Dubai Luxury Realty Developer (DAMAC) Successfully Closes an Additional US$175m Sukuk in January 2024 to Consolidate with its 3.5-year US$300m Senior Unsecured Sukuk Offering in October 2023

Dubai – Another example of corporate Sukuk issuance traction, especially in the real estate sector in the Gulf Cooperation Council (GCC) markets, is the issuance on 23 January 2024 of an additional US$175 million Sukuk tranche by DAMAC Real Estate Development Limited, the Dubai-based luxury apartment and real estate developer.

This transaction will be consolidated and form a single series with the 3.5-Year US$300 million Senior Unsecured Reg S Sukuk due in 2027 issued by Alpha Star Holding VIII Limited, a DIFC incorporated special purpose vehicle, on behalf of DAMAC as Obligor, on 12th October 2023. That transaction was priced at a profit rate of 8.375% per annum.

Like the main transaction, this additional issuance was facilitated by Emirates NBD Capital, acting as the sole global coordinator and joint lead manager together with HSBC, J.P. Morgan, Abu Dhabi Commercial Bank, Dubai Islamic Bank, First Abu Dhabi Bank, GFH Financial Group, and Mashreq.

According to DAMAC, the transaction received similarly strong support from the global investor community with the book well over-subscribed, reflecting the company’s robust credit fundamentals and the confidence regional investors have in the company following its recent reorganisation and the positive credit ratings actions it received in 2022/2023. DAMAC is rated Ba2, with a stable outlook by Moody’s Investor Services and BB- with a positive outlook by S&P Ratings.

DAMAC is a regular and proactive issuer of Sukuk. In 2023, the company successfully closed three Sukuk issuances with an aggregate value of US$900 million.

Al Rajhi Bank Extends SAR1.9bn (US$510m) Murabaha Facility to Jabal Omar Development Company to Facilitate the Accelerated Completion of Construction Projects in the Holy City of Makkah

Jeddah – Al Rajhi Bank, the largest Islamic bank in the world in terms of assets, extended a SAR1.9 billion (US$510 million) Murabaha facility to Jabal Omar Development Company on 25 January 2024. The facility, which has a tenor of two years, is the largest Murabaha transaction thus far in 2024.

The facility, which is backed by a Ministry of Finance guarantee, is aimed at helping the Saudi developer Jabal Omar accelerate the completion of the phases of under construction assets in the holy city of Makkah.

Jabal Omar Development Company is arguably one of the largest real estate developers in the region and one of the largest listed companies on the Saudi Tadawul Stock Exchange. Its flagship project, Jabal Omar, is a mixed-use real estate mega-development project within walking distance of The Grand Mosque of Makkah.

In a disclosure to Tadawul (the Saudi Exchange), the company stressed that the proceeds will be used to accelerating the completion of the phases under construction of current projects in Makkah and repayment of some existing debt obligations.

The facility is collateralised by security note and rights over certain real estate assets within the Jabal Omar Project; a Saudi Ministry of Finance (MoF) guarantee through an agreement on a number of representations and warranties to the ministry and mortgaging a bundle of land in favour of the ministry.

Jabal Omar was recently granted a license to operate the second tower of Jabal Omar Jumeirah Hotel in Makkah. The Jabal Omar master plan consists of several phases, with a land area of over 235,000 square metres and a built-up area of over 2.5 million square metres with a total of 46 towers which include hospitality, commercial and residential developments.

Türkiye Treasury Continues Fixed Rate Domestic and FX-denominated Sukuk Al-Ijarah Issuance Momentum Through Two Auctions in 2024 Raising an Aggregate TYR9.804bn (US$318.8m)

Ankara – Türkiye’s sovereign Sukuk issuance continued its momentum in January and February 2024 with two auctions as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic market on the back of improving macro-economic fundamentals, and in the light of the unexpected resignation of the erstwhile Governor of the Central Bank of Türkiye, Hafize Gaye Erkan, in February 2024.

