Securities Commission Malaysia (SC) Launches FIKRA ACE Platform to Enhance the Islamic Capital Market Ecosystem by Facilitating the Development of Islamic Fintech Through a Structured Approach

Kuala Lumpur – The Securities Commission Malaysia (SC) launched on 27th June 2023 FIKRA ACE, a fintech initiative that aims to enhance the Islamic capital market (ICM) ecosystem by facilitating the development of Islamic fintech through a structured approach. FIKRA ACE, says the SC, is the latest manifestation of an enhanced, three-year initiative following the launch of the Commission’s inaugural Islamic fintech Accelerator Programme – FIKRA, in May 2021.

SC Chairman Dato’ Seri Dr. Awang Adek Hussin emphasised at the launch that “Malaysia has the capability to sustain a thriving Islamic fintech ecosystem by capitalising on its global leadership in the Islamic Capital Market. As we witness the remarkable growth and innovation in Islamic fintech, we are reminded of the potential it holds for both the Islamic finance industry and the broader global economy.”

Dr Hussin sees huge potential growth for Islamic fintech over the next few years, an opportunity the ICM can ill-afford to overlook. According to SC data, in 2021, Islamic fintech transactions in Organisation of Islamic Cooperation (OIC) countries totalled US$79 billion. While this represents a mere 0.8% of global fintech transaction volume, this segment is projected to grow to US$179 billion by 2026 at a projected 17.9% compounded annual growth rate (CAGR).

From a single accelerator approach, FIKRA ACE now consists of three components:

- Accelerator which is an Islamic-solutions focused accelerator programme;

- Circle, a networking platform to connect relevant stakeholders of the Islamic capital market and fintech industry and;

- Excel, a platform for collaborations with higher learning institutions for capacity building.

The initiative, says the SC, “will identify companies with fintech solutions to nurture, grow, and connect with the ICM ecosystem in various segments. The initiative also aims to support the Islamic fintech space by building capacity and a talent pipeline for the industry. For the 2023 cohort, three focus areas of FIKRA ACE are Islamic social finance (such as Zakat, Waqaf, Sadaqah), Shariah-compliant sustainable and responsible investment (SRI) and Islamic fund and wealth management.”

FIKRA ACE is organised in collaboration with the Malaysia Digital Economy Corporation (MDEC) as the ecosystem and strategic partner. The accelerator programme for the 2023 cohort is expected to commence in August.

Sukuk Issuance Has a Bright Future in Senegal as New Issuers Await Adoption of West African Economic and Monetary Union Regional Sukuk Regulatory Framework

Diamniadio Dakar – “The Islamic finance market is a very dynamic and growing financial market and Sukuk occupies an important place in its architecture. The Government of Senegal gives importance to debt fund-raising through Sukuk offerings,” emphasised Madame Oulimata Sarr, Minister of Economy, Planning & Cooperation of Senegal.

Financing by Sukuk, she added, has a bright future in Senegal because of the will of the Senegalese authorities to exploit its potential through the creation of a favourable legal framework that will allow the emergence of Islamic finance in our country. In addition, at the regional level, it will also be important to improve the legal framework for the Sukuk markets to facilitate access to the private sector and small businesses.

Madame Oulimata Sarr stressed, in an interview titled “Senegal and ICIEC – Empowering Real Economy, Driving Development Impact,” launched in a Special Report ceremony on 7th of July 2023 on the side line of the “Invest in Senegal Forum” in Diamniadio, Dakar, that the relationship between the Islamic Development Bank (IsDB) Group and Senegal is marked by real dynamism with cumulative approved financing of totaling some US$4.8 billion to date.

“We intend to rely more on the IsDB Group and its affiliates in order to achieve our development goals. In general, the strengthening of our cooperation with the IsDB should be accentuated around projects and programmes that fall within the framework of the Member Country Partnership Strategy (MCPS), based on the Global Value Chains approach. The aim is to identify high-impact projects that will stimulate the development of competitive industries in Senegal’s economy. Moreover, with this in mind, the Agribusiness and Petrochemical industries have been selected as Champion Industries within the framework of the MCPS, in accordance with the Adjusted and Accelerated Priority Action Plan (PAP2A) 2019-2023 and the Priority Action Plan III 2024-2028 of the Emerging Senegal Plan,” she stressed.

