DP World Successfully Closes US$1.5bn Green Sukuk in October 2023 to Support the Group’s Sustainability and Decarbonization Strategy

Dubai – Dubai-owned Global Ports, Logistics and Supply Chain Operator and Solutions Provider, DP World successfully closed its latest Sukuk issuance in the international market thus re-affirming its commitment to sustainable operations.

The Ports Giant issued a 10-year US$1.5 billion Green Sukuk in October 2023 “to support its global decarbonisation efforts.” The Sukuk, which was oversubscribed 2.3 times due to strong demand from local, regional and international investors, is listed and traded on both Nasdaq Dubai and the London Stock Exchange’s International Securities Market and Sustainable Bond Market.

The proceeds from the Sukuk, according to DP World, will be earmarked for eligible green projects in line with DP World’s recently published Sustainable Finance Framework. Current projects cut across electrification, renewable energy, clean transportation and energy efficiency metrics.

The Sukuk Certificates were issued through its Cayman Island incorporated special purpose vehicle, DP World Crescent Limited, under its US$5 billion Trust Certificate Issuance Programme, established in September 2023 and arranged, by Citigroup, Deutsche Bank, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, HSBC and JP Morgan.

DP World launched its US$1.5 billion Green Sukuk due in September 2033, priced at a spread of US Treasuries plus 119.8 basis points (bps), which translates into a 5.5% coupon rate. According to the company, the DP World’s Sukuk achieved one of the tightest spreads for a BBB+ rated corporate globally. The strength of demand for the Sukuk was supported by robust credit ratings — Moody’s (Baa2/Stable) and Fitch (BBB+/Stable) — as well as a strong ESG ratings from Sustainalytics (Negligible Risk), CDP (A- Leadership) and MSCI (B).

DP World Group Chairman and CEO Sultan Ahmed bin Sulayem commented: “We aspire to lead global trade into a more resilient, efficient, and sustainable future for our customers and their customers. That’s why we are acting with scale and ambition, using our hands-on expertise to reshape trade for the better. The price we achieved for this Green Sukuk is phenomenal and represents the confidence investors have in DP World as a company and our commitment to sustainability.”

DP World’s current portfolio of green and sustainable assets is spread throughout the globe and runs through various elements of its diverse multi-functional business, all of which aim to make trade flow sustainably throughout the world. “Within Clean Transportation, we have included electrified freight transportation and hybrid vessels. Our electrified equipment is testament to our mature and strong decarbonisation programme. The Group also boasts a number of green buildings within its portfolio that meet internationally recognised green certification building standards, such as BREEAM and LEED,” added Sultan Ahmed bin Sulayem.

Decarbonisation is a core focus for DP World, and the corporate has already committed to becoming carbon neutral by 2040 and net zero carbon by 2050. In this respect, says Yuvraj Narayan, Group Deputy Chief Executive and Chief Financial Officer: “Our Green Sukuk amplifies our commitment to placing sustainability at the heart of everything we do, ensuring that we are able to create real societal and economic change. Through this issuance we are able to further align our sustainability strategy, and decarbonisation efforts with the Group’s financing strategy.”

Citigroup, Deutsche Bank, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, HSBC, J.P. Morgan and Standard Chartered Bank wee mandated as joint lead managers and bookrunners to the transaction, while HSBC acted as sole ESG structurer.

—————————————————————–

IsDB-led Arab Coordination Group Allocates US$10bn to Drive a Comprehensive and Affordable Transition to Renewable Energy in Developing Member Countries

Abu Dhabi – The Arab Coordination Group (ACG), a strategic alliance comprising regional and international development finance institutions, at a meeting at COP28 on 4th December 2023 approved new funding of US$10 billion until 2030 to drive a comprehensive and affordable transition to renewable energy in developing countries.

The commitment is an integral part of a strategic plan encompassing seven key points designed to expedite the global shift towards clean energy sources. It further aligns with the ACG’s earlier pledge of US$24 billion. The key points of the strategic plan include:

- Mobilizing financial resources by increasing the use of Green Bonds/Sukuk, blended finance, and risk mitigation tools such as credit and investment insurance/Takaful and guarantees.

- Enhancing innovation and adopting new technologies to maximize the impact on energy efficiency and storage.

- Supporting universal access to clean energy.

- Enhancing resilience to climate change of key sectors including food, water resources, transport and urban networks.

- Encouraging cooperation and knowledge sharing.

- Improving workforce skills worldwide in the clean energy sector.

- Monitoring and evaluation of the progress and impact.

