IsDB Board Approves Latest Round of Development Financing Aggregating USD277mn Aimed at Boosting the Healthcare, Education and Urban Transport and Regeneration Sectors in Three Member Countries

Jeddah – The Board of Executive Directors of the Islamic Development Bank (IsDB), at its 361st meeting in Jeddah in early July 2025, which was chaired by IsDB President, Dr. Muhammad Al Jasser, approved its latest round of new development financing totalling USD277mn aimed at boosting job creation, improving access to essential services, and supporting inclusive, sustainable growth across its Member Countries.

This latest round of development financing approvals, said the IsDB, highlights the Bank’s strong commitment to supporting transformative projects that make a tangible difference in people’s lives, while advancing the UN Sustainable Development Goals (SDGs).

The approved financing spans vital sectors, namely healthcare, education, and transportation and is focused on addressing urgent development challenges, from improving urban mobility to strengthening public health systems and building human capital.

In Mauritania, the IsDB Board approved €26.18mn (USD30.51mn) for the “Expansion of the National Cardiology Centre in Nouakchott Project” which will strengthen the country’s ability to prevent and treat cardiovascular diseases, one of the leading causes of premature death. It will also improve access to life-saving specialized care for thousands of people.

In Côte d’Ivoire, the Board approved an €200mn (USD233.06mn) financing package aimed at supporting the “Abidjan Sustainable and Integrated Urban Mobility Project,” a major initiative that will modernize the city’s public transport system. The project aims to reduce congestion, promote greener transportation, and make it easier for residents, especially those in underserved areas to reach jobs, schools, and essential services.

In The Gambia, the Bank is investing USD32.20mn to help establish the “School of Medicine and Allied Health Sciences (SMAHS)” at the University of The Gambia. This initiative will help address the country’s critical shortage of healthcare professionals by building a pipeline of locally trained doctors, nurses, and public health experts, ultimately improving the quality and resilience of the national health system.

The approval of these strategic projects said the Board underscores the IsDB’s steadfast commitment to financing transformative, high-impact initiatives that drive socio-economic progress. These investments, it added, demonstrate the Bank’s multidimensional and substantial contribution to the Member Countries’ development priorities towards building a more resilient, inclusive, and prosperous future, forming part of IsDB’s broader efforts to foster impactful investments that deliver sustainable, measurable results and help communities thrive.

Consortium of Islamic Financial Institutions led by ICD Arrange USD145mn Syndicated Murabaha Facility for Turk Eximbank to Support Export-oriented Businesses and Private Sector Exports from Türkiye

Jeddah – The Islamic Corporation for the Development of the Private Sector (ICD), a multilateral development financial institution and the private sector funding arm of the Islamic Development Bank (IsDB) Group, successfully closed a USD145mn Shariah- compliant syndicated financing facility for Türkiye İhracat Kredi Bankası A.Ş., the official Export Credit Agency of Türkiye (Turk Eximbank). The facility, which was launched at end July and completed in early August 2025, was structured as a Commodity Murabaha Syndication with a tenor of 3 years. This partnership between the two institutions aims to boost export-oriented businesses and the exports of private sector entities in Türkiye and provide Shariah-compliant financing solutions to support these exporters.

The syndicated financing facility was led by ICD as Mandated Lead Arranger and Bookrunner. ICD is also the Investment Agent of the facility. Three leading GCC-based Islamic banks participated in the facility. Warba Bank and Kuwait International Bank. joined as Joint Lead Arrangers, whereas AlRayan Bank joined as Co-Lead Arranger.

The ICD reiterated that it remains committed to develop Shariah-compliant financial channels in Member Countries to promote Islamic finance. This syndicated financing facility demonstrates the strong relationship of ICD, a multilateral development financial institution, with other leading Islamic financial institutions, to mobilize resources toward the sustainable development of the private sector across its Member Countries.

