NDMC Launches May and June 2025 Rounds of Saudi Arabian Government Guaranteed SAH Retail Savings Sukuk at a Profit Rate of 4.76% and 4.66%

Riyadh – Saudi Arabia’s National Debt Management Centre (NDMC) of the Ministry of Finance launched the May and June 2025 rounds of the Saudi Arabian Government Guaranteed SAH Retail Savings Sukuk. The NDMC opened the June subscription window for its savings Sukuk product “Sah,” offering a return rate of 4.76%, and the May subscription window at a return rate of 4.66% as part of its 2025 issuance calendar.

The SAH Sukuk launched by the Saudi MoF in February 2024 is gaining traction especially among younger and retail investors. According to the NDMC, the subscription windows are offered through digital channels of the participant financial institutions – the primary dealers and distributors.

The SAH Savings Sukuk product, which was launched by the Ministry of Finance and managed by the NDMC, is an initiative under the umbrella of the Financial Sector Development Programme’s initiatives (one of the Saudi Vision 2030 programs) aimed to increase the savings ratios among individuals by motivating them to allocate a portion of their income to savings on a periodic basis, in addition to increasing the supply of savings products, raising the awareness around financial literacy and the importance of savings and its benefits for future plans.

SAH Sukuk are reserved for Saudi citizens only, who are over the age of 18 years, provided the subscriber has an account with either SNB Capital, AlJazira Capital, Alinma Investment, SAB Invest or Al Rajhi Capital, the primary dealers and distribution channels. SAH Sukuk is the first subsidized savings product intended for individuals that is compatible with Shariah principles in the form of Sukuk. It comes under the aegis of the Saudi Ministry of Finance’s Local Trust Certificates Issuance Programme denominated in Saudi riyals.

The purpose of issuance of SAH Sukuk is to enhance the financial planning of the younger generation for the future and increasing individuals’ savings rates by motivating them to periodically deduct a portion of their income and allocate it to savings, in addition to increasing the supply of savings products.

Its key marketing drivers include Shariah compliance products which enjoy growing popularity and traction among Saudi youth, featuring a short-term tenor of 1-year, annual returns, easy subscription, no fees for subscribers, and no restrictions on redemption. The SAH Sukuk are structured for a one-year term with fixed returns, and profits are paid at maturity.

The minimum subscription rate of SAH Sukuk is SAR1,000, which is equivalent to the nominal value, while the maximum subscription limit is SAR200,000 for the total number of issues per individual during the programme period. The SAH Sukuk has the potential to become an exemplary retail Sukuk savings product – in terms of Issuer of Last Resort (the Saudi Government), Guarantor, Volume, Competitive Pricing, and Investors, albeit transparency and data by the NDMC could be improved.

The Shariah-compliant, riyal-denominated SAH Sukuk issuance is part of the local trust certificate issuance programme of NDMC aimed at fostering financial inclusion and increasing personal savings. This latest issuance window closed on 3 June 2025. The sukuk is issued monthly, and the return rate for each tranche is determined based on prevailing market conditions.

Bahrain-based Al Salam Bank Latest Institution to Tap International Market with an USD450mn Additional Tier 1 (AT1) Capital Sukuk Issuance

Manama – Bahrain-incorporated Al Salam Bank successfully close a USD450mn Additional Tier 1 (AT1) Capital Sukuk issuance on 3 June 2025. The issuance, which was structured as a private placement and advised by ASB Capital (the Group’s asset management and investment banking arm headquartered in the DIFC), says the Bank, attracted substantial demand from regional and international investors “reflecting strong investor confidence in the Bank’s financial strength and long-term growth strategy.”

Details and the pricing of the Sukuk were not disclosed in the announcement either to the Bahrain Bourse or the Dubai Financial Market on which the certificates and the Bank are listed.