This comprehensive initiative, says the IsDB, emerges as countries participating in COP28 declare their commitment to reducing carbon emissions. It comes at a crucial juncture, following a year marred by record and catastrophic climate events. The ongoing United Nations Conference on Climate Change puts a significant focus on substantially increasing climate financing and expediting the transition process. All of this unfolds as the world grapples with escalating temperatures and unprecedented natural disasters.

This commitment builds upon prior actions by the Arab Coordination Group in the realm of climate action. In 2022 alone, the Group allocated around US$15.7 billion to nearly 500 financing operations across more than 80 countries. These funds were directed towards addressing fundamental challenges faced by societies in low-and-medium-income-countries (LMICs), such as food insecurity and climate change. Moreover, they supported key economic sectors and facilitated international trade. Notably, in 2022, the largest share of commitments by ACG members (27%) was dedicated to the energy sector, followed by 27% to the financial sector, and 21% to agriculture and water resources.

Judging by its portfolio of pledges over the last year and more recently in November 2023, the ACG is probably one of the most proactive financiers in the world currently in helping member pursue the UN Sustainable Development Goals (SDG) agenda by 2030 and the Net Zero target of the 2015 Paris Climate Agreement by 2050.

This latest allocation comes after the Group in a move to upscale their development support for African countries ahead of the COP28 climate change conference, announced at a meeting in the Saudi capital on 9 November 2023 that it is allocating a record US$50 billion to help build resilient infrastructure and inclusive societies in the African continent. Announcing the initiative at the consecutive Arab-Africa and Saudi-Africa Summit Economic Summits Economic Conference held in Riyadh, Dr Muhammad Al Jasser, President of the IsDB, emphasized that many countries in Africa are particularly vulnerable to climate change, making strengthening climate resilience and adaptation an urgent priority.

The Arab Coordination Group (ACG) is a strategic alliance that provides a coordinated response to development finance. Its current members comprise some of the most liquid development finance institutions in the world, including the Abu Dhabi Fund for Development, the Arab Bank for Economic Development in Africa, the Arab Fund for Economic and Social Development, the Arab Gulf Programme for Development, the Arab Monetary Fund, the IsDB, the Kuwait Fund for Arab Economic Development, the OPEC Fund for International Development, the Qatar Fund for Development and the Saudi Fund for Development.

Dr Al Jasser emphasizes that the IsDB and ACG can play a vital role in promoting regional integration and connectivity in Africa, supporting trans-Saharan and trans-Sahelian land corridors, and launching initiatives like the Arab-Africa Trade Bridges (AATB) Programme to enhance trade and investment flows between Arab and African countries. In Riyadh, he unveiled ambitious plans for the IsDB Group’s own investments in Africa, with an estimated US$37 billion earmarked for projects through 2030, excluding guarantees. This includes a commitment of up to US$7.8 billion for agriculture and rural development in Africa, with a focus on addressing short-term food security challenges and enhancing agricultural value chains.

The IsDB’s long-standing partnership with Africa, dating back to its first project in 1976, the year the Bank started operations, added Dr Al Jasser, highlights its dedication to promoting economic growth, stability, and sustainable development in the African continent.

—————————————————————–

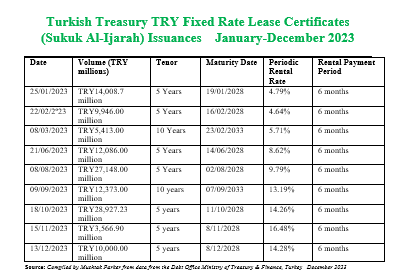

Türkiye Treasury Continues Fixed Rate Sukuk Al-Ijarah Issuance Momentum Through Two Transactions in November 2023 in the Domestic Market Raising an Aggregate TYR13,566.9bn (US$468.11m)

Ankara – Turkish sovereign Sukuk issuance continued its momentum in November and December 2023 with two auctions as the Turkish Treasury further consolidates its regular issuance of Sukuk Al-Ijarah in the domestic market on the back of improving macro-economic fundamentals.

Since the return of the respected Mehmet Simsek as Türkiye’s Finance Minister in May 2023 following the re-election of President Recep Tayyip Erdogan, and the appointment of the seasoned former Islamic banker, Osman Celik as Deputy Finance Minister, public debt issuance including Sukuk Al Ijarah seems to have stabilised into a regular monthly pattern.

