Iconic Dubai Realty Developer Binghatti Holding Successfully Closes its Maiden US$300m Ijara/Murabaha Sukuk in February 2024

Dubai – Binghatti Holding Limited, the Dubai-based real estate developer, is the latest UAE property developer to raise funds in the Islamic debt market by successfully closing its inaugural Sukuk – a 3-year US$300 million Ijara/Murabaha Sukuk offering priced competitively at a profit rate of 9.625% per annum payable semi-annually in arrears. The transaction was closed on 28 February 2024.

The Sukuk certificates were issued by Binghatti Sukuk SPC Limited, a private company with limited liability incorporated in the DIFC as Trustee on behalf of the Obligor, Binghatti Holding Limited.

The company had mandated Emirates NBD Bank and HSBC to act as joint global coordinators, and together with Abu Dhabi Islamic Bank, Dubai Islamic Bank, Mashreqbank (acting through its Islamic Banking Division), RAKBANK and Sharjah Islamic Bank as Joint Lead Managers and Bookrunners, and to arrange a series of investor calls with accounts in the UK, Europe, Offshore US, the GCC, MENA region and Asia. Company executives met potential investors face-to-face in roadshow meetings in the UK and Asia, who accounted for most of the subsequent subscriptions to the Sukuk certificates.

This transaction attracted widespread demand from both regional and international investors, with the order book reaching an impressive US$621 million with a 2.1 times over-subscription. The robust demand saw the Sukuk offering experiencing a tightening of pricing by 30 basis points, demonstrating strong investor demand and confidence in the company’s strategy. According to Muhammad Binghatti, CEO of Binghatti Holding Company, the transaction received “immense response (which) demonstrates the strength of our business model and attractiveness of our investment proposition.”

According to the Base Prospectus, the net proceeds of the Trust Certificates will be applied by the Trustee pursuant to the terms of the relevant Transaction Documents on the relevant Issue Date in the following proportion: (a) not less than 55% of the aggregate face amount of the Trust Certificates towards the purchase from Binghatti Properties Investments Limited of all of its rights, title, interests, benefits and entitlements in, to and under the Assets pursuant to the Purchase Agreement; and (b) the remaining (being not more than 45% of the aggregate face amount of the Trust Certificates) towards the purchase of commodities to be subsequently sold to Binghatti pursuant to the Murabaha Agreement.

The Binghatti brand is synonymous with some of the most iconic projects in the Middle East. The company’s product offering spans all segments of the market, including affordable to mid-luxury, luxury, and uber-luxury markets. According to a disclosure to the London Stock Exchange, “the company is distinguished by its iconic architectural style that represents the brand’s distinct design DNA integrated across its wide array of real estate developments. With a real-estate portfolio of over 50 projects and an exceeding value of AED30 billion, Binghatti is the pioneering real estate developer in the world that has formed partnerships to develop branded real estate projects with global luxury brands, such as Bugatti, Mercedes-Benz and Jacob & Co.”

Consortium of Banks Sign Hybrid Conventional/Islamic Financing Facility for DEWA and Masdar in February 2024 to finance the Sixth Phase of the Mohammed bin Rashid Al Maktoum Solar Park

Abu Dhabi – A consortium of local and international banks closed a hybrid conventional and Islamic financing facility totalling an aggregate Dh5.51 billion (US$1.4 billion) on 21 February 2024 to finance the DEWA Phase VI of the Mohammed bin Rashid Al Maktoum Solar Park, the largest single site solar park in the world.

The project is promoted by Dubai Electricity and Water Authority (DEWA) and Abu Dhabi Future Energy Company (Masdar) is the preferred bidder to build and operate the 1,800MW 6th phase of the Mohammed bin Rashid Al Maktoum Solar Park using photovoltaic solar panels based on the Independent Power Producer (IPP) model, which costs up to AED5.51 billion.

The solar park’s capacity on commissioning will exceed 5,000 megawatts by 2030, with investments totalling AED50 billion. This, says DEWA, is a new milestone in promoting the use of clean and renewable energy in the UAE. This latest phase will provide clean energy for approximately 540,000 residences while reducing carbon emissions by 2.36 million tonnes annually. The project, says Masdar, will cover an area of 20 square kilometres. In addition, the 6th phase has achieved the lowest Levelized Cost of Energy (LCOE) of US$1.6215 cents per kilowatt hour (kWh) in the Solar Park.

