Türkiye Treasury Continues Fixed Rate Sukuk Al-Ijarah Issuance Momentum Through Two Transactions in September and October 2023 in the Domestic Market Raising an Aggregate TYR38.8bn (US$1.4bn)

Ankara – Turkish sovereign Sukuk issuance continued its momentum in September and October 2023 as the Turkish Treasury further consolidates its regular issuance of Sukuk Al-Ijarah in the domestic market. Since the return of the respected Mehmet Simsek as Türkiye’s Finance Minister in May 2023 following the re-election of President Recep Tayyip Erdogan, public debt issuance including Sukuk Al Ijara seems to have stabilised into a regular monthly pattern.

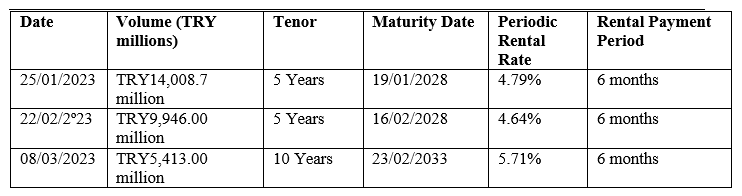

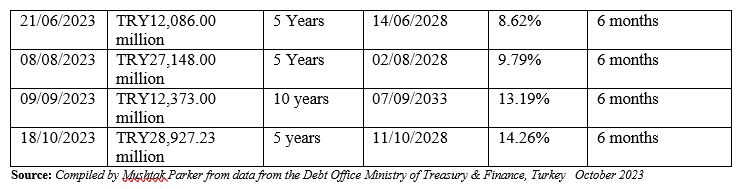

The Turkish Treasury raised TRY9,898.40 million (US$352.78 million) in an auction on 20th September 2023 through the issuance of 10 years Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 7th September 2033 priced at a fixed profit rate of 13.19% over a 6-month rental period. The total bids for this issuance amounted to TRY 12,373.00 (US$440.97 million).

In a second auction on 18th October 2023, the Turkish Treasury raised TRY28,927.23 million (US$1,030.96 million) through the issuance of 5 years Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 11th October 2033 priced at a fixed profit rate of 14.26% over a 6-month rental period. This brings the aggregate funds raised so far by the Turkish Treasury in the January-October 2023 period to TRY107,427.33 million (US$3,828.70 million) from the market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah).

These two latest auctions follow the one on 8th August 2023 when the Turkish Treasury raised TRY27,148.00 million (US$1,016.39 million) in a 5-Year transaction maturing on 2nd August 2028 and priced at a fixed profit rate of 9.79% over a 6-month rental period.

It also follows the forays of the Turkish Treasury in the US Dollar Denominated Fixed Rent Rate Lease Certificate (Sukuk Al-Ijarah) market. The Turkish Treasury raised an aggregate US$296.785 million through two Sukuk Al-Ijarah issuances – one in July and the other in August.

The transaction on 25th July 2023 raised US$132.734 million with a tenor of 728 days priced at a fixed rental rate of 3.00% over 6 months. The transaction on 25th August 2023 raised US$164.051 million also with a tenor of 728 days and priced at a fixed rental rate of 3.00% over 6 months. Demand for the certificates was robust. Both issuances were part of a hybrid fixed rate bond and Sukuk transaction. In the August 2023 issuance the Treasury raised US$2.4 billion through a bond issue compared with the US$164.051 million Sukuk Al-Ijarah. Both issuances mature on 22nd August 2025. The total demand for these issuances, according to the Turkish Treasury exceeded US$2.65 billion.

According to the Ministry, the lease certificates were issued “in order to increase domestic savings, broaden the investor base and diversify the Treasury’s borrowing instruments.” The latest Lease Certificate transactions were done through a direct sale auction on 18th September and 18th October respectively. The auctions were conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions is “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle wholly owned by the Ministry of Treasury & Finance, the obligor.

