Mashreq Latest MENAT Bank to Successfully Raise Funds from the Global Market in April 2025 Through a USD500mn Debut Sukuk Wakala Offering Despite Tariff-related Market Volatility

Mashreq, a leading financial institution in the MENA region, is yet another debutante in the international Sukuk market in April, when it successfully priced its maiden Sukuk issuance on 16 April 2025. According to the Bank, the transaction marks the first public issuance from the CEEMEA region since the U.S. tariffs announcement on 2 April 2025, signalling a reopening of the primary markets.

Judging by the spate of new entrants to the international Sukuk market, and the big-ticket primary issuances from sovereign wealth funds, oil and gas companies, transport and logistic operators and real estate developers in April 2025, the tariff and trade disruptions of the Trump administration seems to have minimal impact on the primary Sukuk market.

In fact, the first quarter of 2025 has seen record numbers of Sukuk issuances driven largely by Malaysian, Saudi and UAE issuers in markets in which Islamic finance is of systemic importance, but supported by the growing markets of Indonesia, Tȕrkiye, Qatar, Kuwait, Bahrain, Pakistan, Nigeria and Egypt.

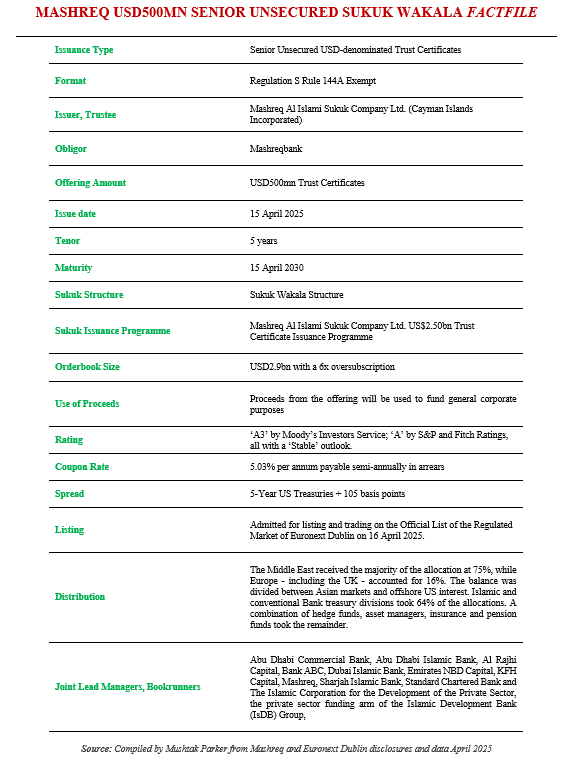

Mashreq had mandated Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank, Al Rajhi Capital, Bank ABC, Dubai Islamic Bank, Emirates NBD Capital, KFH Capital, Mashreq, Sharjah Islamic Bank, Standard Chartered Bank and The Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank (IsDB) Group, to act as 2025 to act as Joint Lead Managers and Bookrunners, and to arrange a series of investor calls and roadshows with accounts in the UK, EU, the MENA region, Asia and Offshore US for a benchmark US dollar-denominated Sukuk offering. The result was a USD500mn 5-year fixed rate RegS Senior Unsecured Sukuk which matures on 16 April 2030.

The Sukuk certificates were issued by Mashreq Al Islami Sukuk Company Ltd. (Cayman Islands Incorporated) on behalf of the Obligor, Mashreqbank, under its USD2.5bn Trust Certificate Issuance programme, established in July 2024 and arranged by Mashreqbank and Standard Chartered Bank.

The transaction marks Mashreq’s successful return to the debt capital markets, following its last issuance in June 2024 – when it priced a US$500m conventional perpetual non-call 5.5-year Additional Tier 1 (AT1) transaction. Notably, it is also the first deal from the CEEMEA region since the announcement of U.S. tariffs on international trade partners, which triggered heightened volatility across global markets.

Despite a challenging market backdrop, Mashreq says it “made the strategic decision to proceed with a public issuance, becoming the first and only issuer in the CEEMEA region to access the market following the tariffs announcement on 2 April.

Demonstrating confidence and clarity, the bank announced a capped issuance size of USD500mn, firmly communicating to investors that the transaction “will not grow.” The market responded positively, with the Sukuk attracting significant demand from a diverse investor base across Europe, Asia, and the Middle East.”

The orderbook peaked at USD2.9bn – the largest ever for a Mashreq issuance – representing an oversubscription of nearly six times and drawing interest from over 90 investors. Ahead of pricing, senior members of Mashreq’s management team, including Group CFO Norman Tambach and Group Head of Treasury and Global Markets Salman Hadi, conducted investor meetings in London on Monday, 14 April 2025.

While the initial plan was to close the transaction on Wednesday, 16 April, strong investor feedback prompted the team to accelerate execution and close a day earlier, on Tuesday.

Initial Price Thoughts (IPTs) were released on Tuesday morning at US Treasuries plus 140 basis points (bps). Given the substantial demand, final pricing was tightened to US Treasuries plus 105bps by noon London time.

This 35bps tightening, achieved in a single iteration, says Mashreq “underscores the strength and quality of the orderbook, which featured participation from leading global fund managers, banks, pension funds, and insurance firms. Despite the pricing adjustment, the orderbook remained robust, allowing Mashreq to successfully launch the transaction at a credit spread of 105bps and a fixed profit rate of 5.03% per annum.”

Mashreq’s Group Chief Executive Officer, Ahmed Abdelaal, commented: “We are pleased with the strong investor engagement and support for this landmark transaction. Being the first public issuance in the CEEMEA region since the onset of the trade war and the subsequent market dislocation, this Sukuk issuance underscores the depth of investor confidence in Mashreq’s credit profile, strategy, and long-term fundamentals. The substantial oversubscription, despite ongoing market volatility, is a testament to our standing with global investors and reinforces our disciplined approach to market execution. This successful outcome not only supports Mashreq’s growth ambitions into 2025 and beyond but also helps re-open the debt capital markets for regional issuers seeking to re-enter with confidence.”

Similarly, Salman Hadi, Mashreq’s Group Head of Treasury and Global Markets, who led the issuance, stated: “We had strong conviction in Mashreq’s credit fundamentals, which gave us the confidence to move forward with the transaction despite challenging market conditions. This strategic timing allowed us to benefit from a clear issuance window, resulting in significant investor demand and the largest orderbook ever for a Mashreq issuance.”

The transaction was well distributed across international and regional investors, reaffirming the investor community’s long trust in Mashreq’s credit. The Middle East received the majority of the allocation at 75%, while Europe – including the United Kingdom – accounted for 16% of the demand. The balance was divided between Asian markets and offshore US interest. Islamic and conventional Bank treasury divisions took the lion’s share of the issuance securing 64% of the allocations. A combination of hedge funds, asset managers, insurance and pension funds took the remainder.

The Sukuk certificates were admitted for listing and trading to the Official List of the Regulated Market of Euronext Dublin on 16 April 2025.