The Turkish Treasury raised TRY3,566.90 million (US$123.07 million) in an auction on 15th November 2023 through the issuance of 5-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 8th November 2028 priced at a fixed profit rate of 16.48% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

In a second auction on 13th December 2023, the Turkish Treasury raised TRY10,000 million (US$345.04 million) through the issuance of 5 years Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 8th December 2028 priced at a fixed profit rate of 14.28% over a 6-month rental period. The total bids for this issuance too matched the allocated amount.

This brings the aggregate funds raised so far by the Turkish Treasury in the January-December 2023 period to TRY120,994.22 million (US$4,174.22 million) from the market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah).

These two latest auctions follow the one on 18th October 2023 when the Turkish Treasury raised TRY28,927.23 million (US$1,030.96 million) in a 5-Year transaction maturing on 11th October 2028 and priced at a fixed profit rate of 14.26% over a 6-month rental period.

It also follows the forays of the Turkish Treasury in the US Dollar Denominated Fixed Rent Rate Lease Certificate (Sukuk Al-Ijarah) market. The Turkish Treasury raised an aggregate US$296.785 million through two Sukuk Al-Ijarah issuances – one in July and the other in August.

The transaction on 25th July 2023 raised US$132.734 million with a tenor of 728 days priced at a fixed rental rate of 3.00% over 6 months. The transaction on 25th August 2023 raised US$164.051 million also with a tenor of 728 days and priced at a fixed rental rate of 3.00% over 6 months. Demand for the certificates was robust. Both issuances were part of a hybrid fixed rate bond and Sukuk transaction. In the August 2023 issuance the Treasury raised US$2.4 billion through a bond issue compared with the US$164.051 million Sukuk Al-Ijarah. Both issuances mature on 22nd August 2025. The total demand for these issuances, according to the Turkish Treasury exceeded US$2.65 billion.

According to the Ministry, the lease certificates were issued “in order to increase domestic savings, broaden the investor base and diversify the Treasury’s borrowing instruments.” The latest Lease Certificate transactions were done through a direct sale auction in November and December respectively. The auctions were conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions is “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.” All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle wholly owned by the Ministry of Treasury & Finance, the obligor.

IsDB Commits to US$1bn in New Concessional Climate Finance to Support Fragile and Conflict-affected Member States

Dubai – The Islamic Development Bank (IsDB) has committed over US$1 billion over the next three years to help vulnerable and conflict-affected member states to mitigate the impacts of climate change. IsDB President, Dr Muhammad Al Jasser made the announcement at an IsDB event during COP28 in Dubai on 2nd December 2023 on ‘Accelerating Climate Action and Finance to Countries and Communities Facing Multifaceted Crises’ and the IsDB launch of the ‘COP28 Declaration on Climate, Relief, Recovery and Peace’.

According to Dr Al Jasser, fragile and conflict-affected countries are disproportionately experiencing the devastating impacts of climate change, thus amplifying resource scarcity in these countries which disrupts livelihoods and further challenges their economies. The IsDB he assured recognizes the urgency of creating genuine momentum in addressing these challenges.

“This financing will prioritize high-impact actions, mainly adaptation finance, aligning them with broader development objectives of addressing fragility. In this endeavour, we will try to deploy as much concessional finance as possible, including through our Lives and Livelihoods Fund. It is crucial to identify high-impact programmes, establish effective policies, and secure significant concessional financing to ensure tangible results,” he emphasized.

Dr Al Jasser highlighted the importance of taking transformative climate action to promote inclusive development, especially among the vulnerable populations of least-developed countries. He also reiterated the Bank’s commitment to developing interventions that foster resilience and sustainable development in the key demographics considering women, youth and children, who often bear the brunt of climate change, conflicts, and economic hardship.

Another important development at the ‘Charting the Course: IsDB Group’s Journey Towards Paris Alignment’ event in Dubai was the Group’s public announcement of its intended alignment with the provisions of the 2015 Paris Climate Agreement through its “fair, inclusive, and just transition conceptual framework and action plan.”

“As Chairman of IsDB Group, I am proud to say that our Bank is proactively embracing this opportunity, aligning our strategies, investments, and operations to support our member countries in achieving their nationally determined contributions (NDCs). We are also committed to aligning our sovereign operations with the Paris Agreement by the end of this year, in line with our member countries’ nationally determined contributions,” Dr Al Jasser reiterated.