The AT1 Capital issuance, says the bank, “forms a key initiative within the Group’s broader financial optimization strategy, enhancing its capital position to support future growth plans. Following market leading annual growth exceeding 35% across balance sheet metrics, the issuance was designed to further enhance the Group’s financial standing and capitalization profile. The issuance also underscores the Bank’s commitment to sustainable growth and financial resilience, positioning it as a leading and diversified financial group in the region. The significant investor demand highlights the Group’s ability to access liquidity from regional and global markets, reflecting strong investor confidence in the Bank’s strategy and financial position.”

Al Salam Bank mandated ASB Capital to advise and structure the issuance. As part of its Capital Markets offering, ASB Capital provides tailored financing solutions to meet the evolving needs of clients by leveraging market expertise and strategic partnerships. Most recently, ASB Capital was also appointed as a joint lead manager by Bapco Energies in Q1 2025 for its USD1bn Sukuk issuance.

Rafik Nayed, Group CEO of Al Salam Bank and Managing Director of ASB Capital, commented: “The overwhelming response to our USD450mn AT1 Capital issuance is a testament to Al Salam Bank’s financial stability, market credibility, and strategic direction. Since 2020, we have consistently increased our total equity by more than 65%, and this issuance further strengthens our capital base and enhances our financial agility to execute our ambitious growth aspirations. We have recently rolled out an aggressive growth strategy across all Group companies. We are confident that the Group is well positioned to continue creating sustainable shareholder value.”

ASB Capital’s ability to attract substantial investor demand, despite global market volatility, he added, “highlights the team’s capabilities in the Capital Markets space. By focusing on efficient capital raising and tailored financing solutions, ASB Capital connects clients to a broad network of funding sources, enabling them to adapt to market conditions and achieve growth aspirations. In addition to Al Salam Bank’s AT1 Capital issuance, the firm’s Capital Markets pipeline includes mandates from regional financial institutions and institutional clients covering Sukuk, Tier 2 Capital, syndications, and other structured instruments.”

Singapore-based Olam Group Secures USD1.85bn Dual Tranche Murabaha and Conventional Financing Facilities from International Bank Consortium

Singapore – Olam Group Limited’s food, feed and fibre operating group, Olam Agri, secured a 3-year USD1,850mn dual tranche financing facility from a consortium of international banks on 30 May 2025. The dual tranche facility is comprised of a USD1,600mn conventional loan and a USD250mn Murabaha financing facility.

Olam Agri is a market leading, differentiated food, feed and fibre agri-business with a global origination footprint, processing capabilities and deep understanding of market needs built over 35 years. The dual tranche facility has Olam Agri subsidiaries – Olam Global Agri Pte. Ltd. and Olam Global Agri Treasury Pte. Ltd. as borrowers of the conventional tranche and as purchasers for the Islamic tranche. The Facility is initially guaranteed by Olam Group which will be assumed by Olam Agri upon the demerger of Olam Agri. Proceeds from the Facility will be used for general corporate purposes.

For the conventional tranche, the Senior Mandated Lead Arrangers are Australia and New Zealand Banking Group Limited, Banco Bilbao Vizcaya Argentaria, BNP Paribas, ING Bank, Intesa Sanpaolo Bank, and Natixis. First Abu Dhabi Bank is the Mandated Lead Arranger. For the Islamic tranche, the Senior Mandated Lead Arranger is Dubai Islamic Bank. HSBC is the Facility Agent for the conventional tranche. DIB is the Investment Agent for the Islamic tranche.

With a strong presence in high-growth emerging markets and products across grains and oilseeds, wheat milling and pasta, rice, edible oils, specialty grains and seeds, animal feed and protein, cotton, wood products, rubber, sugar & bioenergy and commodity financial services, Olam Agri is at the heart of global food and agri-trade flows with 45.1 million MT in volume handled in 2024.

Focused on transforming food, feed and fibre for a more sustainable future, it aims at creating value for customers, enable farming communities to prosper sustainably and strive for a food-secure future. Olam Agri Holdings Limited, which holds the Olam Agri business, is a 64.6% owned subsidiary of Olam Group. 35.4% of Olam Agri Holdings is owned by SALIC International Investment Company, a wholly owned subsidiary of Olam Agri’s strategic partner The Saudi Agricultural and Livestock Company.