Since its creation in 1975, the IsDB Group has contributed significantly to the financing of development programmes in Senegal. “Our country is always seeking to benefit from the entire diversified range of financing offered by the IsDB as the parent company and its various sister entities, which are the Islamic Corporation for the Development of the Private Sector (ICD), the International Islamic Trade Finance Corporation (ITFC), Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC) and the Islamic Development Bank Institute (IsDBI),” she said.

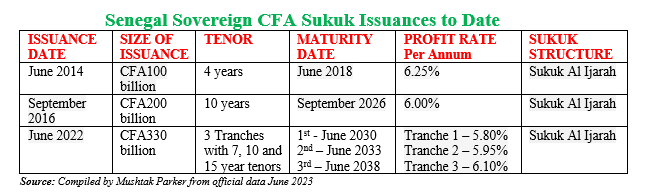

Minister Sarr maintained that Sukuk has experienced significant growth and development over the past few years. At the level of the West African Economic and Monetary Union (UEMOA), Islamic financial instruments have entered the regional market since 2014. However, she noted that despite the issuance of Sukuk on the regional financial market, there is not yet a specific regulatory framework for Sukuk in the UEMOA.

All Sukuk issuances offered to date in the market have been issued on the basis of Regulation No. 02/2010/CM/UEMOA relating to the Common Fund for the Securitization of Receivables and Securitization Operations in the UEMOA.

Senegal in fact pioneered the first sovereign Sukuk issuance in the region in 2014. Senegal in 2022 raised 330 billion CFA francs (US$560 million) through the Société de Gestion et d’Exploitation du Patrimoine Bâtiment de l’Etat (SOGEPA) as the issuer as the special financial vehicle. This transaction constitutes the mobilization of the first Sukuk issued, within the West African Monetary Union (UMOA), in accordance with the principles of Islamic finance by a corporate.

Over the past several years, ICIEC, the only Sharia’a compliant multilateral credit and investment insurer in the world, has supported numerous landmark transactions and projects in Senegal with an investment totalling US$3.6 billion through risk mitigation, credit enhancement solutions and guarantees. Notable projects include Blaise Diagne International Airport (AIBD SA), Stade du Sénégal (Abdoulaye Wade Stadium), Dakar Expo Center, the Market of National Interest, Hann-Fann Wastewater Collector, and the Dakar Truck Station.

“The ICIEC guarantees (and de-risking tools),” explained Minister Sarr, “have enabled the realization of several infrastructure projects in Senegal. ICIEC’s credit and investment insurance products play a major role in project risk mitigation, as they make them more attractive to investors. In addition, these products make it possible to ensure projects are more bankable with foreign investors who have a high-risk perception when it comes to investing in Africa or in developing countries.”

Despite their vital importance in project financing, insurance often contributes to the increase in the cost of a project, especially in Africa which suffers from an unfavorable and biased credit rating. “As you well know, the pricing of insurance premiums is partly based on a country’s credit rating and as rating agencies overstate risk on the continent, African countries find themselves paying very high premiums,” she noted.

As one of the most important development banks in the world, the IsDB Group, she urged, could play a key role with rating agencies “to change this perception of overvalued risk on the African continent. In addition, we are advocating with insurers such as ICIEC for a reduction in insurance premiums. In fact, lower insurance premiums would help reduce project costs on the continent and make the market more accessible to African private sectors.”