UKEF Provides Improved Terms for Climate-friendly Exporters as Electronic Trade Documents Act 2023 Gets Royal Assent

London – British exporters are benefitting from more flexible and competitive support from UK Export Finance (UKEF), the state export credit agency and partner entity of ICIEC, the multilateral credit and investment insurer of the IsDB Group, as part of the Government’s drive to encourage them to use and offer finance solutions and other options which are consistent with the Green Finance agenda in line with the UN SDGs and the Paris Net Zero objectives.

The initiative is also in line with new international trade measures in which the UK as a participant to the OECD Arrangement on Officially Supported Export Credits, announced in July 2023, have agreed a significant modernisation package meaning that export credit agencies like UKEF can offer greater incentives for climate-friendly and green transactions.

According to the export credit agency, “UKEF can now offer longer repayment terms and more flexible repayment structures for an expanded range of renewable and green transactions. UKEF will also be able to provide longer repayment terms and a more flexible approach for standard transactions too, ensuring that it can offer customers competitive finance options in many other sectors.”

The UK is also spearheading a pioneering game-changing development in the global electronic trade documentation architecture with the Electronic Trade Documents Act (ETDA) 2023 in the UK receiving Royal Assent from King Charles III on 20 July which became legally effective on 20 September 2023 in an effort to make Global Britain’s trade with partners all over the world more straightforward, efficient and sustainable.

Digitalization of trade could be a great equaliser and facilitator by providing new opportunities for those economies that have so far been left behind by allowing them to overcome some of the most important barriers to trade that they face, such as transportation costs and institutional disadvantages.

There is no doubt that biggest boost can come from the UK’s ETDA with the British Government’s initial estimate that the UK economy is set to receive a £1.14 billion boost over the next decade through the “innovative trade documentation digitalisation act.” With less chance of sensitive paper documents being lost, and stronger safeguards through the use of technology, digitalising trade documents is also set to give businesses that trade internationally greater security and peace of mind.

“The Electronic Trade Documents Act,” stressed Chris Southworth, Secretary General of the UK Chapter of the International Chamber of Commerce (ICC), “is a game changing piece of law not just for the UK but also for world trade. The act will enable companies to finally remove all the paper and inefficiency that exists in trade today and ensure that future trade is far cheaper, faster, simpler and more sustainable. This presents a once in a generation opportunity to transform the trading system and help us drive much needed economic growth.”

The ICC estimates 80% of trade documents around the world are based off English law, and this act serves as the cornerstone to truly digitalising international trade.

With English law being the very foundation of international trade, including Islamic finance contracts such as the Commodity and Syndicated Murabaha and Sukuk issues, this act puts the UK ahead of the curve and in the lead of not only other G7 countries, but almost all other countries in the world. Commodity Murabaha, Tawarruq and Sukuk constitute a major component of the direction of financing in the global Islamic finance ecosystem

The UK, says Minister for International Trade, Nigel Huddleston, is widely seen as a leader in digital trade and this act will make it easier for businesses to trade efficiently with each other, cutting costs and growing the UK economy by billions over time. “It’s exciting to see the power of technology being harnessed to benefit all industries, reduce paper waste and modernise our trading laws, an approach which the rest of the world will seek to follow,” he added.

ICIEC Provides €336.31m (US$366.27m) Sovereign Risk Cover for Two Major Road and 37 Bridges Project in Senegal Financed by SPE

Dakar – The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), the Sharia’a-compliant multilateral insurer of the IsDB Group, extended a €336.31 million (US$366.27 million) Foreign Investment Insurance Policy Cover in November 2023 to SPE, which is managed by Société Générale (SocGen), for the financing of the Dakar-Tivaouane Highway, and the Expansion of the Route de Rufisque Road, including the Construction of 37 Bridges.

According to ICIEC, the Policy covers 95% of the risk of Non-Honouring of Sovereign Financial Obligation (NHSFO) of the Ministry of Finance and Treasury, acting on behalf of the Government of Senegal.

Société Générale sought an insurance cover for the Non-Honouring of Sovereign Financial Obligation (NHSFO) of the Government of Senegal, related to an Islamic financing facility totalling €300 million in addition to the related profit amount for a maturity of 12 years. Notably, the overall contract amount stands at €489 million, being part of an overall €1 billion project, supported by the World Bank, the AfDB Group, the Saudi Fund for Development, and the Government of Senegal.

The financing and risk cover are for two significant road projects: the construction of DAKAR-TIVAOUANE Road (55 Km) and the widening works of the CYRNOS-SEVEN UP-MALICK Road, commonly known as the “Ancienne Route de Rufisque.” These road projects hold strategic importance as they form integral links in Trans-African Corridors like Tangier – Nouakchott, Dakar – Lagos – Algiers, and Nouakchott – Dakar. These corridors are planned for extension towards Madrid, Spain.

