Turkish Treasury conducts three domestic Sovereign Sukuk Al Ijarah auctions in January and February 2022 of CPI indexed lease certificates, fixed rate lease certificates and gold-backed lease certificates

Ankara – The Debt Office of the Turkish Treasury and Finance Ministry held two auctions of lease certificates in the first two months of 2022.

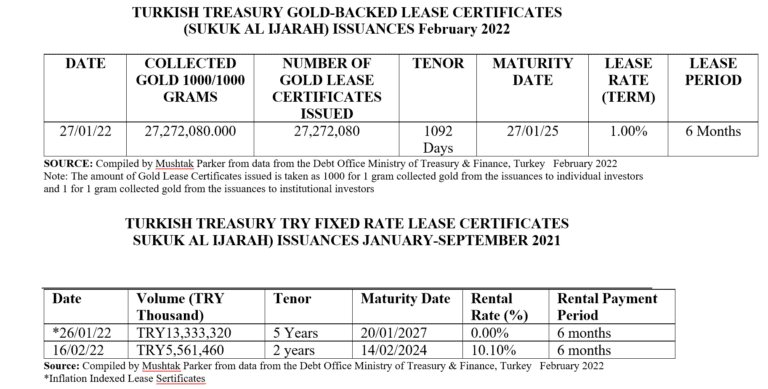

The first transaction raised TRY13,333.32 million (US$910 million) through CPI Indexed Lease Certificate issuance (Sukuk Al Ijarah) through a direct sale auction on 26 January 2022 of its latest fixed rate CPI Indexed lease certificates (Sukuk Al-Ijarah) offerings. The auction was conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems). The issuance has a tenor of 5 years maturing on 26 January 2027 and was priced at a fixed rental rate of 0.0 %.

In the second transaction the Debt Office of the Turkish Treasury and Finance Ministry raised TRY5,561.46 million (US$378.12 million) through a TRY 2-year Fixed Rate Lease Certificate (Sukuk al Ijarah) issuance on 16 February 2022.

The Lease Certificate issuance was done through a direct sale auction conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems). The issuance has a tenor of 2 years maturing on 14 February 2024 and was priced at a fixed rental rate of 10.10% over a 6-month rental payment period.

The Turkish Treasury is a proactive issuer of lease certificates (Sukuk Al-Ijarah) as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates/bonds, FC denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury is that it is issuing the lease certificates “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments.”

In a third transaction on 21 January 2022 the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 1,092 days maturing on 27 January 2025 and priced at a Lease Rate of 1.0 % payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 27,272,080.000 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 27,272,080 gold lease certificates (at a nominal value). The amount of Gold Lease Certificates issued, according to the Treasury, is taken as 1000 for 1 gram collected gold from the issuances to individual investors and 1 for 1 gram collected gold from the issuances to institutional investors.

The direct sale auction of its latest Gold-backed Lease Certificates (Sukuk Ijarah) offering was conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems).

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a wholly-owned special purpose vehicle owned by and on behalf of the obligor, the Ministry of Treasury & Finance. The Ministry of Treasury & Finance issues these gold-backed lease certificates “to diversify borrowing instruments, broaden the investor base and bring the idle gold into the economy.”

According to Turkish Finance Minister Lütfi Elvan “citizens are provided with a safe investment tool for gold savings. With the gold bond and gold-denominated lease certificate issuance through five banks, our citizens will win themselves and contribute to the economy.” Investors will be paid TL-denominated returns on a semi-annual basis indexed to the gold price. On maturity, according to the Treasury, investors may request the principal payment as 1 kilogram of gold bar (produced by refineries) or Republic Gold Quarter Coins printed by the Turkish State Mint.

Saudi Central Bank reports a 55% increase in electronic payments in Saudi retail sector as electronic payment Infrastructure expands

Riyadh – Another sign of the proliferation of FinTech in the Saudi financial and payments sector is the fact that the share of electronic payments in retail has exceeded 57% of total transactions conducted in 2021, surpassing the 55% target set out by the Financial Sector Development Program (FSDP), one of the main programmes of Saudi Vision 2030.

According to Fahad Almubarak, Governor of the Saudi Central Bank (SAMA), the central bank is working on promoting the electronic payment solution infrastructure, expanding electronic payment activities and accelerating the electronic transformation of transactions, under the FSDP and SAMA’s strategic plans for the payments sector, primarily aiming to reduce dependency on cash, and increase the rate of electronic payments to 70% by 2025.

Almubarak also noted that joint efforts between the government and private sectors to increase payment choices and implement various payment digitization initiatives including opening financial services to a new class of FinTech stakeholders in the Kingdom.