She was swiftly replaced by Fatih Karahan, a former Federal Reserve Bank of New York economist and senior Goldman Sachs executive. His boss, the respected Finance Minister Mehmet Simsek, has moved quickly to effect any transition and has emphasised that the government’s economic programme would continue uninterrupted and that Türkiye President Recep Tayyip Erdogan fully supports the programme and the team at the Türkiye Treasury and Central Bank.

The country’s headline inflation reached 65% in January 2024 and is expected to go on a downward trend in June, following years of high inflation which severely affected the cost and standard of living of millions of ordinary Turks.

The good news is that foreign investors, including Pimco and Vanguard, started buying Turkish assets in late 2023 in a strong signal of confidence in Erkan and Simsek’s reformed economic programme. The Turkish Islamic finance sector too has seen a major boost with the appointment in January 2024 of the seasoned former Islamic banker, Osman Celik, as Deputy Finance Minister.

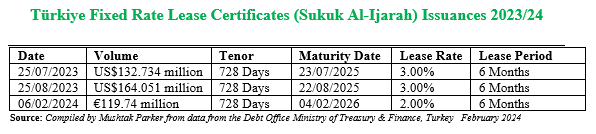

As a further encouraging sign, public debt issuance including domestic Sukuk Al Ijarah and FX-linked leasing certificates seems to have stabilised into a regular monthly pattern as part of the country’s public debt fund raising universe. The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificate (Sukuk Al-Ijarah) market.

The latest transaction in the FX-linked issuance market was on 7 February 2024 when the Treasury raised €119.74 million through a Fixed Rent Rate Lease Certificate (Sukuk Al Ijarah) issuance with a tenor of 728 days priced at a fixed rental rate of 2.00%over 6 months and maturing on 4 February 2026. Demand for the certificates was robust. The issuance was part of a hybrid fixed rate Eurobond and Euro-denominated Sukuk Al Ijarah transaction. The Euro Denominated Fixed Coupon Rate Government Bond tranche raised €779.443 million for the Treasury. The total demand for these issuances matched the aggregate allocated amount of €899.183 million.

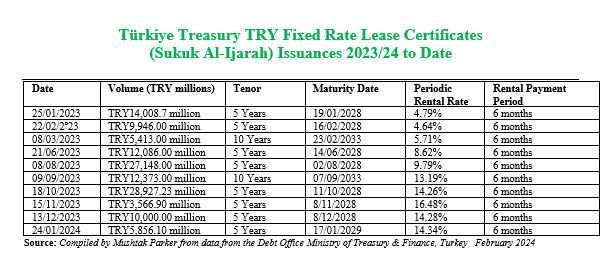

In the Fixed Rate Lease Certificates (Sukuk al Ijarah) market, the Türkiye Treasury raised TRY5,856.01 million (US$190.39 million) in an auction on 24 January 2024 through the issuance of 5-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 17 January 2029 priced at a fixed profit rate of 14.34% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

The Türkiye Treasury in fact raised TRY120,994.22 million (US$4,174.22 million) from the domestic market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah) in nine auctions in FY2023. This issuance calendar for 2024 and the first two issuances in January and February 2024, suggest that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy.

According to the Ministry, the lease certificates were issued “in order to increase domestic savings, broaden the investor base and diversify the Treasury’s borrowing instruments.” The latest Lease Certificate transactions were done through a direct sale auction in November and December respectively. All the auctions were conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions is “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle wholly owned by the Ministry of Treasury & Finance, the obligor.

Ittihad International Successfully Closes Inaugural 5-year US$350m Sukuk Offering as More GCC Corporates Migrate to Islamic Finance

Abu Dhabi – The UAE-based Ittihad International Investment LLC successfully closed its inaugural Sukuk issuance in December 2023 – a US$350 million 144A/Reg S senior unsecured Sukuk offering.

The transaction involved the issuance of a 5-year debut Sukuk issuance by a corporate rated sub-investment grade in a very challenging regional and global economic climate. Ittihad International Investment LLC is an alternative investment conglomerate that develops and manages a diversified, non-oil and gas investment portfolio across the industrial, infrastructure, healthcare and environmental services sectors in the Middle East and Egypt.