Dr. Khalid Khalafalla, Acting CEO of ICD, commented: “I am glad to announce this medium-term financing facility, which is designed to promote economic development and support Shariah-compliant export-oriented businesses in Türkiye. Through this initiative, we aim to empower private sector projects, particularly corporates and SMEs, those have meaningful developmental impact on the Turkish economy”

Mr. Ali Güney, General Manager of Turk Eximbank similarly stressed that “Turk Eximbank is one of the main enablers of the government’s export-led growth strategy and the largest development finance bank and official export credit agency (ECA) in Türkiye. We remain committed to support Turkish exporters and strengthening their global competitiveness. We consider ICD a strategic partner in this endeavour and look forward to continuing our cooperation in the future”

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new ICD-arranged facility for Turk Eximbank, with the transaction being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.

Saudi and Regional Bank Consortium Arrange Maiden USD300mn Syndicated Murabaha Facility for Local Real Estate Firm Ajlan & Bros

Jeddah – A consortium of Saudi and regional banks arranged a USD300mn syndicated Murabaha facility for Abdul Aziz Al Ajlan Sons Co. for Commercial and Real Estate Investment in July 2025.

The facility which has a tenor of 7 years is the maiden such facility for the company of which the proceeds will be used to finance the Group’s expansion plans and to diversify its fund-raising base.

Gulf International Bank – Saudi Arabia (GIB), First Abu Dhabi Bank (FAB) and Kuwait Finance House B.S.C. (C) acted as Initial Mandated Lead Arrangers and Bookrunners for the new facility. GIB also acted as the Sole Coordinator and Facility Agent.

Ajlan Abdulaziz Al Ajlan, Chairman of Ajlan & Bros, commented: “The USD300mn financing through a syndicated facility, which was subscribed by leading regional banks, is a testament to the appeal and confidence in the Saudi market, and in the Ajlan Group’s expansion plans, in key strategic sectors aligned with Vision 2030”.

GIB – Saudi Arabia’s CEO, Khaled Abbas commented that the “strong backing and participation of leading regional banks highlights the growing investor confidence and appetite for USD-denominated syndications for Saudi family-owned enterprises, particularly during this dynamic phase of economic transformation and growth in the Kingdom. We are grateful for the trust the Company has placed in GIB for its debut offering and remain dedicated to delivering tailored financing solutions to diversify and optimise their sources of funding in support of sustainable long-term growth.”

ITFC Arranges its Largest-ever USD513mn Syndicated Murabaha Facility for Pakistan to Support the Country’s Critical Energy Sector Needs

Jeddah – The International Islamic Trade Finance Corporation (ITFC), the trade fund of the Islamic Development Bank (IsDB) Group, signed a USD513mn Syndicated Murabaha Financing Facility with the Islamic Republic of Pakistan, represented by the Ministry of Economic Affairs, to support the country’s critical energy sector needs.

The signing ceremony in July 2025 was witnessed by Dr. Muhammad Al-Jasser, President of the Islamic Development Bank (IsDB), and the agreement was signed by Eng. Adeeb Yousuf Al-Aama, CEO of ITFC, and Hon. Dr. Kazim Niaz, Federal Secretary for Economic Affairs, on behalf of the Government of Pakistan.

This milestone facility marks the largest syndicated financing arranged by ITFC for Pakistan over the last three years, reaching USD513mn, which was significantly oversubscribed, with the final amount raised being more than double the initial target, reflecting strong interest and confidence from investors. The proceeds of the financing will be used for the import of crude oil, petroleum products, and liquefied natural gas (LNG) to meet Pakistan’s energy needs.

Eng. Adeeb Y. Al-Aama, CEO of ITFC, commented: “This syndicated financing is a clear vote of confidence by the market in both the ITFC capabilities and Pakistan’s economic trajectory. It demonstrates the growing trust of our financing partners and ITFC’s steadfast commitment to supporting energy security in Pakistan. Since 2008, our strategic partnership with the Government of Pakistan has resulted in the approval of more than USD8.1bn in trade finance, reflecting our longstanding commitment to the country’s economic growth. This agreement represents a continuation in that partnership, as we remain dedicated to mobilizing Shariah-compliant resources that support Pakistan’s development priorities and strengthen its trade resilience.”