“The Mohammed bin Rashid Al Maktoum Solar Park,” emphasised Sheikh Saeed Mohammed Al Tayer, MD & CEO of DEWA, “supports the UAE’s position as a leading global hub for clean energy. It is aligned with the UAE Net Zero by 2050 strategic initiative, the Dubai Clean Energy Strategy 2050 and the Dubai Net Zero Carbon Emissions Strategy 2050 to provide 100% of Dubai’s total power capacity from clean energy sources by 2050. The 1,800MW sixth phase of the solar park will see the total production capacity increase to 4,660MW by 2026. DEWA will have around 27% of the generation mix sourced from clean energy sources by 2030.”

The financing facility saw the participation of Abu Dhabi Commercial Bank, Commercial Bank of Dubai, First Abu Dhabi Bank, HSBC, Standard Chartered Bank, Abu Dhabi Islamic Bank and Warba Bank in the transaction. Sheikh Mohamed Jameel Al-Ramahi, CEO of Masdar, reminded that “accessing capital is fundamental to accelerating the global energy transition and this expansion of the Mohammed bin Rashid Al Maktoum Solar Park is an important milestone for the UAE in its own clean energy journey.”

The project will sell its entire power output to DEWA, the sole buyer of power output in Dubai under a long-term PPA. The sixth phase of the project, set to be operational in stages, will increase the total production capacity to 5,000MW by 2030, making it the largest solar park in the world.

The financing, according to Dentons, the City law firm who advised DEWA and Masdar on the transaction, was structured as a dual tranche syndicated conventional and Islamic Ijara facility. Standard Chartered Bank acted as documentation bank, global agent, conventional facility agent and account bank. Abu Dhabi Islamic Bank (ADIB) led on the Islamic structure, which needed to be AAOIFI/UAE Central Bank compliant. First Abu Dhabi Bank PJSC acted as Global Green Facility Coordinator and HSBC Bank (Middle East) acted as Regional Green Facility Coordinator.

Hedging was provided by First Abu Dhabi Bank and ADIB, while Abu Dhabi Commercial Bank, Commercial Bank of Dubai, First Abu Dhabi Bank, HSBC and Standard Chartered Bank acted as Conventional Mandated Lead Arrangers and Lenders, with Abu Dhabi Islamic Bank and Warba Bank acting as Islamic Mandated Lead Arrangers and Participants.

According to Stephen Knight, Banking and Finance Partner Stephen Knight at Dentons, “this transaction is a new milestone in the use of clean and renewable energy in the UAE, to helping shape the future of the UAE, in this case in line with the country’s National Energy Strategy 2050.”

Türkiye Treasury Continues Fixed Rate Domestic, FX-denominated and Gold-linked Sukuk Al-Ijarah Issuance Momentum Through Three Auctions in February 2024 Raising an Aggregate TYR9.804bn (US$318.8m)

Ankara – Türkiye’s sovereign Sukuk issuance continued its momentum in February and March 2024 with three auctions as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic, international and Gold-linked markets on the back of improving macro-economic fundamentals, with inflation on a downward trajectory from the 65% recorded in January 2024.

Not surprisingly, for manifold reasons, public debt issuance including domestic Sukuk Al Ijarah, FX-linked leasing certificates and Gold-linked leasing certificates have settled down into into a regular pattern as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond markets. The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificate (Sukuk Al-Ijarah) market.

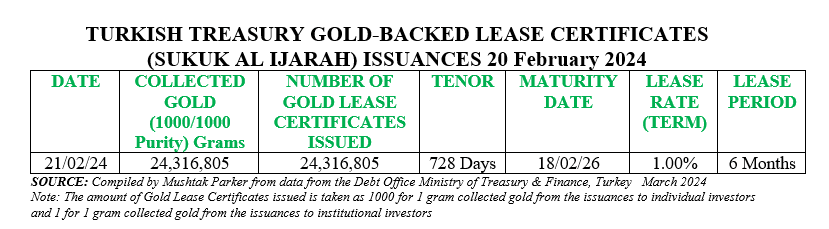

On 21 February 2024 the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 7282 days maturing on 18 February 2026 priced at a Lease Rate of 1.00% payable over the 6 Month lease period.