SAMA also stressed that the number and value of payments made through the National “Mada” payment system has exceeded 5.1 billion transactions during 2021 for a growth rate of 81% compared to growth of 76% recorded in 2020. SAMA also observed a sizable increase in the number of PoS terminal numbers and commercial sector coverage reaching more than a million PoS terminals were deployed by the end of 2021 compared to 721,000 terminals deployed by the end of 2020.

Contactless Payments (NFC) methods also witnessed a big increase in utilization as they accounted for 95% of all PoS transactions in 2021, alongside other electronic payment methods such as e-commerce payments, “SADAD” system payments and the new Instant Money Transfer through “Sarie” system, and others.

Additionally, corporate payments in the business sector have marked a significant increase in electronic payments, with 84% of the sector’s total payment transactions being electronic in 2021, compared to just 51% in 2019, marking a 65% increase in electronic payment share during these past two years. Results have also shown that major corporations rely on electronic payments to complete 99.6% of their transactions, while the same metric stood at 78% for SMEs transactions and 76% for those of micro enterprises.

Sharia’a compliant retail and corporate financing overwhelmingly dominate the Kingdom’s commercial banking landscape.

Credit Suisse and Mashreqbank arrange hybrid US$343.5m syndicated conventional and Islamic credit facility for Pakistan Ministry of Finance

Karachi – The Pakistan Ministry of Finance raised US$343.5 million in a hybrid syndicated conventional and Islamic credit facility in February 2022.

The conventional facility was arranged by Credit Suisse (Singapore Branch) and Mashreqbank, and the Islamic tranche by Mashreq Al Islami, the Islamic banking division of Mashreqbank, who both acted as the lead advisers and the mandated lead arrangers and bookrunners to the respective tranches.

The financing comprises a syndicated conventional facility of US$165.5 million, reflecting an upsize of US$43 million, and an Islamic facility of US$178 million, reflecting an upsize of US$30 million. It was oversubscribed 1.7 times due to strong demand from the syndicated loan market.

The facility has a tenor of 1 year and the proceeds from the facility will be used by the Ministry of Finance to support its balance-of-payments requirements and/or finance the import of crude oil and petroleum products by its oil importing entities.

Saudi corporates access US$814.77m in Murabaha facilities in February/March 2022

Jeddah – Saudi corporates continue to access Islamic financing facilities from the market with several agreements signed in February/March 2022. Some US$814.77 million in Murabaha facilities were extended in the period to four Saudi corporates.

Al Moammar Information Systems Co. (MIS), a regular user of Islamic corporate finance, in early March renewed a SAR1.699 (US$450 million) Murabaha facility extended by Banque Saudi Fransi.

The 1-year facility is secured by a Promissory Note provided by MIS to the amount of the total facilities. In a filing with Tadawul (the Saudi Stock Exchange), MIS said that the proceeds from the facility will be used to finance projects and the issuance of bank letters of credit and guarantees.

In another transaction, Amlak International Real Estate Finance Company similarly renewed a SAR664.5 million (US$177.12 million) Murabaha facility with Saudi Investment Bank on 28 February 2022. The 1-year facility is also secured by a Promissory Note provided by Amlak to the amount of the total facilities, in addition to the assignment of accounts receivable to the bank. The proceeds from the facility will be used to finance the expansion of the business and for balance sheet purposes.

In a third transaction, Saudi Automotive Services Company (SASCO), another regular user of Islamic corporate finance, received a SAR504 million (US$134.34 million) Islamic credit facility from Riyad Bank in February 2022. The facility is comprised of a SAR450 million long-term financing and a SAR54 million hedging facility “against fluctuations in floating profit rates and the stabilizing profit rate.”

The proceeds from the facility will be used to part finance SASCO’s acquisition in January 2022 of 80% for the capital of Naft Co. amounting to SAR1.1 billion. The facility has a tenor of 10 years, which includes a three-year grace period. The facility is secured by an Order Note of 100% of the facility value.

In the final transaction, Aseer Trading, Tourism and Manufacturing Co. obtained a SAR200 million (US$53.31 million) Revolving Short Term Murabaha Facility from AlRajhi Bank in February 2022. The facility can be automatically renewed each year. The proceeds will be used for working capital purposes and is secured against an Order Note and Pledges of Shares.

Malaysia’s mortgage securitiser Cagamas Berhad continues issuance momentum with RM345m (US$82.01m) 3-month Islamic commercial papers offering in February 2022

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, one of the most prolific issuers of Sukuk, continued its Sukuk issuance momentum in with a RM345 million (US$82.01 million) 3-month Islamic Commercial Papers (ICPs) issuance on 18 February 2022.