According to Dr. Kazim Niaz, Federal Secretary for Economic Affairs, “this significant financing from the International Islamic Trade Finance Corporation (ITFC) underscores the growing confidence of international capital markets and development partners in Pakistan’s economic trajectory. We are witnessing positive trends in our macroeconomic indicators, reflecting the resilient efforts towards economic recovery and stability. This facility will further bolster our trade capabilities and contribute to sustained growth. Pakistan remains committed to fostering an environment conducive to robust partnerships and enhanced economic cooperation. The Government of Pakistan is grateful for the continuous support extended by the ITFC”.

This latest financing reflects ITFC’s continued efforts to provide impactful, Shariah-compliant trade solutions that address the urgent needs of member countries. By supporting Pakistan’s energy sector, the facility contributes to broader goals of economic stability, sustainable development, and enhanced trade integration across the OIC region, added the Corporation.

Türkiye Treasury Continues Sovereign Sukuk Al-Ijara Issuance Through Two Auctions of FX-denominated and Fixed Rate TRY Leasing Certificates Raising a Total of USD1,047.13mn in July 2025

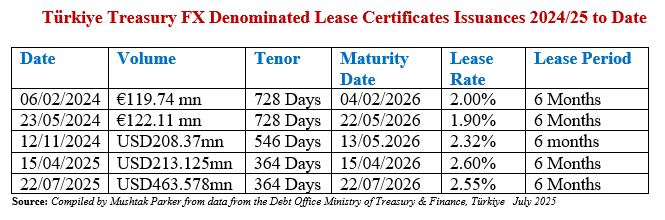

Ankara – Türkiye’s sovereign domestic Sukuk issuance continued its momentum in July 2025 with an auction of FX-linked lease certificates and fixed rate lease certificates (Sukuk Al-Ijarah) on 22 and 23 July 2025 as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic markets on the back of improving macro-economic fundamentals especially inflation. This issuance is also in tandem with the return of the Government of Türkiye to the international Sukuk market with a 5-year USD2.5bn Sukuk Al Ijara offering on 25 June 2025.

The Treasury’s public debt issuance domain includes domestic fixed rate and CP Indexed lease certificates (Sukuk Al Ijarah), FX-linked lease certificates and Gold-linked lease certificates as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond markets.

The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificates (Sukuk Al-Ijarah) market. On 22 July 2025, the Treasury issued FX-linked leasing certificates on 22 July 2025 when it raised USD463.578mn through a Fixed Rent Rate Lease Certificate (Sukuk Al Ijarah) issuance with a tenor of 364 days priced at a fixed rental rate of 2.55% over 6 months and maturing on 22 July 2026. Demand for the certificates was robust.

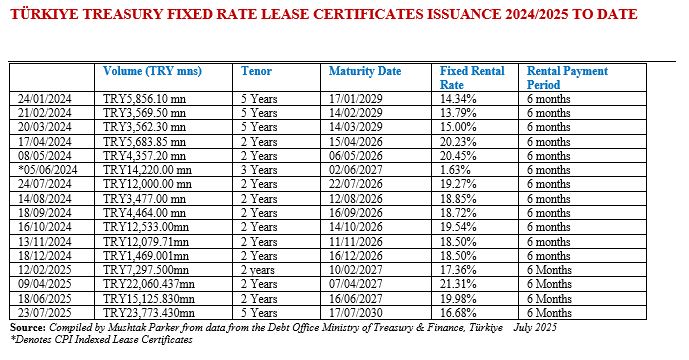

The Fixed Rate Lease Certificate market however is the mainstay of the Treasury’s fund-raising in the Sukuk market. The Türkiye Treasury raised TRY23,773.430mn (USD583.55mn) in an auction on 23 July 2025 through the issuance of 5-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 17 July 2030 priced at a fixed rental rate of 16.68% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

The Türkiye Treasury issued consecutive monthly Sukuk Al Ijarah during 2024, aggregating TRY83,272.161mn (US$2,321.83mn), suggesting that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy. To date the Türkiye Treasury has raised an aggregate TRY68,257.197mn (USD1,675.197mn) in 2025 through four auctions in February, April, June and July 2025.