The amount of gold collected, according to the Treasury, amounted to 24,316,805 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 24,316,805 gold lease certificates (at a nominal value). The amount of Gold Lease Certificates issued, according to the Treasury, is taken as 1,000 for 1 gram collected gold from the issuances to individual investors and 1 for 1 gram collected gold from the issuances to institutional investors.

The direct sale auction of its latest Gold-backed Lease Certificates (Sukuk Ijarah) offering was conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

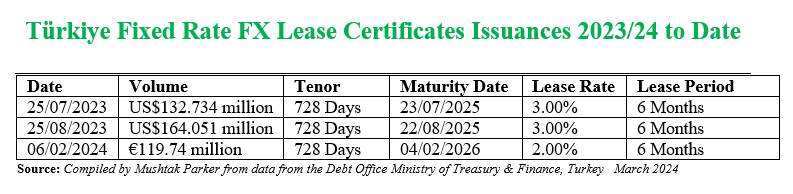

The latest transaction in the FX-linked issuance market was on 7 February 2024 when the Treasury raised €119.74 million through a Fixed Rent Rate Lease Certificate (Sukuk Al Ijarah) issuance with a tenor of 728 days priced at a fixed rental rate of 2.00%over 6 months and maturing on 4 February 2026. Demand for the certificates was robust.

The issuance was part of a hybrid fixed rate Eurobond and Euro-denominated Sukuk Al Ijarah transaction. The Euro Denominated Fixed Coupon Rate Government Bond tranche raised €779.443 million for the Treasury. The total demand for these issuances matched the aggregate allocated amount of €899.183 million.

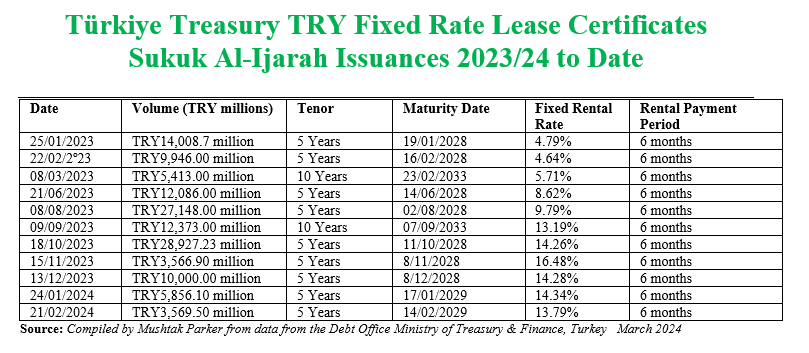

In the Fixed Rate Lease Certificates

(Sukuk al Ijarah) market, the Türkiye Treasury raised TRY3,569.50 million

(US$110.38 million) in an auction on 21 February

2024 through the issuance of 5-year Fixed Rate Lease Certificates (Sukuk al Ijarah)

maturing on 14 February 2029 priced at a fixed profit rate of 13.79% over

a 6-month rental period. The total bids for this issuance matched the allocated

amount. The Türkiye Treasury in fact raised TRY120,994.22

million (US$4,174.22 million) from the domestic market through the issuance of

Fixed Rate Lease Certificate (Sukuk al Ijarah) in nine auctions in FY2023. This issuance calendar for 2024, and the

first two issuances in January and February 2024, suggest that Sukuk Al Ijarah

are now a fixed feature of the Treasury’s public debt fund raising strategy.

According to the Ministry, the lease certificates were issued “in order to increase domestic savings, broaden the investor base and diversify the Treasury’s borrowing instruments.” The latest Lease Certificate transactions were done through a direct sale auction in November and December respectively. All the auctions were conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions is “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor. The Ministry of Treasury & Finance issues these gold-backed lease certificates “to diversify borrowing instruments, broaden the investor base and bring the idle gold into the economy.”