The issuance is one tranche of a three-tranche hybrid offering totalling RM1.195 billion, comprising also a RM700 million 3-month Conventional Commercial Papers (CCPs) and a RM150 million 2-year Conventional Medium-Term Notes (CMTNs). Proceeds from all the issuances will be used to fund the purchase of housing loans and Islamic financing from the domestic financial system.

This latest issuance follows the RM300 million 3-month Islamic Commercial Papers (ICPs) on 14 January 2022, which are all issued under Cagamas’s RM20 billion Islamic and Conventional Commercial Paper Programme.

Cagamas President/ Chief Executive Officer, Datuk Chung Chee Leong commented: “We are pleased with the successful conclusion of the Company’s latest issuances, priced prior to news of the US Bureau of Labor Statistics’ Consumer Price Index biggest upward surprise of 7.5% year-on-year gain since February 1982 and headlines of an escalated conflict between Russia and Ukraine.

“The ICPs and CCPs were priced at 3-month Kuala Lumpur Interbank Offered Rate (KLIBOR) plus 3 basis points (bps), equivalent to 2.00% based on KLIBOR fixing on the pricing date. The 2-year CMTNs were priced at 2.86%. The spreads were 20 to 21 bps above the corresponding Malaysia Islamic Treasury Bills (MITB) and Malaysia Treasury Bills (MTB) for the 3-month ICPs and CCPs papers whereas for the 2-year CMTNs, the spread was 45 bps above the Malaysian Government Securities (MGS).”

The issuances were priced via a private placement exercise, which brings the Company’s aggregate issuances for the year to RM2.53 billion.

The papers, which will be redeemed at their full nominal value upon maturity, are unsecured obligations of the Company, ranking pari passu and with all other existing unsecured obligations of the Company. All proceeds from Cagamas issuances are used to fund the purchase of eligible sustainability assets, housing finance loans and Islamic home financing from the financial system.

Cagamas plays a major role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia.

Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysian sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM321.595 billion worth of corporate bonds and Sukuk

IILM holds second consecutive monthly auction in February 2022 with a US$1.21bn reissuance of short-term A-1 rated Sukuk

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM) completed its second issuance of its short-term Sukuk issuance programme for 2022 when it successfully completed the auction for the reissuance of an aggregate US$1.21 billion short-term “A-1” rated Sukuk across three different tenors of one, three, and six-month on 7 February 2022.

All the above transactions come under IILM’s US$3.51 billion short-term issuance programme. The Corporation held an auction on 7 February 2022 for the three series of re-issuances totalling US$1.21 billion, priced by the market as follows:

i) US$450 million of 1-month tenor certificates at 0.24%

ii) US$560 million of 3-month tenor certificates at 0.44%

iii) US$200 million of 6-month tenor certificates at 0.61%

This latest reissuance follows a similar three tranche transaction in January 2022 totalling US$1 billion.

The February auction, says the IILM, “garnered strong demand” from GCC-based Primary Dealers and investors, resulting in a strong orderbook in excess of US$1.83 billion, representing an average oversubscription ratio of 1.52 times and average bid-to-cover ratio of 1.52%.

Dr. Umar Oseni, Chief Executive Officer of the IILM, stressed that the February “auction saw a strong interest for the 1-month and 3-month tenors of the IILM’s papers, on the backdrop of a global rise in interest rates and tighter policy by the Federal Reserve. Overall, we are pleased that the IILM’s issuance this month for all tenors were fully subscribed at competitive all-in profit rates, despite the current market condition on the back of geopolitical developments all around the world. The IILM continues to provide investors with an international safe-haven investment solution to manage their liquidity needs in the Islamic markets with sufficient flexibility.”

The IILM has achieved year-to-date cumulative issuances totalling US$2.21 billion through six Ṣukuk series. According to the IILM, the Corporation will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

The IILM is a regular issuer of short-term Ṣukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The IILM has issued a total of US$77.75 billion across 167 short-term Sukuk issuances over the last eight years, reflecting the organisation’s ability to provide high quality Sharia’a compliant instruments and reliable offerings to Primary Dealers and investors, as well as offering stability to the global Islamic liquidity market.

The IILM is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services.

