KFH Becomes First Islamic Bank to Sign a Women’s Empowerment Principles Agreement with UN Group Human Resources Department

Kuwait City – Kuwait Finance House (KFH), one of the pioneering Islamic banks established in 1978, signed the first Women’s Empowerment Principles agreement by an Islamic bank with the United Nations Group Human Resources Department on 9 March 2023.

The move is part of KFH’s commitment to implement the UN Sustainable Development Goals (SDGs) Agenda 2030. Zeyad Abdullah Al Omar, Group Chief Human Resources Officer at KFH, stressed that the endorsement of the UN Women’s Empowerment Principles are key drivers of business growth and sustainability, and as such essential to the growth of the Kuwait economy and societal progress.

“KFH,” he noted, “has provided a solid foundation, healthy environment and work culture and ethic, in which female employees can thrive and realise their full potential. Some 35% of women hold executive management posts and 55 employees in both the Middle & Senior Management at KFH are female.”

He pointed out that KFH is constantly reinventing itself to better serve its mission to foster positive change, meet customer satisfaction. “Undoubtedly, gender-balanced teams offer a competitive advantage and we are pleased to say that a successful work life balance by offering resources such as flexible hours, maternal and paternal leave,” added Al Omar.

In addition, KFH has provided equal access to education, training and acquiring new skills. The Bank also ensures equal pay for performing the same role and fair compensation for all employees regardless of gender.

Al Omar revealed that KFH is considering plans and practices to drive more empowerment of female employees and pledged “support to advance and invest in women empowerment to create an inclusive women-diverse resources, opportunities, skills development, productive and up-to-date training.”

California-based Air Lease Corporation Successfully Closes Maiden 5-year US$600m Benchmark Sukuk Issuance by a North American Corporate – the Largest Sukuk Issuance by a US-based Borrower

Los Angeles – Another sign of the increasing mainstreaming of Sukuk as a fund-raising instrument to issuers across the world is the inaugural Sukuk offering by Air Lease Corporation (ALC), a leading global aircraft leasing company based in Los Angeles, California that has airline customers throughout the world, on 15 March 2023.

ACL successfully completed its inaugural benchmark US$600 million Sukuk offering priced at a profit rate of 5.85% per annum. The trust certificates have a tenor of 5 years maturing on 1 April 2028. The Company will make semi-annual distributions of the profit rate under the Certificates, which were offered pursuant to Rule 144A and Regulation S under the Securities Act of 1933, as amended. The certificates are rated “BBB” by both S&P Global Ratings and Fitch Ratings with a Stable Outlook and are listed on the London Stock Exchange.

The transaction, according to Gregory B. Willis, Executive Vice President and Chief Financial Officer of ACL “represented the first ever offering of its kind into the Middle East market from a North American corporate and the largest Sukuk from a US-based borrower to date. This inaugural sukuk offering is a testament to ALC’s strong credit profile and further evidence of our commitment to a well-diversified, global funding programme. We are grateful to our banking partners for their commitment and support in structuring and executing this landmark transaction.”

ACL had mandated Bank ABC, Dubai Islamic Bank, Al Rayan Bank, Citi, Deutsche Bank, Emirates NBD, JPMorgan, KFH Capital and Warba Bank to act as joint lead managers and bookrunners to the transaction, and to arrange a series of investor meetings and calls with accounts in the GCC, UK, Europe, Asia and with Offshore US investors.

“We are proud to highlight the strong liquidity in this region (the Middle East) and the opportunity for other investment grade borrowers to raise funds at cost efficient rates. This transaction complements our strong airline relationships in the Middle East region and we look forward to further developing our funding presence in this region,” added Daniel Verwholt, Senior Vice President and Treasurer of Air Lease Corporation.

The Company intends to use the net proceeds of the offering for general corporate purposes, which may include, among other things, the purchase of commercial aircraft and the repayment of existing indebtedness.

According to Emirates NBD, the transaction attracted strong demand for the Sukuk certificates with the order book exceeding US$2.2 billion, allowing ALC to increase the offering to US$600 million from the planned US$500 million target. As such the profit rate was tightened by 30 basis points (bps) to 5.85%, at a spread of 185bps over US treasuries due to the robust order book.