The Türkiye Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions are “to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor. The auction was conducted by the Central Bank of Turkey via its AS (Auction System under Central Bank Payment Systems).

Malaysian Mortgage Securitiser Cagamas Berhad Raises Total of RM17.1bn (USD4.04bn) in Funding from the Market in FH2025 Through Bond and Sukuk Issuances to Drive Local Mortgage Securitisation Liquidity Market

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, continued its robust performance in FH 2025, raising a total of RM17.1bn (USD4.04bn) in funding through bond and Sukuk issuances. This marks a significant increase compared to the RM8.2bn (USD1.94bn) raised in the corresponding period in 2024.

This achievement, says Cagamas, comes against a backdrop of persistent global economic uncertainty, driven by renewed trade tensions, evolving tariff regimes, and monetary policy recalibrations across major economies. Despite these challenges, Cagamas reaffirmed its position as a cornerstone of Malaysia’s debt capital market and a reliable liquidity provider to the financial system. Kameel Abdul Halim, President/Chief Executive Officer of Cagamas Commented: “In an environment shaped by shifting global trade dynamics and inflationary pressures, Cagamas remains steadfast in its mission to support Malaysia’s financial stability. Our ability to secure RM17.1bn in funding reflects the confidence placed in us by investors and our agility in navigating complex market conditions.”

Building on its sustainability agenda, Cagamas continued to champion sustainability finance in 2025. The Company ranked second among the top issuers of ESG bonds, raising RM800mn (USD188.97mn) in total, comprising RM500mn (USD118.11mn) through ASEAN Social SRI Sukuk and RM300mn (USD70.86mn) though ASEAN Social Bonds, reinforcing its commitment to inclusive growth and sustainability stewardship. These instruments support financing initiatives that promote social equity and responsible development, in line with Malaysia’s broader sustainability goals.

“We are truly appreciative of the continued support from our international investors, which underscores Cagamas’ credibility and resilience. This support enabled the Company to successfully execute six foreign currency bond issuances during the first half of the year, raising a total of SGD893mn (USD694.02mn). These issuances tapped into diverse global liquidity pools, strengthened Cagamas’ presence in international capital markets, while continued to provide support for asset-selling financial institutions amidst global market headwinds,” added Kameel.

Looking ahead, Cagamas remains focused on strengthening the secondary mortgage market and advancing capital market development. These efforts are integral to ensuring sustained liquidity for primary lenders of home financing and housing loans, especially in a time of heightened global economic recalibration.

Cagamas is a major player in the mortgage securitisation market and issues bonds and Sukuk regularly to buy housing finance bundles from the market, thus increasing liquidity in the housing finance sector and reaffirming the Corporation’s role as a secondary mortgage corporation in providing liquidity to primary lenders of home financing and housing loans.

Cagamas plays an important role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia. Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysia’s sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM430.86bn (US$101.77bn) worth of corporate bonds and Sukuk.

DIB Arranges Maiden Islamic Aircraft Leasing Facility for Turkish Airlines

Istanbul – Another sign of Turkish utilities and state-owned entities increasingly looking to raising financing through alternative Islamic debt instruments as part of a diversified fund-raising strategy is the inaugural aircraft leasing facility raised by Turkish Airlines in July 2025.