Bank of Sharjah together with Abu Dhabi Commercial Bank alongside other international and regional banks, acted as joint lead managers and bookrunners to the transaction.

Mohamed Khadiri, CEO of Bank of Sharjah, stressed that the Bank’s “participation in this Sukuk issuance underscores our strategic vision to offer financing and capital market solutions to meet the funding requirements of UAE-based corporates. While Ittihad has previously accessed the loan syndication market, the success of this transaction holds strategic importance, representing a major milestone in the Group’s history as it marks their entry into the Islamic capital markets for the first time.”

According to Mr Khadiri, the offering was 1.7 times oversubscribed with the order book reaching about US$600 million. The Sukuk has a 5-year tenor and a maturity date of 11 September 2028 and was priced at a profit rate of 9.7500% per annum payable on a semi-annual basis.

In December 2023, Fitch Ratings assigned Ittihad’s US$350 million Sukuk trust certificates, issued through its wholly owned special purpose vehicle, Ittihad International Ltd (Ittihad International) on behalf of the Obligor, Ittihad International Investment, a final rating of ‘B+’ with a Recovery Rating of ‘RR4’. The proceeds of the issuance were used to repay US$310 million of existing secured debt at the group level and US$30 million short term facilities at the subsidiaries level.

“The ratings,” said Fitch in its rating rationale, “reflect Ittihad’s high but improving leverage, and moderately negative free cash flow (FCF) as working capital (WC) normalises. Rating strengths are a strong regional presence in paper, cement, building materials and copper production, with a competitive position in the local market. Fitch rates Ittihad on a consolidated basis using the generic approach due to its diversified portfolio of companies spread across the industrials, healthcare and business services sectors.”

ITFC Pens Three Murabaha Agreements with Three Member States Totalling US$125m to Support the Energy, SME and Private Sectors

Jeddah – The International Islamic Trade Finance Corporation (ITFC), the trade fund of the Islamic development Bank (isDB) Group, signed three Murabaha financing facilities with counterparties in three member states totalling US$125 million in January and February 2024.

By far the largest deal was a US$90 Million Master Murabaha Agreement signed on 30 January 2024 in favour of Djibouti, with the International Hydrocarbons Company of Djibouti (SIHD) as the executing agency. The facility aims to support SIHD’s mandate of securing energy supply through the importation of petroleum products that is essential for electricity generation to boost all the sectors of the economy.

According to Eng. Hani Salem Sonbol, CEO of ITFC, the facility also supports intra-OIC trade, as the petroleum products will be sourced mainly from other OIC member countries. It also underlines ITFC’s commitment to fulfilling UN SDG 7, ‘Energy for All’. “This financing will promote positive impact on the level of human and economic development and is expected to further strengthen the strategic cooperation between ITFC and Djibouti in the energy sector,” added Eng. Sonbol.

Over the years, ITFC and Djibouti have enjoyed a longstanding relationship with a total of US$1.6 billion approved by the Corporation in favour of the country, with 33 operations targeting the energy and health sectors. The Master Murabaha Agreement signing also aligns with the US$600 million 3-year Framework Agreement signed in May 2023 between ITFC and Djibouti.

Meanwhile, the ITFC and the Saudi Export-Import Bank (Saudi EXIM Bank) also signed a US$25 million line of financing agreement for Bank Al Habib Limited in Pakistan. This financing is designed to facilitate export opportunities of non-oil products of small-and-medium-sized-enterprises (SMEs) in Saudi Arabia to Pakistan.

Under the “KSA SMEs Export Empowerment” Programme, this collaborative effort aims to broaden export horizons for Saudi SMEs, fostering increased participation and attracting new importers of Saudi goods in Pakistan. The ITFC and Saudi EXIM Bank, committed to elevating the competitiveness of Saudi non-oil exports globally, provide credit facilities to targeted financial institutions. ITFC also collaborates with The Small and Medium Enterprises General Authority “Monsha’at” within the framework of the Programme in organizing business matching opportunities for Saudi enterprises with potential partners in several countries and in various sectors such as the pharmacy sector, food industries, and others. This in line with the objective of aligning with the Kingdom’s Vision 2030, which represents one of the objectives of the KSA SMEs Export Empowerment Programme, which was launched by the three partners in 2022.