The Sukuk offering, added Emirates NBD, was anchored by Middle Eastern investors who received 80% of the allocation. The Sukuk was priced flat to its existing conventional curve, attracting high-quality institutional investors outside the US, and diversifying ALC’s investor pool.

Emirates NBD Capital CEO Mohammad Al Bastaki is confident that “the robust over-subscription and the participation of high-quality institutional investors from the Middle East will support ALC’s efforts to diversify its investor base and reflects the high demand for Sharia’a-compliant issues outside the region. We expect this milestone issue will incentivise other non-regional issuers to consider sukuk issuances.”

ALC is the second largest aircraft leasing company globally, with total platform scale of over US$55 billion across its owned, managed and on order fleet. The company is principally engaged in buying commercial aircraft (from Airbus and Boeing and is considered their largest client) and leasing them to airline businesses in every major geographical region, spanning approximately 115 airlines across 61 countries. In addition, the company supplies fleet management and remarketing services to third parties.

ACL has a current portfolio of over 900 aircraft, catering for 17 customers in 62 countries. As of 31 March 2023, ALC’s fleet was comprised of 437 owned aircraft and 86 managed aircraft, with 376 new aircraft on order from Boeing and Airbus set to deliver through 2029. Aircraft investments in the quarter totalled approximately US$1.4 billion, including the proceeds from the US$600 million debut Sukuk.

Seattle-based Pentavirate Issues Debut 5-year US$100m Sukuk Al Ijara Targeting Acquisition of High-yielding Commercial Real Estate Focusing on Self-storage, Logistics and Senior Housing Assets

Seattle – Pentavirate, a Seattle-based global investment firm, is another US-based firm to raise funds through the issuance of Sukuk. The company issued its debut Sukuk on 20th February 2023 – a 5-year US$100 million Sukuk Al Ijara offering, backed by US commercial real estate.

“Pentavirate’s debut offering,” stressed Chad Gleason, Pentavirate Managing Director, “is part of an overall US$2 billion multi-series Ijara Sukuk Programme. The first series will target acquisitions of North America’s highest-yielding commercial real estate, focusing on self-storage, industrial logistics and senior housing. Our objective is to provide global investors with exposure to stable, Shariah-compliant assets in the United States.”

Danish Chotani, CEO of Burj Financial and Placement Advisor to Pentavirate in the Middle East, commented: “Sukuk statistics show that 90% of issuers and 80% of their investors are in the Middle East and Southeast Asia; thus far, there has been a lack of developed market issuances that allow investors with Sharia’a mandates to diversify their portfolios toward fixed-income assets in high-growth western economies. The few times these issuances have occurred, the intense demand has resulted in oversubscription.”

“The first series of our non-leveraged Ijara Sukuk,” he added, “will have a 5-year term, offering a coupon aligned with the underlying investment, plus an offering size that can adapt on demand. The first series is expected to be closed by Q2 of 2023.” The Sukuk has received an institutional rating of (A-) from EuroRating and Amanie Advisors from Malaysia is the Sharia’a Advisor to the transaction.

Pentavirate’s team has a successful track record in acquiring cash-flowing properties from owner-operators and then upgrading them to institutional-level performance for later disposition to Real Estate Investment Trusts (REIT) and fund managers.

Pentavirate is a full-service capital placement firm, specializing in risk-adjusted investment vehicles. Its current portfolio is over US$1 billion of estimated dry powder, while addressing the growing need for Sharia’a compliant investments.

“Our due diligence and analytics,” emphasised the company, “continue to point to acquisitions for self-storage, senior housing, and multifamily in secondary and tertiary North American markets as a stable securitization for our debt offering. These institutional-grade assets have gained strong interest from investors for their resilience to economic stressors year after year returns.”