The IILM’s short-term Sukuk programme is rated “A-1” by S&P with current outstanding issuance size amounting to US$3.51 billion. According to the IILM, the primary dealers that participated in the auction conducted under the competitive bidding of the Bloomberg AUPD Platform included Abu Dhabi Islamic Bank; Al Baraka Turk Participation Bank; Barwa Bank; Boubyan Bank; CIMB Islamic Bank Berhad; First Abu Dhabi Bank; Kuwait Finance House; Macquarie Bank; Maybank Islamic Berhad; Qatar Islamic Bank; and Standard Chartered Bank.

ICIEC and Afreximbank Pen wide-ranging MoU covering collaboration in risk sharing and credit enhancement to boost trade and investment flows between Arab and African countries

Cairo – The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), the export credit and investment insurance agency of the Islamic Development Bank (IsDB) Group, and The African Export Import Bank (Afreximbank), the leading multilateral African trade finance institution, signed a landmark Memorandum of Understanding (MoU) in early March 2022 in Cairo in a move designed to advance the two institutions’ relationship and thereby promote trade and investment flows between Arab and African countries.

The MoU, which has a tenure of three years and is renewable, is consistent with the mandates of both multilaterals. ICIEC’s mandate is to support exports and imports of strategic goods of Member Countries through the flow of trade and investments and by providing credit and political risk insurance. Afreximbank’s mandate is to facilitate, promote and expand extra- and intra-African trade.

The agreement between ICIEC and Afreximbank is very comprehensive covering collaboration in risk sharing and credit enhancement either on a bilateral basis or through the Co-Guarantee Platform for Africa (CGP) for trade and trade enabling investment to/from Africa; in innovative structures such as Sukuk origination, Aviation Financing, Resilient Facilities and Climate Financing; ICIEC’s proposed provision of credit insurance to Afreximbank to cover its LC confirmation business through the issuance of a Documentary Credit Insurance Policy; the provision of credit enhancement to support Afreximbank syndications led by IsDB Group entities; and ICIEC partnering with AfrexInsure in underwriting and in reinsurance and fronting arrangements.

Afreximbank will also endeavour to promote ICIEC’s investment insurance services among companies and investors investing in common member countries in Africa; providing Direct Consulting Support for ICIEC members for market expansion/entry projects, virtual introductions to associates or potential Joint Venture partners among Arab African countries; and ICIEC supporting Afreximbank’s Digital Platforms including the Africa Due Diligence Repository Platform and its TRADAR Club, which includes access to TRADAR Intelligence and TRADAR Regulations.

Oussama Kaissi, CEO of ICIEC, welcomed the signing of the MoU, the latest initiative in the long-standing cooperation between Afreximbank and the IsDB Group. “We look forward to effect this wide-ranging MoU with Afreximbank. We are confident that the MoU will further consolidate our existing good relations with the bank in our mutual objective of boosting intra-Arab African trade in Member Countries common to both entities, through ICIEC’s tried and tested suite of de-risking and credit enhancement solutions.”

Similarly, Professor Benedict Oramah, President of Afreximbank, emphasised the importance of further reinforcing the strong ties between the Bank and the IsDB Group. “We have for some time enjoyed a constructive and productive relationship with ICIEC, and I am delighted that our co-operation has now been formalized in this MoU. As Afreximbank continues to expand its activities to accelerate Africa’s participation in global value chains, improved trade and investment links with the Arab world will only grow in importance”.

Malaysia’s MBSB Bank launches RM5bn sustainability sukuk Wakalah Programme with debut issuance imminently on the cards

Kuala Lumpur – MBSB Bank Berhad (formerly Asian Finance Bank) mandated Maybank Investment Bank Berhad to launch a RM5 billion Sustainability Sukuk Wakalah Programme in February 2022.

The Sustainability Sukuk Programme is MBSB Bank’s first sustainability Sukuk platform and according to the bank “will be the first of its kind in the world to be issued by an Islamic bank.” The Sustainability Sukuk Wakalah Programme will have a perpetual programme tenure and has been accorded a preliminary rating of A+IS by Malaysia Rating Corporation Berhad.

Proceeds raised from the Sustainability Sukuk Programme shall be utilised to finance and/or refinance, in part or in whole, future and/or existing eligible Sharia’a-compliant financings, including for the construction and/or development of eligible projects which will be identified in accordance with the bank’s Sustainability Sukuk Framework issued to govern the issuance of the Sustainability Sukuk.

Maybank Investment Bank is the Sole Principal Adviser, Sole Lead Arranger, Sole Lead Manager and Sole Sustainability Structuring Adviser while Maybank Islamic is the Sharia’a Adviser for the Sustainability Sukuk Programme.