Dubai Luxury Realty Developer (DAMAC) Successfully Closes its Third Sukuk Issuance in the International Market in 2023 with a US$300m 3.5-year Senior Unsecured Sukuk Offering in October 2023

Dubai – DAMAC Real Estate Development Limited, the Dubai-based luxury apartment and real estate developer, successfully priced its latest Sukuk offering – a 3.5-Year US$300 million Senior Unsecured Reg S Sukuk – on 12th October 2023.

On 2nd October 2023, DAMAC had mandated Emirates NBD Capital, HSBC and J.P. Morgan (B&D) as Joint Global Coordinators for the transaction. They also acted as Joint Bookrunners with Abu Dhabi Commercial Bank, Dubai Islamic Bank, First Abu Dhabi Bank, GFH Financial Group, and Mashreq. The coordinators were mandated to arrange a series of investor calls and meetings with accounts in London, Europe, Asia, the Middle East and US Offshore accounts.

The Sukuk was issued by Alpha Star Holding VIII Limited, a DIFC incorporated special purpose vehicle wholly-owned by the Obligor, DAMAC.

According to DAMAC, the transaction received strong support from the global investor community with the book over-subscribed by 2.1 times. The transaction was eventually priced at a profit rate of 8.375% per annum due 12th April 2027. The Sukuk, according to the company, saw significant demand, reflecting DAMAC’s robust credit fundamentals and the confidence regional investors have in the company following its recent reorganisation and the positive credit ratings actions it received in 2022/2023. DAMAC is rated Ba2, with a stable outlook by Moody’s Investor Services and BB- with a positive outlook by S&P Ratings.

In October 2023, Moody’s assigned a Ba2 corporate family rating (CFR) and Ba2-PD

probability of default rating (PDR) to Damac Real Estate Development Limited, DIFC. Concurrently, Moody’s has also assigned a Ba2 backed instrument rating to the benchmark-sized senior unsecured Sukuk issued by Alpha Star Holding VIII Limited. The outlook on both entities is stable.

According to Moody’s, the rating of DAMAC is supported by:

i) The company’s market leading position in residential real estate development in Dubai as the largest privately owned property developer by number of units delivered.

ii) DAMAC’s track record of successfully navigating through real estate cycles since its inception in 2002, with very significant peak to trough declines from 2008 to 2010 and from 2014 to 2020.

iii) Strong off-plan sales with a sales backlog of AED42.0 billion (US$11.4 billion) as of August 2023, which creates good revenue visibility over the next 2-3 years.

iv) A track record of high pre-completion payment collections through real estate cycles, which helps fund construction without the need for project debt.

v) Strong profitability with gross margin of 44% for the twelve months ending in June 2023and generally above 35%.

vi) And prudent financial policies with a focus on cash flow generation and a target maximum debt to equity ratio of 50%.

DAMAC is a regular and proactive issuer of Sukuk. This is the company’s third Sukuk issuance this far in 2023. Prior to this latest offering, DAMAC issued a 2.25 Year US$200 million Senior Unsecured Reg S Sukuk on 15th February 2023 which was priced at a 7.5% profit rate per annum and maturing on 7th May 2025. This was followed by a 3-Year US$400 million offering in April 2023 priced at a profit rate of 7.75% per annum on 16th April, tighter than guidance price of around 7.875% released earlier as order books hit over US$1.15 billion. This brings the aggregate funds raised through three Sukuk issuances in 2023 to US$900 million.

DAMAC Real Estate Development reported interim net profit in June for first half 2023 of AED1.091 billion (US$296.93 million), an increase on the AED 477.255 million (US$129.865 million) for the same period in the previous year. Total assets reached AED29.8 billion (US$8.12 billion); Sukuk holdings totalled AED2.19 billion (US$595.03 million); and revenues reached AED2.53 billion (US$688.64 million) for the first half of 2023 respectively.