IsDB Board Approve US$403m of New Development Financing for Egypt, Kyrgyzstan and Tajikistan for Three Projects in the Energy, Education and Transport Sectors

Jeddah – The Board of Executive Directors of the Islamic Development Bank (IsDB) in its 350th meeting held in Jeddah, Saudi Arabia on 1 April 2023 and chaired by IsDB President Dr Muhammad Al Jasser, approved US$403 million of financing for three infrastructure projects – one each in Egypt, Kyrgyzstan and Tajikistan – in support of socio-economic development and promoting sustainability in key sectors such as energy, education, and transport.

By far the largest part of the funding allocated – €318 million (US$344.5 million) – is the IsDB’s contribution towards Phase I of the Electric Express Train Project in Egypt. The objective of the project is to provide access to safe, affordable, accessible transport systems for all by developing a 660km sustainable, green, and climate-resilient electric express railway system. This project, according to the IsDB, is expected to benefit 25 million people annually and decrease Green House Gas (GHG) emissions by approximately 250,000 tons of CO2 annually.

The Board also approved an additional US$13 million financing for the Central Asia-South Asia Electricity Transmission and Trade Project (CASA-1000) in the Republic of Kyrgyzstan. The Bank had originally approved US$ 50 million towards this project. The project aims to meet the electricity demand in Afghanistan and Pakistan through the establishment of cross-border energy exchange among four IsDB member countries as part of the Bank’s regional economic integration strategy. Once operational, says the IsDB, the project will utilize efficient and environmentally friendly indigenous hydropower resources of Kyrgyzstan and Tajikistan, creating conditions for sustainable electricity trade between Central and South Asia.

The IsDB also allocated US$35 million for a third project, the IsDB/ISFD/GPE/OFID Project for Support for the Implementation of the National Education Development Strategy of Tajikistan (Phase II). The Islamic Solidarity Fund (ISFD), the social development fund of the IsDB Group, is contributing US$ 10 million towards the project, which aims to improve the learning environment and facilitate system strengthening for the country’s sustainable implementation of an inclusive, competency-based education system.

According to Dr Al Jasser, “the transformative projects approved will have a significant impact on improving transportation, education, and energy, as well as promoting regional economic integration and addressing emergency situations. The IsDB Group remains committed to supporting its member countries in their pursuit of prosperity and resilience, particularly during these challenging times.”

ITFC Signs Three Trade Finance Agreements in March 2023 Totalling US$280m with Tunisian Energy and Petrochemical Entities

Tunis – The International Islamic Trade Finance Corporation (ITFC), the trade fund of the IsDB Group, signed three trade finance agreements in March 2023 totalling US$280 million with the Tunisian Electricity and Gas Company, the Tunisian Company for Refining Industries (STIR), and the Tunisian Chemical Complex (Groupe Chimique Tunisien).

The financing, according to ITFC, is to support energy security in Tunisia, to revitalize its industrial sector, and to support trade between Tunisia and Sub-Saharan African countries. The agreements were signed by Eng. Hani Salem Sonbol, CEO of ITFC, with CEOs of the three entities in the presence of Samir Saied, Minister of Economy and Planning and Ms. Neïla Nouira Gongi, the Minister of Industry, Mines and Energy.

The three trade finance transactions comprised a €120 million Murabaha facility to the Tunisian Electricity and Gas Company to finance the import of natural gas; a US$100 million Murabaha facility to the Tunisian Company for Refining Industries to finance the import of crude oil and petroleum products; and a US$50 million Murabaha facility to Groupe Chimique Tunisien to finance the import of raw materials for the pharmaceutical industry.

ITFC also signed an MoU with the Technological Pole Sidi Thabet to cooperate in implementing training programs and capacity building in the field of biotechnology applied in health and pharmaceutical industries under the framework of the Arab-Africa Trade Bridges (AATB) Programme (AATBP).

According to ITFC CEO, Eng. Hani Salem Sonbol “The Corporation remains committed to building on its successes to be a greater catalyst for trade development among OIC member countries. The support provided to Tunisia is part of this commitment to strengthen local and regional economies through the advancement of trade and the provision of trade finance solutions, technical assistance and trade development support.”

