Qatar Islamic Bank (QIB) Successfully Closes Second Benchmark USD750mn Sukuk Wakala/Murabaha in Nine Months at Tightest Profit Rate for a GCC Bank Originated Senior Unsecured 5-Year Issuance in 2025

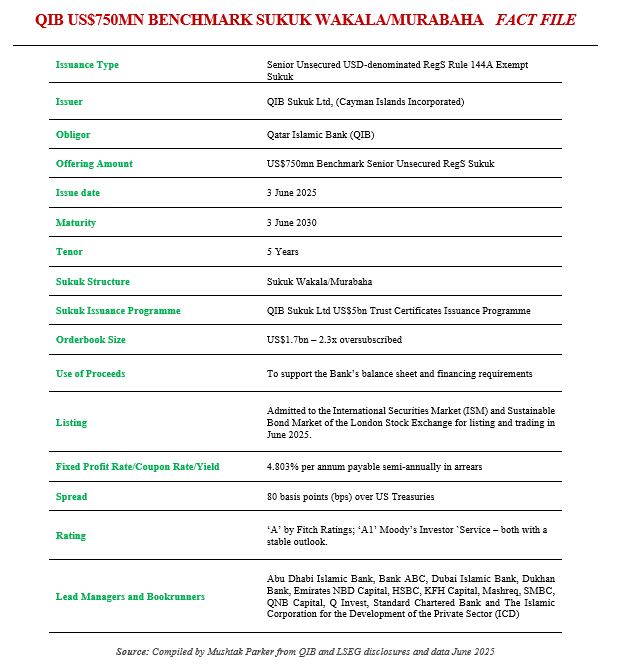

Qatar Islamic Bank (QIB), the largest and oldest Islamic Bank in Qatar, closed its second benchmark Sukuk offering in nine months in the international financial market on 3 June 2025, successfully issuing a benchmark Senior Unsecured USD-denominated RegS Rule 144A Exempt USD750mn Sukuk Wakala/Murabaha with a tenor of 5 years, maturing on 3 June 2030.

The Sukuk certificates were issued by the Trustee, QIB Sukuk Limited, a special purpose vehicle incorporated in the Cayman Islands, on behalf of the Obligor QIB, under its USD5bn Trust Certificates Issuance Programme, which was arranged by HSBC Bank in 2024.

This follows a similar 5-year transaction in September 2024 for the issuance of a benchmark USD750mn Senior Unsecured RegS Sukuk Wakala/Murabaha maturing in September 2029. QIB announced its intention to issue a Sukuk on 3 June 2025 and mandated Abu Dhabi Islamic Bank, Bank ABC, Dubai Islamic Bank, Dukhan Bank, Emirates NBD Capital, HSBC, KFH Capital, Mashreq, QNB Capital, QInvest, SMBC, Standard Chartered Bank and The Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the IsDB Group, to act as joint lead managers and bookrunners to the transaction, and to arrange a series of investor calls with European, Asian and Middle Eastern accounts.

Initial investor feedback was encouraging and allowed QIB to open the order book on the next day. The order book quickly grew to peak at USD 1.7bn, representing an oversubscription rate of 2.3 times, which according to QIB, “is one of the highest levels of demand seen for Sukuk issuances.” The aim was to issue a benchmark Sukuk Wakala/Murabaha issuance with a 5-year tenor. The final size was confirmed at USD750mn.

The initial price thoughts (IPTs) were set at around 115-120 basis points (bps) plus US Treasuries. The robust order book enabled QIB to confidently tighten the pricing by 35-40 basis points from the IPTs in one iteration to 80 basis points over the US Treasury Rate. Investor diversity was broad and comprised of banks, private banks, fund managers and agencies from all over the world.

The USD750mn Sukuk certificates, rated ‘A1’ by Moody’s Investor Service and ‘A’ by Fitch Ratings in line with QIB’s institutional credit ratings, were successfully priced at a profit rate of 4.803% per annum payable semi-annually in arears with and tenor of 5 years. The profit rate was equivalent to a credit spread of 80 basis points over the US Treasury Rate, which says the Bank was well inside QIB’s fair value and lower than secondary market spreads of all Qatari banks, reflecting the positive perception of international investors around QIB’s credit quality.

Moreover, QIB’s profit rate was the lowest achieved by a GCC bank for a senior unsecured 5-year issuance in 2025.

In June 2025 Moody’s Ratings affirmed Qatar Islamic Bank’s long-term deposit ratings at A1, with a stable outlook. In its rating rationale, Moody’s stressed that the affirmation of QIB’s ratings including the ‘baa2 BCA (Baseline Credit Adjustment) rating’ “reflect the bank’s strong capital metrics, its strong and stable profitability supported by its established and growing Islamic banking franchise, and solid asset quality. These strengths are moderated by the bank’s significant balance sheet concentrations and exposure to cyclical sectors, such as real estate and its relatively high reliance on confidence-sensitive external funding, as well as some depositor concentrations.”

Mr. Bassel Gamal, QIB’s Group Chief Executive Officer, commented: “QIB is proud of another successful transaction in the international capital markets, where it has built a reputable name and large investor base from around the globe. The strong demand for our Sukuk underscores the faith investors have in robust economic position of the State of Qatar’s and strong financial fundamentals of QIB.”

The pricing for the June 2025 issuance contrasts with that of the September 2024 transaction where the certificates were priced at a profit rate of 4.485% per annum which was equivalent to a credit spread of 100bps over the US Treasury rate.

The proceeds from the Sukuk, according to the Base Prospectus, will be used for general corporate purposes, and an amount equivalent to the net proceeds will be applied to finance and/or refinance, in whole or in part, a portfolio of eligible projects.

This latest QIB Sukuk Certificates were admitted to trading on the London Stock Exchange’s International Securities Market and was listed in June 2025.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by Qatar Islamic Bank, with the US$337.5m Murabaha tranche being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.