According to Turkish Treasury “citizens are provided with a safe investment tool for gold savings. With the gold bond and gold-denominated lease certificate issuance through five banks, our citizens will win themselves and contribute to the economy.” Investors will be paid TL-denominated returns on a semi-annual basis indexed to the gold price. On maturity, according to the Treasury, investors may request the principal payment as 1 kilogram of gold bar (produced by refineries) or Republic Gold Quarter Coins printed by the Turkish State Mint.

Middle East Healthcare Company Successfully Completes SAR1bn (US$270m) Saudi Riyal Denominated 5-year Sukuk on 6 March 2024 Priced at a Fixed Profit Rate of 7.2% Per Annum

Jeddah – Middle East Healthcare Company (formerly Saudi German Health) successfully completed its latest Sukuk offering on 6 March 2024 – a Saudi riyal denominated fixed rate SAR1 billion (US$270 million) Sukuk Mudaraba/Murabaha.

The 5-year unsubordinated Sukuk was issued by Middle East Healthcare Company under its SAR1.5 billion Sukuk Issuance Programme and completed on 6 March 2024. The transaction was priced at a fixed profit rate of 7.2% per annum payable quarterly in arrears.

In a statement to Tadawul, the Saudi Stock Exchange, the company said the early redemption of the Sukuk before the maturity date is permissible under specific conditions outlined in the base issuance prospectus and the relevant final terms. The Sukuk certificates have been admitted for listing and trading on Tadawul in mid-March 2024.

The company mandated Al Rajhi Capital Company as financial advisor, lead manager and dealer in relation to the offering and issuance of the Sukuk. Al Rajhi Banking and Investment Corporation acted as the receiving bank. The Sukuk was offered to eligible and qualified investors in Saudi Arabia and any other relevant jurisdiction where the Sukuk may be distributed.

The proceeds of the issuance, according to the base prospectus, will be used to enter into the Mudaraba and into a Murabaha Transaction in accordance with the terms of the Sukuk Documents. The amounts so received by the Issuer will be used by it for general corporate purposes.

The transaction is unique in that it is aimed at both institutional and retail investors who can purchase the Sukuk certificates subject to the distribution protocol as laid out in the base prospectus.

Saudi Arabia’s Largest Mall Developer Arabian Centres Company (Cenomi Centers) Successfully Completed Two Sukuk Transactions in March 2024 Raising an Aggregate US$500m in Proceeds

Jeddah – Arabian Centres Company (Cenomi Centers), the largest owner, operator and developer of shopping malls and complexes in Saudi Arabia, successfully completed two Sukuk transactions in the international US dollar market in March 2024 raising an aggregated US$500 million in the process.

In a disclosure to Tadawul (Saudi Stock Exchange) Cenomi Centers confirmed that the Company is pleased to announce that it completed the offering of a Reg S US$500 million Sukuk on 6 March 2024. The Sukuk has a tenor of five years which is non-callable for two years. The Sukuk may be redeemed prior to the scheduled dissolution date in certain cases as detailed in the offering circular of the Sukuk issuance.

The Company mandated Goldman Sachs International and HSBC Bank plc to act as Dealer Managers for the Offering and Morrow Sodali Limited to act as Information and Tender Agent for the transaction.

The final yield for the Sukuk transaction was set at a profit rate of 9.50% per annum, down from the initial guidance of 10% per annum, payable semi-annually in Arrears. According to Cenomi Centers, demand for the Sukuk certificates was robust with the order book reaching in excess of US$1.5 billion. The Company expects the Sukuk issuance to be credit neutral and the proceeds from the issuance shall be used to refinance the Company’s 2019 Sukuk which are due to mature in November 2024.

The benchmark US$500 million Sukuk issuance was immediately followed by a second transaction – a US$100 million tap issuance on 6 March 2024 which “was completed by way of a private placement and which shall be consolidated and will form part of the same currently outstanding US$500 million Sukuk due 2029 and issued on 6 March 2024.” The final settlement date for the tap issuance was 18 March 2024.

The Sukuk certificates have been admitted for listing and trading on the Official List of The International Stock Exchange in Cayman Islands.

Cenomi Centers has ambitious growth plans, but the company is beholden towards existing facility repayments and underpinning its capital strategy. This was evidenced in the recent completion and opening of U Walk Jeddah, as well as further flagship developments under construction, including Jawharat Riyadh and Jawharat Jeddah.