The Programme is geared towards enhancing Saudi non-oil exports through key areas such as capacity building, access to export markets, advisory services, and export financing, and consequently paves the way for SMEs to thrive and expand.

In a further development, ITFC also extended a US$10 million line of Murabaha trade finance to Asia Alliance Bank in Uzbekistan to support the activities of the Private Sector and SMEs in the Central Asian country. The facility will cater to the import and pre-export financing needs of private sector clients, including SMEs, in Uzbekistan.

“Since 2018, ITFC has allocated US$19 million in financing to Asia Alliance Bank, reflecting our longstanding commitment to fostering economic growth and development in the country. This latest agreement further solidifies ITFC’s dedication to supporting the private sector and SMEs in Uzbekistan,” stressed Nazeem Noordali, Chief Operating Officer at ITFC. Since 2018, ITFC has approved Line of Trade Finance Facilities totalling US$423 million in favour of 12 banks in Uzbekistan, highlighting the Corporation’s substantial contributions to the country’s trade finance landscape.

Al Rajhi Bank Arranges a SAR500m (US$133.32m) Murabaha Facility for Saudi Tadawul Group in January 2024 to Finance the Group’s Merger and Acquisitions Programme

Jeddah – Saudi Tadawul Group Holding Co., which owns the Saudi Stock Exchange and its affiliate companies, signed a SAR500 million (US$133.32 million) Murabaha financing agreement with Al Rajhi Bank on 1 February 2024. The proceeds said the company in a disclosure to Tadawul, will be used to finance the Group’s planned mergers and acquisitions programme.

The facility comprises two tranches – one with a 12-month short term tenor and the other with a 5-year medium term tenor. The facility is guaranteed by a Promissory note given by Group to the value of the financing.

The Tadawul Group stressed that “the facility is aligned with the Group’s strategic commitment to champion the Saudi capital market development, by continually executing the Group’s ambitious strategy, pursuing sustainable growth and diversify revenues.”

Inaugural Government Guaranteed SAH Savings Sukuk Launched by the Saudi Ministry of Finance in February 2024 Attracts SAR SAR861m (US$229.58m) in Savers’ Subscriptions

Riyadh – Saudi Arabia is the latest core Islamic finance market to launch a retail savings Sukuk under the label SAH Sukuk, which are government-guaranteed Sukuk aimed at retail investors, following in the footsteps of Malaysia, Indonesia and Nigeria.

According to the National Debt Management Centre (NDMC) of the Ministry of Finance, the first savings round of the SAH Sukuk closed on 6 February 2024 with a total volume of savings subscriptions reaching SAR861 million (US$229.58 million). The subscriptions were fully allocated on 13 February 2024 to some 35,000 applicants.

The Sukuk mature on 5 February 2025 and are priced at a fixed profit rate of 5.64%. The second SAH Sukuk savings round is scheduled to be held on 3 March 2024, according to the published issuance calendar for Government Sukuk. The subscription window will be done through digital channels of the participant financial institutions – the primary dealers and distributors.

The SAH Sukuk, launched by the Ministry of Finance and NDMC, is an initiative under the umbrella of Saudi Arabia’s Financial Sector Development Programme’s initiatives (one of the Saudi Vision 2030 pillars) which is “aimed to increase the savings ratios among individuals by motivating them to allocate a portion of their income to savings on a periodic basis, in addition to increasing the supply of savings products, raising the awareness around financial literacy and the importance of savings and its benefits for future plans.”

SAH Sukuk are reserved for Saudi citizens only, who are over the age of 18 years, provided the subscriber has an account with either SNB Capital, AlJazira Capital, Alinma Investment, SAB Invest or Al Rajhi Capital, the primary dealers and distribution channels.

SAH Sukuk is the first subsidized savings product intended for individuals that is compatible with Sharia’a principles in the form of Sukuk. It comes under the aegis of the Saudi Ministry of Finance’s Local Trust Certificates Issuance Programme denominated in Saudi riyals. The purpose of issuance of SAH Sukuk is to enhance the financial planning of the younger generation for the future and increasing individuals’ savings rates by motivating them to periodically deduct a portion of their income and allocate it to savings, in addition to increasing the supply of savings products.

