Iconic Dubai Realty Developer Binghatti Holding Successfully Closes its Latest Benchmark USD500mn Ijarah/Murabaha Sukuk in July 2025 as GCC Experiences Property Development and Construction Boom

Binghatti Holding Limited, the iconic Dubai-based real estate developer, is the latest UAE property developer to raise funds in the Islamic debt market by successfully closing a 5-year US$500mn Ijarah/Murabaha Sukuk offering at end July 2025. The transaction marked Binghatti’s return to the international Sukuk market in over a year following its maiden issuance of a USD300mn Sukuk Ijarah/Murabaha in February 2024 followed by a tap issuance of USD200mn taking the aggregate size of the issuance to USD500mn.

This latest issuance by Binghatti follows a growing trend of several UAE-based property developers tapping the Islamic debt markets to capitalise on a construction boom in the GCC. In recent months, several developers including Omniyat, Damac, and the Abu-Dhabi based Aldar Investment Properties have tapped the Islamic capital market with sukuk issuances. In fact, Aldar has joined Binghatti to similarly issue a USD450mn Sukuk in July 2025, following Sukuk issuances by Damac and Omniyat earlier in the year.

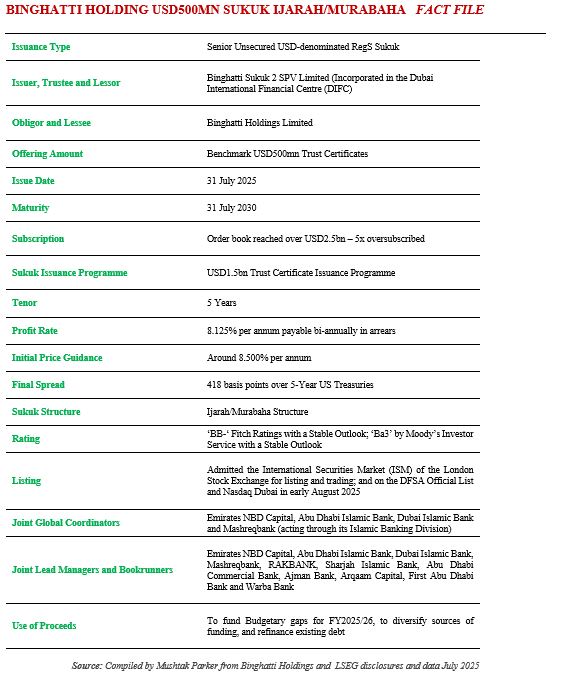

The Sukuk certificates were issued by Binghatti Sukuk 2 SPV Limited, a private company with limited liability incorporated in the DIFC as Trustee and Lessor on behalf of the Obligor and Lessee, Binghatti Holding Limited. It was issued under Binghatti Sukuk 2 SPV Limited’s USD1.5bn Trust Certificate Issuance Programme established on 30 July 2025.

The company had mandated Emirates NBD Capital, Abu Dhabi Islamic Bank, Dubai Islamic Bank and Mashreqbank (acting through its Islamic Banking Division), to act as joint global coordinators, and together with RAKBANK, Sharjah Islamic Bank, Abu Dhabi Commercial Bank, Ajman Bank, Arqaam Capital, First Abu Dhabi Bank and Warba Bank to act as Joint Lead Managers and Bookrunners, and to arrange a series of investor calls with accounts in the UK, Europe, Offshore US, the GCC, MENA region and Asia.

Company executives met potential investors face-to-face in roadshow meetings in the UK and Asia. Initial price thoughts were set at around 8.50% per annum. who accounted for most of the subsequent subscriptions to the Sukuk certificates. The transaction attracted widespread demand from both regional and international investors, with the order book reaching an impressive USD2.5bn with a 5 times oversubscription. The robust demand saw the Sukuk offering experiencing a tightening of the profit rate by 3.75%, demonstrating strong investor demand and confidence in the company’s strategy.

According to Muhammad Binghatti, CEO of Binghatti Holding Company, “Binghatti’s landmark Sukuk marks a pivotal milestone in our journey, reinforcing our position as one of the region’s most dynamic and diversified developers. The strong demand and investor trust highlight Binghatti’s unique model, a vertically integrated platform underpinned by phenomenal growth and market-leading execution.”

The senior unsecured Regulation S Sukuk attracted an order book exceeding USD2.5 billion, with half the demand coming from international investors. This allowed the company to tighten the pricing from the initial guidance of 8.5% and to price the transaction at a final profit rate of 8.125% per annum payable bi-annually in arrears – which translates into a spread of 418 basis points over the 5-year US Treasuries. This compared with the profit rate of 9.625% per annum payable semi-annually in arrears for the 3-year USD3400mn Sukuk in February 2024.

According to Ahmed Abdelaal, Group CEO of Mashreq, “the exceptional investor response underscores the strong appetite for the Dubai growth story and confidence in Binghatti’s trajectory. This landmark issuance affirms their access to global capital markets and establishes a new 5-year benchmark for the sector.”

According to the Base Prospectus, the net proceeds of the Trust Certificates will be applied by the Trustee pursuant to the terms of the relevant Transaction Documents on the relevant Issue Date in the following proportion: (a) not less than 55% of the aggregate face amount of the Trust Certificates towards the purchase from Binghatti Properties Investments Limited of all of its rights, title, interests, benefits and entitlements in, to and under the Assets pursuant to the Purchase Agreement; and (b) the remaining (being not more than 45% of the aggregate face amount of the Trust Certificates) towards the purchase of commodities to be subsequently sold to Binghatti pursuant to the Murabaha Agreement.

The Binghatti brand is synonymous with some of the most iconic projects in the Middle East. The company’s product offering spans all segments of the market, including affordable to mid-luxury, luxury, and uber-luxury markets. According to a disclosure to the London Stock Exchange, “the company is distinguished by its iconic architectural style that represents the brand’s distinct design DNA integrated across its wide array of real estate developments.” Binghatti’s AED12.5bn revenue backlog and AED70bn+ development portfolio position makes it as one of Dubai’s leading developers. The Group currently has 20,000+ units under development across 30 projects in key areas like Downtown Dubai, Business Bay, JVC, and Meydan. Its branded residences include collaborations with luxury icons Bugatti, Mercedes-Benz, and Jacob & Co. Further strengthening its development pipeline, Binghatti recently acquired a 9 million sq. ft. megaplot in Nad Al Sheba 1. The site will host Binghatti’s first master-planned community, with an estimated development value of over AED25bn.

The trust certificates rated ‘BB-’ by Fitch Ratings and ‘Ba3’ by Moody’s Investor Service – both with a Stable Outlook, were admitted to the International Securities Market (ISM) of the London Stock Exchange for listing and trading; and on the DFSA Official List and Nasdaq Dubai in early August 2025.

The company in July 2025 reported interim net profit of AED1.82bn for FH 2025 – triple the size of the same period in 2024. Total sales reached AED8.8bn and revenue rose 189% YoY to AED6.3bn for the same period.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by Binghatti, with the US$225m Murabaha tranche being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.