According to the company, the Jawharat developments will add over 280 thousand square meters of state-of-the-art, first-of-their- kind features and attractions including unique luxury offerings to the Kingdom and the region. These two flagship assets, once stabilized, are anticipated to have a material incremental contribution to Cenomi Centers’ revenue and both are expected to open in the first half of 2025.

Cenomi Centers has increased its engagement and visibility with the Islamic finance market to meet part of its financing strategy. In February 2024, the company secured a Sharia’a compliant, sustainability linked Murabaha Syndicated financing agreement totalling an aggregate SAR5.25 billion (US$1.4 billion) with a syndicate of top tier banks, led by HSBC and including Saudi National Bank, Saudi Awwal Bank, Arab National Bank, Commercial Bank of Dubai, Mashreq Bank PSC, and Qatar National Bank.

Saudi Arabia’s Alinma Bank Joins Pre-Ramadan Frenzy of Sukuk Offerings with Successful Completion of a Perpetual US$1bn Additional Tier I Capital Certificates Issuance on 29 February 2024

Riyadh – The resort to Sukuk issuance as a cost-effective fund-raising tool for Saudi banks, corporates and government, which doubles up as a source of funding diversification strategy, continues unabated as the holy month of Ramadan set in early March 2024.

The latest institution to tap the international Sukuk market is Alinma Bank, one of the top banks in the Kingdom, which is also a dedicated Islamic bank. In a disclosure to Tadawul (the Saudi Stock Exchange) Alinma Bank confirmed the completion of a US$1 billion Reg S Additional Tier I Capital Certificates issuance under the Mudaraba structure on 29 February 2024.

The Perpetual Mudaraba Sukuk, which is callable after 5 years, was priced at a yield and profit rate of 6.5% per annum payable semi-annually in arrears. The Sukuk certificates were issued through the Trustee, Alinma Tier 1 Sukuk Limited, incorporated as an exempted company with limited liability in the Cayman Islands, on behalf of the Mudarib, Alinma Bank.

The Bank mandated Abu Dhabi Islamic Bank, Alinma Investment Company, Emirates NBD Bank, J.P. Morgan Securities, MUFG Securities EMEA. and Standard Chartered Bank as joint lead managers and bookrunners to the transaction and to arrange a series of roadshows and investor calls with accounts in the UK, Offshore US, Europe, the GCC, MENA Region and Asia. in relation to the proposed offer.

The initial price guidance was set by Alinma Bank at around 7% for the Additional Tier 1 Sukuk non-callable for 5 years. Due to robust demand for the certificates the pricing tightened to close at 6.5% per annum. Proceeds from the Sukuk issuance will be utilized for improvement of Tier 1 Capital and general banking purposes, the bank said in a disclosure to Tadawul.

The Additional Tier 1 Capital Certificates were admitted for listing and trading on the International Securities Market of the London Stock Exchange. Alinma Bank has been assigned a long-term rating of “A-” with a “stable outlook” by Fitch Ratings and “A3” with a “positive outlook” by Moody’s Investors Service. The Certificates will not be rated by any rating agency upon their issue.

ITFC Signs US$715m Financing Agreements with Uzbekistan to Boost Local Cotton and Wheat Production to further Ensure Food Security

Tashkent –The International Islamic Trade Finance Corporation (ITFC), the trade fund of the Islamic Development Bank (IsDB) Group, signed several agreements with Uzbekistan, amounting to US$ 715 million, on the side line of the Arab Coordination Group meeting, which was held from 4th to 5th March 2024 in Tashkent, Uzbekistan.

ITFC has been actively supporting the Government and local banks in Uzbekistan since 2018, with total financing approved for the country standing at US$773 million. This financing is geared towards supporting the production of cotton and wheat, ensuring food security, and helping stabilize prices for essential commodities, as well as supporting the trade finance needs of private sector and SME clients. In addition, ITFC will continue supporting local banks with technical assistance through new Integrated Trade Solutions during 2024.

The collaboration, according to ITFC, also encompasses the “Trade Connect Central Asia+ (TCCA+)” Programme, a flagship initiative developed by ITFC. The TCCA+ targets the expansion and economic integration of trade and investment cooperation among six countries: Azerbaijan, Kazakhstan, the Kyrgyz Republic, Tajikistan, Turkmenistan, and Uzbekistan.