Sukuk issuers have been buoyed by encouraging reports from S&P Global and the IMF about the growth metrics and prospects for the UAE economy in 2023 and 2024. The UAE’s economy is expected to expand by 4% in 2024 and 3% this year, driven by strong growth in its non-oil sector, according to S&P Global. Key contributors to the country’s economic growth in 2024 include wholesale trade, industry, real estate, construction, financial services and tourism, as well as the oil and gas sectors, albeit the latter is beholden to the vagaries of the volatility of the market. The economic growth forecast is in line with projections from the UAE Central Bank, which expects the country’s economy to expand by 3.3% this year. The IMF in its latest update projects overall real GDP growth to be around 3.5% this year.

Dubai’s real estate sector is also expected to show “greater flexibility” with expectations for housing prices to stabilise in light of strong demand, added S&P. Dubai’s residential real estate prices rose 17% in the second quarter on an annual basis, marking the 10th consecutive quarter of expansion, amid strong demand and robust economic growth, according to a report by realty consultancy Knight Frank.

Islamic Development Bank Board Approves US$800m of New Funding to Support Development Projects in a Number of Member States

Jeddah – The Board of Executive Directors of the Islamic Development Bank (IsDB) approved a total of US$800 million new funding during its 352nd meeting on 9th September 2023 in Jeddah, Saudi Arabia, to finance critical projects to contribute in the development agenda of its member countries, improve the living conditions of its population and to enhance the attainment of the UN Sustainable Development Goals (SDGs).

IsDB President and Chairman of the Board of Executive Directors, Dr Muhammad Al Jasser, expressed optimism that the approved projects in key sectors such as energy,education, health, and transportation will ameliorate the socio-economic challenges of the population in IsDB member countries, especially those in vulnerable communities and will also accelerate the drive to achieve significant targets of the SDGs.

He also added that the Bank had made an emergency intervention to support the most

vulnerable people affected by the conflict in Sudan. “The IsDB and Islamic Solidarity Fund contributions will deliver a multisectoral emergency response and provide life-saving support to approximately 125,000 people affected by the sudden outbreak of conflict in Sudan,” Dr Al Jasser explained.

The financing of the projects, he added, is geared toward contributing to the development agenda and improving the living conditions of the population in IsDB member countries in line with the Realigned Strategic Goals of the IsDB Group’s revamped and unwavering commitment to supporting its member countries in their pursuit of prosperity and resilience, particularly during these challenging times.

The financing approved include:

i) EUR182.26 million to the Republic of Cote d’Ivoire to improve transportation in the region.

ii) EUR40.25 million to the Republic of Senegal to improve transportation in the region.

iii) US$40 million and EUR48.05 million to finance two projects related to improving the water, sanitation and health sectors in the Republic of Guinea.

iv) EUR46.57 million to Islamic Republic of Mauritania, to promote quality education in the country.

v) US$19.8 million to the Republic of Mozambique to promote quality education in the country.

vi) US$200 million to the Kingdom of Bahrain to boost electricity transmission and innovation in the energy and IT sectors.

vii) EUR61.9 million to the Federal Republic of Nigeria to boost electricity transmission and innovation in the energy and IT sectors.

viii) EUR128.17 million to the Republic of Togo to strengthen environmental resilience structures.

ix) US$1.5 million to the Republic of Sudan to support the most vulnerable people affected by the conflict in Sudan.

x) US$5.46 million IsDB and ISFD contribution to reduce food insecurity in member countries affected by fragilities and conflict through the Tadamon Accelerator for Food Security Response Programme.

ITFC Leads US$277m Syndicated Murabaha Facility for Turk Eximbank to Support the Access to Trade and Export Finance of SMEs and the Corporate Sector

Istanbul – The International Islamic Trade Finance Corporation (ITFC), the trade fund of the Islamic Development Bank (IsDB) Group, led a Syndicated Murabaha Facility worth US$ 277 million in favour of Turk Eximbank in accordance with its mandate of promoting trade among OIC member states.

