Boubyan Bank Raises USD500mn Through 5-Year Fixed Rate Sukuk Wakala/Murabaha in May as Kuwait Lifts Restrictions on Government and Central Bank to Access Public Debt Market

These are exciting times for the Kuwaiti debt capital market, including Sukuk origination. In May 2025, Kuwait’s Minister of Finance, Ms Noura Al-Fusam, authorized the Kuwait Investment Authority (KIA) to carry out foreign borrowing operations and the Central Bank of Kuwait to conduct domestic borrowing operations on behalf of the ministry. Prior to this, the government through the Ministry of Finance had been barred from borrowing from the debt capital markets since 2017.

In March, Kuwait issued a Decree Law on Public Debt in the Official Gazette that outlined a framework for managing public borrowing, as the country prepares to return to global debt markets for the first time in eight years. The law allows the government to issue financial instruments with maturities of up to 50 years and sets a ceiling for public debt at 30 billion Kuwaiti dinars (USD97.9bn), or its equivalent in major convertible foreign currencies.

Kuwait’s headline fiscal deficit is expected to remain high, averaging 8.9% of GDP between 2025 and 2028, compared with an estimated 2% in 2024, according to S&P Global Ratings. The widening deficit is due to low oil prices and high expenditure levels, primarily resulting from wages, subsidies, and grants, which collectively account for about 70% of total expenditure, according to S&P. The government is looking to increase non-oil revenues through higher government fees and improved collection through digitalisation. Kuwait’s GDP economic growth is expected to remain modest at 2% in 2025-2026 amid subdued global growth. This compared with GDP growth for neighbouring Saudi Arabia projected at 3% to 3.7% for 2025/26.

It is widely anticipated that Kuwait will re-enter the international financial market this year with a sovereign issuance. Whether it is a conventional bond or a Sukuk or both remains to be seen. Kuwait has been a relative latecomer to the Sukuk market compared with other GCC countries. Kuwait Finance House, one of the oldest Islamic commercial banks, has in the last two years accessed the Sukuk market with international issuances. Other institutions such as Warba Bank, Boubyan Bank, Kuwait International Bank are more seasoned issuers and have led from the front.

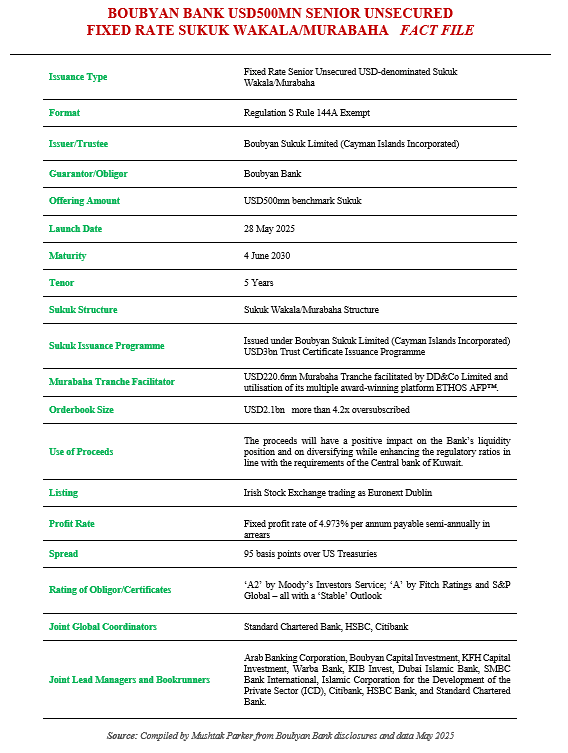

In this respect, Boubyan Bank, the Kuwait incorporated Islamic bank which is 60.4% owned by the National Bank of Kuwait, returned to the international Sukuk market at end May 2025 with a 5-Year Senior Unsecured RegS Sukuk Wakala/Murabaha transaction on 4 June 2025.

Boubyan Bank mandated Citigroup, HSBC and Standard Chartered Bank to act as the joint global coordinators, as well as lead managers and bookrunners together with Bank ABC, Boubyan Capital Investment, KFH Capital Investment, Warba Bank, KIB Invest, Dubai Islamic Bank, SMBC Bank International, the Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the Islamic Development Bank (IsDB) Group, on 29 May 2025, and to arrange a series of investor calls and meetings in London, Europe, the Middle East, Asia and with Offshore US Accounts.

The Bank had set the initial price guidance for a 5-Year fixed rate Senior Unsecured USD-denominated Regulation S Rule 144A Exempt Sukuk Wakala/Murabaha at around 130 basis points (bps) plus US Treasuries. Demand for the certificates, rated ‘A’ by Fitch Ratings and S&P Global and ‘A2’ by Moody’s Investors Service in line with their ratings of the Obligor, was robust from investors in the GCC, Europe, Asia and from Offshore US Accounts with the orderbook exceeding USD2.1bn – more than 4.2x oversubscribed.

This allowed the Bank to tighten the spread to a final 95 bps over US Treasuries which translates into a fixed profit rate of 4.973% per annum payable semi-annually in arrears.

According to Adel Abdul Wahab Al-Majed, Vice Chairman and Group Chief Executive Officer of Boubyan Bank, the proceeds will have a positive impact on the Bank’s liquidity position and on diversifying while enhancing the regulatory ratios in line with the requirements of the Central Bank of Kuwait. The Sukuk certificates have been accepted in early June 2025 for listing and trading on the Irish Stock Exchange trading as Euronext Dublin.

According to ICD, one of the joint lead managers (JLM) and bookrunner to the transaction, the Corporation “remains committed to its mandate of developing capital markets in member countries, exemplified by its ongoing efforts to facilitate private sector access to Islamic capital markets. As of 2025, total Sukuk issuance facilitated by the ICD as a JLM has reached USD8.85bn, highlighting its pivotal role in strengthening financial ecosystems. This focus on capital market development is particularly significant in member countries like Kuwait, where robust banking systems ensure that private sector funding needs are sufficiently met by local institutions.”

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by Boubyan Sukuk Limited, with the US$220.6m Murabaha tranche being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.