This follows earlier forays into the Syndicated Murabaha market and the Sukuk market over the last year by Türkiye Varlık Fonu Yönetimi A.Ş. (Türkiye Wealth Fund (TWF), the state-owned sovereign wealth fund which successfully completed its maiden Sukuk offering – a USD750mn Sukuk Al-Ijarah in October 2024.

This latest transaction was executed by Dubai Islamic Bank (DIB) – a 12-year aircraft leasing (Ijarah) facility arranged for Turkish Airlines, the national flag carrier of Türkiye. The value of the transaction was not disclosed but it does mark the airline’s inaugural Islamic aircraft finance deal. A high-level signing ceremony was held in Istanbul, in the presence of Dr. Adnan Chilwan, Group Chief Executive Officer of DIB, Turkish Airlines Chairman of the Board and the Executive Committee Prof. Ahmet Bolat.

The event marked a key milestone in the partnership between DIB and Turkish Airlines, highlighting their shared commitment to innovation in ethical finance and paving the way for deeper collaboration across global markets and for Shariah-compliant structures to serve as a catalyst for growth within one of the world’s most prestigious airline fleets. Islamic aircraft leasing is well established in the sector going back several decades. Garuda of Indonesia, Malaysian Airlines, Syrian Air, Emirates Airlines, AirAsia have all accessed Islamic finance facilities in the past for fleet expansion purposes.

According to DIB, this latest deal represents a significant milestone in the bank’s ongoing efforts to advance the global influence of Islamic finance. By enabling one of the world’s leading airlines to adopt a fully Shariah-compliant financing structure, DIB reaffirms the strength, credibility, and adaptability of Islamic finance in delivering complex cross-border funding structures.

The transaction marks Turkish Airlines’ first-ever Islamic finance-backed aircraft financing, introducing Shariah-compliant structures into its funding portfolio as part of its broader diversification strategy. DIB acted as financier for the acquisition and induction of a new Airbus A350-941 into the Turkish Airlines fleet, with the transaction structured through a 12-year Islamic finance lease (Ijarah).

Dr. Adnan Chilwan, Group Chief Executive Officer at DIB, commented: “At a time when global markets are rethinking the foundations of sustainable finance, this transaction sends a clear signal that Islamic finance is no longer a niche; it is a resilient and globally relevant financial structure for the future. For Turkish Airlines to embrace Shariah-compliant financing for the first time and to choose DIB as their Islamic finance provider reflects both the strength of our principles and the confidence they have placed in our capabilities. We value this collaboration deeply. It not only supports the airline’s strategic growth but also reinforces the strengthening of economic ties between the UAE and Türkiye. This relationship continues to thrive on a vision rooted in mutual respect, shared ambition, and enduring cooperation.”

Turkish Airlines Chairman, Prof. Ahmet Bolat reiterated that “this transaction demonstrates our commitment to financial innovation and strengthening our fleet while also marking a new chapter in our cooperation with leading institutions in the UAE and the broader Gulf region. We are pleased to have completed this landmark financing in collaboration with DIB and look forward to building on this partnership in the future.”

This transaction further strengthens DIB’s position as a global leader in cross-border Islamic finance, showcasing the growing demand for Shariah-compliant solutions in capital-intensive sectors such as aviation. It reflects DIB’s continued focus on delivering innovative structures that not only meet financial objectives that uphold ethical and faith-based finance standards across markets. In fact, DIB has been increasing its footprint in Türkiye whether it is through investing in Islamic FinTech in Türkiye or arranging syndicated Murabaha’s such as the USD150mn Murabaha facility for Turkcell, Türkiye’s leading telecommunications and technology services provider in May 2025 to support Turkcell’s ongoing investments in digital infrastructure.

Cagamas Berhad launches its Latest Green Building Funding Initiative, the Green Mortgage Guarantee Programme, to Support Conventional and Islamic Financial Institutions in Expanding their Green Lending Portfolios while Promoting Environmentally Conscious Homeownership

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, continues to consolidate its Green building finance and sustainability architecture with the launch of its latest initiative, the Green Mortgage Guarantee Programme (Green MGP), marking a significant milestone in Malaysia’s journey towards sustainable and inclusive housing finance.

