Regular Issuer Sharjah Islamic Bank Returns to International Market with Second Benchmark Senior Unsecured Issuance in 2025 – a USD500mn Perpetual Non-Call 6 Years AT1 Capital Sukuk Mudaraba Issuance in May

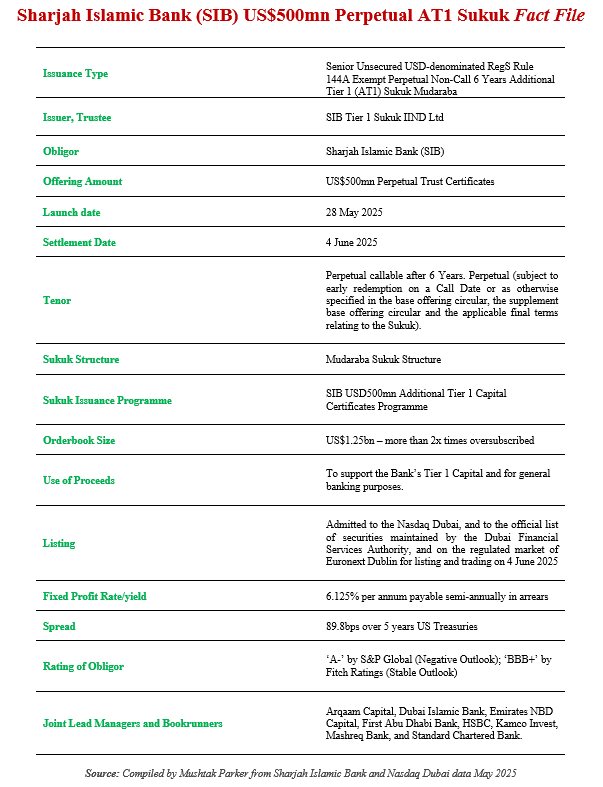

It is not only Saudi-based Islamic banks that are setting the pace in Perpetual Additional Tier 1 (AT1) Capital Sukuk originations. Emirati banks it seems are not keen to be left behind. Sharjah Islamic Bank (SIB), one of the first banks to issue Sukuk in the international financial markets, successfully closed its latest foray into the global capital market by pricing a USD500mn perpetual AT1 Sukuk Mudaraba with a fixed profit rate of 6.125% and a six-year non-call period.

This is SIB’s second foray into the international market in 2025. In February, SIB closed a 5-Year US$500mn Sukuk Murabaha/Ijara issuance, maturing on 26 February 2030, marking its seventh issuance under the Bank’s USD3.0bn Trust Certificate Issuance Programme, which was established in 2013 and updated in July 2024. SIB priced the February USD500mn Sukuk Murabaha/Ijara at a profit rate of 5.20% percent, representing a margin of 89.8 basis points (bps) over 5-year US Treasuries.

This latest AT1 Sukuk transaction marks the Bank’s eighth issuance – this time issued by SIB Tier 1 Sukuk IIND Ltd on behalf of the Obligor, Sharjah Islamic Bank, under the SIB USD500mn Additional Tier 1 Capital Certificates Programme (Cayman Islands Incorporated).

SIB mandated Arqaam Capital, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, HSBC, Kamco Invest, Mashreq Bank, and Standard Chartered Bank on 28 May 2025 to act as Joint Lead Managers and Bookrunners, and to arrange a series of investor calls and meetings in London, Europe, the Middle East, Asia and with Offshore US Accounts. The Bank had set the initial price guidance for the Perpetual Non-Call 6 Years AT1 Capital Sukuk Mudaraba Issuance at around 6.50%.

The issuance, according to SIB, drew robust demand and was oversubscribed by more than 2x from a wide spectrum of investors across the GCC, Europe, and Asia, reflecting the high level of confidence the bank enjoys among international financial institutions and investment funds. This transaction further demonstrates the Bank’s strategic use of capital markets as an effective tool to support its growth trajectory and strengthen its capital base, added SIB.

The transaction was successfully closed with a fixed profit rate of 6.125% and a six-year non-call period. According to SIB, this transaction was the tightest set AT1 Issuance thus far in 2025 globally. With a reset spread of 195.6 basis points (bps), the issuance also saw a reduction in the spread achieved in 2019 by 125.7 bps. This transaction, added the bank, forms part of a broader capital strategy aimed at strengthening SIB’s capital structure, supporting business expansion across key markets while maintaining a commitment to financial governance, resilience, and sustainability.

Mohamed Abdalla, CEO of Sharjah Islamic Bank, commented: “This latest sukuk issuance reflects the continued success of our strategy to leverage capital markets in supporting the SIB’s financial position and long-term expansion. Since our first Sukuk in 2006, we have built a solid track record as a trusted and consistent issuer in the global Islamic finance space. This marks our tenth sukuk issuance, reaffirming SIB’s leadership in the international sukuk market. The transaction attracted exceptional interest, far exceeding expectations, and securing demand from a highly diversified investor base.”

Ahmed Saad, Deputy CEO of Sharjah Islamic Bank, added that “the overwhelming interest from international investors in this issuance underscores growing trust in our performance, strategy, and future vision. The strong pricing outcome is a testament to SIB’s position as a robust Islamic banking institution offering innovative, Shariah-compliant financial solutions and maintaining deep engagement with global investors.”

The Sukuk certificates, rated ‘A-’ by S&P Global Ratings and ‘BBB+’ by Fitch Ratings, were admitted for listing on Nasdaq Dubai and to the official list of securities maintained by the Dubai Financial Services Authority on 4 June 2025, and on the regulated market of Euronext Dublin in June 2025.

This latest transaction brings Sharjah Islamic Bank’s total outstanding on Nasdaq Dubai to USD 2.5 billion across five listings. It also reinforces Dubai’s strategic role in advancing the Islamic capital markets ecosystem. To mark the occasion, HE. Ahmed Saad, DCEO of Sharjah Islamic Bank rang the market opening bell at Nasdaq Dubai in the presence of Hamed Ali, CEO of Nasdaq Dubai and Dubai Financial Market (DFM).

With this listing, the total value of Sukuk listed on Nasdaq Dubai has reached USD 95.7 billion, underlining its status as one of the world’s largest venues for Islamic fixed-income securities.