Alinma Bank Successfully Closes Second Benchmark USD500mn Sukuk Wakala/Murabaha in Two Months at Tightest Profit Rate for a GCC Bank Originated Senior Unsecured 5-Year Issuance in 2025

Alinma Bank, one of the leading ‘new’ dedicated Islamic banks in Saudi Arabia based on “adopting a digital-first banking model”, successfully completed its second benchmark USD500mn Sukuk issuance in as many months.

The Bank returned to the international Sukuk market in May 2025 with the aim of boosting its Additional Tier 1 (AT1) capital with a benchmark USD500mn AT1 Capital Sukuk Mudaraba. The transaction was launched on 20 May 2025 and distributed by way of private placement to eligible investors in the Kingdom of Saudi Arabia and to international investors.

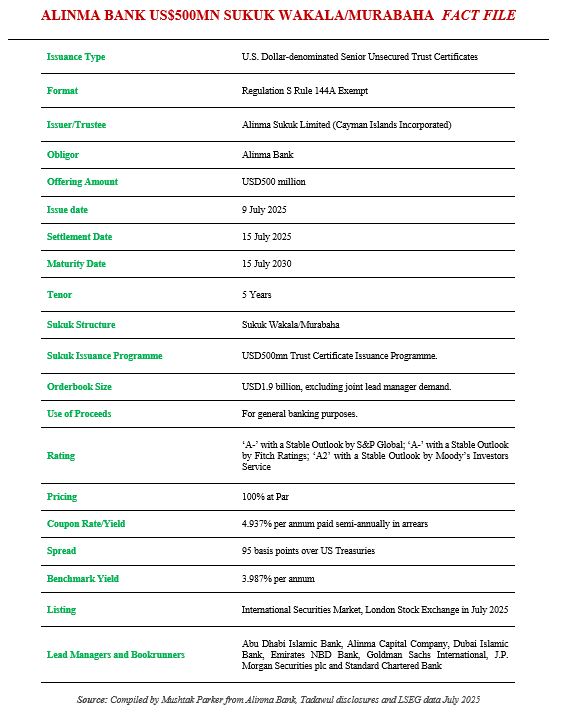

The Sukuk certificates of the latest US dollar transaction were issued by Alinma Sukuk Limited (Cayman Islands Incorporated) on behalf of the Obligor Alinma Bank. The certificates were issued under the Bank’s USD500mn Trust Certificate Issuance Programme, established in May 2025 and arranged by Alinma Capital Company and J.P. Morgan.

Alinma Bank had mandated Abu Dhabi Islamic Bank, Alinma Capital Company, Dubai Islamic Bank, Emirates NBD Bank, Goldman Sachs International, J.P. Morgan Securities plc and Standard Chartered Bank to act as Joint Managers and Bookrunners to the transaction on 7 July 2025, and to arrange a series of investor calls and roadshows with accounts in the UK, Europe, the MENA region, Asia and Offshore US.

The initial price thoughts (IPTs) were in the area of 130 basis points plus US Treasuries. The order book size exceeded USD1.9bn indicating robust demand for the certificates. This allowed price tightening on Alinma Bank’s USD500 million 5-year senior unsecured Sukuk offering to 95 basis points plus US Treasuries, with a benchmark yield of 3.987% and coupon of 4.937% per annum payable semi-annually in arrears.

This compares with the 6.5% profit rate of the Additional Tier One USD500mn Sukuk issued in May 2025.

This Sukuk is based on a Wakala and Murabaha structure according to the base prospectus of the offering. The offering was distributed through a private placement exercise.

In a disclosure to Tadawul (the Saudi Exchange), Alinma Bank stressed that the Sukuk may be redeemed by the Bank in certain cases as detailed in the base offering circular and the applicable pricing supplement relating to the Sukuk. The settlement of the Sukuk issuance was on 15 July 2025. According to Alinma Bank, the proceeds from the issuance will be used for general banking purposes.

This latest Alinma Bank Sukuk Certificates were admitted to trading on the London Stock Exchange’s International Securities Market and was listed in July 2025. The Sukuk certificates are rated ‘A-’ with a Stable Outlook by S&P Global; ‘A-’ with a Stable Outlook by Fitch Ratings; and ‘A2’ with a Stable Outlook by Moody’s Investors Service.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by Alinma, with the US$141.96m Murabaha tranche being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.