The first agreement is a Framework Agreement on cooperation for the period of 2024 – 2026, amounting to US$600 million. This agreement was signed by Mr. Laziz Kudratov, Minister of Investment, Industry and Trade and IsDB Governor of Uzbekistan, and Eng. Hani Salem Sonbol, CEO of ITFC. The agreement aims to strengthen areas of cooperation between ITFC and Uzbekistan, focusing on trade finance, agricultural and food security financing for the public sector, support for state-owned enterprises, and financing for small and medium enterprises in sectors like pharmaceuticals, food and agriculture, textile, and manufacturing.

The second agreement is a US$100 million Murabaha Financing Agreement signed by Mr Ilkhom Norkulov, First Deputy Minister of Economy and Finance, and Eng. Sonbol, for financing projects that contribute to food security and agriculture in Uzbekistan, through procurement of strategic agricultural goods, to ensure a stable supply of wheat throughout the year. This initiative helps to stabilize wheat prices and support local farmers.

Additionally, ITFC signed a Line of Trade Financing Agreement jointly with AgroBank and its subsidiary SmartBank, amounting to US$15 million. This agreement will support SMEs and the private sector in Uzbekistan, boosting private sector contributions to the country’s economic development. The line of financing, says ITFC, will provide Sharia’a-compliant trade finance solutions to the private sector and SME clients of AgroBank and its subsidiary SmartBank. This financing will be focusing on sectors like food and agriculture, manufacturing, and textiles, and will aim to promote financing of green projects.

“The agreements signed today,” stressed Eng. Hani Salem Sonbol, “strengthen our collaboration with Uzbekistan and are a testimony of our commitment to the socio-economic development in Uzbekistan and the Central Asia region at large. We believe the projects and programmes that will benefit from the approved financing will positively contribute to national economic growth. We are pleased to be covering key sectors such as food security and the private sector which align with our focus on contributing to the achievement of the Sustainable Development Goals especially SDG 2 (Zero Hunger) and SDG 8 (Decent Work & Economic Growth).

“With a focus on key sectors such as trade finance, agriculture, and SME development, these agreements are meant to stimulate growth, ensure food security, support SMEs, and create sustainable economic opportunities. ITFC remains dedicated to driving positive change in Uzbekistan and the region, leveraging its expertise and resources to foster prosperity and resilience.”

ICD Provides US$30m Line of Financing for Banque Misr to Support Small-and-Medium-sized-Enterprises (SMEs) in Egypt

Cairo – The Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the Islamic Development Bank (IsDB) Group, has extended a US$30 million Line of Financing to Banque Misr on 19 February 2024 to finance private sector projects and to support Small-and-Medium-sized-Enterprises (SMEs) in Egypt.

The funding agreement was signed by ICD Acting CEO, Engineer Hani Salem Sonbol, and Banque Misr Chairman Mr Mohamed EL-Etreby.

“Banque Misr is a valuable customer for ICD. This new financing line builds upon our successful 2017 partnership with Banque Misr, where we provided line of finance of US$25 million for a period of 5 years, the current agreement aligns with our goals in Egypt by increasing access to finance for SMEs, fostering job creation, and empowering youth and women entrepreneurs in the economy,” explained Mr Sonbol.

Since its inception, ICD has provided US$315 million in financing to Egypt, supporting private sector companies, financing lines to banks, and direct investments. These funds, maintain ICD, have demonstrably contributed to economic growth, job creation, and development across various sectors, including energy, food, and industry.

According to Mr Mohamed EL-Etreby, Chairman of Banque Misr, the line of financing and cooperation with ICD is within the framework of Banque Misr’s strategy to support and assist projects in all categories, with the aim of enhancing Egypt’s economic development, encouraging the manufacturing of local products for exports, thus reducing the import bill.

UAE Central Bank Licences Ruya, an Ajman-based Islamic Digital Community Bank, Aimed at Serving Families, Entrepreneurs and Small Businesses

Ajman – The UAE Central Bank has licensed Ruya, which says it is “a modern digital- native Islamic community bank, operating out of its headquarters in the Marsa area of Ajman”.

