Riyad Bank Issues Second Capital Sukuk in 2025 Through a USD1.25bn Benchmark Tier 1I Sukuk Wakala Offering to Boost its Capital Under Basel III Requirements

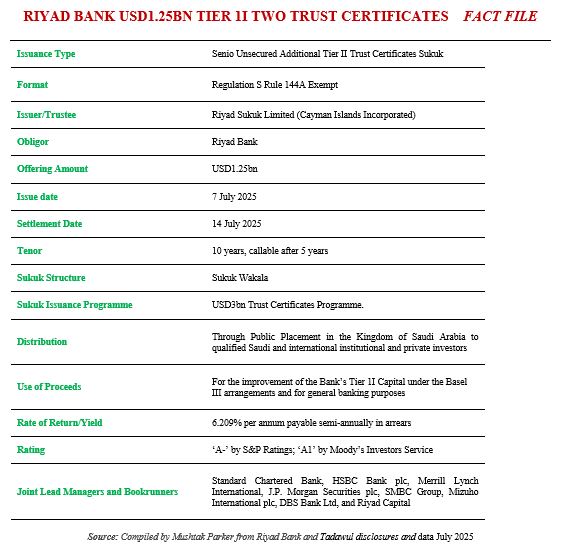

Riyad Bank in Saudi Arabia returned to the Sukuk market in July 2025 successfully closing a benchmark senior unsecured RegS USD1.25bn Tier II Trust Certificates on 7 July 2025. The settlement date of the offering was on 14 July 2025.

The Sukuk has a tenor of 10 years but is callable after 5 years. This is Riyad Bank’s second foray into the Sukuk market in 2025. In January this year the Bank raised funds from the local market to boost its capital through a benchmark SAR2bn (USD530mn) Additional Tier 1 Capital Sukuk offering by way of a private placement to qualified institutional and individual investors in the Kingdom.

Following approval from its Board, Riyad Bank announced its intention to issue US dollar denominated Tier II Trust Certificates under its International Trust Certificate Issuance Programme updated on 16 May 2025.

The Bank mandated Standard Chartered Bank, HSBC Bank plc, Merrill Lynch International, J.P. Morgan Securities plc, SMBC Group, Mizuho International plc, DBS Bank Ltd, and Riyad Capital to act as Joint Lead Managers and Bookrunners to the transaction, and to arrange a series of investor calls and roadshows with accounts in the UK, Europe, the MENA region, Asia and Offshore US. The offering started on 7 July 2025 and closed on 14 July 2025.

The Sukuk certificates were issued by Riyad Sukuk Limited (Cayman Islands Incorporated) under its USD3bn Trust Certificates Issuance Programme. The transaction was successfully completed on 14 July 2025 and the Sukuk certificates, rated ‘A-’ by Fitch Ratings, ‘A-’ by S&P Ratings, and ‘A1’ by Moody’s Investors Service – all with a stable outlook, were priced at a fixed profit rate of 6.209% per annum payable semi-annually in arrears profit rate, starting from the settlement date.

The proceeds from the Sukuk, according to the disclosure, will be used to strengthen the Bank’s Tier 1I Capital under the Basel III arrangements and for general banking purposes.

This latest Riyad Bank Sukuk Certificates were admitted to trading on the London Stock Exchange’s International Securities Market and was listed in July 2025.

The transaction is novel because Riyad Bank is the pioneer of Basel III compliant USD Tier 2 Sukuk from the region and Saudi Arabia. It issued its inaugural such USD1.5bn Sukuk in February 2020. That issuance was also the largest issue size raised in a debut Sukuk from the region and the pricing achieved was at the time one of the lowest compared to Tier 2 instruments globally.

Riyad Bank, through its special purpose vehicle listed on the London Stock Exchange, Riyad Sukuk Limited, has announced its intention to call (redeem) its USD1.5bn fixed rate reset Tier 2 Trust Certificates issued on 25 February 2020 and due in 2030 in full and at face value on 25 February 2025.

The Sukuk was issued with an original maturity of ten (10) years due on 25 February 2030 and, in accordance with the Sukuk’s terms and conditions, Riyad Bank may require Riyad Sukuk Limited as issuer to call the Sukuk on 25 February 2025. Regulatory approval has already been obtained in this regard.

“The redemption amount together with any periodic distribution accrued but unpaid will be paid by or on behalf of, Riyad Sukuk Limited on 25 February 2025 to the relevant holders of the Sukuk in accordance with the terms and conditions of the Sukuk,” said the LSEG in a statement.