The Dakar-Tivaouane Highway and the expansion of the Route de Rufisque Road, which includes the construction of 37 bridges, according to ICIEC, promises substantial development impacts and key result areas. This ambitious project is expected to yield a significant annual traffic increase of 10%, create 2,000 direct jobs, and stimulate an additional 6,000 indirect jobs.

Beyond its economic implications, it serves as a critical link within the trans-African corridors, such as Tangier – Nouakchott, Dakar – Lagos – Algiers, and Nouakchott – Dakar, with potential extensions planned towards Madrid in Spain. Furthermore, the expansion of the old Rufisque Road holds the promise of improving the quality of life for nearby residents and alleviating urban congestion. As it traverses key agricultural zones, it also assumes a pivotal role in the transportation of oil and gas, underscoring its multifaceted and far-reaching impact on the region’s development.

IsDB and Partners Extends US$200m Murabaha Facility to the Development and Investment Bank of Türkiye (TKYB) to Support Post-Earthquake Recovery of Affected Businesses and SMEs

Istanbul – The relations between Türkiye and the IsDB Group continue to flourish. IsDB President Dr Muhammed Al Jasser saw fit to interrupt his presence at COP28 in Dubai by attending the 39th COMCEC Ministerial Meeting in Istanbul on 4th December 2023, where he was invited personally by host President Recep Tayyip Erdogan to deliver the keynote address.

Established in 1981, the Standing Committee for Economic and Commercial Cooperation of the Organization of Islamic Cooperation (COMCEC) is the principal multilateral economic and commercial cooperation platform serving the 57 OIC member states. Meeting annually in Türkiye, COMCEC serves as a pivotal forum to address and provide solutions to the economic challenges facing the OIC countries.

Dr Al Jasser emphasized the need for escalated investment and improved economic cooperation within the COMCEC Framework and outlined “a future vision centered on increased solidarity for shared prosperity, enhanced economic cooperation and integration, amplified investment in seamless connectivity infrastructure, and the development of human and institutional capacities, leveraging South-South Cooperation.”

In Istanbul, as part of the above escalated investment and financing strategy and the IsDB Group’s Food Security Response Programme (FSRP) and its Agri-food Support (PERAS) project in Türkiye, Dr Al Jasser also signed a US$200 million Murabaha financing agreement with the Development and Investment Bank of Türkiye (TKYB) to support post-earthquake recovery of affected businesses and SMEs in the affected regions. The PERAS project is designed to revitalize Türkiye’s agriculture and agri-food sectors in the 17 provinces most affected by the February 2023 earthquakes. This includes the enhancement of food security, support for resilient agricultural value chains, and promotion of sustainable farming and food production systems.

“Today marks a significant milestone in our enduring partnership with Türkiye,” stressed Dr Al Jasser. “With this US$200 million agreement, we are not just funding a project; we are investing in the resilient spirit of the Turkish people. This initiative is crucial in rebuilding and revitalizing the earthquake-affected areas, especially in the agriculture and agri-food sectors. Our solidarity with Türkiye in these challenging times is unwavering, as we collectively turn these challenges into opportunities for sustainable development and resilience. I am also happy that the IsDB has brought in our Strategic Partner-the OPEC Fund to join the IsDB Group in supporting this key project,” he added. Indeed, another financing partner in the initiative is the Islamic Trade Finance Corporation (ITFC), the trade fund of the IsDB Group.

Osman Çelik, Türkiye’s Deputy Minister of Treasury and Finance reminded that the “IsDB has been an important partner within the framework of our development agenda. We are very glad for our fruitful collaboration. Post-Earthquake Recovery and Agrifood Support Project will serve the earthquake-affected region by supporting the economic recovery of agriculture and the agri-food sectors.”

The funds, according to the IsDB will be used to support a range of initiatives within the PERAS project. These initiatives include rebuilding critical agricultural infrastructure, enhancing agri-food processing and distribution capabilities, and implementing innovative agricultural technologies to improve productivity and sustainability.

The investment is also aimed at developing robust market linkages to ensure the long-term viability and growth of Türkiye’s agricultural sector, thereby contributing to the overall economic recovery of the earthquake-affected regions.

