ANB Returns to the Sukuk Market After an Absence of Five Years with a SAR3.35bn (USD890mn) Additional Tier 1 Capital Sukuk

The Saudi banking sector is a mainstay of corporate Sukuk issuance – second only to the sovereign issuances by the National Debt Management Centre of the Saudi Ministry of Finance and government-linked entities such as the Public Investment Fund (PIF), the Kingdom’s sovereign wealth fund, and its subsidiaries, Saudi Aramco, the state-owned oil and gas company, and various utilities.

Banks usually raise funds for working capital requirements, expansion needs, refinancing existing more expensive debt, and general corporate purposes. Over the last few years Saudi banks have regularly accessed the market to raise funds to boost and stabilise their capital structures especially through the issuance of Additional Tier 1 (AT1) Capital Sukuk as per the Basel III provisions.

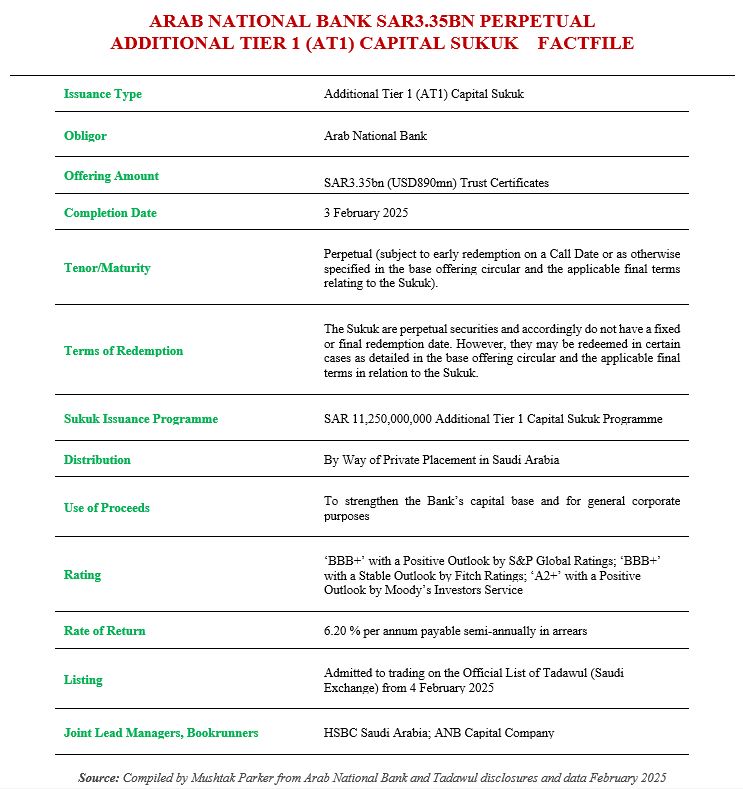

The latest Saudi bank to issue an AT1 Capital Sukuk is Arab National Bank (ANB). According to a disclosure to Tadawul (The Saudi Exchange) ANB commenced the issuance of a benchmark perpetual SAR3.35bn (USD890mn) AT1 Sukuk on 16 January 2025 by way of a private placement in the Kingdom to Institutional and Qualified Clients in accordance with the Rules on the Offer of Securities and Continuing Obligations issued by the Capital Market Authority.

ANB had mandated HSBC Saudi Arabia and ANB Capital Company to act as sole Joint Lead Managers and Bookrunners to the transaction. The trust certificates were issued under the Bank’s SAR11.25bn (USD3bn) Additional Tier 1 Capital Sukuk Programme. The offer was successfully completed on 3 February 2025.

The Sukuk are perpetual securities and accordingly do not have a fixed or final redemption date. However, they may be redeemed in certain cases as detailed in the base offering circular and the applicable final terms in relation to the Sukuk. Demand for the trust certificates was buoyant which allowed the Bank to set the transaction at a final rate of return of 6.20 % per annum payable semi-annually in arrears.

According to ANB, the proceeds from the offering will be used to strengthen the Bank’s capital base and for general corporate purposes.

Earlier this year ANB reported a 10% year-on-year increase of net special commission income from SAR7,259mn (USD1,935.22mn) in FY 2023 to SAR7,972mn (USD2,125.3mn) in FY 2024. Total operating income increased by 11% from SAR8,567mn (USD2,283.93mn) to SAR9,500mn (USD2,532.66mn) for the same period. ANB’s total assets increased by 12% from SAR221,422mn (USD59,030.19mn) in 2023 to SAR248,307mn (USD66,197.62mn) in 2024.