Since its inception in 2008, ITFC has provided a total financing of US$2 billion to Tunisia to cover the strategic energy and commodities sectors. ITFC has also sought to support the development of relations between Tunisia and Africa and other Arab countries by accelerating trade exchanges and financing the commercial infrastructure within the framework of the Arab-Africa Trade Bridges Programme (AATBP).

SRC Signs Landmark SAR5bn (US$1.33bn) Mortgage Portfolio

Purchase Agreement with Alrajhi Bank to Further Support Develop-ment of Housing Finance and Mortgage Securitisation in the Kingdom

Riyadh – The Saudi Real Estate Refinance Company (SRC), the Sharia’a compliant mortgage finance and securitisation company wholly owned by the Public Investment Fund, signed a portfolio purchase agreement with Alrajhi Bank, the world’s largest Islamic bank in terms of assets and market cap, on 19 March 2023 to refinance SAR5 billion (US$1.33 billion) of the Bank’s real estate financing portfolio.

The deal, the largest signed in the Saudi banking industry of its kind, reflects the ongoing efforts by SRC to actively support further development in the residential real estate finance sector by expanding its refinancing portfolio, and its solutions to create a stable secondary real estate market in the Kingdom.

This is the latest agreement in a series of similarly significant deals to support mortgage financiers and originators in order to broaden Saudi citizens’ access to more affordable and flexible home financing solutions that suit their needs. Through these agreements, SRC and its other counterparts, provide liquidity, capital management and balance sheet de-risking solutions to enhance real estate financiers and originators’ financing capacity which ultimately leads to increasing demand for home ownership in the Kingdom.

In January 2023, for instance, Saudi Home Loans Company (SHLC), one of the largest Islamic mortgage finance companies in the Kingdom, raised two Tawarruq finance facilities totalling an aggregate SAR815 million (US$ 217.11 million). The first facility is for SAR500 million (US$133.19 million) with a 5-year tenor provided by Arab National Bank. The second facility – a 3-year SAR315 million (US$83.91 million) facility (comprising SAR300 million in Tawarruq Finance and SAR15 million in the form of a Treasury Product) – was provided by Riyad Bank.

The proceeds from both facilities, stressed SHLC, is to expand and increase the company’s sales volume through new originated loans to its customers, in line with the company’s strategy and future expansion plans.

There is no doubt that SRC is setting the pace in the mortgage finance and securitisation sector. In February 2023, the Company announced that it will be lowering the mortgage benchmark curve (the Long-Term Financing Rate –LTFR-) by 26 basis points for mortgage tenors from 20 to 30 years. The rates for mortgages shorter than 20 years is maintained.

According to Fabrice Susini, CEO of SRC, by reducing the long end of the mortgage rates in a rising global interest rate environment, SRC continues to support the development of a robust mortgage market and its liquidity. “This reduction in longer tenor of the LTFR mortgages, which actually reflects the observations of the rates, is a testament to our commitment to enhancing sensibly market liquidity, providing capital and risk management solutions to originators and lenders, and increasing home financing affordability to support access to homeownership for Saudi citizens,” he added.

To Susini “the agreement with Alrajhi Bank is also significant milestone in our strategic approach to help accelerate growth in the Kingdom’s thriving housing market. It is part of our strategic partnerships with leading financiers and originators which underpin our efforts to develop a best-in-class secondary mortgage market in the kingdom. In addition, by providing our solutions, we continue to help accelerate the growth of affordable home financing and expanding citizens’ access to homeownership, in line with Vision 2030 goals.”

Similarly, Waleed Abdullah Almogbel, CEO of Alrajhi Bank, stressed that “this significant deal and our strategic partnership with SRC support our ongoing joint drive to offer customers more access to flexible and affordable home financing solutions. The deal with SRC strategically enhances our mortgage solutions and supports our established capabilities to address the needs of a broad customer base and the increasing demand for home ownership in the Kingdom.”

