its Fourth Auction of 2024 with a US$740m Three Tranche Re/issuance of Short-Term A-1 Rated Sukuk in April

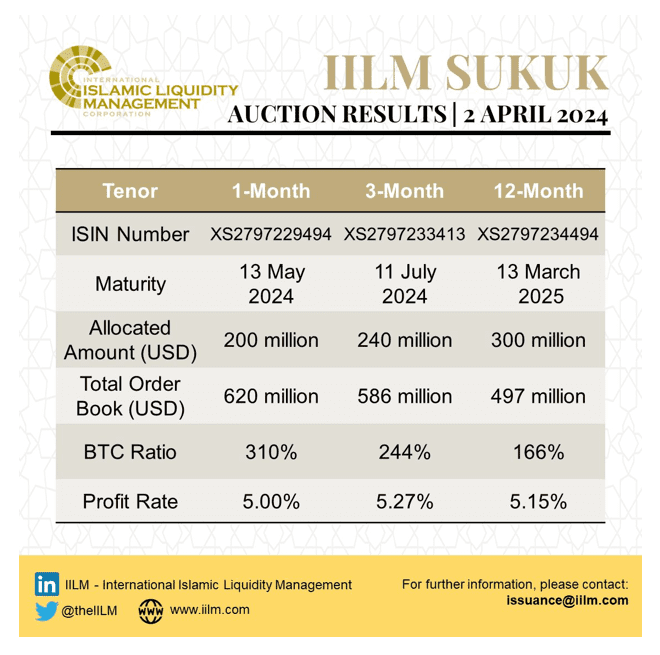

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Sharia’a-compliant financial instruments, successfully reissued its fourth consecutive transaction with a total of US$740 mn short-term Ṣukuk across three different tenors of one, three, and twelve-month respectively on 2 April 2024.

The transaction is the fourth consecutive one of the 2024 calendar season and follows the first auction of the year on 16 January 2024 which comprised a re-issuance of US$840 mn short-term Sukuk across three tranches in three different tenors; a second auction on 5 February 2024 which comprised an re-issuance of US$1.05 bn short-term Sukuk across three tranches and three tenors; and a third auction on 5 March 2024 which was a reissuance of US$980 mn short-term Ṣukuk across three different tenors of one, three, and six-month respectively.

The auction on 2 April 2024 comprised a re-issuance of US$740 mn short-term Sukuk across three tranches, three tenors and were priced as follows:

- US$200 mn of 1-month tenor certificates at a profit rate of 5.00%

- US$240 mn of 3-month tenor certificates at a profit rate of 5.27%

- US$300 mn of 12-month tenor certificates at a profit rate of 5.15%

The April reissuance witnessed a competitive tender among Primary Dealers and investors from the markets across the GCC region as well as Asia, with a strong orderbook more than US$1.70 bn, representing an average bid-to-cover ratio of 230%.

The April 2024 Ṣukūk reissuance also featured the IILM’s fifth 12-month tenor since its introduction in 2022. Further to today’s reissuance, the IILM has achieved year-to-date cumulative issuances totalling US$3.61 bn through twelve Ṣukuk series.

The IILM is a regular issuer of short-term Ṣukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The above transaction was executed under IILM’s US$4 bn short-term Sukuk Issuance Programme. The Programme and IILM Sukuk are rated “A-1” by S&P Global and “F1” by Fitch Ratings.

The IILM’s short-term Sukuk programme has a current outstanding issuance size amounting to US$3.51 bn. The IILM’s short-term Sukuk is distributed by a diversified network of 10 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, and Standard Chartered Bank.

The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Turkey, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.

Electronic e-Payments Flourish in Saudi Arabia Reaching 10.8bn Transactions or 70% of All Retail Transactions in FY2023

Riyadh – Electronic e-payments in Saudi Arabia witnessed a significant increase in FY 2023 as the Kingdom continues its progress towards the modernisation of its financial and payments eco-system under the key pillars of Saudi Vision 2030.

According to the Saudi Central Bank (SAMA), the share of retail consumer electronic payments – one of the Financial Sector Development Program’s Key Performance Indicators (KPIs) – reached 70% of total retail payments in 2023, up from 62% in 2022. This achievement is attributed to the significant growth of payments processed through national payment systems in 2023, which reached 10.8 bn transactions compared to 8.7 bn transactions in 2022.

In recent years, added the central bank, the Kingdom has witnessed rapid growth in the adoption of electronic payments because of an integrated, strategic, and collaborative approach across the financial community. The evolving cost-effective and reliable e-payment system helps enhance transaction efficiency and support financial stability.

SAMA confirmed that it will continue its efforts to provide payment choices and promote the use of digital payments through further development of the national payment’s infrastructure and enhancement of payment related services.

Meanwhile SAMA also licensed two crowdfunding operations in March and April 2024. They include ‘Funding Souq’, a company licensed in April 2024, and ‘Thara’ in March 2024 to provide debt-based crowdfunding solutions.

With the ‘Funding Souq,’ license there are now 10 authorized companies offering debt-based crowdfunding solutions in Saudi Arabia. This brings the total number of finance companies licensed and permitted by SAMA to 61 companies.

According to the central bank, the licenses reflect SAMA’s commitment to support the financial sector, increase efficiency of financial transactions, and promote innovative financial solutions for financial inclusion in Saudi Arabia.