Turkish Treasury Raises TRY41.5bn (US$1.6bn) Through Four Fixed Rate TRY Lease Certificate Auctions in January-June 2023 to Help Improving Country’s Challenging Economic Fundamentals

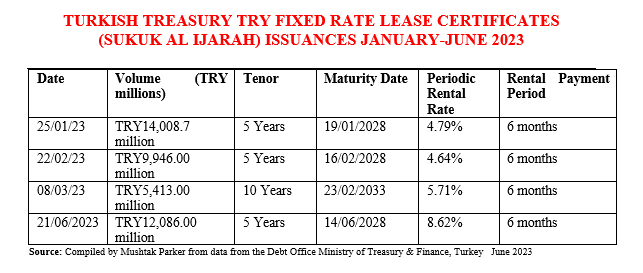

Ankara – The Debt Office of the Turkish Treasury and Finance Ministry is consolidating its regular issuance of Sukuk Al-Ijarah in the domestic market. In the first six months of 2023, the Turkish Treasury raised TRY41,453.7 million (US$1,573.51 million) from the market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah).

In January 2023, the Turkish Treasury raised TRY14,008.7 million (US$740.78 million) through a TRY 5-year Fixed Rate Lease Certificate (Sukuk al Ijarah) issuance. This was followed by a second auction on 22 February 2023 which raised TRY9,946.00 million (US$516.72 million) through a TRY 5-year Fixed Rate Lease Certificates (Sukuk al Ijarah); and a third transaction on 8 March 2023 which similarly raised TRY5,413.00 million (US$281.22 million) through a 10-year Fixed Rate Lease Certificate (Sukuk al Ijarah) issuance. On 21 June 2023, the Treasury raised TRY12,086 million (US$458.76 million) through a 5-year Fixed Rate Lease Certificate (Sukuk al Ijarah) issuance.

The January issuance has a tenor of 5 years maturing on 19 January 2028 and was priced at a fixed rental rate of 4.79% over a 6-month rental payment period. The February issuance too has a tenor of 5 years maturing on 16 February 2028 and was priced at a fixed rental rate of 4.64% over a 6-month rental payment period. The March issuance has a tenor of 10 years maturing on 23 February 2033 and was priced at a fixed rental rate of 5.71% over a 6-month rental payment period. This latest June 2023 issuance has a tenor of 5 years maturing on 14 June 2028 and was priced at a fixed rental rate of 8.62% over a 6-month rental payment period.

According to the Ministry, the lease certificates were issued “in order to increase domestic savings, broaden the investor base and diversify the Treasury’s borrowing instruments.” All three Lease Certificate issuances were done through a direct sale auction on 24 January, 21 February, 7 March 2023 and 21 June 2023 respectively. The auctions were conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions is “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle wholly-owned by the Ministry of Treasury & Finance, the obligor.

IsDB Signs US$1bn Cooperation MoU with Agence Française de Développement for Co-financing Green Projects in Global South

Vienna – The Islamic Development Bank (IsDB) signed a memorandum of understanding (MoU) with Agence Française de Développement (AFD) to cooperate and co-finance green and sustainable projects in member countries in the Global South for the period 2023-2028.

The MoU was signed on 20th June 2023 in Vienna by Dr. Muhammad Al Jasser, Chairman of the IsDB Group, and Mr. Rémy Rioux, Chief Executive Officer AFD, and aims to reinforce strategic and operational collaboration between the IsDB, and AFD, France’s leading bilateral aid provider. The collaboration will focus on project development and co-financing in developing countries, particularly IsDB member states in Africa.

“To illustrate our enduring partnership,” stressed Dr Al Jasser, “the IsDB and AFD recently co-financed a large water and sanitation project in Cotonou, Benin, with €89 million from IsDB and €40 million from AFD. We have also jointly committed to financing a large-scale programme in Nigeria focused on entrepreneurship, job creation, and support for the development of fast-growing industries.”

Under the MoU, the two entities have committed to a target of US$1 billion (US$500 million each) for the period, aimed at co-financing projects aligned with the UN Sustainable Development Goals (SDGs) and the Paris climate agreement. The priority sectors for investment, where there is a growing demand from developing countries, include climate and green finance, sustainable infrastructure and urban development, resilient and inclusive agriculture and food systems, education, health and social services for all, and private sector development.

According to Dr. Al Jasser, “AFD is one of IsDB’s long-standing partners, having co-financed the IsDB’s very first operation in 1976. Our partnership has since gone from strength to strength and yielded over US$4 billion in co-financing, supporting total investment worth over US$10 billion, mainly in the infrastructure sector. I am highly con>dent that the new Memorandum of Understanding AFD and IsDB signed today will give a new impetus to our partnership and collective support to mutual client countries towards the attainment of the Sustainable Development Goals.”