ICIEC Provides 2-year BMP Policy Cover for US$210m Syndicated Murabaha Financing Arranged by ITFC for Egypt’s General Authority for Supply Commodities (GASC)

Cairo – The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), the Sharia’a-compliant multilateral insurer of the IsDB Group, provided a Bank Master Policy (BMP) to its IsDB Group sister entity, the Islamic Trade Finance Corporation (ITFC), the trade fund of the Group, to cover the risk of Non-Honouring of Sovereign Financial Obligation (NHSFO) of the Government of Egypt through the Ministry of Finance for a 2-year US$210 million Syndicated Murabaha Facility arranged by ITFC in October 2023.

ICIEC received a request from ITFC for a BMP of up to US$210 million. This insurance is to cover a Murabaha Syndicated Facility in which ITFC acted as the Bookrunner, Mandated Lead Arranger, and Agent. The syndicated facility is a collaborative effort among a consortium of banks aimed at financing the purchase of food commodities for the General Authority for Supply Commodities (GASC) in Egypt. Notably, the facility benefits from a guarantee provided by the Ministry of Finance of Egypt. As part of this arrangement, ICIEC’s policy will play a crucial role in mitigating non-payment risks associated with the Government of Egypt due to both commercial and political factors.

“ICIEC’s support to import strategically important essential commodities will help Egypt address the challenges related to food security. Importing food can help to strengthen Egypt’s relationships with other countries. This can lead to increased trade and investment, which can benefit both Egypt and the countries that it imports food from. That assists in meeting the United Nations SDG number 17, Partnerships for the Goals,” explained Oussama Kaissi, CEO of ICIEC.

Importing food commodities, he added, can help to reduce Egypt’s reliance on its own resources, such as water and land. This can help to conserve these resources and make them available for other uses, such as growing crops for export. That assists in meeting the United Nations’ SDG number 12, Responsible Consumption and Production.

“The transaction supports synergy with our sister entity the ITFC. The syndicated Murabaha Financing Facility amounting to US$210 million is in line with the objective of the Food Security Response Program (FSRP) of IsDB Group. ICIEC pledged an approval amount of US$500 million for FSRP during the period (July 2022- December 2025). Total approvals reached US$573 million, where Egypt’s share is US$100 million related to four policies with Cargill USA for the purpose of import grain and other soft commodities, he further added.

ITFC Concludes Two Murabaha Financing Agreements Totalling US$40m with Two Turkish Participation Banks – Vakif Katilim Bankasi and Ziraat Katilim Bankasi

Istanbul – The Islamic Trade Finance Corporation (ITFC), the trade fund of the IsDB Group, signed two Murabaha financing agreements totalling US$40 million with two of the top Turkish participation banks, Vakif Katilim Bankasi and the state-owned Ziraat Katilim Bankasi on 5th December 2023 during the COMCEC Economic Ministerial Meeting.

The allocated US$40 million, of which each bank will receive US$20 million, will be used to support the private sector and SME clients of Ziraat Katilim Bankasi and Vakif Katilim Bankasi in meeting their trade financing needs. The collaboration, said Eng. Hani Salem Sonbol, CEO of ITFC, aims to bolster the growth of the private sector and SMEs in Türkiye through the provision of Sharia’a-compliant Murabaha financing.

According to Mr Sonbol, “these agreements represent a significant step towards strengthening trade and economic activities in Türkiye. We are confident that our collaboration with Ziraat Katilim Bankasi and Vakif Katilim Bankasi will play a crucial role in fostering sustainable development and prosperity for the private sector and SMEs in the region.”

Malaysia’s Mortgage Securitiser Cagamas Berhad Continues Issuance Momentum with Aggregate RM4,180m (US888.13m) of Sukuk Issuances in November to Fund Purchase of Islamic Mortgages

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, one of the most prolific issuers of Sukuk, successfully concluded several fund-raising transactions in November 2023 through hybrid conventional bond and Sukuk issuances.

In the first transaction on 6th November 2023, Cagamas successfully concluded an aggregate of RM4.8 billion (US$1.02 billion) worth of funds first announced in October, the highest funds raised in a month year-to-date. The issuances comprised an RM180 million (US$38.24 million) 3-month Islamic Commercial Papers (ICPs), RM3.5 billion (US$740 million) multi-tenured Islamic Medium Term Notes (IMTNs), RM465 million multi-tenured Conventional Medium Term Notes (CMTNs), 1-year SGD150 million (RM520 million equivalent) Medium Term Notes and RM158 million through other funding avenues.

