Saudi Bank Al Bilad Successfully Closes Benchmark USD650mn AT1 Sukuk Mudaraba in May 2025 to Complement and Support Its Capital Base Enabling the Achievement of its Long-term Strategic Objectives

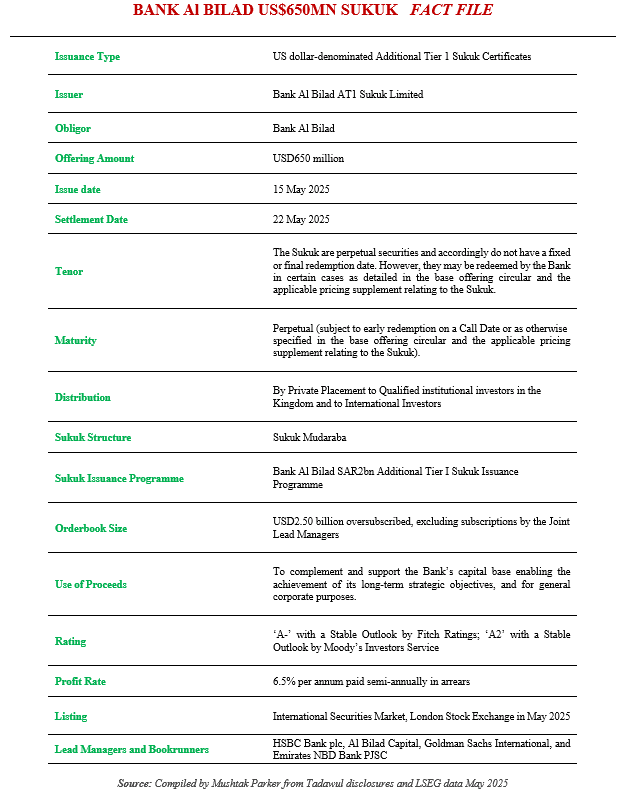

Bank Al Bilad returned to the international Sukuk market in May 2025 with a benchmark USD650mn Additional Tier 1 (AT1) Capital Sukuk Mudaraba. The transaction was launched on 15 May 2025 and distributed by way of private placement to eligible investors in the Kingdom of Saudi Arabia and to international investors.

The Sukuk certificates were issued under the Bank’s USD2bn Additional Tier 1 Sukuk Issuance Programme. The Bank mandated HSBC Bank, Al Bilad Capital, Goldman Sachs International, and Emirates NBD Bank, as Joint Lead Managers and bookrunners on 13 May 2025 to arrange investor calls with accounts in the Kingdom and internationally in relation to the offer with the intention to issue a benchmark US dollar-denominated Sukuk by way of a private placement.

The result was a Perpetual non-call USD650mn AT1 Sukuk Mudaraba issuance. The initial price thoughts were around a profit rate of 6.75% per annum.

The order book was robust reaching USD2.5bn and almost 4X oversubscribed, which allowed the issuer to tighten the price to a final coupon rate/yield of 6.5% p.a. paid semi-annually in arrears.

In a disclosure to Tadawul (the Saudi Exchange), Bank Al Bilad stressed that the Sukuk are perpetual securities and accordingly do not have a fixed or final redemption date. However, they may be redeemed by the Bank in certain cases as detailed in the base offering circular and the applicable pricing supplement relating to the Sukuk.

The settlement of the Sukuk issuance was on be on 22 May 2025. According to Bank Al Bilad, the proceeds from the issuance will be used to complement and support the Bank’s capital base under the Basel III provisions, thus enabling the achievement of its long-term strategic objectives, and for general corporate purposes.

Application has been made to list and trade the Sukuk certificates, rated ‘A-’ with a Stable Outlook by Fitch Ratings; and ‘A2’ with a Stable Outlook by Moody’s Investors Service, on the International Securities Market of the London Stock Exchange.

Bank Al Bilad, which was established in 2004, reported interim net profits for Q1 2025 totalling SAR700.4mn (USD186.75mn) compared to SAR643.1mn (USD171.47mn) for the same quarter last year. Total assets for Q1 2025 stood at SAR159,102.7mn (USD42,421.06mn) compared with SAR143,700.3mn (USD38,314.37mn) in Q1 2024.