IsDB and Türkiye Sign USD740mn of Development Finance Agreements Aimed at Supporting Post-earthquake Recovery Through Investments in Disaster-resilient Health Systems and Green and Inclusive Education

Ankara – The Islamic Development Bank (IsDB) and the Republic of Türkiye signed two strategic financing agreements totaling around USD740mn on 20 June 2025 aimed at supporting the country’s post-earthquake recovery through investments in disaster-resilient health systems and promoting green, resilient, and inclusive education. The agreements were signed in Ankara by Mr. Kerem Dönmez, Director General of Foreign Economic Relations, Ministry of Treasury and Finance of Türkiye, and Dr. Walid Abdelwahab, Director of the IsDB Group Regional Hub in the country.

In the health sector, the two parties have signed a EUR500mn financing agreement for the reconstruction and upgrading of two hospitals in Istanbul as part of the Istanbul Seismic Risk Reduction and Emergency Preparedness (ISMEP) initiative. The Fatih Sultan Mehmet Training and Research Hospital will be expanded from 310 to 1,584 beds. Once operational, it will handle over 2.6 million outpatient visits and 800,000 emergency cases annually. This project represents the largest single financing by the IsDB to Türkiye and will significantly enhance the country’s capacity to deliver safe, high-quality, and earthquake-resilient healthcare services. The project is co-financed by the Council of Europe Development Bank.

The second agreement allocates USD165mn in financing for the construction of 33 modern, climate-resilient schools in earthquake-affected and high-risk provinces. These schools will annually serve approximately 72,000 students, offering advanced learning environments with modern tools and facilities. The project is part of a larger initiative involving co-financing from the World Bank to deliver a total of 93 schools and reaffirms the Government’s commitment to inclusive and sustainable education recovery.

Each of these initiatives, says the IsDB, contributes to Türkiye’s commitments towards the United Nations Sustainable Development Goals (SDGs), thereby reinforcing IsDB’s role as a catalyst for inclusive and sustainable development across the Global South.

Over the past 50 years, the IsDB Group has allocated more than USD14.7bn towards development financing projects and initiatives in Türkiye, focusing on 587 projects that cover various sectors, including health, renewable energy, education, and modern transportation, along with numerous other environmentally sustainable projects. This series of financings marks another significant milestone in the longstanding development partnership between Türkiye and the IsDB Group and aligns with the 2024–2026 Country Engagement Framework and the Government’s 12th Development Plan.

Mr. Kerem Dönmez stated that these projects demonstrate the critical importance attached to improving resilient infrastructure by the Government of Türkiye in the health and education sectors, both in Istanbul and in the earthquake-affected region. Dr. Walid Abdelwahab reaffirmed the IsDB Group’s unwavering commitment to supporting Türkiye’s recovery and fostering its long-term resilience. “We are proud to support transformative projects that address urgent needs and promote long-term development in Türkiye,” he stated.

