Dubai Islamic Bank (DIB) Issues Third Consecutive Annual US$1bn Sustainability Sukuk in March 2024 Priced at the Lowest Ever Credit Spread Achieved by the Bank

If accolades are to be awarded for Sukuk issuance sustainability, then Dubai Islamic Bank (DIB), one of the most prolific and regular issuers of Sukuk by a financial institution and one of the largest Islamic banks in the UAE in terms of assets, must take credit for its third consecutive annual Sustainability Sukuk issuance on 27 February 2024.

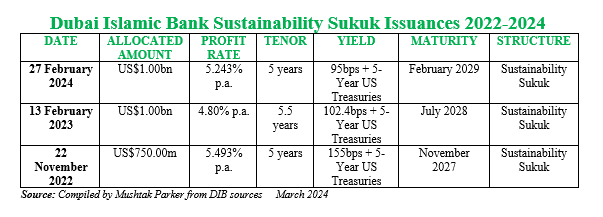

DIB, rated ‘A3’ by Moody’s Investors Service and ‘A’ by Fitch Ratings, successfully priced its third Sustainability Sukuk – a landmark US$1 billion 5-year benchmark senior issue with a profit rate of 5.243% per annum payable semi-annually in arrears and representing a spread of 95 basis points (bps) over 5-Year US Treasuries.

Prior to this latest offering, DIB issued its maiden 5-year US$750 million benchmark senior unsecured Sustainability Sukuk in November 2022, followed by a second such offering – a US$1 billion 5.5-year senior unsecured Sukuk issuance in February 2023. As a comparison, the US$1 billion February 2023 transaction was priced at a profit rate of 4.80% per annum representing a spread of 102.4 bps over 5-Year US Treasuries. This is in contrast with the US$750 million November 2022 transaction which was priced at a profit rate of 5.493% per annum representing a spread of 155bps over 5-Year US Treasuries.

This latest Sukuk was also issued by DIB Sukuk Limited, its Cayman Island incorporated special purpose vehicle, on behalf of the Obligor, Dubai Islamic Bank. Standard Chartered Bank acted as Sole Sustainability Structurer, while Al Rajhi Capital, Bank ABC, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, HSBC, J P Morgan, KFH Capital, Sharjah Islamic Bank, Standard Chartered Bank and Mashreq acted as Joint Lead Managers and Bookrunners on the transaction.

DIB Sukuk Limited had mandated the banks to arrange a series of investor calls and visits in the UK, Europe, GCC and MENA regions, Asia and with Offshore US Accounts. The Sukuk was issued in line with DIB’s Sustainable Finance Framework, which was created to facilitate the financing of green, social and other ESG projects. The initial price guidance for the Sukuk issuance was set at 125bps over U.S. Treasuries, but the pricing tightened at 95bps over US Treasuries at launch. The Sukuk were issued under DIB’s US$7.5 billion Trust Certificate Issuance Programme.

According to DIB, the transaction achieved several landmarks:

- The pricing on the deal reflects the lowest ever credit spread achieved by DIB, making the bank one of the select few Middle East financial institutions to remain inside UST+100bps for a senior unsecured issuance.

- The US$1 billion size is the largest Sustainability issuance by a Middle East financial institution in nearly a year.

The Sukuk was priced after completing a comprehensive marketing exercise with roadshows in Singapore and London, where DIB updated investors on its positive financial performance as well as its long term ESG strategy and plans. Despite issuing a larger size of US$1 billion, the transaction was oversubscribed by 2.5 times, which says the bank “is a clear indication of how well DIB’s financial and sustainability story resonates with regional and global investor base.”

This latest deal, stressed Dr Adnan Chilwan, Group Chief Executive Officer, DIB, “affirms our steadfast commitment to ESG which aligns with the UAE’s Net Zero agenda and the Dubai Clean Energy Strategy. Despite the issuance in an extremely crowded market environment, we significantly accelerated the transaction execution given the overwhelming response with orders exceeding US$2.5 billion. This enabled us to comfortably issue a larger size well within our pricing parameters. This deal once again demonstrated DIB’s leadership in Islamic Sustainable Finance, supported by an established and strong investor following from Europe, Asia and the Middle East. I would like to extend my sincere appreciation to our investors for their continued trust and confidence.”

DIB, he added, is committed towards a more sustainable future as it enters a decade of change to support the UAE’s ambitions towards a low-carbon economy. DIB’s ESG roadmap is set to unlock further efficiencies within the business as it integrates sustainability and climate risk into its operating models with the aim to ensure that the bank is safeguarded against the biggest environmental risks that are impacting the global economies.

The Sukuk certificates issued under DIB Sukuk Limited were admitted for listing and trading on the Regulated Market of Euronext Dublin and NASDAQ Dubai in March 2023.

In January 2024, the DIB Group reported net profit of AED7,010 million in 2023, up 26% YoY compared to AED 5,552 million in 2022, driven by rising non-funded income and lower impairment charges. Net financing and Sukuk investments reached AED268 billion, up 12% YoY. Gross new underwriting and Sukuk investments recorded AED88 billion in FY2023 vs AED63 billion in FY2022.

Total income reached AED20,142 million compared to AED14,101 million, a solid expansion of 43% YoY. The Group’s balance sheet expanded strongly by 9% YoY to reach AED314 billion in 2023. Customer deposits increased to AED222 billion, up 12% YoY with CASA comprising 37% of DIB’s deposit base. Sheikh Mohamed Al Shaibani, Chairman of DIB Group, commenting on the results reiterated the Group’s proactive commitment to Islamic Sustainable and ESG Finance: “Supporting the UAE’s Year of Sustainability, we, together with the UAE Banks Federation commit to delivering AED1 trillion in sustainable finance over the coming years. DIB has already been at the forefront of this commitment with US$1.75 billion (US$2.75 billion if we include the February 2024 transaction) of sustainable Sukuk already issued supporting a growing ESG portfolio. With a long term ESG strategy set in place, the bank will continue to drive positive climate actions in the UAE and beyond in the years to come.”