The proceeds from the facility will be used to boost export-oriented SMEs and private sector businesses in Türkiye and offer Sharia’s-compliant trade financing solutions. The agreement is positioned to act as a catalyst for firms, providing them with the trade finance options they need to take advantage of opportunities in foreign markets. This facility, stressed ITFC, will boost the private sector’s ability to access trade finance funds by bridging the financial divide and supporting an environment favourable to economic growth and job creation.

Turkish Finance and Treasury Minister, Mehmet Simsek posted on social media: “Turk Eximbank, under the coordination of ITFC, the trade finance institution of the Islamic Development Bank (IsDB), with the participation of eight financial institutions from the Gulf region, secured US$277 million of one-year term foreign financing to support Turkish exports.” Türkiye’s steps in managing its economy has paved the way for attracting external financing.

Eng. Hani Salem Sonbol, CEO of ITFC commented: “As a long-term partner of Turk Eximbank, we share a common vision of supporting jobs and fostering socio-economic development in Türkiye. This new funding is intended to boost support for Turkish exporters, particularly SMEs, and will open up new possibilities for the growth of trade between Türkiye, OIC member nations, and its international trading partners. We are dedicated to making investments to assist Turkish and regional economic growth notwithstanding the global crisis and its challenges.”

Similarly, Ali Güney, General Manager of Turk Eximbank stressed that “as Turk Eximbank, being one of the main pillars of government’s export-led growth strategy and largest development bank in Türkiye, we will continue to work and further increase our efforts to support Turkish exporters. We consider ITFC our strategic partner on this front, and I am very pleased to see the strong relationship established between our institutions and we hope our cooperation will continue in the future.”

SAMA Commits to Development of Islamic Finance Sector in Saudi Arabia and to Support Industry Bodies as Islamic AUM Reaches SAR3.1 trillion (US$830 billion)

Jeddah – The Saudi Central Bank (SAMA) has pledged its commitment to support the Islamic finance sector and industry bodies including the Islamic Financial Services Board (IFSB), which held its 20th Anniversary Forum in the Kingdom in August 2023, to develop a resilient and sound Islamic finance market.

Ayman Al-Sayari, Governor of the Saudi Central Bank (SAMA) and Chairman of the IFSB Council, noted that the global Islamic finance sector has witnessed accelerated growth, with the value of its assets standing at over SAR11.2 trillion (US$3 trillion), displaying an average annual growth of 9.6% over the last 3 years.

“Saudi Arabia has a deep-rooted and historical relationship with Islamic finance. It houses the largest Islamic finance market in the world, with total Islamic assets across sectors exceeding SAR3.1 trillion (US$830 billion). The Islamic banking sector alone accounts for 33% of the global Islamic bank assets,” he told delegates at the IFSB Forum.

Al-Sayari also noted that Saudi Arabia is the largest sovereign Sukuk issuer in the world and its cooperative insurance sector is the fastest growing worldwide, with a growth rate approaching 27% in 2022. He asserted the importance of evaluating the soundness, resiliency and interlinkages of the industry sectors, including Islamic banking, capital markets and Islamic insurance.

Meanwhile, SAMA in September licensed several new companies in the finance and cooperative insurance sectors including Al-tizam for Electronic Insurance Brokerage and Altheqa Insurance Brokers to provide insurance aggregation services. This decision, according to the central bank, reflects SAMA’s endeavour to support the insurance sector, increase its financial efficiency, and promote innovative insurance services for financial inclusion in Saudi Arabia. With these two licenses, the number of authorized insurance aggregation companies operating in Saudi Arabia rises to five.

SAMA also licensed Intelligent Solutions to provide finance aggregation services to support the finance sector, increase efficiency of financial transactions, and promote innovative financial solutions for financial inclusion in Saudi Arabia. Finally, SAMA licensed Alhulul Al-Mubassatah Financial Company (SiFi) to provide E-wallet solutions. With SiFi, there are now 25 licensed companies offering payment services in Saudi Arabia, in addition to 7 companies that have obtained initial approval to operate within SAMA’s regulatory sandbox.