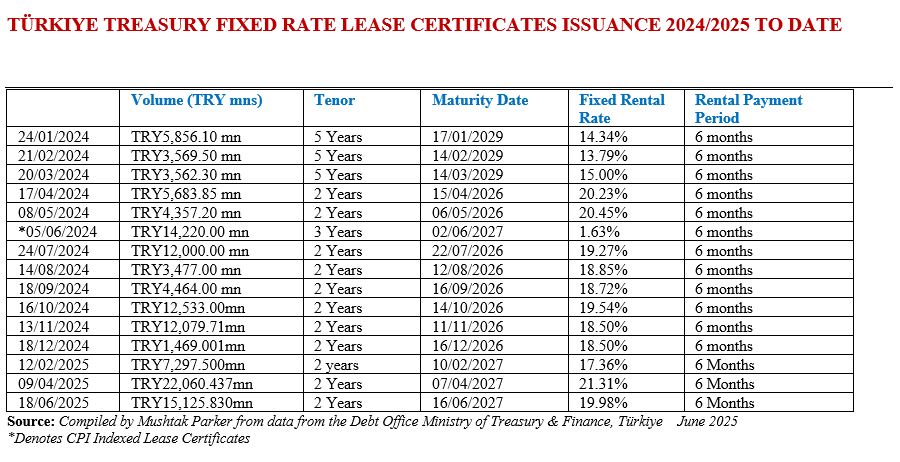

Türkiye Treasury Continues Domestic Sovereign Sukuk Al-Ijara Issuance Through TRY15,125.83mn (USD380.25mn) Auction of Fixed Rate Leasing Certificates Totalling TRY44,483.8mn (USD1,118.3mn) at end June 2025

Ankara – Türkiye’s sovereign domestic Sukuk issuance continued its momentum in June 2025 with an auction of fixed rate lease certificates (Sukuk Al-Ijarah) on 16 June as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic markets on the back of improving macro-economic fundamentals.

This issuance is also in tandem with the return of the Government of Türkiye to the international Sukuk market with a 5-year USD2.5bn Sukuk Al Ijara offering on 25 June 2025.

The Treasury’s public debt issuance domain includes domestic fixed rate and CP Indexed lease certificates (Sukuk Al Ijarah), FX-linked lease certificates and Gold-linked lease certificates as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond markets.

The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificates (Sukuk Al-Ijarah) market.

The Fixed Rate Lease Certificate market however is the mainstay of the Treasury’s fund-raising in the Sukuk market. The Türkiye Treasury raised in an auction on 16 June 2025 through the issuance of 2-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 16 June 2027 priced at a fixed rental rate of 19.98% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

The Türkiye Treasury issued consecutive monthly Sukuk Al Ijarah during 2024, aggregating TRY83,272.161mn (US$2,321.83mn), suggesting that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy. To date the Türkiye Treasury has raised an aggregate TRY44,483.767mn (USD1,118.30mn) in 2025 through three auctions in February, April and June 2025.

The Türkiye Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions are “to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor. The auction was conducted by the Central Bank of Turkey via its AS (Auction System under Central Bank Payment Systems).

Malaysia’s SC Launches National Sustainability Reporting Framework and 40 Hadiths Book Series to Promote ESG Ethics in Financial System and a Deeper Understanding of Shariah Principles on ESG in Transactions

Kuala Lumpur – The Securities Commission Malaysia (SC) launched two initiatives in June 2025 to promote and consolidate the embedding of sustainability and environmental ethics in the financial system in general, and adherence to Islamic ESG principles in financial and commercial transactions relating to the country’s Islamic banking and capital market ecosystem.

The capital market regulator introduced The National Sustainability Reporting Framework (NSRF) aimed at addressing the use of the IFRS® Sustainability Disclosure Standards issued by the International Sustainability Standards Board (ISSB), specifically the IFRS S1 General Requirements for Disclosure of Sustainability related Financial Information, and IFRS S2 Climate-related Disclosures (collectively referred to as the ISSB Standards), as the baseline sustainability disclosure standards for companies in Malaysia, as well as the assurance requirements for sustainability reporting.

The NSRF, says the SC “is meant to ensure corporate Malaysia provides consistent, comparable and reliable sustainability information to enhance Malaysia’s competitiveness and attractiveness to investors.” The Framework prioritises climate-related disclosures to support Malaysia’s net-zero goals, with a focus on transparency and accountability. Companies are encouraged to provide clear, accurate data on their climate risks and opportunities to facilitate informed decision-making. It also provides a phased approach to sustainability reporting, allowing companies to gradually adopt the ISSB standards. This approach, says the SC, ensures that companies of different sizes and levels of readiness can implement reporting processes in stages, giving them time to build capacity and align with global standards.

The SC also launched the 40 Hadiths book series on sustainability and ethical sales transactions to promote a deeper understanding of the Islamic perspective on sustainability and Islamic ethics in commercial transactions. The publications, launched during the 3rd SC Nadwah of Shariah Advisers in Islamic Capital Market (ICM), aim to enhance industry awareness and practical implementation.

