Robust Investor Demand for AlRayan Bank Senior Unsecured RegS Sukuk Wakala Certificates as Bank Returns to the International Sukuk Market After Hiatus of 5 Years

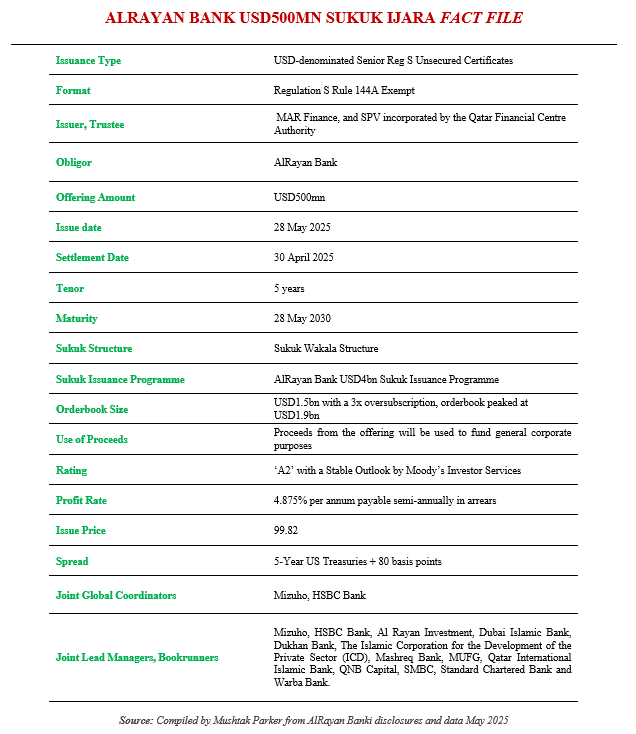

Qatar’s second largest Islamic bank in terms of balance sheet and market value, AlRayan Bank, successfully closed its latest foray into the Sukuk market after an absence of 5 years with a benchmark USD500mn 5-year Senior Unsecured RegS Sukuk Wakala offering on 28 May 2025.

AlRayan Bank had earlier mandated Mizuho and HSBC Bank to act as Joint Global Coordinators and together with Al Rayan Investment, Dubai Islamic Bank, Dukhan Bank, The Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank (IsDB) Group, Mashreq Bank, MUFG, Qatar International Islamic Bank, QNB Capital, SMBC, Standard Chartered Bank and Warba Bank to act as Joint Lead Managers and Book Runners to the transaction, and to arrange a series of investor calls and meetings in London, Europe, the Middle East, Asia and with Offshore US Accounts.

This issuance indeed followed a series of global investor meetings across Asia / EU / UK and led by AlRayan Bank’s senior management team, demonstrating the bank’s proactive engagement with international investors.

These discussions, stressed AlRayan Bank, played a crucial role in showcasing the bank’s financial strength and strategic vision, ultimately contributing to the successful execution of this Sukuk issuance. The Sukuk certificates, rated ‘A2’ by Moody’s Investor Services with a stable outlook, were issued through MAR Finance, an SPV incorporated by the Qatar Financial Centre Authority on behalf of the Obligor, AlRayan Bank, under the Bank’s USD4bn Sukuk Issuance Programme.

The transaction was settled at a final spread of 5-year US Treasuries + 80 bps with a profit rate of 4.875% per annum at an issue price of 99.82 payable semi-annually in arrears. “The successful completion of this transaction underscores the robustness of the Qatari economy and AlRayan Bank’s strong credit fundamentals. This issuance reaffirms AlRayan Bank’s standing as a leading financial institution in the region and marks a significant milestone in its journey to diversify its funding sources and continue to strengthen its presence in the international markets,” added AlRayan Bank.

In a disclosure, AlRayan Bank stressed that in many ways this was a landmark transaction, highlighting:

- A strong return to the Capital Markets after a 5-year hiatus, being AlRayan Bank’s first transaction since the successful completion of the merger in December 2021 and the establishment of the bank’s new corporate identity “AlRayan Bank”.

- The first Qatari bank to issue a USD benchmark Sukuk RegS offering out of the QFC Entity (MAR Finance LLC, established in Qatar Financial Centre).

- The issuance had the tightest re-offer spread over US Treasuries ever achieved by any Qatari bank at US 5Y Treasury+80bps, with the largest price tightening from Initial Price Thoughts (IPTs) in recent deals with a sizeable 40bps reduction in spread.

- The issuance boasted a final orderbook of US$1.5bn (covered more than 3 times) that peaked at over US$1.9bn.

- Both investor and geographic diversification were achieved in the offering.

H.E. Sheikh Mohamed bin Hamad Bin Qassim Al Thani, Chairman of AlRayan Bank, commented on the issuance closure: “We are delighted with the outstanding success of this issuance. The significant demand for our Sukuk reflects the financial strength and credit worthiness of AlRayan Bank, which is backed by its asset quality, strong liquidity and robust capitalization. We extend our sincere gratitude to all those who contributed to the success of this transaction.”

Omar Al-Emadi, Acting Group Chief Executive Officer of AlRayan Bank, similarly was pleased “with the successful return of AlRayan Bank to the international capital markets and with the remarkable response of this Sukuk issuance not only from Qatar institutions but also from a diverse group of regional and international investors.”

“This underscore,” he added, “the global confidence in Qatar’s economic resilience and AlRayan Bank’s solid financial standing within the international financial markets. We extend our deepest gratitude to the Joint Global Coordinators and JLMs, whose expertise and unwavering commitment and support played a pivotal role in the success of this transaction.”

The transaction, according to ICD, “achieved one of the tightest spreads for a financial institution in the GCC which is a testament to investors’ appetite to secure AlRayan’s Sukuk given the scarcity of the name in the market. This is just one of many Sukuk transactions ICD has successfully facilitated, raising a total of USD8.35bn thus far in 2025. As part of ICD’s ongoing mission to assist private sector entities and member countries in accessing the Islamic debt capital market, we continue to play a crucial role in supporting financial institutions with the right tools and expertise.”