Its key marketing drivers include Sharia’a compliance products which enjoy growing popularity and traction among Saudi youth, featuring a short term tenor of 1 year, annual returns, easy subscription, no fees for subscribers, and no restrictions on redemption.

The minimum subscription rate of SAH Sukuk is SAR1,000, which is equivalent to the nominal value, while the maximum subscription limit is SAR200,000 for the total number of issues per individual during the programme period.

Malaysia, Indonesia and Nigeria have a track record of issuing project-linked savings and investment Sukuk to ultra-retail investors. These include investment in road infrastructure, light rail systems and primary healthcare clinics, all of which are guaranteed by the respective government issuers.

ADIB-led Bank Consortium Arranges Dual Currency EGP5.5bn (US$180m) Murabaha Syndication Facility for Saudi ICT Group

Cairo – A consortium of regional banks led by Abu Dhabi Islamic Bank (ADIB) Egypt, and its investment arm, Abu Dhabi Islamic Capital, have arranged two Syndicated Murabaha financing facilities on 5 February 2024 for Giza Systems and its subsidiary VAS Integrated Solutions, which are both subsidiaries of Saudi-based Arabian Internet and Communications Services Company (AICSC).

AICSC is primarily engaged in providing Internet Services and Information Communication & Technology (ICT) services. The Company has three segments which include Core ICT Services, Information Technology (IT) Managed and Operational Services and Digital Services.

In a disclosure to Tadawul, the Saudi Exchange, AICSC confirmed that the total value of the financing facilities for the two companies were EGP 2.82 billion (US$91 million) and US$84 million. They include a medium-term financing for a period of 5 years comprising EGP1,070 million (US$35 million) and US$48 million; and short-term banking facilities for a period of one year, comprising EGP1,750 million (US$57 million) and US$36 million. In Egyptian pound value terms, the deal is worth an aggregate EGP5.5 billion (US$180 million).

Banks participating in the Egyptian Pounds facilities tranche include Abu Dhabi Islamic Bank (Egypt), Bank ABC (Egypt), Credit Agricole (Egypt), Emirates NBD (Egypt), Abu Dhabi Commercial Bank (UAE), Arab Bank (Egypt), Ahli United Bank (Egypt) and Al Baraka Bank Egypt. Banks participating in the US Dollars facility tranche include Bank ABC (Bahrain), Ahli United Bank (Bahrain), and Abu Dhabi Commercial Bank (UAE).

The facilities are collateralised through corporate guarantees provided by VAS Integrated Solutions. According to AICSC, the proceeds from the facilities will be used to refinance existing debt “on better terms with lower financing costs that will support the growth, expansion and development of VAS Integrated Solutions subsidiaries business in the region.”

The deal represents the first dual currency structured Murabaha financing in the Egyptian market. The deal aims to support the expansions of the two companies, open new markets, increase their project portfolio, and expand integrated technological solutions in various fields.

Middle East Healthcare Company Launches SAR1bn (US$270m) Saudi Riyal Denominated 5-year Sukuk in February 2024 Aimed at both Qualified Institutional and Retail Investors

Jeddah – Middle East Healthcare Company (formerly Saudi German Health) launched its latest Sukuk offering on 8 February 2024 – an initial Saudi riyal denominated SAR1 billion (US$270 million) Sukuk.

The issuance amount said Middle East Healthcare Company in a disclosure to Saudi Exchange “has been determined on an initial basis at SAR1 billion. The definitive issuance amount will be determined after the completion of the offer period, based on market conditions at that time.”

The company mandated Al Rajhi Capital Company as financial advisor, lead manager and dealer in relation to the offering and issuance of the Sukuk. The Sukuk is being offered to eligible and qualified investors in Saudi Arabia and any other relevant jurisdiction where the Sukuk may be distributed.

The Sukuk, which has a tenor of 5 years and matures in February 2029, has a fixed profit rate of 7.2% per annum payable on a quarterly basis.