According to SC Chairman Dato’ Mohammad Faiz Azmi, the publications mark a significant milestone in raising industry awareness on embedding the principles of Maqasid al-Shariah Guidance in the ICM, specifically in areas such as environmental stewardship, responsible business, and trade practices. “Internalising the Guidance encapsulated in these Hadiths contributes to the development of a just, inclusive and sustainable economy. More importantly, the SC is committed to making Maqasid al-Shariah a fundamental framework for business dealings in ICM,” he added.

UAE’s Securities and Commodities Authority Launches MENA Region’s Regulatory Milestone – a First FinFluencer Licence Aimed at Formalising and Supervising Digital Financial Content

Abu Dhabi – The Securities and Commodities Authority (SCA) of the UAE launched the MENA region’s first Finfluencer licence at end May 2025, which the Authority maintains is an innovative regulatory milestone aimed at formalising and supervising digital financial content.

The initiative seeks to establish a clear governance framework for individuals offering investment analysis, recommendations, and financial promotions across digital platforms. This initiative is designed to enhance investor protection in the UAE.

The SCA defines a Finfluencer as an individual registered with the SCA to provide financial recommendations related to the purchase, sale, or holding of a financial product or virtual asset, or to offer recommendations related to a financial service or any local resource within the country. This may be done through traditional or modern media channels, such as various written or audio social media platforms, participation in seminars, meetings, or forums, blogging, public appearances by any means, or through statements, opinions, or analyses about the present or future value, price, or expected performance. It also includes individuals who engage the public through content, visuals, advice, recommendations, discussions, information, analyses, opinions, or reports related to financial investments or specific financial products within the country.

Commenting on the initiative, Waleed Saeed Al Awadhi, CEO of the SCA, commented: “Introducing the Finfluencer license is not merely a regulatory measure; it is a strategic move to redefine the role of regulators in the digital economy. Through this initiative, the SCA aspires to elevate global benchmarks of market integrity, foster transparency, and nurture a disciplined and trustworthy financial environment. The SCA positions itself as an enabler of transformative change, adopting forward-thinking regulatory models that evolve with the fast-paced dynamics of the financial and investment landscape.”

This initiative comes as part of a package of incentive measures adopted by the SCA to align its regulatory framework with the fast-moving landscape of digital finance. In this respect, the SCA has waived registration, renewal and legal consultation fees related to this service, for a period of three years. This is in line with efforts to eliminate government bureaucracy and promote financial innovation within a robust legal and regulatory framework.

According to the SCA, the licence is available to individuals who offer financial, or investment recommendations related to regulated products or entities within the UAE through digital or traditional media. Eligible applicants must register with the SCA and comply with all applicable regulatory obligations, ensuring the highest standards of investor protection and reinforcing public trust in the local capital markets.

This initiative is integral to the SCA’s overarching strategic vision of elevating the UAE’s position as a leading regional and global financial hub. By embracing agile and forward-looking regulatory approaches, the SCA reaffirms its commitment to safeguarding market integrity, advancing financial literacy, and aligning with international best practices in the rapidly evolving digital financial landscape, added the regulator.

ITFC Pens €106mn (USD124.7mn) Murabaha Financing Agreement with Burkino Faso Textile Agency SOFITEX to Boost Cotton Production

Jeddah – The International Islamic Trade Finance Corporation (ITFC), the trade fund of the Islamic Development Bank (IsDB) Group, consolidated its longstanding support with Burkino Faso by signing an €106mn (USD124.69mn) Murabaha financing agreement with the country’s cotton executing agency, Société Burkinabè des Fibres Textiles (SOFITEX) in June 2025.

The facility provided aims to support the country’s cotton campaign, reinforcing ITFC’s longstanding commitment to enhancing agricultural productivity and economic stability in Burkina Faso. Commenting on the signing, Nazeem Noordali, COO of ITFC stressed that “ITFC’s commitment to Burkina Faso’s economic development is once again demonstrated through this renewed financing facility. We recognize the critical role of the cotton sector in the economy and its impact on employment in Burkina Faso, which has been a key focus of our interventions since 2008. This partnership with SOFITEX aligns with our ongoing efforts to drive sustainable growth in the sector while ensuring its long-term resilience and prosperity.”