Mr. Rémy Rioux, CEO of AFD, stressed that the MoU rightly sets “financial objectives, priority sectors of collaboration and a basis for operational exchanges at regional hub levels as well as at general management levels, to achieve them. It is exactly what we aim to do at a larger scale in the Finance in Common Movement, representing 530 public development banks, be they bilateral, regional, multilateral or domestic, which can all contribute to redirect investment flows towards the SDGs.”

Sobha Realty Successfully Closes Inaugural 5-year US$300m Hybrid Murabaha/Wakala Sukuk at a Profit Rate of 8.75% per annum

Dubai – UAE-based Sobha Realty is another corporate to successfully tap the international market with a maiden Sukuk issuance in mid-July 2023 – a US$300 million 5NC3 Sukuk with a 5-year tenor maturing in 2028.

The hybrid Murabaha/Wakala Sukuk was issued by Sobha Sukuk Limited, an exempted company with limited liability incorporated in the Cayman Islands, on behalf of the obligor, PNC Investments LLC, and was priced at a profit rate of 8.75% per annum paid semi-annually.

Sobha Realty mandated Dubai Islamic Bank, Emirates NBD Capital, Mashreqbank, and Standard Chartered Bank to act as joint global coordinators to the transaction. They were also joined by Sharjah Islamic Bank to act as joint lead managers and bookrunners, and to arrange a series of investor calls with local and international accounts.

According to Sobha Realty, “this landmark achievement includes a call feature, making it the first of its kind for a GCC sub-investment grade benchmark-sized Sukuk. The issuance not only signifies a significant milestone for Sobha Realty but also for the entire industry.”

The Sukuk issuance garnered “exceptional investor diversification, with a notable participation from international investors. This achievement highlights Sobha Realty’s commitment to innovation and its ability to attract a diverse range of investors from around the globe.”

According to Ravi Menon, Co-Chairman of Sobha Realty, the successful issuance of the inaugural US$300 million Sukuk is a milestone accomplishment for the company and a testament “to our dedication to innovation and our capacity to entice investors from various parts of the world. We take immense pride in the confidence shown in us by the global investment community.”

The Sukuk certificates, rated Ba3 by Moody’s Investors Service and BB- by S&P Global Ratings, are listed on the International Securities Market of the London Stock Exchange, and the Official List of Securities of the DFSA.

Saudi National Bank (SNB) Signs Long-term SAR1.4bn (US$370m) Murabaha Credit Facility Agreement with Southern Province Cement Company (SPCC) to Fund New 5,000 t/d Cement Production Line

Jeddah – The Abha-based Southern Province Cement Company (SPCC) penned a SAR1.4 billion (US$370 million) Murabaha credit facility with Saudi National Bank (SNB) on 22nd June 2023, as big ticket Murabaha facilities with long-term tenors continue to flourish in the Saudi corporate finance market.

In a filing with Tadawul (the Saudi Stock Exchange), SPCC confirmed that the proceeds from the facility will be used to finance the construction of a cement production line with a daily capacity of 5,000 tonnes, and the infrastructure of another production line with the same capacity in Jazan Cement plant.

The facility has a tenor of 10 years with a grace period of 2 years and is guaranteed by a promissory note provided by SPCC to the value of the financing. The company is one of the largest cement producers in the Kingdom is engaged in the manufacture and marketing of cement, clinker and other cement-related products. SPCC, which operates plants in Jazan, Bisha and Tuhama in the Kingdom, got approval from its Board and shareholders in May 2023 to raise the financing.

Major shareholders include the Public Investment Fund (PIF), the sovereign wealth fund of the Kingdom, with 37.43%, and Hassana Investment Co. with 19.21%. The remainder of the shareholders include a range of minority shareholders comprising top asset management and investment firms.

The company reported net profits after Zakat and tax of SAR49 million in Q1 2023, down 43.68% on the SAR87 million in the same quarter in 2022, attributed largely to a decreased demand for cement and a rise in the cost of inputs. Total sales revenues during Q1 2023 amounted to SAR300 million, compared with SAR330 million for the same quarter of the previous year.