Saudi National Bank Extends SAR1,600m (US$426.53m) Murabaha/ Financing Facility to Saudi Advanced Petrochemical Company as Murabaha Facilities Flourish in Saudi Market in September 2023

Riyadh – The Saudi National Bank has extended a SAR1,600 million (US$426.53 million) Murabaha/Tawarruq financing facility to Saudi Advanced Petrochemical Company (SAPC) in September 2023. The facility has a tenor of five years and is guaranteed by a promissory note offered by SAPC. The proceeds of the facility will be used for general corporate purposes said SACP in a disclosure to Tadawul (the Saudi Stock Exchange).

In another transaction, Alrajhi Bank provided a SAR500 million (US$133.29 million) Murabaha financing facility to Elm Company. The facility has a tenor of 12 months and is guaranteed by a promissory note to the amount of total facilities limit. The proceeds of the facility, according to Elm Company, will be used to finance its working capital requirements and its bank guarantee facilities.

New Bank Negara Malaysia Govenor Abdul Rasheed bin Abdul Ghaffour and Deputy Governor Adnan Zaylani bin Mohamad Zahid Commence Their Terms of Office

Kuala Lumpur – Datuk Shaik Abdul Rasheed bin Abdul Ghaffour was appointed the new Governor of Bank Negara Malaysia for a five-year term effective 1 July 2023 to 30 June 2028. He succeeds Governor Tan Sri Nor Shamsiah Mohd Yunus, who completed her five-year term on 30 June 2023. Governor Abdul Ghaffour started his tenure on 1 September 2023.

Governor Shamsiah said: “It has been a privilege and honour to have led the Bank for the past five years. I am thankful for the opportunity to lead the Bank in service to the country, especially during such a tumultuous and critical period for the nation. I am confident that Rasheed is the right person to helm the exemplary leadership and exceptional commitment in discharging the responsibility as Governor and Chairperson of the Board.”

Datuk Abdul Rasheed joined the Bank in 1988, rising to the position of Deputy Governor in 2016. He graduated from Universiti Malaya with a Bachelor of Economics. He also holds an MBA from the Saïd Business School, Oxford University. Over the span of his career in the Bank, Datuk Abdul Rasheed has helmed various senior positions. He is currently a member of the Monetary Policy Committee and Financial Stability Committee, a position he has held since 2015.

Malaysian Prime Minister, Anwar Ibrahim, who is also the Minister of Finance, also appointed Encik Adnan Zaylani bin Mohamad Zahid as Deputy Governor for a three-year term effective 1 September 2023. As Deputy Governor, Encik Adnan Zaylani will oversee the Financial Markets and Development sectors. He will be a member of the Bank’s Board of Directors and continue to serve on various committees of the Bank, including the Management Committee and Monetary Policy Committees.

Encik Adnan Zaylani joined the Bank in 1994 and holds a Master of Public Policy from the Blavatnik School of Government, University of Oxford. He also holds a Master of Science in Global Market Economics and a Bachelor of Science in Economics from the London School of Economics and Political Science.

Throughout his 29-year career with the Bank, he has been involved in diverse areas of central banking ranging from investments and financial markets, foreign exchange policy, Islamic finance and financial sector development. He is currently the Chairman of the Financial Markets Committee, and a member of the Board Executive Committee of the International Islamic Liquidity Management Corporation, and the Board of Directors of International Centre for Education in Islamic Finance (INCEIF).

Arab National Bank Renews SAR2,098m (US$559.29m) Murabaha Financing Facility for SHL Finance Company to Expand its Business

Jeddah – Arab National Bank (ANB) renewed a big ticket Murabaha financing facility for the SHL Finance Company in September 2023. The proceeds from the SAR2,098 million (US$559.29 million) facility, which matures in April 2024, will be used to expand and increase the sales volume in line with the company’s strategy and future vision.

In a disclosure to Tadawul, SHL Finance confirmed that the agreement is a continuous transaction that is renewed annually and is carried out in the normal course of business and in accordance with prevailing commercial conditions and without any preferential terms.