Turkish Treasury Raises TRY29,367.7m (US$1,525.71m) Through Three Fixed Rate TRY Lease Certificate Auctions in January-March 2023 to Help Improving Country’s Dire Economic Fundamentals

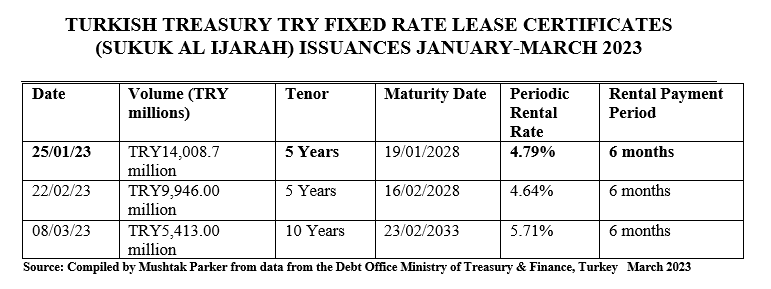

Ankara – The Debt Office of the Turkish Treasury and Finance Ministry is consolidating its regular issuance of Sukuk Al-Ijarah in the domestic market. In the first three months of 2023, the Turkish Treasury raised TRY29,367.7 million (US$1,525.71 million) from the market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah).

In January 2023, the Turkish Treasury raised TRY14,008.7 million (US$740.78 million) through a TRY 5-year Fixed Rate Lease Certificate (Sukuk al Ijarah) issuance. This was followed by a second auction on 22 February 2023 which raised TRY9,946.00 million (US$516.72 million) through a TRY 5-year Fixed Rate Lease Certificates (Sukuk al Ijarah); and a third transaction on 8 March 2023 which similarly raised TRY5,413.00 million (US$281.22 million) through a 10-year Fixed Rate Lease Certificate (Sukuk al Ijarah) issuance.

The January issuance has a tenor of 5 years maturing on 19 January 2028 and was priced at a fixed rental rate of 4.79% over a 6-month rental payment period. The February issuance too has a tenor of 5 years maturing on 16 February 2028 and was priced at a fixed rental rate of 4.64% over a 6-month rental payment period. The March issuance has a tenor of 10 years maturing on 23 February 2033 and was priced at a fixed rental rate of 5.71% over a 6-month rental payment period.

According to the Ministry, the lease certificates were issued “in order to increase domestic savings, broaden the investor base and diversify the Treasury’s borrowing instruments.” All the three Lease Certificate issuances were done through a direct sale auction on 24 January, 21 February and 7 March 2023 respectively. The auctions were conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions is “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle wholly-owned by the Ministry of Treasury & Finance, the obligor.

Malaysia’s MBSB Bank Launches Sharia’a Compliant Trade Finance Mobile App to Provide Customers a Seamless Trade Finance Service and to Boost Business Exponentially

Kuala Lumpur – Malaysian Islamic bank, MBSB Bank, launched a trade finance mobile application named ‘M TRADE Mobile App’ in March 2023 which it says is a “Sharia’a compliant mobile application that can be downloaded into all mobile devices from Apple App Store or Google Play.”

According to MBSB Bank, M TRADE Mobile App provides greater convenience and gives access through a one-stop solution that offers mobile trade finance features such as instant online request via scan upload and document pick-up, real time info on facility limit and transaction status.

“M TRADE Mobile App,” emphasised MBSB Bank Group Chief Executive Officer, Datuk Nor Azam M. Taib, “allows users to manage their trade finance transactions seamlessly thus providing convenience to our trade finance customers who are always on-the-go. With fingerprint and facial identification interface, it also gives business owners the peace of mind knowing that their business information is guarded. Its engaging and user-friendly interface is intended to help users to quickly understand the features and to best manage their finances.”

MBSB Bank’s trade finance portfolio stood at RM1.8 billion (US$410 million) in 2022. Datuk Nor Azam and we are confident that the M TRADE Mobile App, will not only provide greater convenience to the Bank’s trade finance customers, but will also act as one of the key enablers for both, the customers and the Bank to grow the business exponentially.

MBSB Bank is also enhancing its digitisation and sustainable finance strategies. In January the Bank signed a Memorandum of Understanding (MoU) with 59 Inc Sdn Bhd to finance sustainable mixed development project with a gross development value of RM850 million.