Saudi Real Estate Refinance Company Signs Housing Finance and Mortgage Securitisation Technical Cooperation Agreement with US’s Ginnie Mae to Support Affordable Housing and Mortgage Market

Jeddah – The Saudi Real Estate Refinance Company (SRC), the Sharia’a compliant mortgage finance and securitisation company owned by the Public Investment Fund (PIF), the Saudi sovereign wealth fund, signed a technical cooperation agreement in June 2023 with Ginnie Mae, a government-owned corporation operating within the US Department of Housing and Urban Development.

Under the agreement, the two entities would share policies and regulations in the housing finance sector. The collaboration is intended to support affordable housing and the mortgage market for citizens in both the US and the Kingdom of Saudi Arabia.

Established in 1968 under the National Housing Act, Ginnie Mae’s primary function is to provide government guarantees for mortgage-backed securities issued by private financial institutions. Currently, Ginnie Mae’s outstanding portfolio of mortgage-backed securities has reached approximately US$2.4 trillion, accounting for 25-30% of the U.S. mortgage market.

Saudi Real Estate Refinance Company (SRC) was established in 2017 by the Public Investment Fund (PIF) as part of the Kingdom’s Vision 2030 Housing Programme and aims to provide Sharia’a compliant refinancing and balance sheet management solutions to primary mortgage financiers, to increase the availability of affordable housing finance options for Saudi citizens.

Since its inception, SRC has actively participated in the capital markets through the issuance of Sukuk and accessing Murabaha financing through syndications, contributing to the development of the financial sector and supporting the economic diversification outlined in Vision 2030.

The Agreement is a non-legal binding collaboration that will cover three areas: 1) bilateral dialogues with housing finance regulatory and policy agencies; 2) roundtable discussions among experts on policies and financial and counter-party risk management; and 3) professional training/exchange on technical issues related to policy objectives, mortgage securitization, capital market risk management, real estate finance, and taxation.

Dammam-based East Pipes Company Signs SAR1.1bn Murabaha Credit Facility with Banque Saudi Fransi for Working Capital Requirements for Aramco, NEOM and PETROJET Projects

Dammam – The Dammam-based East Pipes Integrated Company for Industry (East Pipes) signed a SAR1.1 billion (US$290 million) Murabaha credit facility with Banque Saudi Fransi on 10th July 2023 with a tenor of 459 days.

East Pipes is a state-of-the-art manufacturer of Helical Submerged Arc Welded (HSAW) pipes. Its main production facility at Dammam, the Kingdom’s Second Industrial City, has a production capacity up to 500,000 tons of pipes annually that are used to transport Water, Oil and Gas, according to wide range of diameters of spiral pipes, supported by the double jointing unit, and a factory for coating all pipes of various sizes and lengths, with an annual production capacity of 4.5 million square meters.

In a filing with Tadawul (the Saudi Stock Exchange), East Pipes confirmed that the proceeds from the financing facility will be used towards funding the working capital requirements of some of the company’s projects recently signed with Saudi Arabian Oil Company (Aramco) as well as NEOM and PETROJET. The facility is guaranteed by a promissory note to the value of the credit amount of SAR1.15 billion.

Malaysia’s Mortgage Securitiser Cagamas Berhad Continues Issuance Momentum with RM3.21bn (US$710m) Hybrid Islamic/Conventional Transaction in July 2023

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, one of the most prolific issuers of Sukuk, continued its issuance momentum into 2023 with the successful pricing of an aggregate RM3.21 billion (US$710 million) worth of funds raised on 6th July 2023. This follows a similar hybrid transaction in June 2023 when Cagamas raised RM3.42 billion (US$740 million) worth of funds from the market. The transaction in July comprised a total of an RM3.21 billion (US$710 million) equivalent worth of funds raised, comprising a total of RM390 million 3-month funding via Conventional Commercial Papers (CCPs), RM100 million multi tenure ASEAN Sustainability Bonds, RM1.36 billion (US$300 million) multi tenure Islamic Medium Term Notes (IMTNs), RM850 million 3-year Conventional Medium Term Notes (CMTNs) and SGD150 million (RM511.95 million equivalent) 1-year Singapore Dollar Medium Term Notes (SGD EMTNs).