The facility is guaranteed by a promissory note for the total amount of the facility and

assignment of receivables to cover 105% of the outstanding balance of the facilities.

Malaysia’s Mortgage Securitiser Cagamas Berhad Continues Issuance Momentum with Aggregate Hybrid RM300m (US$62.69m) of Green Sukuk/Bond Transaction in October 2023 in collaboration with Hong Leong Islamic Bank

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, one of the most prolific issuers of Sukuk, Hong Leong Bank, and Hong Leong Islamic Bank successfully concluded HLB’s green housing loans and financing (green assets) transaction worth a total of RM300 million (US$62.69 million).

The transaction was funded by the issuance of Cagamas’ one-year ASEAN Green Bond worth RM210 million (US$43.88 million) and one-year ASEAN Green SRI Sukuk worth RM90 million (US$18.81 million) (collectively, ASEAN Green MTNs) under Cagamas’ RM60 billion (US$12.54 billion) Conventional/Islamic Medium Term Notes programme.

The issuances of the ASEAN Green MTNs by Cagamas are Malaysia’s first corporate issuances relating to green housing loans and financing. The green housing assets comprise of green residential properties and buildings utilising GreenRE1 and Green Building Index (GBI)2 certifications as their qualifying eligibility criteria.

The GreenRE Certification is the “leading green building certification tool developed by the industry for the industry in Malaysia”, focusing on energy efficiency, water efficiency, carbon emission, environmental protection, indoor environmental quality and other green features.

The Green Building Index (GBI) says Cagamas is “Malaysia’s industry recognised green rating tool for buildings to promote sustainability in the built environment”, providing opportunities for developers and building owners to design sustainable buildings that reduce our impact on the environment”

This transaction stressed Cagamas, demonstrates Cagamas’ and HLB’s joint commitment to support not only the growth of green housing, but also the broader objective to transition to a low-carbon economy. Previously, Cagamas had collaborated with HLB to issue an ASEAN Sustainability Bond to fund the purchase of affordable housing loans in 2021.

According to Kevin Lam, Group Managing Director and Chief Executive Officer of HLB, the green assets transaction not only reinforces the Bank’s leading role in sustainable finance but also underscores its commitment to delivering value to customers, shareholders and the environment.

“We are currently witnessing a fundamental transformation in the way businesses operate where profitability must now align with the preservation of our environment. The increasing demand for green asset financing highlights the urgency of addressing climate impact and sustainability concerns. It also reflects a growing awareness that sustainable business practices are not just the right thing to do but also essential for long-term economic viability and environmental stewardship. We are pleased to work with Cagamas on our maiden green assets transaction and we look forward to expanding our collaboration to other types of financing,” said Lam.

Similarly, Kameel Abdul Halim, President/Chief Executive Officer of Cagamas Berhad stressed: “We are extremely pleased that our collaboration with HLB has resulted in our inaugural issuances of the ASEAN Green Bond and ASEAN Green SRI Sukuk to fund the purchase of eligible green assets. The purchase of these green assets not only contributes positively to our environment but also fortifies our essential role in the facilitation of liquidity within a developing green capital market. This practical step underlines our continued efforts as an intermediary in the secondary market, helping to support industry-led green initiatives to achieve their sustainability agenda. In collaborating with HLB, we are making a tangible contribution towards building climate resilience within the Malaysian financial sector while seamlessly executing our core mission.”

To date, Cagamas has cumulatively issued RM2.9 billion (US$610 million) worth of sustainability-related bonds and Sukuk under its RM60 billion Conventional/Islamic Medium Term Notes programme. Proceeds were channelled in accordance with the Cagamas Sustainability Bond/Sukuk Framework, which is aligned to internationally-recognised market principles, standards and best practices, to support the growth of Malaysia’s social and green finance market.

“As we mark this significant milestone, we hope to broaden our involvement in the green bond/Sukuk market and anticipate a sustained momentum to pave the way for a more impactful and continued supply of green bond/Sukuk issuances. We look forward to similar industry collaborations, which are aligned to Cagamas’ sustainability agenda, to enhance accessibility to affordable green homes and strengthen the green finance ecosystem,’’ added Kameel.