According to MBSB Bank’s Head of Corporate Banking Division, Noor Hanim Ahmad Kushairi, “as an Islamic financial institution, we understand the importance of implementing sustainable framework in our organisation which is why we offer green financing to reduce the adverse impact of climate change. For last year alone, we have approved over RM500 million in green financing, to both SMEs and large corporate clients.”

Malaysia’s Mortgage Securitiser Cagamas Continues Issuance Momentum with Combined RM715m (US$162.39m) Islamic and Conventional Medium-Term Notes Offerings in March 2023

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, one of the most prolific issuers of Sukuk, continued its issuance momentum into 2023 with the successful pricing of two-tenor Sukuk issuances in March 2023.

Cagamas Berhad successfully closed a combined RM715 million (US$162.39 million) worth of issuances on 13 March 2023, comprising 1-year Variable Rate Notes (VRNs), 3-year Islamic Medium-Term Notes (IMTNs) and 5-year IMTNs. Proceeds from the issuances will be used to fund the purchase of house financing from the domestic financial system.

In February 2023, Cagamas Berhad successfully closed the issuance of RM120 million (US$26.86 million) two-year Islamic Medium-Term Notes (IMTNs).

“The 3-year and 5-year IMTNs were successfully concluded via book building exercises which allowed the Company to achieve a final book-to-cover ratio of 2.0 times and 5.0 times respectively, with participation from a diversified pool of investors including corporates, insurers, financial institutions and a sovereign fund. The issuances bring the total funds raised for the year to RM2.74 billion (US$620 million),”

said President/Chief Executive Officer, Datuk Chung Chee Leong.

Cagamas plays a major role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia.

The papers which will be redeemed at their full nominal value upon maturity, are unsecured obligations of the Company, ranking pari passu with all other existing unsecured obligations of the Company.

Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysian sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market.

Since incorporation in 1986, Cagamas has cumulatively issued circa RM366.3 billion (US$83.19 billion) worth of corporate bonds and Sukuk.

IILM Continues Consecutive Monthly Auction in March 2023 with a US$1.09bn Reissuance of Short-Term A-1 Rated Sukuk over Three Tenors

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), an international organisation that develops and issues short-term Sharia’a-compliant financial instruments, successfully launched its third Sukuk issuance of 2023 on 7 March 2023 with the reissuance of an aggregate US$1.09 billion short-term Sukuk across three different tenors of one, three, and six-month respectively.

In February 2023, the IILM reissued an aggregate US$920 million across three different tenors of one, three, and six-month respectively.

The auction on 7 March 2023 comprised three tranches and was priced as follows:

- US$360 million of 1-month tenor certificates at a profit rate of 4.9%

- US$330 million of 3-month tenor certificates at a profit rate of 5.0%

- US$400 million of 6-month tenor certificates at a profit rate of 5.09%.

The Sukuk were issued under the IILM’s US$4 billion short-term Sukuk Issuance Programme. IILM Sukuk are rated “A-1” by S&P Global and “F1” by Fitch Ratings. According to IILM, the auction generated a robust demand from both Primary Dealers and investors with a combined orderbook of US$1.91 billion, representing an average bid-to-cover ratio of 175%.

Further to today’s reissuance, the IILM has achieved year-to-date cumulative issuances totalling US$2.79 billion through nine Sukuk series. The IILM will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

The IILM is a regular issuer of short-term Ṣukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. Since its inaugural issuance in 2013, the IILM has issued a total of US$91.29 billion through 202 short-term Sukuk issuances ranging from 2-week to 12-month tenor, “reflecting the organisation’s ability to provide high quality Sharia’a compliant instruments and reliable offerings to both Primary Dealers and investors, as well as offering stability to the global Islamic liquidity market.”

The IILM’s short-term Sukuk programme has a current outstanding issuance size amounting to US$3.51 billion. The IILM’s short-term Sukuk is distributed by a diversified network of 10 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, and Standard Chartered Bank. The IILM short-term Sukuk programme is rated “A-1” by S&P and “F1” by Fitch Ratings.