The transaction is unique in that it is aimed at both institutional and retail investors who can purchase the Sukuk certificates subject to the distribution protocol as laid out in the base prospectus.

HSBC-led Bank Consortium Arranges Landmark Sustainability-linked SAR5.25bn (US$1.4bn) Syndicated Murabaha Financing Facility for Saudi Arabia’s Largest Mall Developer Cenomi Centers

Riyadh – Cenomi Centers, the largest owner, operator and developer of shopping malls and complexes in Saudi Arabia, has secured a Sharia’a compliant, sustainability-linked Murabaha Syndicated financing agreement totalling an aggregate SAR5.25 billion (US$1.4 billion) with a syndicate of top tier banks.

HSBC Saudi Arabia led the syndication, which was closed on 13 February 2024, working as the exclusive financial coordinator and lead sustainability coordinator, with participation from Saudi National Bank, Saudi Awwal Bank, Arab National Bank, Commercial Bank of Dubai, Mashreq Bank PSC, and Qatar National Bank.

The new arrangements consist of a twelve-year term Sustainability-linked Murabaha facility in two tranches as well as a revolving four-year renewable Murabaha facility. The new facilities benefit from improved pricing, and covenants package in comparison to existing facilities.

According to Alison Rehill-Erguven, CEO of Cenomi Centers, this landmark and sustainability linked transaction in the Saudi market within the sectors of Real Estate, Lifestyle and Leisure carries a number of sustainability linked incentives which are aligned with Cenomi Centers’ integral ESG ambitions, as set out in the most recent sustainability report including a carbon emissions reduction target, increasing the percentage of assets connected to the grid and bolstering of the number of women in leadership roles.

“We are pleased to secure a financing agreement that supports our long-term growth strategies and will drive forward our ambitions to set the benchmark in Saudi Arabia to be the largest and one of the most innovative mall developers and operators. In addition to providing us with fiscal agility, the arrangements tie closely with our sustainability objectives and vision of creating and maintaining a business model that offers a positive, lasting impact on the communities and landscape in which we operate,” she added.

The arrangements will provide up to SAR 5.25 billion for Cenomi Centers and help to support its ambitious growth plans by contributing towards existing facility repayments and underpinning its capital strategy. This was evidenced in the recent completion and opening of U Walk Jeddah, as well as further flagship developments under construction, including Jawharat Riyadh and Jawharat Jeddah.

According to the company, the Jawharat developments will add over 280 thousand square meters of state-of-the-art, first-of-their- kind features and attractions including unique luxury offerings to the Kingdom and the region. These two flagship assets, once stabilized, are anticipated to have a material incremental contribution to Cenomi Centers’ revenue and both are expected to open in the first half of 2025.

The facility comprised three components:

i) A sustainability-linked Revolving Murabaha facility – with a tenor of 4 years (subject to two one-year extension options);

ii) A sustainability-linked Term Murabaha – Tranche A – with a tenor 12 years; and

iii) A sustainability-linked Term Murabaha – Tranche B – with a tenor of 12 years.

The financing facility is guaranteed by promissory notes (covering the facility size and any profit payments) provided by Cenomi Centers, and the company will also create a pledge over certain moveable assets and provide mortgages over certain immovable properties in favour of the financiers.

The proceeds of the facilities will be used in the repayment of amounts outstanding under its existing facilities; payment of fees, costs and expenses incurred in connection with the new facilities; and for general corporate and working capital purposes of the Company.

The new revised facilities are structured as sustainability-linked financings, adhering to the LMA’s Sustainability-Linked Loan Principles. Through the transaction’s sustainability-linked mechanism, Cenomi Centers commits to certain targets with respect to three sustainability Key Performance Indicators (KPIs) which relate to: a reduction in carbon emissions; an increase in the percentage of assets connected to the KSA national grid; and an increase in the percentage of women in certain leadership roles at the company.