Cagamas plays a major role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia. The papers which will be redeemed at their full nominal value upon maturity, are unsecured obligations of the Company, ranking pari passu with all other existing unsecured obligations of the Company.

Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysian sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM408.46 billion (US$89.95 billion) worth of corporate bonds and Sukuk.

IILM Continues Consecutive Monthly Auction in September and October 2023 with an AggregateUS$2.58 billion Reissuance of Short-Term A-1 Rated Sukuk over Several Tenors

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), an international organisation that issues short-term Sharia’a-compliant financial instruments, successfully launched its ninth and tenth series of Sukuk issuances of 2023 on 5th September and 3rd October 2023 with the reissuance of an aggregate US$2.58 billion short-term Sukuk in three tranches across three different tenors of one, three, and six months respectively.

This transaction follows the eighth series of Sukuk issuances of 2023 in August with the reissuance of an aggregate US$1.15 billion short-term Sukuk in three tranches across three different tenors of one, three, and six months respectively.

The auction on 5th September 2023 comprised a reissuance of US$1.6 billion short-term Sukuk across three tranches and was priced as follows:

i) US$280 million of 1-month tenor certificates at a profit rate of 5.41%

ii) US$440 million of 3-month tenor certificates at a profit rate of 5.65%

iii) US$440 million of 6-month tenor certificates at a profit rate of 5.80%.

This latest auction, according to the IILM, marked the 9th auction of the year. According to the Corporation, the auction generated a robust demand from both Primary Dealers and investors with a combined orderbook of US$2.09 billion, representing an average bid-to-cover ratio of 180%.

The auction on 3rd October 2023 comprised a reissuance of US$980 million short-term Sukuk across three tranches and was priced as follows:

i) US$330 million of 1-month tenor certificates at a profit rate of 5.37%

ii) US$380 million of 3-month tenor certificates at a profit rate of 5.70%

iii) US$270 million of 12-month tenor certificates at a profit rate of 5.85%.

This latest auction, according to the IILM, marked the 10th auction of the year. According to the Corporation, the auction generated a robust demand from both Primary Dealers and investors with a combined orderbook of US$2.03 billion, representing an average bid-to-cover ratio of 223%.

Dr. Umar Oseni, Chief Executive Officer of the IILM, commented: “Today’s successful auction comes on the back of a continued challenging macro environment, as we remain in a ‘higher for longer’ reality on interest rates and tightening monetary policy. However, as the market enters the final quarter of the year, the IILM’s Islamic papers continue to gain solid momentum among a wide investor base searching for a safe return on their investments. We are pleased that the 12-month tenor Ṣukūk, which was issued for the fourth time since its introduction last year, received overwhelming demand with subscription level reaching 2.4 times the offered amount.”

The Sukuk transaction was executed under IILM’s US$4 billion short-term Sukuk Issuance Programme. The Programme and IILM Sukuk are rated “A-1” by S&P Global and “F1” by Fitch Ratings. Further to the above two reissuances, the IILM has achieved year-to-date cumulative issuances totalling US$9.63 billion through 30 Sukuk series. The IILM will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

The IILM is a regular issuer of short-term Ṣukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. Since its inaugural issuance in 2013, the IILM has issued a total of US$97.57 billion through 220 short-term Sukuk issuances ranging from 2-week to 12-month tenor, “reflecting the organisation’s ability to provide high quality Sharia’a compliant instruments and reliable offerings to both Primary Dealers and investors, as well as offering stability to the global Islamic liquidity market.”

The IILM’s short-term Sukuk programme has a current outstanding issuance size amounting to US$3.51 billion. The IILM’s short-term Sukuk is distributed by a diversified network of 10 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, and Standard Chartered Bank. The IILM short-term Sukuk programme is rated “A-1” by S&P and “F1” by Fitch Ratings.