According to SOFITEX CEO, M. Bienvenu Pare, “this financing will not only help boost cotton production but also create tangible impacts on rural livelihoods, strengthen value chains and support the country’s sustainable economic growth. We look forward to the positive outcomes of this collaboration for Burkina Faso’s cotton sector and wider agriculture industry.”

This latest financing facility is in line with the USD900mn Framework Agreement signed in May 2023 between ITFC and Burkina Faso. With this financing, ITFC continues to play a crucial role in supporting Burkina Faso’s agricultural sector and contributing to the country’s economic stability and agricultural productivity while advancing SDG Goal 1 “No Poverty” and SDG 2 “Zero Hunger”.

Over the years, ITFC and the Republic of Burkina Faso have enjoyed a good and longstanding relationship with a total of USD3.3bn approved in financing across 48 operations in Burkina Faso, mainly in the energy and agriculture sectors.

Alinma Bank Signs SAR938mn (USD250.14mn) Murabaha Financing Agreement with Dr Soliman Abdul Kader Fakeeh Hospital Company to Support the Group’s Expansion and Regional Growth Plans

Jeddah – Saudi Arabia’s Alinma Bank, one of the leading ‘new’ dedicated Islamic banks in Saudi Arabia based on “adopting a digital-first banking model”, signed a Murabaha financing agreement with Dr. Soliman Abdul Kader Fakeeh Hospital Company and its subsidiaries Fakeeh Care Group, for the total value of SAR938mn (USD250.14mn).

The facility signed on 26 June 2025 comprises a long-term tranche of SAR638mn (USD170.14mn) and a short-term tranche of SAR300mn (USD80mn). In a disclosure to Tadawul (The Saudi Exchange) the company stressed that the Shariah compliant Credit Facility Agreement was achieved at competitive terms and conditions with Alinma Bank.

This Credit Facility Agreement will be available to all Fakeeh Care Group entities and the proceeds will be used to finance Fakeeh Care Group’s expansion and growth plans. This facility replaces previously existing facilities of SAR838mn (USD223.47mn) for Dr. Soliman Abdul Kader Fakeeh Hospital Company, and SAR570mn (USD152.00mn) for Dr. Soliman Fakeeh Hospital Medical Company in Riyadh.

The new facility is guaranteed by a Corporate Promissory Note given by Dr. Soliman Abdul Kader Fakeeh Hospital Company and its subsidiaries Fakeeh Care Group amounting to the total value of the facility.

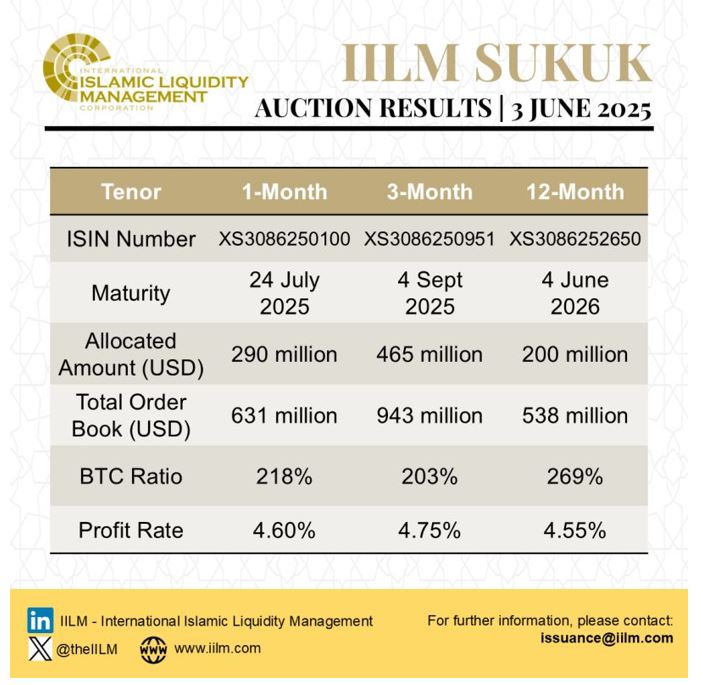

IILM Continues Short Term Sukuk Issuance Momentum with Two Auctions in June 2025 with an Aggregate Reissuance of USD1.98bn and for the First Six Months of 2025 of USD11.47bn Amid Robust Investor Demand