IILM Successfully Closes its Second Auction of 2024 with an US$1.05bn Three Tranche Re/issuance of Short-Term A-1 Sukuk

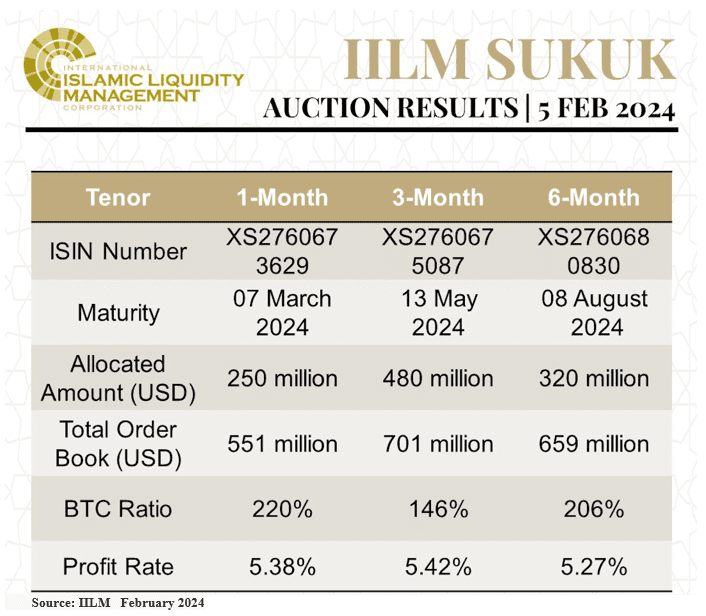

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Sharia’a-compliant financial instruments, successfully reissued a total of US$1.05 billion short-term Sukuk across three different tenors of one, three, and six-month respectively on 5 February 2024.

The transaction is the second consecutive one of 2024 calendar season and follows the first auction of the year on 16 January 2024 which comprised a re-issuance of US$840 million short-term Sukuk across three tranches in three different tenors.

The auction on 5 February 2024 comprised a re-issuance of US$1.05 billion short-term Sukuk across three tranches, three tenors and were priced as follows:

i) US$250 million of 1-month tenor certificates at a profit rate of 5.38%

ii) US$480 million of 3-month tenor certificates at a profit rate of 5.42%

iii) US$320 million of 6-month tenor certificates at a profit rate of 5.27%

In a disclosure, IIFM stressed that the February 2024 “Sukuk reissuance, which marks the IILM’s second auction for the year, garnered a strong demand from both Primary Dealers and investors from the markets across the GCC region as well as Asia, with a combined order book of US$1.91 billion, representing an average bid-to-cover ratio of 182%.” To date, the Corporation has achieved year-to-date cumulative issuances totalling US$1.89 billion through six Sukuk series over two auctions – one in January and the other in February 2024.

The appointment of Mohamad Safri Shahul Hamid as the new Chief Executive Officer of IILM, effective 1 January 2024, has meant that the Corporation is currently undergoing a strategic restructuring. Mohamed Safri is a seasoned banker with over three decades of experience including 13 years at CIMB Bank Group, where he had served in various capacities, including as Deputy CEO of CIMB Islamic and as a Senior Managing Director in the Bank’s Public Sector Finance Group, including several years in Sukuk origination and liquidity management.

The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Turkey, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.

With the February 2024 Sukuk reissuance, the IILM has successfully issued a total US$102.83 billion through 240 series in total issuances since the organisation’s inception in 2010 and inaugural Sukuk issuance in 2013. The IILM achieved cumulative issuances totalling US$11.52 billion across 36 US dollar-denominated short-term Sukuk series in January-December 2023 and crossing the US$100 billion mark in total issuances since the organisation’s inception.

After the January 2024 reissuance, CEO Mohamed Safri has been quick to reiterate that the Corporation will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

The IILM is a regular issuer of short-term Ṣukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The above transaction was executed under IILM’s US$4 billion short-term Sukuk Issuance Programme. The Programme and IILM Sukuk are rated “A-1” by S&P Global and “F1” by Fitch Ratings.

The IILM’s short-term Sukuk programme has a current outstanding issuance size amounting to US$3.51 billion. The IILM’s short-term Sukuk is distributed by a diversified network of 10 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, and Standard Chartered Bank.