“The successful conclusion of our fund-raising activities in October albeit a period marked by global uncertainties in the fixed income market and extreme volatility arising from geopolitical tensions, reflect Cagamas’ commitment to support the domestic financial system. This underscores our role in providing liquidity to the primary lenders of home financing and housing loans as a secondary mortgage corporation,” said President/Chief Executive Officer, Kameel Abdul Halim.

“Strong demand from local and foreign investors also enabled the Company to price its issuances competitively above the corresponding Malaysian Government Securities,” he added. Proceeds raised from the above issuances are used to fund the purchase of Islamic home financing and conventional housing loans from the domestic financial institutions.

Cagamas and Bank Simpanan Nasional (BSN) also successfully concluded an affordable housing transaction totalling RM500 million (US$106.24 million). The transaction was funded by the issuance of Cagamas’ multi-tenured ASEAN Social Sustainable and Responsible Investment Sukuk (SRI Sukuk), comprising RM150 million (US$31.87 million) 1-year, RM100 million (US$21.25 million) 2-year, and RM250 million (US$53.12 million) 3-year SRI Sukuk, issued under Cagamas’ RM60 billion (US$12.75 billion) Conventional Medium Term Notes and Islamic Medium Term Notes programme (CMTN/IMTN Programme).

BSN’s commitment of RM500 million will be strategically utilised to support affordable housing initiatives, primarily focusing on the financing aspect. This strategic allocation aligns with BSN’s vision of fostering positive social change and contribution, and its unwavering dedication to sustainability.

According to Jay Khairil, Chief Executive of BSN, the Bank “recognises the critical role financial institutions play in addressing societal challenges, particularly in the context of affordable housing. Our substantial commitment to sustainable and responsible investments underscores our dedication to supporting the development of affordable housing solutions, and we believe that this initiative will contribute to a more sustainable and resilient future for all.”

The affordable housing transaction, comprising BSN’s home financing facilities namely Youth Housing Scheme (YHS) and Skim Rumah Pertamaku (SRP), has successfully met Cagamas’ eligibility criteria for affordable housing. Cagamas’ SRI Sukuk, which is assigned a Social Benefit rating of Tier 11 by RAM Sustainability Sdn Bhd, attracted a diversified pool of investors, including institutional investors, banks, and a statutory body, which enabled Cagamas to price its issuances competitively above the corresponding Malaysian Government Securities.

Commenting on the SRI Sukuk issuance, Kameel Abdul Halim added: “The issuance reflects resilience in our papers against persisting concerns stemming from global market conditions and economic uncertainties.”

To date, Cagamas has cumulatively issued RM3.4 billion worth of sustainability-related bonds and Sukuk under its CMTN/IMTN Programme. The fund-raising activities above bring the Company’s aggregate funds raised for the year to RM24.03 billion (US$5.11 billion). The SGD denominated bonds, issued via the Company’s wholly owned subsidiary, Cagamas Global P.LC. are fully and unconditionally guaranteed by Cagamas while the Ringgit issuances, which will be redeemed at their full nominal value upon maturity, are unsecured obligations of the Company, ranking pari passu with all other existing unsecured obligations of the Company.

Cagamas plays a major role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia. Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysian sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM413.76 billion (US$87.91 billion) worth of corporate bonds and Sukuk.

IILM Concludes 2023 Issuance Programme in November and December with Aggregate US$1.89bn Re/issuance of Short-Term A-1 Rated Sukuk over Several Tenors as Cumulative Issuances Since the Debut Offering in 2013 Crosses the US$100bn Mark

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), an international organisation that issues short-term Sharia’a-compliant financial instruments, successfully launched its eleventh and twelfth series of Sukuk issuances of 2023 on 7th November and 5th December 2023 with the reissuance of an aggregate US$1.89 billion short-term Sukuk in three tranches across three different tenors of one, three, and six months respectively.

The auction in November saw a subscription of US$1.1 billion, while the final auction of 2023 in December saw the orderbook reach US$790 million this concluding its issuance programme for the year.

“With the conclusion of today’s successful issuance,” said the Corporation, “the IILM has achieved year-to-date cumulative issuances totalling US$11.52 billion across 36 US dollar-denominated short-term Sukuk series and crossing the US$100 billion mark in total issuances since the organisation’s inception through 234 short-term Sukuk issuances ranging from 2-week to 12-month tenor, “reflecting the organisation’s ability to provide high quality Sharia’a compliant instruments and reliable offerings to both Primary Dealers and investors, as well as offering stability to the global Islamic liquidity market. Furthermore, the IILM’s Sukuk issuances during the year-to-date period accounts for approximately 20% of total global US dollar Sukuk issuances.”