Launched in February 2024, the promoters of Ruya see the bank as “a disrupter in the finance industry that distinguishes itself by providing a digital banking experience, guided by the pillars of fairness, transparency and social responsibility. Deeply ingrained in the community, Ruya, which means ‘vision’ or ‘foresight’ in Arabic, places a high priority on providing support for families, entrepreneurs and small businesses.”

According to Ruya Chairman, Naser Mohamed Almur Al Zaabi, the bank is driven by four core values – i) Community, in support of strong connections and community well-being; ii) Prosperity by creating pathways to individual and collective success; iii) Integrity through ensure transparency, honesty and trust; and iv) Partnership through collaboration for shared success with clients, communities and stakeholders.

Ruya aims to blend innovative technology with the core principles of Islamic finance, Takaful and investment aimed at catering to the needs of both individuals and small businesses. The bank currently offers three accounts – Smart Account, Current Account and Savings Account. It is also busy building up a suite of digital products and solutions for businesses, entrepreneurs and community social organisations.

The launch of Ruya comes at a time when the Islamic finance sector seems to be flourishing in the UAE. According to a UAE Central Bank Islamic Finance Report 2023, the country ranks as the fourth largest Islamic finance market in the world. The global Islamic finance sector grew by 11% in 2022, bringing the value of global Islamic financial assets under management to AED16.5 trillion (US$4.5 trillion). The sector, says the Report, achieved a 69% increase over 5 years and a 163% increase over the past 10 years.

According to Marwan Obaid Al Muheiri, Vice Chairman of Ruya, in the above context “Ruya is a new style of Islamic bank, catering to the growing demand for more ethical, convenient and digital-first banking solutions, particularly among younger customers. Our user-friendly app will be paired with open-door branches that will serve as educational and collaborative community centres, fostering financial literacy and inclusivity.”

Malaysia’s Mortgage Securitiser Cagamas Berhad Resumes Sukuk Issuance After Absence of Three Months with Aggregate Hybrid RM960m (US204.1m) of Sukuk/Bond Issuances in March 2024

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, one of the most prolific issuers of Sukuk, returned to the Sukuk market after a hiatus of three months following the appointment of a new President/Chief Executive Officer, Kameel Abdul Halim.

The mortgage securitiser successfully concluded the issuance of RM960 million (US$204.06 million) worth of bonds and Sukuk on 6 March 2024. This was Cagamas’s first Sukuk transaction since November 2023 and the inaugural one for 2024. This latest offering comprised a RM460 million 1-year Conventional Medium-Term Notes, RM200 million 2-year CMTNs and RM300 million (US$63.77 million) Islamic Medium-Term Notes (IMTNs).

This compared with two auctions in November 2023, which raised an aggregate RM4.18 billion (US$890 million) through three Sukuk issuances, and RM1,143 million (US$242.96 million) through conventional bond issuances.

Commenting on this latest transaction in March 2024, President/ Chief Executive Officer of Cagamas, Kameel Abdul Halim noted: “The Company successfully issued RM960 million worth of bonds and Sukuk through its first public book building exercise this year. The order book received overwhelming response, oversubscribed by 2.3 times which attracted subscription from a diverse pool of investors including financial institutions, pension funds, insurance companies, foreign investors and asset managers.”

This, he continued, “allowed the Company to successfully tighten the yield by 5 basis points (bps) from the initial price guidance. The bonds and Sukuk were priced competitively at a spread of 35 bps over the Malaysian Government Securities (MGS). This demonstrated the strength and resilience of the domestic fixed income market. Proceeds raised from the issuances will be used to fund the purchase of Islamic home financings and housing loans from the domestic financial system, reflecting continued provision of liquidity by Cagamas to the domestic banking system.”

The new issuance will bring the Company’s aggregate funds raised for the year to RM2.08 billion (US$440 million). The papers will be redeemed at their full nominal value upon maturity, are unsecured obligations of the Company, ranking pari passu with all other existing unsecured obligations of the Company.

Cagamas plays a major role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia. Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysian sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM413.76 billion (US$88.16 billion) worth of corporate bonds and Sukuk.