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Shariah-compliant liquidity management instruments, continued its short-term Sukuk issuance momentum with two auctions in June 2025 – the first one was a reissuance of an aggregate USD955mn short-term Sukuk across three different tenors of one, three, and twelve-month respectively on 3 June and the second one a reissuance of an aggregate USD1.025bn across three different tenors of one, three, and six-month on 3 June 2025.

The first auction on 3 June 2025 comprised three series which were priced competitively at:

i) 4.60% for USD290 million for the 1-month tenor maturing on 24 July 2025

ii) 4.75% for USD465 million for the 3-month tenor maturing on 4 September 2025

iii) 4.55% for USD200 million for the 12-month tenor maturing on 4 June 2026.

The reissuance of an aggregate USD955mn short-term Sukuk on 3 June 2025 across three different tenors of one, three, and twelve-month marked the IILM’s tenth auction year-to-date.

The auction attracted strong demand from the IILM’s network of Primary Dealers and global investors, resulting in a healthy orderbook of USD2.11bn and a robust average bid-to-cover ratio of 221%, reflecting continued confidence in the IILM’s short-term Sukuk programme.

Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented: “With today’s USD955mn Sukuk reissuance — our tenth auction for the year — the IILM’s year-to-date issuance reached USD10.45bn. We remain on-track to meeting our full year issuance target for 2025 of approximately USD20bn, which is set to be an all-time high for the IILM (2023: USD11.52bn; 2024: USD13.01bn). This latest auction was conducted in a volatile market environment marked by heightened uncertainty. Timing-wise, it took place just ahead of the Eid break and against the backdrop of a surge in global Sukuk issuances over the past two weeks, totalling USD4.8bn.”

Despite all these headwinds, the robust bid-to-cover ratio of over two times achieved for today’s auction, exactly a week after our last issuance (of USD 1.28 billion), clearly reinforces the market’s growing interest and confidence in the IILM’s Sukuk as one of the most sought-after instruments for short-term Islamic liquidity management globally,” he added.

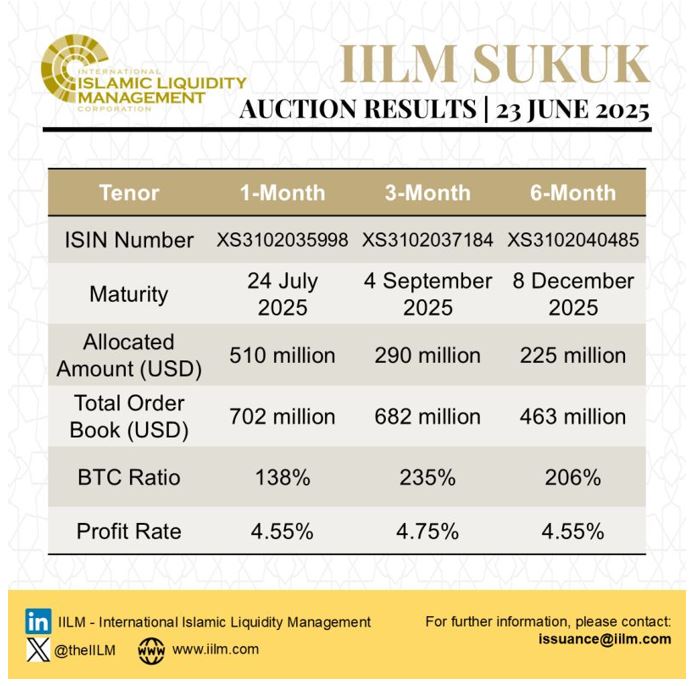

In the second transaction on 23 June 2025, the IILM also successfully completed the reissuance of an aggregate USD1.025bn short-term Sukuk across three different tenors of one, three, and six-months, which included a new asset in the portfolio.

