Al Rajhi Bank Spearheads a Spate of Saudi Bank US Dollar Sukuk Issuances in May 2025

Sukuk issuances continued unabated in Saudi Arabia during May 2025 leading up to the Eid-ul-Adha festivities. The first standout feature was the Sukuk offerings of the top five Islamic banks in the Kingdom – four in the international market aggregating USD2.3bn and one in the Saudi riyal market raising SAR1.73bn (USD461.26mn) – bringing the total funds raised by the five banks through Sukuk origination in May alone to USD2.7613bn.

Lower oil prices and therefore revenues, continued geopolitical tensions, budgetary challenges, and the insatiable demand for funding by the NEOM mega initiative and a spate of other projects has been no dampener on the Sukuk origination market.

In fact, Sukuk is now the preferred choice of debt raising instruments of issuers across the economic spectrum. This is why the upward trajectory of outstanding global Sukuk crossing the USD1 trillion mark in 2025 projected by both Fitch Ratings and Moody’s Investor Services is not surprising.

Fitch Ratings, at end April 2025 projected that the Saudi debt capital market (DCM) alone is likely to cross USD500bn outstanding in 2025, with fundamentals intact.

“This is supported by the funding diversification across sectors, deficits and project financing under Saudi Vision 2030, and regulatory initiatives. However, the DCM is not immune from the surge in global volatilities, most recently caused by the US government’s tariff rises on 2 April. The primary dollar market has been relatively quiet since,” stressed Fitch Ratings.

A few weeks later, the primary dollar market has come back with a vengeance with the four benchmark US dollar issuances plus the USD22bn plus equivalent in Saudi riyal issuances in May 2025.

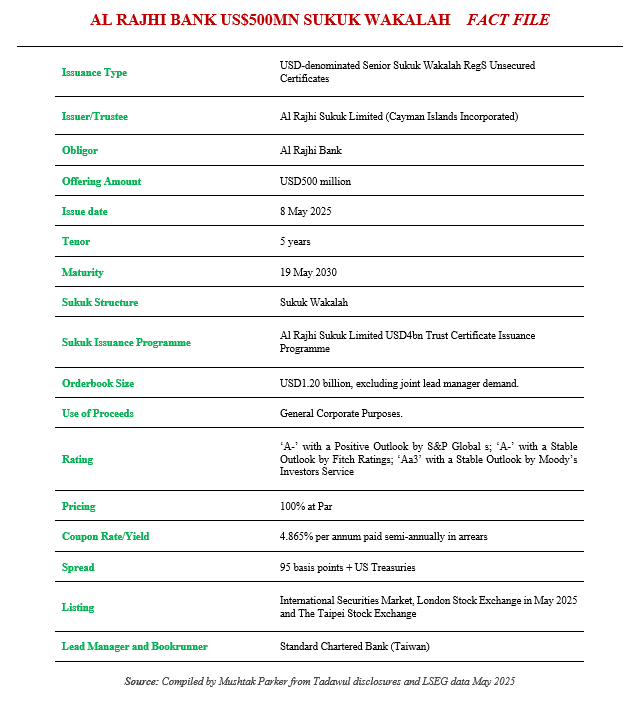

Al Rajhi Bank, the largest Islamic bank in the OIC member countries and in the world in terms of balance sheet, went to the international market on 8 May 2025 to successfully complete a 5-year benchmark senior unsecured RegS USD500mn Sukuk Wakalah offering.

The Bank is a proactive and regular issuer of Sukuk in both the domestic and international as a fund-raising tool and in accessing Murabaha syndicated facilities.

Details of the issuance have been unforthcoming, which is unusual given that the Bank has been hitherto very open with its disclosures. There was no disclosure to Tadawul (Saudi Exchange) but the Lead Manager and Bookrunner for the transaction was Standard Chartered Bank (Taiwan) which suggests that the transaction probably was through a private placement to investors in Taiwan and East Asia.

Not surprisingly the certificates are listed on the International Securities Market, of the London Stock Exchange and The Taipei Stock Exchange.

The latest Sukuk transaction certificates were issued through Al Rajhi Sukuk Limited (Cayman Islands Incorporated) on behalf of the Obligor, Al Rajhi Bank, under Al Rajhi Sukuk Limited USD4bn Trust Certificate Issuance Programme. The 5-Year certificates mature on 19 May 2030.

The initial price thoughts were put at around 125 basis points over US treasuries. Due to the robust demand for the certificates with the orderbook reaching USD1.2bn, the price was tightened to a final spread of 95 basis points plus US Treasuries, resulting in a coupon rate/yield of 4.865% paid semi-annually in arrears.

The proceeds from the issuance will be used to finance general corporate requirements.

Prior to this transaction, Al Rajhi Bank last tapped the market in January 2025 with a Perpetual USD1.5bn Sukuk Wakalah under the bank’s USD5bn Additional Tier 1 Capital Certificate Issuance Programme which was priced at a profit rate of 6.250% per annum paid semi-annually in arrears.