“Demand for investment grade papers, similar to Cagamas’, remain firm; while global markets continue to weigh in the prospect of longer than anticipated stiff monetary policy stance by the Federal Reserve. Proceeds raised from the issuances will be used to fund the purchase of housing loans and Islamic home financings from the domestic financial system, reflecting continued provision of liquidity by the Company to the domestic banking system,” said President/Chief Executive Officer, Datuk Chung Chee Leong.

Total funds raised in 2023 thus far by Cagamas stands at RM12.97 billion (US$2.86 billion). Year-to-date, Cagamas has concluded six SGD issuances and one HKD issuance, amounting to RM2.86 billion equivalent in foreign currencies, he added. The SGD denominated bonds, issued via the Company’s wholly-owned subsidiary, Cagamas Global P.L.C. are fully and unconditionally guaranteed by Cagamas while the Ringgit issuances, which will be redeemed at their full nominal value upon maturity, are unsecured obligations of the Company, ranking pari passu with all other existing unsecured obligations of the Company.

Cagamas plays a major role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia. The papers which will be redeemed at their full nominal value upon maturity, are unsecured obligations of the Company, ranking pari passu with all other existing unsecured obligations of the Company.

Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysian sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM407.43 billion (US$89.73 billion) worth of corporate bonds and Sukuk.

IILM Continues Consecutive Monthly Auction in July 2023 with an US$790 million Reissuance of Short-Term A-1 Rated Sukuk over Three Tenors

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), an international organisation that develops and issues short-term Sharia’a-compliant financial instruments, successfully launched its seventh series of Sukuk issuances of 2023 on 11th July with the reissuance of an aggregate US$790 million short-term Sukuk in three tranches across three different tenors of one, three, and six months respectively.

This transaction follows the sixth series of Sukuk issuances of 2023 on 10th June with the reissuance of an aggregate US$1.2 billion short-term Sukuk in three tranches across three different tenors of one, three, and twelve months respectively.

The auction on 11th July 2023 comprised a reissuance of US$790 million short-term Sukuk across three tranches and was priced as follows:

- US$350 million of 1-month tenor certificates at a profit rate of 5.23%

- US$230 million of 3-month tenor certificates at a profit rate of 5.62%

- US$210 million of 6-month tenor certificates at a profit rate of 5.70%

According to IILM, the auction generated a robust demand from both Primary Dealers and investors with a combined orderbook of US$1.56 billion, representing an average bid-to-cover ratio of 198%.

Despite the challenging global market conditions on the back of the US debt ceiling issues, the auction, according to IILM, saw a healthy coverage ratio across all tenors, signifying a sustained demand for the IILM’s Islamic liquidity management instruments by investors seeking high quality Sharia’a-compliant papers.

The Sukuk transaction was executed under IILM’s US$4 billion short-term Sukuk Issuance Programme. The Programme and IILM Sukuk are rated “A-1” by S&P Global and “F1” by Fitch Ratings. Further to the above two reissuances, the IILM has achieved year-to-date cumulative issuances totalling US$6.34 billion through 21 Sukuk series. The IILM will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

The IILM is a regular issuer of short-term Ṣukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. Since its inaugural issuance in 2013, the IILM has issued a total of US$93.84 billion through 211 short-term Sukuk issuances ranging from 2-week to 12-month tenor, “reflecting the organisation’s ability to provide high quality Sharia’a compliant instruments and reliable offerings to both Primary Dealers and investors, as well as offering stability to the global Islamic liquidity market.”

The IILM’s short-term Sukuk programme has a current outstanding issuance size amounting to US$3.51 billion. The IILM’s short-term Sukuk is distributed by a diversified network of 10 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, and Standard Chartered Bank. The IILM short-term Sukuk programme is rated “A-1” by S&P and “F1” by Fitch Ratings.