The three series on 23 June 2025 were priced competitively at:

i) 4.55% for USD510 million for the 1-month tenor maturing on 24 July 2025

ii) 4.75% for USD290 million for the 3-month tenor maturing on 4 September 2025

iii) 4.55% for USD225 million for the 6-month tenor maturing on 8 December 2025

This auction was the IILM’s eleventh auction for the year and saw the onboarding of Qatar’s Al Rayan bank as the 15th Primary Dealer in the institution’s network. This latest auction of short-term Sukuk brings the IILM’s year-to-date cumulative issuance to USD11.47bn, across 33 Sukuk series of varying tenors. The auction saw a competitive tender amongst the Primary Dealers and Investors globally, with a very healthy orderbook of USD2.2bn, representing a strong and sustained average bid-to-cover ratio of 215%.

This latest auction, says the IILM, was conducted amid one of the most challenging periods in recent years since the global Covid-19 pandemic, marked by evolving (and intensifying) geopolitical developments, including heightened tensions in the Middle East stemming from the escalating Iran-Israel conflict, alongside persistent macroeconomic uncertainty and shifting monetary policies globally.

“Despite these formidable headwinds,” maintained IILM Chief Executive Officer, Mohamad Safri Shahul Hamid, “the IILM’s successful issuance underscores the resilience of its offerings and continued relevance of its short-term Sukuk as one of the most sought-after Shari’ah-compliant liquidity management tools for Islamic financial institutions globally.”

Both issuances form part of the IILM’s “A-1” (S&P) and “F1” (Fitch Ratings) rated USD6bn short-term Sukuk issuance programme. The IILM’s short-term Sukuk is distributed by a diversified and growing network of 15 primary dealers globally, namely Al Rayan Bank, Abu Dhabi Islamic Bank, Al Baraka Turk, Affin Islamic Bank, Boubyan Bank, CIMB Islamic Bank Berhad, Dukhan Bank, First Abu Dhabi Bank, Golden Global Investment Bank, Kuwait Finance House, Kuwait International Bank, Maybank Islamic Berhad, Golden Global Investment Bank, Meethaq Islamic Banking from Bank Muscat, Qatar Islamic Bank, and Standard Chartered Bank.

The Corporation is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The Corporation says it will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The issuance forms part of the IILM’s “A-1” (S&P Ratings) and “F1” (Fitch Ratings) rated USD6bn short-term Sukuk issuance programme.

Looking ahead into 2025, the IILM plans to boost its asset origination activities through bespoke and attractive offerings to address the diverse needs of global sovereign and sovereign-linked Sukuk issuers, as well as rolling out alternative to Sukuk assets to allow further growth of supply and meet the growing market demand.

The IILM will also continue to expand its investor base and network of primary dealers as it looks to expand regional collaborations and enter new markets to further integrate Islamic liquidity solutions into the global financial system. The Corporation, says Mr Mohamad Safri, remains committed to developing the Islamic liquidity management infrastructure and enhancing the Sharia’a-compliant liquidity tools available to the market, working closely with scholars, regulators, and industry stakeholders to resolve inconsistencies that may hinder growth.

The IILM says it will also continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The IILM’s ongoing commitment to innovation and impact, according to the Corporation, continues to bolster the liquidity management capabilities of Islamic financial institutions. By providing highly rated tools that are increasingly traded in secondary markets, the IILM helps these institutions meet their Liquidity Coverage Ratio (LCR) requirements while offering sustainable returns.

The IILM consistently issues short-term Sukuk across 1-month, 3-month, 6-month, as well as 12-month tenors, tailored to the liquidity needs of Islamic financial institutions. Since its inaugural issuance in 2013, the IILM has successfully issued a cumulative of USD122.69bn worth of short-term Sukuk across 297 series.

The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.