According to Datuk Nor Azam M Taib, MBSB Bank’s Acting Chief Executive Officer, “this Sustainability Sukuk Programme is essential in placing MBSB Bank in the sustainability space and in line with the current banking industry theme. It also allows the bank to continue to grow our sustainable generating assets including lending in green projects, affordable housing, public health, education, SME financing and also the underserved segments.”

In addition, he added that “the Sustainability label attached to our Sukuk offers diversification to investors as we acknowledge there is a growing demand of Sustainability Sukuk in the market and this enables the bank to have access to a larger pool of investors including those with dedicated ESG mandates.”

MBSB Bank’s Sustainability Sukuk Wakalah Programme, said Datuk Nor Azam, is in compliance with the relevant sustainability frameworks such as the Securities Commission Malaysia’s Sustainability and Responsibility Investment Sukuk Framework, the ASEAN Capital Markets Forum’s Green, Social and Sustainability Bond Standards, and the International Capital Markets Association’s Green, Social and Sustainability Bond Principles.

The bank is working on issuing its debut Sukuk imminently under the Programme.

BNM hosts virtual meeting between Centralised Sharia’a Advisory Authorities in Islamic finance aimed at strengthening connectivity and fostering mutual respect among Shariah boards at both central bank and national levels

Kuala Lumpur – Bank Negara Malaysia (BNM) recently hosted the Third Roundtable Meeting between Centralised Sharia’a Advisory Authorities in Islamic

Finance (CSAAs). The meeting was held virtually and participated by more than 50 delegates from 16 countries and three standard-setting bodies.

The meeting, which was chaired by the Chairman of the BNM Sharia’a Advisory Council, Tan Sri Dr. Mohd Daud Bakar, aimed “to further strengthen connectivity and foster mutual respect among Shariah boards at both central bank and national levels.

The main resolutions of the Meeting include:

1. Given the important role of CSAAs in mainstreaming Islamic finance, having a broader picture on Islamic finance development in their countries is critical. This mainly include industry-wide issues which could not be resolved by individual Islamic financial institutions (IFIs) and their respective Shariah boards. Such areas include providing Shariah guidance in navigating through any unprecedented crisis, developing Shariah parameters on rectification of Sharia’a non-compliant (SNC) events and incomes, as well as promoting the best ethical behaviour among Shariah board members and management of IFIs in preserving the Sharia’a sanctity of their operations.

2. CSAAs should strive to build greater coordination with other regulators and Governments in driving future-proof initiatives for the Islamic finance industry. It is critical for CSAAs to address challenges including those arising from misalignment of

regulatory frameworks with Sharia’a principles. For example, to address the impact of climate change, CSAAs can collaborate with the Government and other relevant regulators to issue a national green framework that is consistent with Sharia’a principles.

3. On Sharia’a governance, the meeting acknowledged the importance of a sound framework to ensure quality Sharia’a boards in terms of behaviour, duty of care and attitude towards fulfilling their mandates. The meeting also recognised the key roles of a competent Sharia’a Secretariat in supporting the effective functioning of its Sharia’a advisory board, at both national and institution levels.

4. The meeting agreed for more focus to be given on key strategic issues, Maqasiid Al Sharia’a and action-oriented commitments in supporting sustainable finance.

The meeting concluded that the CSAA was established to deliberate on Sharia’s matters in Islamic finance. Each country adopts a different model and approach

in establishing their respective Sharia’a advisory authority, to commensurate with the size and complexity of its Islamic finance industry as well as the local custom.

The role of the Sharia’a advisory authority has been pivotal in preserving the Sharia’a sanctity and public confidence on Islamic financial transactions, creating a conducive environment for the industry to innovate and grow.

ICD extends its fifth line of financing facility to TuranBank to support SMEs affected by the COVID-19 pandemic

Jeddah – The Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the Islamic Development Bank (IsDB) Group, extended a US$10 million Line of Financing facility to TuranBank in Azerbaijan on in February 2022. The facility will be used to finance private sector enterprises including small and medium enterprises (SMEs) affected by the COVID-19 pandemic.

According to Ayman Sejiny, CEO of ICD, “the facility with TuranBank resonates with ICD’s renewed support to private sector businesses in Azerbaijan and will boost businesses and preserving jobs. It is in line with ICD’s commitment to assist Azerbaijan and other Central Asian member states in overcoming the adverse impact of the pandemic on the economy and strengthen their financial resilience.”

Fazil Musayev, CEO of TuranBank, emphasised the importance of cooperation with and accessing financing from “international financial institutions, as it allows us to attract cheaper financial resources to the country’s economy. ICD and TuranBank have a long-term partnership dating back to 2008.” This is the fifth line of financing extended by ICD to TuranBank to date.