The Green MGP product will be offered through its sister company, Cagamas SRP Berhad and is designed to support Islamic and conventional financial institutions in expanding their green lending portfolios while promoting environmentally conscious homeownership. This innovative product offers mortgage guarantees for residential properties that are either certified as “green” or “sustainable,” as well as for homes with green enhancements, thereby aligning housing finance with Malaysia’s climate goals under the Twelfth Malaysia Plan and the national commitment to achieve net zero emissions by 2050.

This is Cagamas’ second Green building finance initiative in five months. In March 2025, Cagamas teamed up with The International Finance Corporation (IFC), the private sector funding arm of the World Bank Group, to sign a memorandum of understanding (MoU) to advance green building finance in Malaysia, further supporting the country’s sustainable development goals.

The collaboration aimed to promote climate-smart investments in the housing and broader building sector and improve the capacity of financial institutions to issue green building finance products aligned with Malaysia’s climate goals, including green bonds/Sukuk, green credit lines, and financing for sustainable cooling technologies. It also aimed to help financial institutions to build pipelines of bankable projects and manage environmental, social, and climate risks in the building sector, as well as facilitating dialogue and knowledge exchange on addressing barriers to sustainable housing development between the public sector and banking sector, among other initiatives.

The collaboration also sought to make green housing more affordable and accessible to lower-income groups and women in Malaysia by growing the market for green mortgage products and addressing other housing finance gaps. Expanding the growing market for green building finance is essential for Malaysia to realise its goal of achieving net-zero emissions by 2050, presenting significant opportunities in this sector.

Similarly, “the Green MGP is more than just a product – it’s a reflection of our commitment to a greener Malaysia. By incentivising green homes and reducing financing risks, we aim to make sustainable living more accessible and reshape the future of Malaysia’s housing and financial landscape,” said Kameel Abdul Halim, President/Chief Executive Officer of Cagamas Berhad.

Building on the success of previous housing guarantee schemes such as Skim Rumah Pertamaku, Skim Perumahan Belia and the new First Home Mortgage Guarantee Programme, which have enabled over 100,000 Malaysians to own their first homes, the Green MGP introduces a new dimension of environmental responsibility. It provides financial institutions with a risk mitigation tool that supports ESG-aligned lending practices, while offering homebuyers better financing options for sustainable properties.

“We recognise that for many institutions, ESG compliance is no longer optional. Through this programme, we hope to support our banking partners in meeting evolving sustainability standards while continuing to promote affordable home ownership,” added CEO Abdul Halim.

Arabian Internet and Communications Services Company Renews SAR1.5bn (USD400mn) Murabaha Financing with Saudi National Bank

Jeddah – The Arabian Internet and Communications Services Company (Saudi Solutions) renewed a two-tranche SAR1.5bn (USD400mn) Murabaha credit facility with Saudi National Bank (SNB) on 20 July 2025.

The renewed facility comprises two tranches – a SAR1bn (USD270mn) short-term facility with a tenor of 1 year to be utilised for issuing letters of credit (LC) and letters of guarantee (LG), and to support the company’s working capital needs. The second tranche comprises a medium-term SAR500mn (USD130mn) Murabaha financing tranche with a 5-year tenor, of which the draw down started with the previous facility to fund the strategic acquisition of Giza Systems Company.

In a disclosure to Tadawul, the Saudi Exchange), the company said that the facilities are guaranteed by a Promissory Note to cover the total financing amount.