IILM Successfully Closes its Third Auction of 2024 with a US$980m Three Tranche Re/issuance of Short-Term A-1 Rated Sukuk

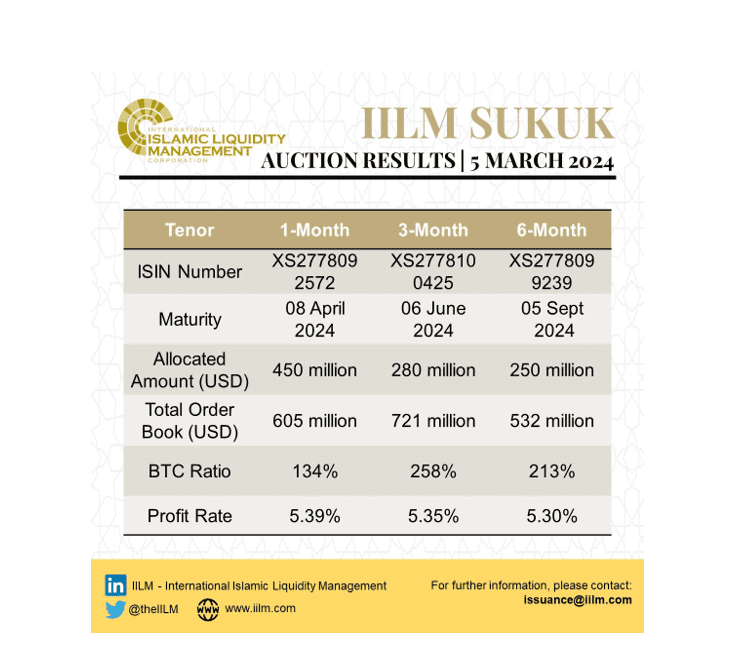

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Sharia’a-compliant financial instruments, successfully reissued a total of US$980 million short-term Ṣukuk across three different tenors of one, three, and six-month respectively on 5 March 2024.

The transaction is the third consecutive one of the 2024 calendar season and follows the first auction of the year on 16 January 2024 which comprised a re-issuance of US$840 million short-term Sukuk across three tranches in three different tenors; and a second auction on 5 February 2024 which comprised an re-issuance of US$1.05 billion short-term Sukuk across three tranches and three tenors.

The auction on 5 March 2024 comprised a re-issuance of US$980 million short-term Sukuk across three tranches, three tenors and were priced as follows:

i) US$450 million of 1-month tenor certificates at a profit rate of 5.39%

ii) US$420 million of 3-month tenor certificates at a profit rate of 5.35%

iii) US$250 million of 6-month tenor certificates at a profit rate of 5.30%

The March reissuance witnessed a competitive tender among Primary Dealers and investors from the markets across the GCC region as well as Asia, with a strong orderbook in excess of US$1.86 billion.

According to Mohamad Safri Shahul Hamid, Chief Executive Officer of IILM, “the successful conclusion of the IILM’s short-term Ṣukuk issuance in March across three different tenors with a strong average bid-to-cover ratio of 190% reflects the competitive nature of the IILM’s Islamic papers, while robust demand across all tenors reaffirms a stable pricing environment. We are pleased with the consistent relative spreads against benchmark rates in comparison to Term SOFR for the 1M, 3M and 6M durations.”

“Despite the resurgence of Global Ṣukuk issuances and the market’s shifting expectations on rates, today’s auction also witnessed several new investors participating at primary level for the first time. This underscores the global cross-border appeal of the IILM’s short-term Ṣukuk and our commitment to support the growth of the global Islamic financial system,” added Mr. Safri.

Further to today’s reissuance, the IILM has achieved year-to-date cumulative issuances totalling US$2.87 billion through nine Ṣukuk series. The IILM is a regular issuer of short-term Ṣukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The above transaction was executed under IILM’s US$4 billion short-term Sukuk Issuance Programme. The Programme and IILM Sukuk are rated “A-1” by S&P Global and “F1” by Fitch Ratings.

The IILM’s short-term Sukuk programme has a current outstanding issuance size amounting to US$3.51 billion. The IILM’s short-term Sukuk is distributed by a diversified network of 10 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, and Standard Chartered Bank.

The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Turkey, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.