Saudi Awwal Bank Returns to International Market with Inaugural USD650mn Additional Tier 1 (ATI) Capital Green Sukuk as ATI Sukuk Issuances Continue to Flourish in Saudi Market Despite Lower Yields

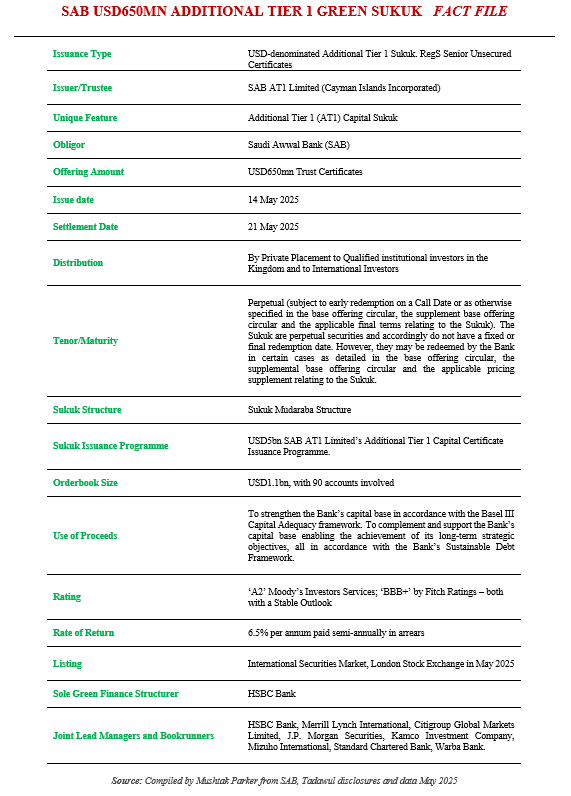

Saudi Awwal Bank (SAB) is another Saudi-based bank that returned to the international Sukuk market in May 2025 with the aim of boosting its Additional Tier 1 (AT1) capital, with a benchmark USD650mn AT1 Capital Sukuk Mudaraba. The transaction was launched on 14 May 2025 and distributed by way of private placement to eligible investors in the Kingdom of Saudi Arabia and to international investors.

Additional Tier One (AT1) Sukuk issuance seems to be the preferred instrument for Gulf Cooperation Council (GCC) Islamic financial institutions in support of Basel III capital requirements. SAB was established on 21 January 1978 by taking over the activities and services of the British Bank of the Middle East in Saudi Arabia and is considered as one of the major banking investment joint-stock companies in the region. Prior to this transaction, SAB issued a two tranche SAR4bn (USD1.07bn) AT1 Sukuk in November 2024, also by way of a private placement in support of the Bank’s capital base.

The Sukuk certificates of the latest US dollar transaction were issued by SAB AT1 Limited (Cayman Islands Incorporated) under its USD5bn Additional Tier 1 Capital Certificate Issuance Programme. In fact, this is the inaugural Sukuk issuance under the programme established as a supplement on 8 May 2025 of its base prospectus set up on 16 April 2025.

The Bank mandated HSBC Bank, Merrill Lynch International, Citigroup Global Markets Limited, J.P. Morgan Securities, Kamco Investment Company, Mizuho International, Standard Chartered Bank and Warba Bank as Joint Lead Managers and bookrunners on 14 May 2025 to arrange a series of investor calls with accounts in the Kingdom and internationally in relation to the offer by way of a private placement. HSBC Bank was appointed as the Sole Green Finance Structurer.

The result was a Perpetual non-call USD650mn AT1 Sukuk Mudaraba issuance. The Initial Price Thoughts were around a profit rate of 6.875% per annum. The order book reached USD1.1bn, which allowed the issuer to tighten the price to a final coupon rate/yield of 6.5% p.a. paid semi-annually in arrears.

In a disclosure to Tadawul (the Saudi Exchange), Saudi Awwal Bank stressed that the Sukuk are perpetual securities and accordingly do not have a fixed or final redemption date. However, they may be redeemed by the Bank in certain cases as detailed in the base offering circular and the applicable pricing supplement relating to the Sukuk.

The settlement of the Sukuk issuance was on be on 21 May 2025. According to Saudi Awwal Bank, the proceeds from the issuance will be used to strengthen the Bank’s capital base in accordance with the Basel III Capital Adequacy Framework and to complement and support the Bank’s capital base enabling the achievement of its long-term strategic objectives, all in accordance with the Bank’s Sustainable Debt Framework.

Application has been made to list and trade the Sukuk certificates, rated ‘A2’ Moody’s Investors Services and ‘BBB+’ by Fitch Ratings – both with a Stable Outlook, on the International Securities Market of the London Stock Exchange.

SAB reported net profit after zakat and income tax of SAR2,135mn (USD569.25mn) for Q1 2025. Net loans and advances reached SAR279bn (USD74.39bn), marking a 22% growth from SAR229bn (USD61.06bn) in Q1 2024. Customer deposits also increased to SAR290bn, (USD77.32bn) up 9% from SAR266bn (USD70.92bn) in Q1 2024.24. Despite a lower interest rate environment, SAB’s net special commission income continued to grow, reflecting the bank’s increased resilience and operational strength.

Lubna Olayan, Chair of SAB, commented: “Despite challenging global macroeconomic conditions, we remain confident in Saudi Arabia’s growth story and proud of SAB’s role in supporting that growth through disciplined, quality focused funding. We are proud to be the partner of choice for internationally minded customers and continue to play a leading role in supporting the growing number of cross-border customers coming into the Kingdom. “In recognition of our efforts to integrate sustainability as a core strategic pillar across operations, we are proud that SAB was recognized as the “Sustainability Program of the Year 2024” at the Saudi Capital Markets Forum, making the Bank the first financial institution in the Kingdom to receive this recognition. The award acknowledges the Bank’s prominent role in advancing environmental, social, and corporate governance practices within the Saudi economy and market.”

.