The auction on 7th November 2023 comprised a reissuance of US$1.1 billion short-term Sukuk across three tranches and was priced as follows:

i) US$350 million of 1-month tenor certificates at a profit rate of 5.43%

ii) US$400 million of 3-month tenor certificates at a profit rate of 5.66%

iii) US$350 million of 6-month tenor certificates at a profit rate of 5.70%.

This latest auction in November 2023, according to the IILM, marked the 11th auction of the year and saw the Corporation successfully crossing the US$100 billion in total issuances since the organisation’s inception in 2010, and inaugural Sukuk issuance in 2013. According to the Corporation, the auction generated a robust demand from both Primary Dealers and investors with a combined orderbook of US$2.79 billion, representing an average bid-to-cover ratio of 254%.

Dr Umar Oseni, Chief Executive Officer of the IILM, commented: “We are very pleased with today’s incredibly successful auction, where we witnessed a healthy coverage ratio above 200% for all three tenors. Today’s issuance also signifies the IILM crossing the US$100 billion mark in total issuances since the organisation’s inception, demonstrating our commitment in providing Islamic financial institutions with access to high-quality liquid assets (HQLA) via our short-term Sukuk instruments on a consistent and regular basis.”

The International Islamic Liquidity Management Corporation (IILM), an international organisation that develops and issues short-term Sharia’a-compliant financial instruments, has successfully reissued a total of USD 790 million short-term Sukuk across three different tenors of one, three, and six-month respectively.

The International Islamic Liquidity Management Corporation (IILM), an international organisation that develops and issues short-term Sharia’a-compliant financial instruments, has successfully reissued a total of US$790 million short-term Sukuk across three different tenors of one, three, and six-month respectively.

The auction on 5th December 2023 comprised an issuance of US$790 million short-term Sukuk across three tranches and was priced as follows:

i) US$250 million of 1-month tenor certificates at a profit rate of 5.46%

ii) US$290 million of 3-month tenor certificates at a profit rate of 5.61%

iii) US$250 million of 6-month tenor certificates at a profit rate of 5.54%

With the December Sukuk reissuance, the IILM has successfully issued a total US$100.94 billion through 234 series in total issuances since the organisation’s inception in 2010, and inaugural Sukuk issuance in 2013.

In its twelfth and final auction for 2023, the IILM’s Sukuk reissuance witnessed a competitive tender among Islamic Primary Dealers and investors across the GCC markets as well as Asia, with a strong orderbook in excess of US$1.99 billion, representing an average bid-to-cover ratio of 252%.

Dr Oseni commented on the December auction: “With the conclusion of today’s successful issuance, the IILM has achieved year-to-date cumulative issuances totalling US$11.52 billion across 36 US dollar-denominated short-term Sukuk series and crossing the US$100 billion mark in total issuances since the organisation’s inception. Despite the prevailing volatile geopolitical climate and uncertainties in the market that we witnessed throughout the year, the IILM continues to explore innovative solutions to address the industry’s evolving Sharia’a-compliant liquidity management needs.”

The Corporation also continued its momentum with the 12-month tenor that was introduced in 2022, with its third and fourth series issued in June and October respectively, this year, with a combined value of US$540 million.

The IILM was also ranked fifth amongst the top Sukuk issuers globally and maintained its first position as a multilateral institution in the First Half of 2023, according to global data provider LSEG, with the highest monthly issuance size reaching US$1.2 billion in June this year. According to Dr Oseni, the IILM recorded several new investors during the year, from different countries and regions in the Middle East, Asia, Africa, and Europe, as the IILM Sukuk gains traction among different types of investors across the globe, with banks leading the pack, followed by government entities, pension funds, asset managers, as well as private banks.

Looking ahead into 2024, added Dr Oseni, the IILM will continue to focus on initiatives to enhance its issuance programme with new features, diversifying its investor base and thus, bolstering liquidity for the IILM Sukuk on the secondary market. The Issuance Calendar for 2024 will be released before the end of the year.

The IILM is a regular issuer of short-term Ṣukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. Both of the above Sukuk transactions were executed under IILM’s US$4 billion short-term Sukuk Issuance Programme. The Programme and IILM Sukuk are rated “A-1” by S&P Global and “F1” by Fitch Ratings.

The IILM’s short-term Sukuk programme has a current outstanding issuance size amounting to US$3.51 billion. The IILM’s short-term Sukuk is distributed by a diversified network of 10 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, and Standard Chartered Bank.