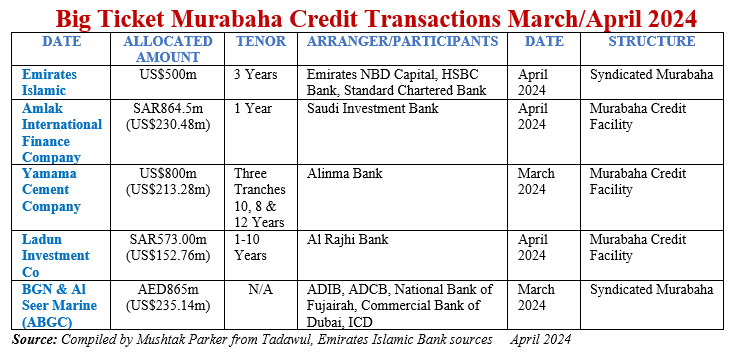

Big Ticket Syndicated Murabaha Transactions Flourish in the GCC in March/April 2024 with Five Transactions Totalling US$1.33bn Successfully Completed

Big ticket Murabaha transactions including syndications flourished during the months of March and April 2024 with five major transactions closed during the period amounting to US$1,331.66 mn equivalent. The transactions involved exclusively Saudi and UAE entities in the banking, cement, and oil and gas marine sectors.

However, one feature common to all the transactions was the lack of pricing disclosure and transparency, and the number and demography of the participants.

The transactions were led by Emirates Islamic, one of the leading Islamic financial institutions in the UAE, which completed a debut US$500 mn Syndicated Murabaha Financing Facility on 18 April 2024.

The landmark three-year term financing facility, says Emirates Islamic, is the first of its kind raised by a Sharia’a-compliant financial institution.

The transaction was structured as a Commodity Murabaha term financing facility which says the bank also complies also with the Shariah principles set out by the Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI). The proceeds will be used for Sharia’a-compliant general corporate funding purposes.

According to Farid AlMulla, Chief Executive Officer of Emirates Islamic, “the new financing facility further strengthens the bank’s balance sheet by increasing its ability to support its clients as well as its own strategic growth ambitions. The successful closing also reflects the market confidence in Emirates Islamic’s growth strategy and financial strength. This landmark facility further underscores Emirates Islamic’s position as one of the leading Shariah-compliant banks in the UAE. As a prominent local Islamic bank, Emirates Islamic remains committed to contributing to the UAE’s progress by spearheading innovations in the Islamic banking sector and creating innovative Sharia’a-compliant products and services that adhere to the highest standards of ethical banking.”

Emirates NBD Capital Limited, HSBC Bank Middle East Limited and Standard Chartered Bank acted as global coordinators and mandated lead arrangers and bookrunners to the transaction.

In a second transaction in Abu Dhabi in March 2024, a consortium of banks led by the local Abu Dhabi Islamic Bank (ADIB), completed a Murabaha syndication totalling AED865 mn (US$235.14 mn) for ABGC, a joint venture between BGN and Al Seer Marine, to finance new and energy-efficient gas carriers. This financing is the second tranche of a larger syndication amounting to US$370 mn, which will be used to finance the construction of three state-of-the-art Very Large Gas Carriers (VLGCs) in South Korea and Japan.

ADIB acted was as the Mandated Lead Arranger, Coordinator, Bookrunner, Sharia’a Advisor, Investment and Security Agent on the deal, and was supported by several mandated arrangers specialized in the maritime and energy sectors including Abu Dhabi Commercial Bank (ADCB), National Bank of Fujairah (NBF), Commercial Bank of Dubai (CBD), and a strategic partner namely The Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the Islamic Development Bank (IsDB) Group.

In the third transaction in April 2024, Amlak International Finance Company, renewed a SAR864.5 mn (US$230.48 mn) Murabaha credit facility with Saudi Investment Bank for a period of one year. The facility said Amlak in a disclosure to Tadawul, is guaranteed through an assignment of receivables to the bank and a promissory Note in favour of the bank. The proceeds from the facility will be used for general balance sheet purposes and as working capital for Amlak’s financing operations.

In the fourth transaction, Alinma Bank arranged a three tranche US$800 mn (US$213.28m) Murabaha credit facility for Yamama Cement Company. The facility comprised a SAR500 mn (US$133.30 mn) tranche with a tenor 10 years; and a SAR200 mn (US$53.32 mn) with a tenor of 8 years; and a third tranche of SAR100 mn (US$26.66 mn) with a tenor of 12 months on a revolving credit basis.

In a disclosure to Tadawul (the Saudi Stock Exchange) Yamama said that the facility is guaranteed by a promissory note and the proceeds will be used to refinancing existing liabilities, and fund capital expenditures and working capital requirements to improve financial efficiency.

In the final transaction, Al Rajhi Bank extended a SAR573 mn (US$152.76 mn) Murabaha credit facility to Ladun Investment Company in Saudi Arabia. The tenor of the facility is between one to 10 years.