IILM Continues Short Term Sukuk Issuance Momentum with Two Auctions in July 2025 with an Aggregate Reissuance of USD1.68bn and for the First Seven Months of 2025 of USD13.15bn Amid Robust Investor Demand

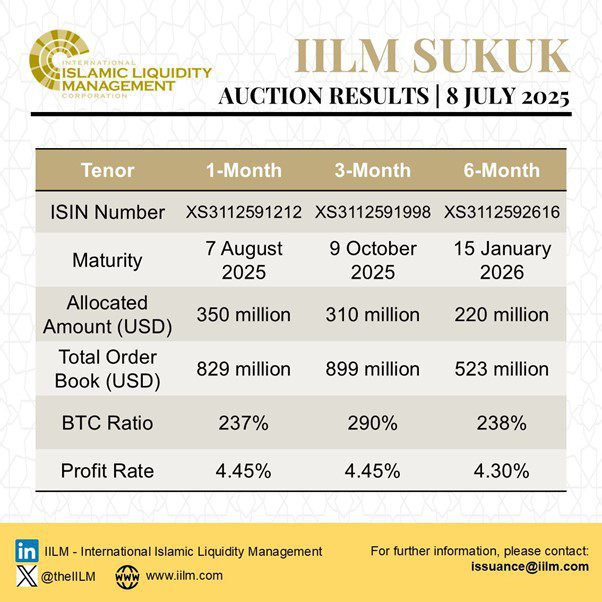

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Shariah-compliant liquidity management instruments, continued its short-term Sukuk issuance momentum with two auctions in July 2025 – the first one was a reissuance of an aggregate USD880mn short-term Sukuk across three different tenors of one, three, and twelve-month respectively on 8 July 2025 and the second one a reissuance of an aggregate USD800mn across three different tenors of 2-week, three, and six-month on 22 July 2025.

In the first auction on 22 July 2025, the three series were priced competitively at:

i) 4.45% for USD350mn for the 1-month tenor maturing on 7 August 2025

ii) 4.45% for USD310mn for the 3-month tenor maturing on 9 October 2025

iii) 4.30% for USD220mn for the 6-month tenor maturing on 15 January 2026.

The successful completion of the first auction of short-term Sukuk on 8 July 2025 brought the IILM’s year-to-date cumulative issuance to USD12.35 billion, across 36 Sukuk series of varying tenors. This marks 95% of the IILM’s total cumulative issuance for the whole of 2024, and 60% of the expected total for 2025. The auction attracted robust participation from the IILM’s network of Primary Dealers and global investors, generating total bids of USD 2.251 billion and achieving a strong average bid-to-cover ratio of 2.56 times — the highest recorded so far in 2025.

Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented: “The exceptionally strong outcome of today’s auction – amid ongoing global tensions, heightened geopolitical risks in parts of the Middle East, and divergent liquidity conditions across markets – underscores the resilience and continued relevance of the IILM short-term Sukuk growth in addressing cross-border Islamic liquidity needs.

“We are particularly encouraged by the solid demand across all three tenors, which were fully subscribed shortly after the book opened. This reflects deep and overwhelming liquidity appetite and reinforces investor confidence in the IILM’s issuance programme. It also reaffirms the role of our instruments as reliable tools for financial institutions navigating today’s uncertain macroeconomic landscape. The IILM remains firmly committed to supporting stability in the Islamic money markets through regular, high-quality issuance that aligns with the evolving needs of our global investor base.”

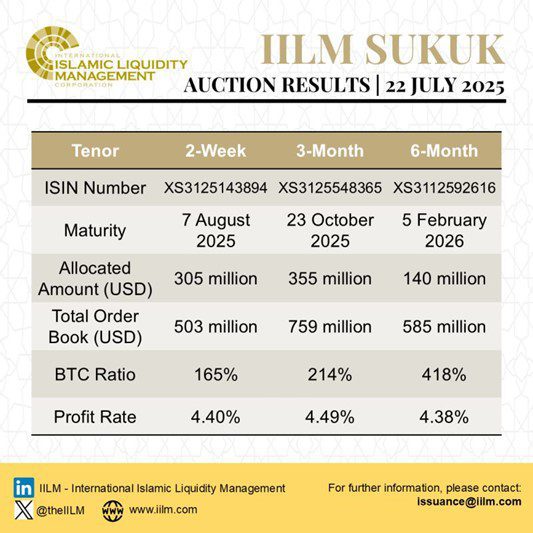

In the second transaction on 22 July 2025, the IILM also successfully completed the reissuance of an aggregate USD800mn short-term Sukuk across three different tenors of two-week, three, and six-month. The three series were priced competitively at:

i) 4.40% for USD305mn for the 2-week tenor maturing on 7 August 2025

ii) 4.49% for USD355mn for the 3-month tenor maturing on 2 October 2025

iii) 4.38% for USD140mn for the 6-month tenor maturing on 5 February 2026.

This completion of this latest auction on 22 July 2025 of short-term Sukuk marks the IILM’s thirteenth auction year-to-date with a cumulative issuance of USD13.15bn, across 39 Sukuk series of varying tenors. The auction attracted robust participation from the IILM’s network of Primary Dealers and global investors, generating total bids of USD1.9bn and achieving a strong average bid-to-cover ratio of 2.3 times.

Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented: “Today’s auction outcome underscores the continued strength of investor demand for high-quality Islamic liquidity instruments, despite ongoing uncertainty surrounding the US Federal Reserve’s rate trajectory and broader shifts in global monetary policy. Market participants remain cautious as central banks weigh persistent inflationary pressures against signs of moderating economic growth.

“The IILM’s consistent ability to attract strong participation across all tenors reflects the market’s confidence in our Sukuk programme as a dependable tool for short-term liquidity management. As global financial conditions remain uneven, the role of stable and Shariah-compliant instruments such as ours will become increasingly vital.”

Both issuances form part of the IILM’s “A-1” (S&P) and “F1” (Fitch Ratings) rated USD6bn short-term Sukuk issuance programme. The IILM’s short-term Sukuk is distributed by a diversified and growing network of 15 primary dealers globally, namely Al Rayan Bank, Abu Dhabi Islamic Bank, Al Baraka Turk, Affin Islamic Bank, Boubyan Bank, CIMB Islamic Bank Berhad, Dukhan Bank, First Abu Dhabi Bank, Golden Global Investment Bank, Kuwait Finance House, Kuwait International Bank, Maybank Islamic Berhad, Golden Global Investment Bank, Meethaq Islamic Banking from Bank Muscat, Qatar Islamic Bank, and Standard Chartered Bank.

The Corporation is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The Corporation says it will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

Looking ahead into 2025, the IILM plans to boost its asset origination activities through bespoke and attractive offerings to address the diverse needs of global sovereign and sovereign-linked Sukuk issuers, as well as rolling out alternative to Sukuk assets to allow further growth of supply and meet the growing market demand. The IILM will also continue to expand its investor base and network of primary dealers as it looks to expand regional collaborations and enter new markets to further integrate Islamic liquidity solutions into the global financial system. The Corporation, says Mr Mohamad Safri, remains committed to developing the Islamic liquidity management infrastructure and enhancing the Shariah-compliant liquidity tools available to the market, working closely with scholars, regulators, and industry stakeholders to resolve inconsistencies that may hinder growth.

The IILM says it will also continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The IILM’s ongoing commitment to innovation and impact, according to the Corporation, continues to bolster the liquidity management capabilities of Islamic financial institutions. By providing highly rated tools that are increasingly traded in secondary markets, the IILM helps these institutions meet their Liquidity Coverage Ratio (LCR) requirements while offering sustainable returns. The IILM consistently issues short-term Sukuk across 1-month, 3-month, 6-month, as well as 12-month tenors, tailored to the liquidity needs of Islamic financial institutions. Since its inaugural issuance in 2013, the IILM has successfully issued a cumulative of USD124.37bn worth of short-term Sukuk across 303 series.

The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.